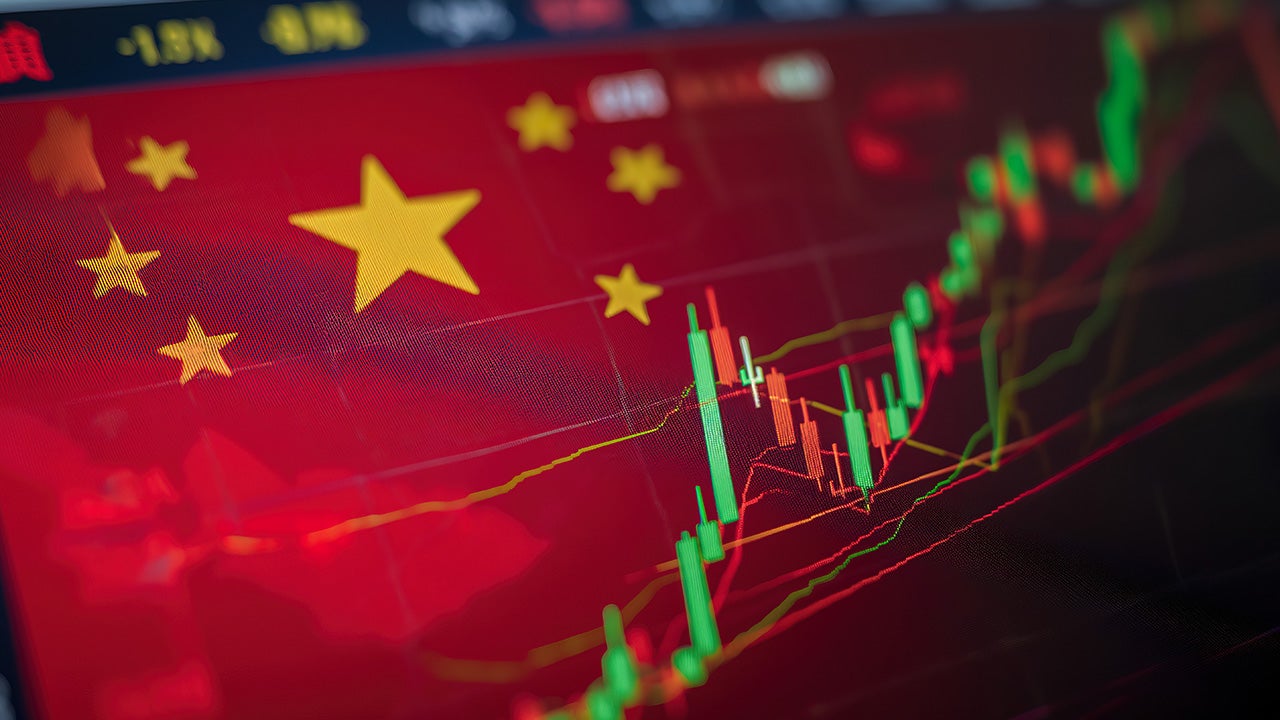

Investor interest in China equities is rising

Investor interest in China equities is rising. Together with supportive government stimulus policies as well as strong economic indicators, this piece unpacks why we expect to see this positive momentum continue.

.svg)