As a team we describe valuation as the core of our process. We care about the price we pay for assets, for the simple reason that we believe the best long-term returns come from buying when stocks are cheap and selling as they become fair valued.

To be very clear; we do not buy stocks because they are cheap. Instead, being cheap piques our interest and that is when our fundamental analysis begins. Our process requires us to understand why the stock is cheap and, more importantly, what will stop it being so. Our analysis involves thinking about multiple facets, including but not exclusively: market positioning, sector dynamics, existing returns, earnings, marginal returns, operational momentum, free cash flow, balance sheet…the list goes on.

We work through these elements and as the process concludes, we come up with a range of share price outcomes and balance the upside against the risks and then we compare the new idea to our existing portfolio of ideas. Typically, as a team, we are fully invested. Our philosophy being, clients have allocated to us to get exposure to European equities, not for us to hold cash. Being fully invested means that for us to add a new idea to our funds, we typically need to sell something. A new investment needs to earn the right to get into the fund: more upside for the same risk, similar upside with less risk, upside with a different risk. New ideas need to add something we do not currently have and if they do shift the overall balance of the portfolio, it must be in the direction we want to take it.

Spoilt for choice

All of which explains why our funds today look the way they do: namely ‘Value’ biased.

We never had a team meeting where a strategic top-down decision to lean towards ‘Value’ was taken: nothing could be further from the way we work as a team. Not least because we think Factor investing has got a lot to answer for: by compartmentalising the market, it can inappropriately pigeonhole companies.

