ETF Bringing you the world in one simple ETF

The reason many people invest is to grow their money, so they’ll have enough in the future to spend on some financial goal they have. But how do you do this? Find out more.

Gold has been closely associated with money throughout history. Coins discovered in what is now Turkey date from the 7th century BC and were made from a mixture of gold and silver.

Those coins bore a marking to ensure authenticity and to indicate their value. Coins have evolved over the centuries in terms of their appearance, and most are made out of cheaper, more abundant metals, such as copper, zinc and nickel. However, coins are still used as the basis for commercial trade.

Despite modern coins and other forms of currency having no gold content, their value continued to be linked to the price of gold. The “Gold Standard” was a system whereby countries would fix the value of their currency in terms of a certain amount of gold, or they would link it to a country that did so. The Gold Standard was adapted after the end of World War II and replaced by the Bretton Woods monetary system, but this broke down in 1971 when the US ended its gold standard.

Currency is no longer pegged to the gold price, but gold has lost none of its lustre for investors. It can still play an important role in a diversified portfolio.

Gold is a scarce commodity but the market is large and liquid. However, until recently, trading volumes could only be estimated, as the majority of gold is traded over the counter (“OTC”) without the requirement for disclosure. That changed in November 2018.

The London Bullion Market Association (“LBMA”) is now publishing weekly data on gold volumes traded OTC for delivery in London and Zurich. This information improves the transparency of the gold market for all investors.

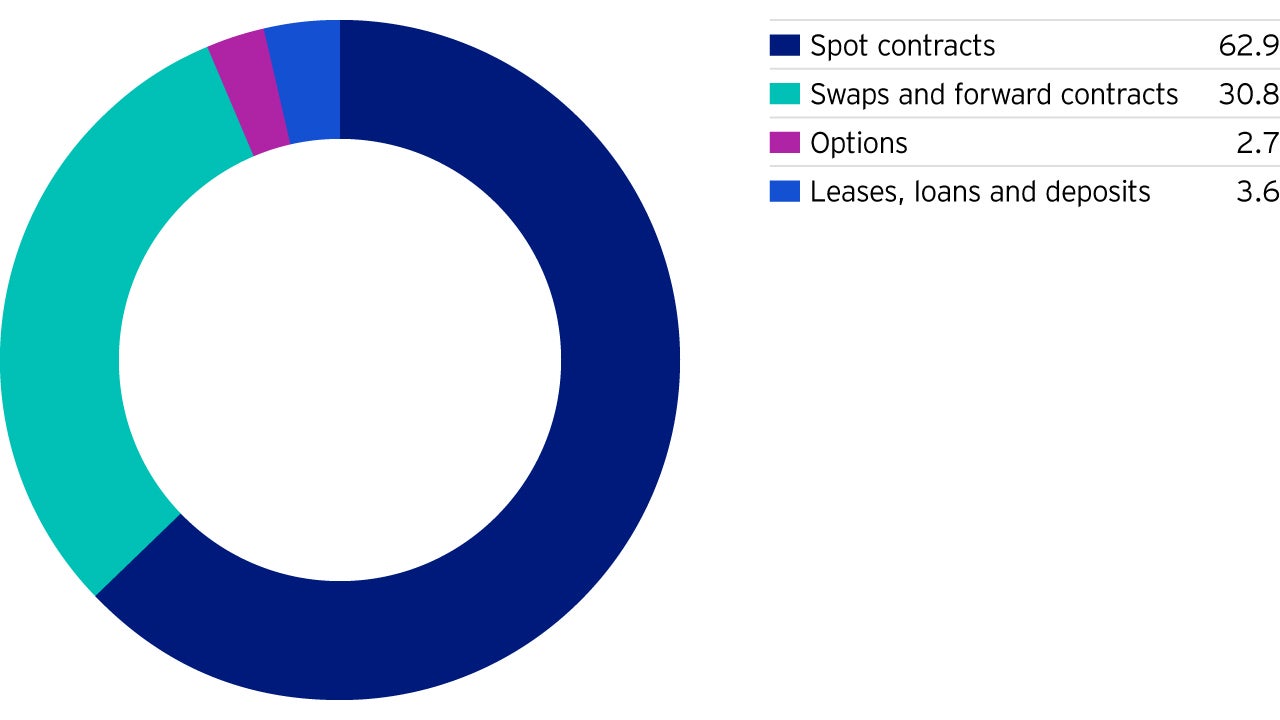

The first report showed an average of 939 tonnes of gold (30.2 million ounces) was traded OTC each day of the period 12-16 November 2018 by LBMA member firms, such as market-makers and banks, equal to US$36.9 billion per day. The following chart shows the different types of OTC contracts.

