History of gold

Gold has been closely associated with money throughout history. Coins discovered in what is now Turkey date from the 7th century BC and were made from a mixture of gold and silver.

Those coins bore a marking to ensure authenticity and to indicate their value. Coins have evolved over the centuries in terms of their appearance, and most are made out of cheaper, more abundant metals, such as copper, zinc and nickel. However, coins are still used as the basis for commercial trade.

Despite modern coins and other forms of currency having no gold content, their value continued to be linked to the price of gold. The “Gold Standard” was a system whereby countries would fix the value of their currency in terms of a certain amount of gold, or they would link it to a country that did so. The Gold Standard was adapted after the end of World War II and replaced by the Bretton Woods monetary system, but this broke down in 1971 when the US ended its gold standard.

Currency is no longer pegged to the gold price, but gold has lost none of its lustre for investors. It can still play an important role in a diversified portfolio.

The gold market: big, liquid and increasingly more transparent

Gold is a scarce commodity but the market is large and liquid. However, until recently, trading volumes could only be estimated, as the majority of gold is traded over the counter (“OTC”) without the requirement for disclosure. That changed in November 2018.

The London Bullion Market Association (“LBMA”) is now publishing weekly data on gold volumes traded OTC for delivery in London and Zurich. This information improves the transparency of the gold market for all investors.

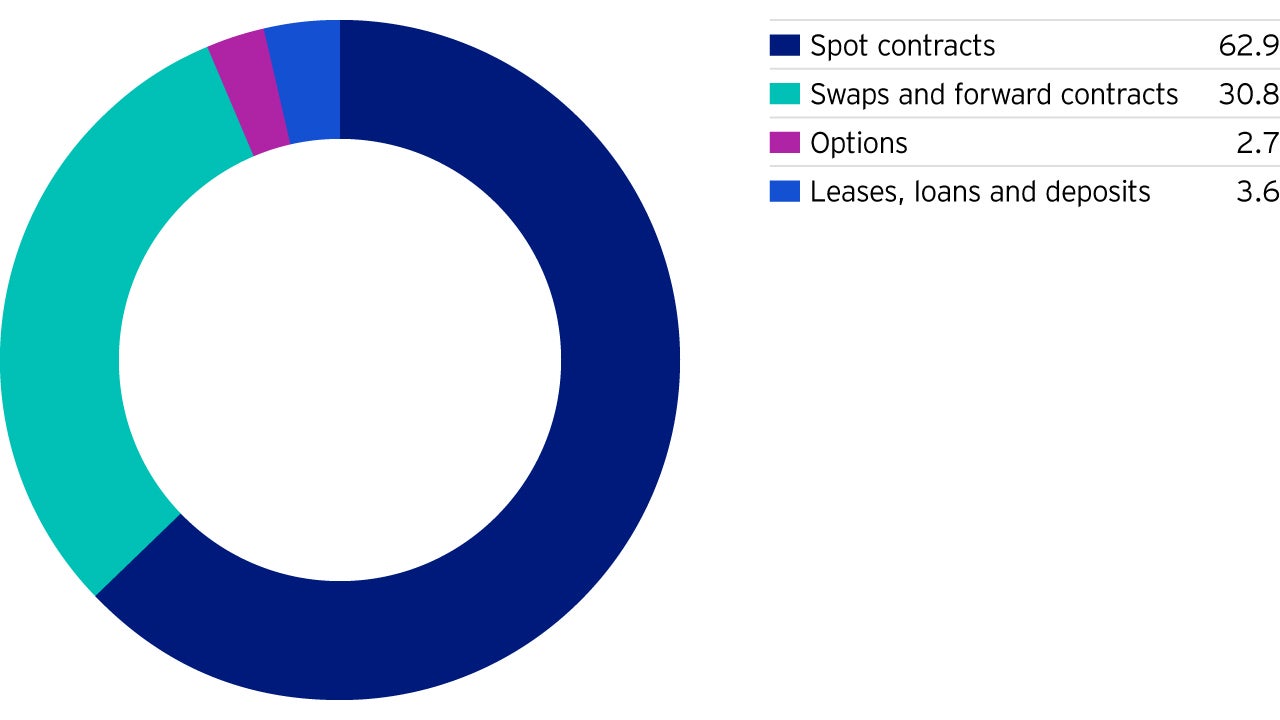

The first report showed an average of 939 tonnes of gold (30.2 million ounces) was traded OTC each day of the period 12-16 November 2018 by LBMA member firms, such as market-makers and banks, equal to US$36.9 billion per day. The following chart shows the different types of OTC contracts.