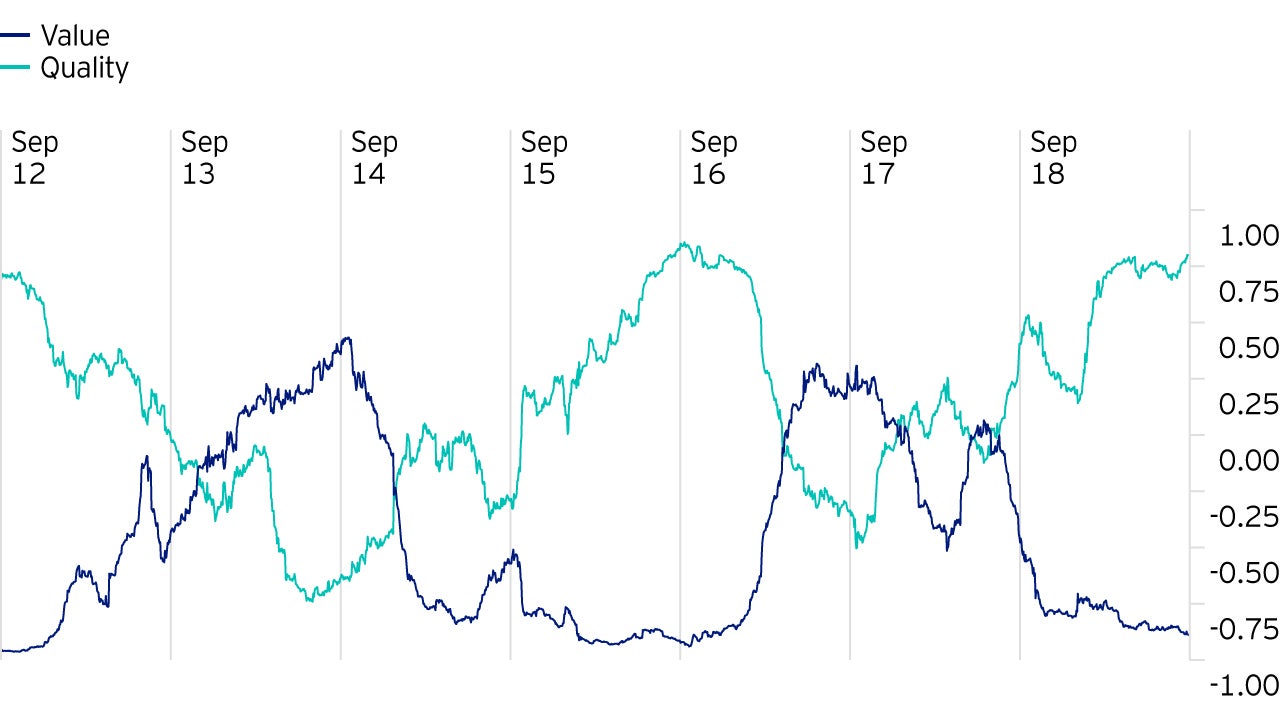

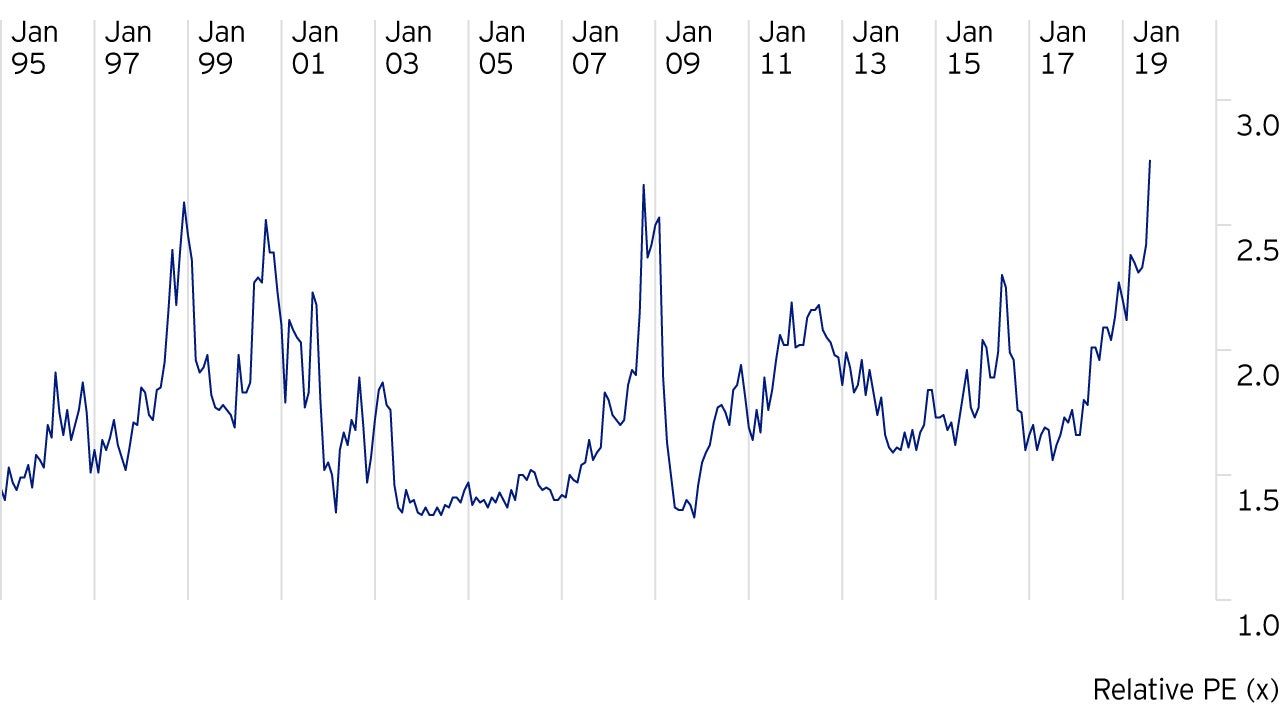

We found ourselves spoilt for choice at the ‘Value’ end of the market and as we carried out our analysis, we found that area of the market to be populated by companies with great business models, strong balance sheets, improving earnings, healthy and sustainable shareholder returns and, crucially, shares trading at silly prices. When we looked to find room for these ideas in the funds, the casualties were stocks that had become highly rated: ‘Quality’ stocks in the portfolios. The companies we sold may have had strong franchises, solid earnings potential and strong returns, but they also had high valuations, a function of their being consensually liked. Indeed, there was a high correlation between the Quality and Momentum factors. All sources of risk and downside.