Gold is also traded actively on futures and options exchanges in New York, Chicago and Tokyo. Gold-backed exchange-traded products have increasingly become another important source of liquidity.

Although the market for gold is distributed globally, most OTC trades are cleared through London. The LBMA is, amongst other things, responsible for setting refining standards by maintenance of the London Good Delivery List:

The gold price is determined via an electronic auction that takes place twice per day in London, at 10.30 am and 3.00 pm GMT. The LBMA Gold Price is a fully transparent benchmark and widely accepted as the basis for pricing spot transactions.

*Bars are permitted by the LBMA to be between 350 and 430 fine troy ounces.

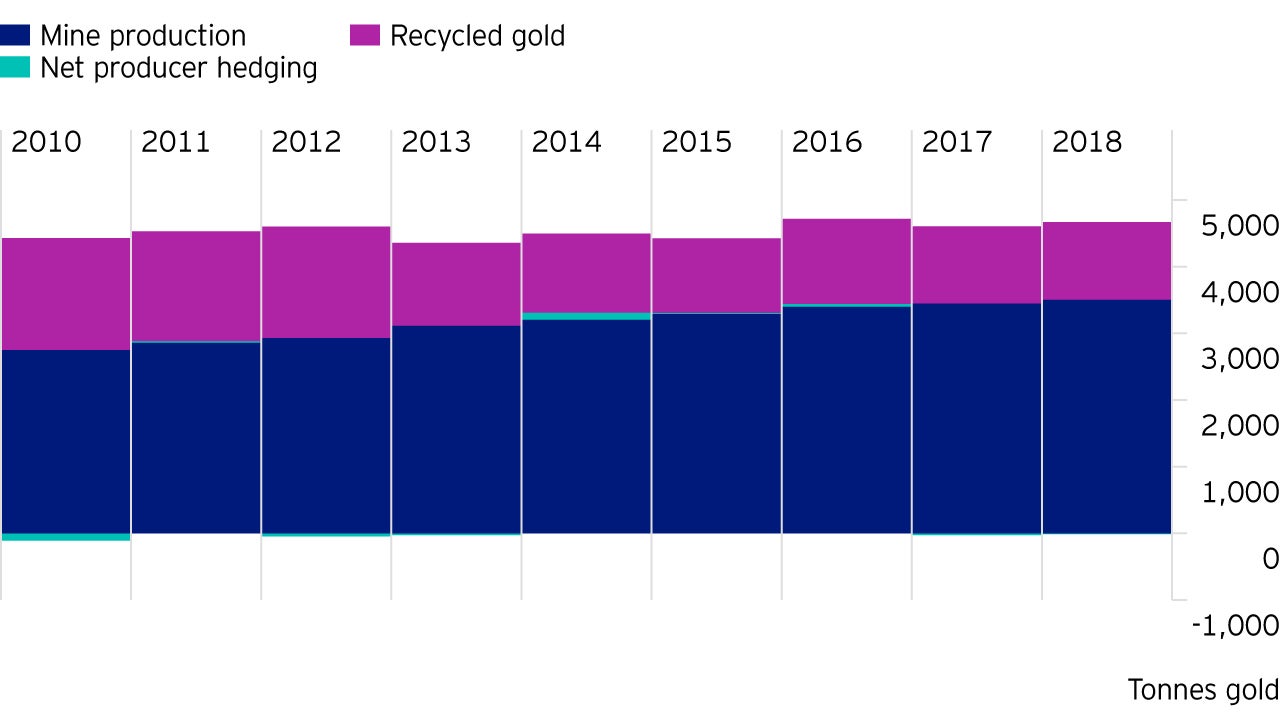

Like any other commodity, the price of gold is driven by supply and demand. In terms of physical supply, the world’s annual supply of gold consists primarily of newly mined gold and a varying amount of recycled gold (mainly from the sale of jewellery). There may also be a small amount of producer hedging (either positive or negative on a net basis). This refers to the selling of future gold production, enabling gold miners to lock in prices for their output.

