Global equities series: Portfolio diversification in America-first global equity markets

This is the eighth of an eight-part series that covers the themes and challenges facing global equities in the second Trump administration. Part 1 covers the impact of an America-first world order while Part 2 looks at Trumpism's issues. In Part 3 we delve into immigration, the Federal workforce and US labor markets. Part 4 unpacks deregulation, oil demand and inflation pressures. Part 5 covers the US fiscal policy, debt and deficit and Part 6 looks at foreign economic policies and trade concerns. In Part 7 we deep dive into geopolitics and geoeconomics and Part 8 unpacks portfolio diversification in America-first global equity markets.

We expect the main channel for the direct transmission of Trump policies to global markets, especially global equities, to be threats or actual effect of high tariffs, potentially across-the-board of all imports, applied to all US trading partners, but singling out China for higher tariffs than the rest of the world. The main policy levers likely to directly affect US equity markets in addition to the tariffs themselves, would be immigration restrictions and deregulation. The raft of policy pledges, spanning tax cuts, immigration curbs and mass deportations, institutional reform and downsizing of the federal government, and heavy oil extraction – are likely to have somewhat offsetting or contradictory effects – including effects that are negative for growth, inflation and in order of importance to Trump, equity and bond markets, and the dollar.

Given the difficulty of radical reform with a narrow margin of Republican Party control in Congress, we expect the reality to be more measured than the domestic policy rhetoric, probably leaning on deemphasizing existing legislation on regulation. Given domestic constraints, Trump may be more aggressive on foreign economic policy, especially tariffs and immigration. Yet we also expect Trump to be somewhat constrained and guided by stock and bond markets as a metric of the economic impact of actual policy decisions. On this basis, we expect a stronger dollar and significant differentiation across global financial markets, even as the US outperforms other countries, based on the experience of the Trump’s first trade war.

With this backdrop, we think investors would be well served by pursuing active country selection based on policy responses to what we expect to be America-First unilateralism, somewhat constrained by the performance of US markets with divergent sector- and country-index performance. Current views on select global equity markets:

- The US will probably continue to outperform despite the rich valuations of both US equities and the dollar. Much of the world, like us, probably sees no alternative to continued economic and security cooperation with the US.

- Mexico, Canada, Europe will tend to cooperate and negotiate, though there may well be some retaliation, which should put a floor under their currencies and stocks, but the uncertainties are likely to promote volatility in Mexico perhaps more than Canada, where the possible election of a pro-Trump populist might help improve relations;

- India is probably relatively well hedged despite its services surplus with the US, given its role as a counterweight to China – though this benefit is partly offset by cyclical economic slowdown and rich equity valuations;

- Japan and South Korea are likely to cooperate for defense reasons, likely offering concessions on trade and defense contributions. Yet South Korea’s recent impeachment of a pro-US/Japan president for trying to impose martial law may lead to a left-leaning government conciliatory to China and North Korea, which could undermine relations with the US and the Quad (US, Japan, Australia and India). Japan seems likely to outperform Korea.

- China seems likely to respond, offsetting damage to growth with stimulus, making low valuations more appealing.

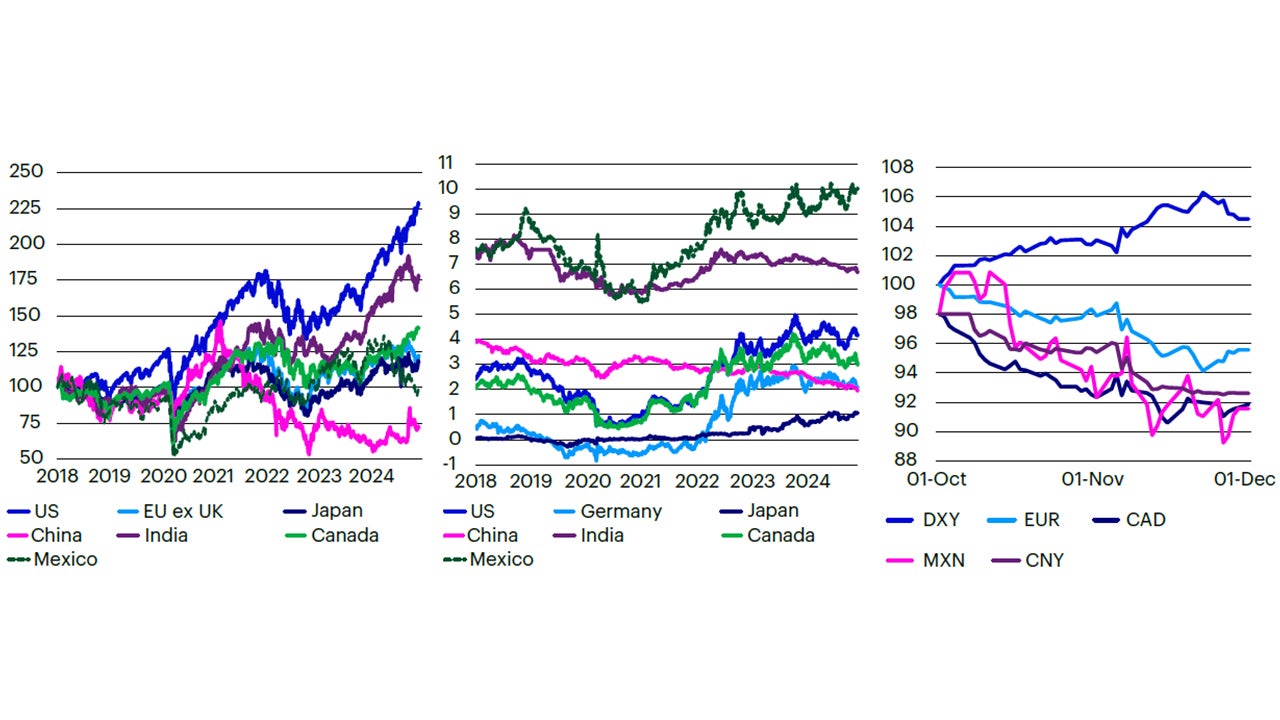

Note: Left, MSCI in USD terms as currency movements reflect shifts in the terms of trade driven by changes in tariffs. Middle, 10-year government bond yields; in the absence of a benchmark common bond for the EU (ex UK); German Bunds as a proxy. Right, index of bilateral currency crosses against the USD, 01 October 2024 = 100; currencies whose quoting convention has a higher number for a weaker currency are shown with index values reversed. Source: Bloomberg, Macrobond, Invesco. Right daily 01 Oct to 01 Dec 2024; rest, daily data from 01 Jan 2018, as at 6 Dec 2024.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations), and investors may not get back the full amount invested.