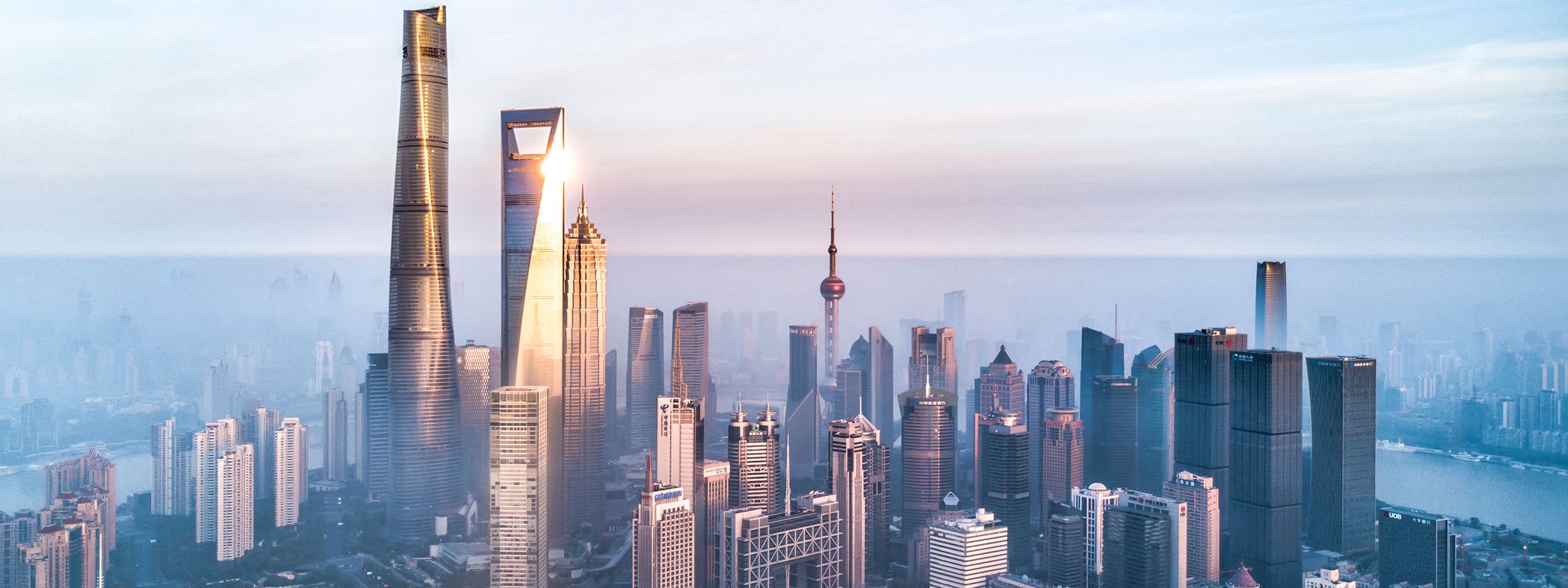

China Opportunities

Which asset classes can offer opportunities in China? Explore the possibilities here.

Why China?

China presents significant investment opportunities as its GDP continues to grow, demographics are changing, and its correlation to other markets is low. Inclusion in global indices and China's ambitious climate change targets also offer the potential for other thematic opportunties.

Why now?

China is on track to surpass the US as the world’s largest economy in 2028.1 It already boasts the second-largest equity and bond markets globally, with an array of both well-established industry leaders and up-and-coming innovators. There are several well-documented macro trends that are driving interest in investing in China, all centered around growth and scale:

The Chinese government has shown commitment to facilitate the economy’s transition from investment to consumption, and from manufacturing to services. In recent years President Xi Jinping has announced various reforms to support the private sector including tax reductions and subsidies.

China’s economy used to be driven by high fixed asset investment (FAI), expansionary fiscal and monetary policies, and growing debt. Return on investment for FAI was low, therefore high GDP growth did not translate into high earnings growth. The government is now placing much higher emphasis on the quality of growth, shifting emphasis towards consumption and services, and away from net exports and FAI.

A major element of the 14th Five-Year Plan (2021-2025) is an ambitious long term plan to become a leading innovative country. The government is focussing on achieving major breakthroughs in core technologies including semiconductors, cloud computing and artificial intelligence. Backing this is a pledge to boost R&D spending by more than 7% every year.

Following major global index providers' decisions to increase the representation of Chinese assets in their indices, foreign inflows into China have increased. We believe that with growing interest from international investors, accountability and transparency in China’s capital markets are expected to improve.

In September 2020, President Xi Jinping announced his target for China to achieve peak carbon emissions by 2030 and carbon neutrality before 2060. The People’s Bank of China (PBoC) has stated that government funding alone will not be enough to reach these targets and the private sector will also have to mobilize funds into green investment. China is in the midst of a rapid scale up of renewable energy capacity that is unparalleled globally. We expect investment opportunities like these that are aligned with China’s energy transition objectives to continue to grow.

Asset Class Opportunities

We believe that equities, fixed income, exchange traded funds (ETFs), and real estate are among the asset classes and investment vehicles that can present investment opportunities in China today. Here we share our insights on the benefits these classes can bring, how their markets function, and how offshore investors can access them.

Sources: Equities market size data as of Y/E 2021 from Securities Times Database, 2021年A股市场画像:总市值首度突破90万亿 全年成交额创纪录, May 2022, https://www.stcn.com/stock/djjd/202201/t20220105_4041088.html; Fixed Income market size data from Wind. Data as of Feb. 28, 2021. Based on CNY 115.3 trillion, exchange rate USD/CNY=6.5.; ETFs market size data from Bloomberg as of July 2021; Real estate market size data based on direct real estate portfolios held as investments for delivering a mix of income and capital returns from MSCI as of Y/E 2021, Real Estate Market Size 2019/2020, June 2022, https://www.msci.com/documents/1296102/19878845/MSCI_Real_Estate_Market_Size_2020.pdf/06a13e2c-0230-f253-26fa-3318cecb1c59.

Marty Flanagan, President & CEO of Invesco and Andrew Schlossberg, SMD & Head of Americas of Invesco talk about their recent trip in Asia in this video.

Investment Insights

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Footnotes

-

1

China’s Economy Could Overtake US Economy by 2030, January 2022, https://www.voanews.com/a/chinas-economy-could-overtake-us-economy-by-2030/6380892.html