Gold is virtually indestructible, meaning that almost all the estimated 190,000 tonnes of gold that has ever been mined still exists today. Melted down, this would fit into a crate 21 meters cubed.1

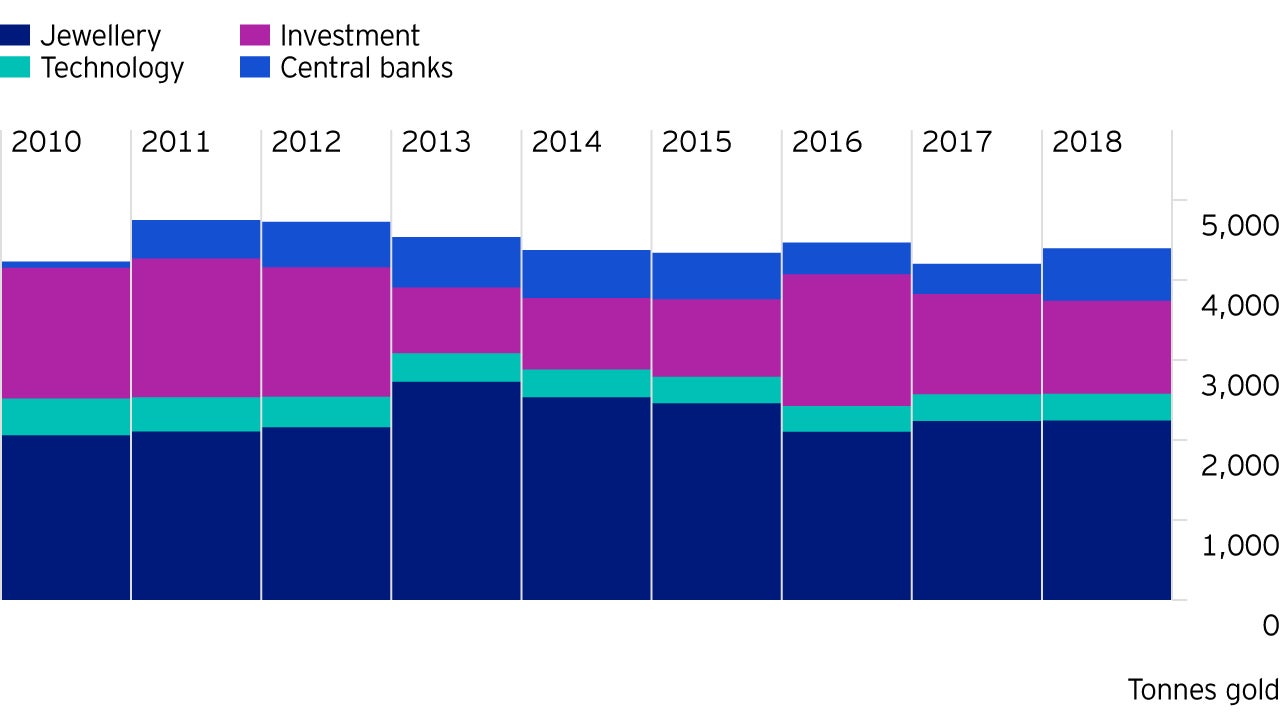

Approximately half of gold today is used for jewellery, with the rest used in a variety of industries, from medicine to aerospace, and of course for investment purposes.

Of the jewellery industry’s 48% of annual gold demand, the majority of this is concentrated in China and India, where gold still holds a significant place in traditional customs.

Central banks have been net buyers of gold every quarter since 2011. Just like other investors, central banks hold gold reserves for diversification purposes and protection against various risks. While the Federal Reserve and central banks from other main developed economies remain substantial holders of gold, the largest buyers over the past 10 years have included the likes of China, India, Russia and Turkey.

Demand for gold as an investment has grown by 18% per year on average since 20012, largely due to the introduction of exchange-traded products making it easier for investors to gain exposure. Physically backed exchange-traded products now account for approximately a third of investment demand3.

The other alternative for non-institutional investors has been to invest in gold bars and coins. However, investors typically pay a premium over the spot gold price and also have to arrange delivery, storage and insurance, each of which adds to the total cost over the holding period.

Invesco has one of the largest and most cost-efficient gold products in Europe. Visit our ETF site.

The reason many people invest is to grow their money, so they’ll have enough in the future to spend on some financial goal they have. But how do you do this? Find out more.

Kevin Grundy, Managing Director, Fund Management, Europe, Invesco Real Estate, discusses the broader market environments in the region and where he is finding the most compelling investment potential for value-add and opportunistic strategies.

Explore the case for the Nasdaq-100 index and how its constituents are driving innovation across the global economy.