Global equities series: Geopolitics, geoeconomics and balance of power

This is the seventh of an eight-part series that covers the themes and challenges facing global equities in the second Trump administration. Part 1 covers the impact of an America-first world order while Part 2 looks at Trumpism's issues. In Part 3 we delve into immigration, the Federal workforce and US labor markets. Part 4 unpacks deregulation, oil demand and inflation pressures. Part 5 covers the US fiscal policy, debt and deficit and Part 6 looks at foreign economic policies and trade concerns. In Part 7 we deep dive into geopolitics and geoeconomics and Part 8 unpacks portfolio diversification in America-first global equity markets.

We believe Trump and team will aggressively exploit linkages among national security, geopolitics, geoeconomics and cross-border economic issues – immigration, trade and foreign investment to push an America-First agenda. US policymakers used to compartmentalize these issues in the pursuit of free trade, open financial markets, democracy, and nation building. But with team Trump focused on “Make America Great Again,” pressure to raise global defense spending will keep rising across major the world, in our view, led by Europe, India, and China, with the US revamping and modernizing. National defense industries and tech sectors are likely to benefit amid stronger, sustained fiscal pressure in bond markets, given other, inescapable demands on fiscal budgets and private funds, including spending for demographic needs, climate change, infrastructure, technology, etc.

Trump seems to be using the transition to nominate personnel to send policy signals and to message a hardening of his negotiating stance, whether it’s the threat of tariffs on USMCA partners Mexico and Canada, insistence on direct bilateral quid pro quo exchanges to rebalance the EU-US bilateral trade surplus, but also to signal geopolitical linkages, such as upping the share of GDP NATO members should contribute in defense spending.

This hardline stance may even be working in some sense with allies and protectorates in Europe. No doubt there is resentment and plans for retaliation are being laid. But Canada, Mexico, and to some extent, Europe, have already signaled willingness to re-engage and negotiate in perhaps more directly, quickly, and effectively than in the first Trump term.

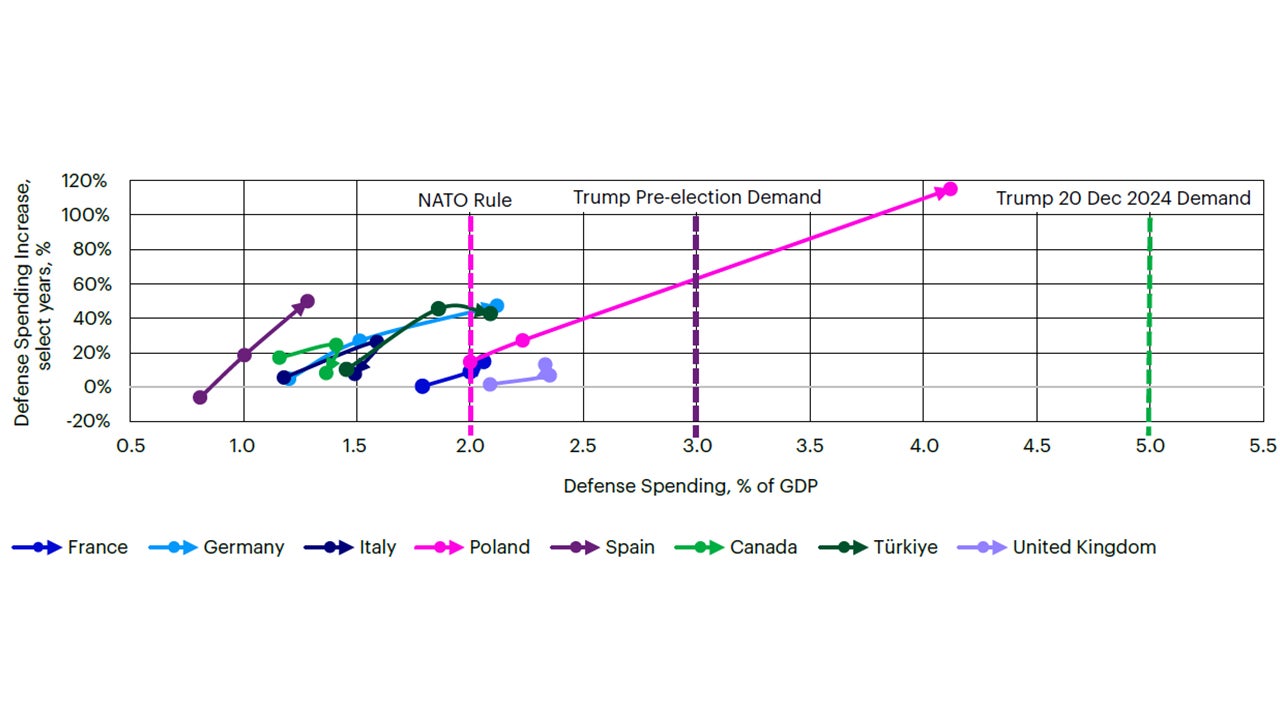

We believe Trump’s aggressive demands that other NATO members as well as allies in Asia step up their defense spend will continue to be met by some success, yet demands that partners do even more of the heavy lifting may continue rising. Trump had raised the stakes during the campaign, suggesting that NATO member defense spending should rise to 3% of GDP. On 20 December 2024, he upped the ante further, signaling that the ask would rise to 5% of GDP. Vice President JD Vance had offered an estimate of US$8.6tn as the cumulative shortfall in NATO partner defense contributions relative to the historical 2% of GDP agreement; this represents an implicit taxation without representation on the US voter, which allows Europe to finance larger, more generous welfare states than it could otherwise afford. In effect, US citizens who lack an EU-style welfare state are indirectly funding one in Europe.

One can debate the merit of this backlash - After all, Europe might choose such a welfare state and continue to finance one itself with or without US-dominated collective security. But the backlash has been decades in the making: President Kennedy was the first to charge Europe over its lack of financial contribution to its own security – a complaint repeated by most presidents since, with the key difference that Trump was the first to try to capitalize on it in domestic politics. And between Russia’s Ukraine War and Trump’s weaponization of NATO and trade as geopolitical leverage, it does seem to be working.

We would hope that stronger contributions to their own national security and defense by some of the highest-income countries in the world, including Western Europe, South Korea, and Japan, will help maintain a relatively open trading relationship with the US as well as support the US’s willingness and capacity to maintain its extensive network of military bases, helping to preserve world peace, freedom of navigation and thereby keeping the world economy functioning relatively well, despite aggressively unilateralist national security, trade, investment and immigration policies.

Note: Change in ratio of defence spending to GDP (y-axis) vs. total defence spending share in GDP; dot 1, 2016 vs. 2014 (year Russia annexed Crimea); 2, 2020 change from 2016; and 3, arrowhead, expected 2024 vs. 2020. Source: NATO, Invesco. Annual data as at 20 December 2024.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations), and investors may not get back the full amount invested.