Tactical Asset Allocation: November 2022

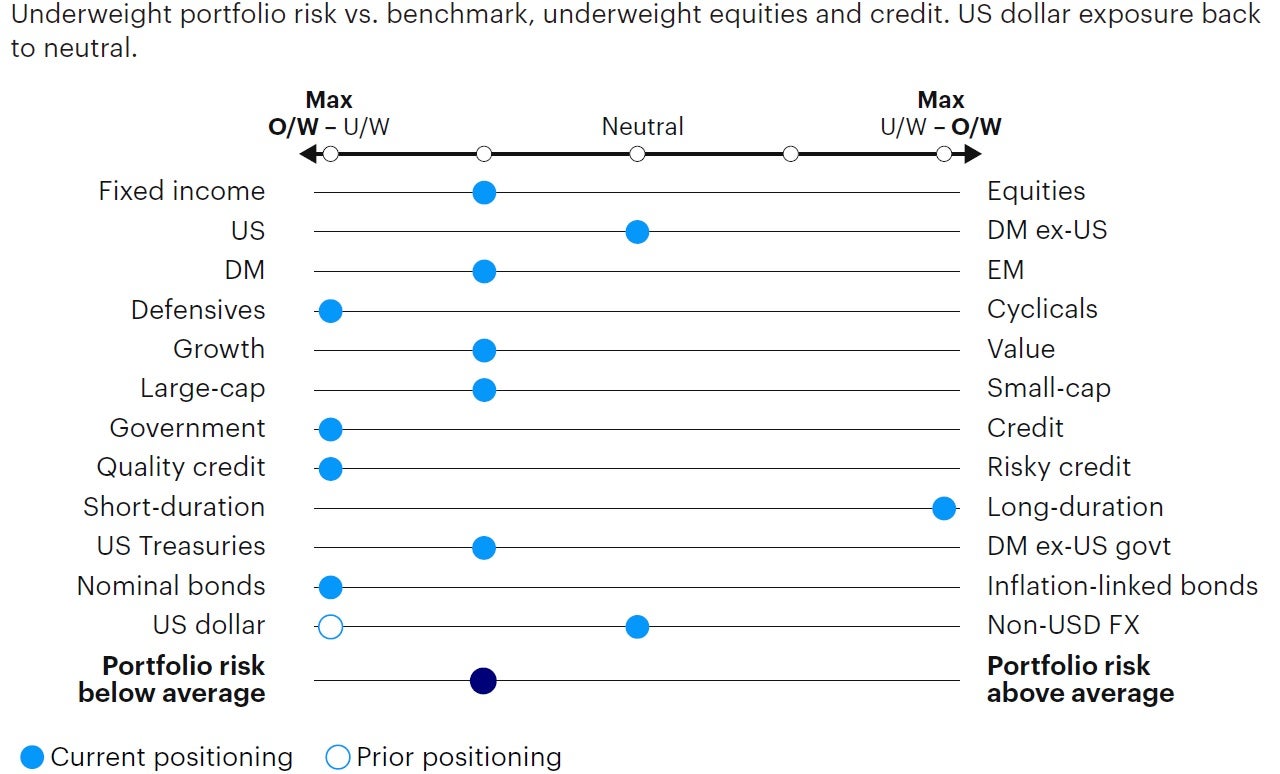

Underweight risk relative to benchmark, favoring fixed income and defensive equity factors.

Synopsis

- Our macro framework remains in a contraction regime. While Q3 earnings have outperformed expectations, forward estimates continue to decline, suggesting weaker growth ahead.

- Underweight risk relative to benchmark in the Global Tactical Asset Allocation model1, favoring fixed income over equities, underweighting credit risk2 and overweighting duration. In equities, favor defensive equity factors and sectors, and underweight emerging markets. We move back to neutral on the US dollar.

Macro update

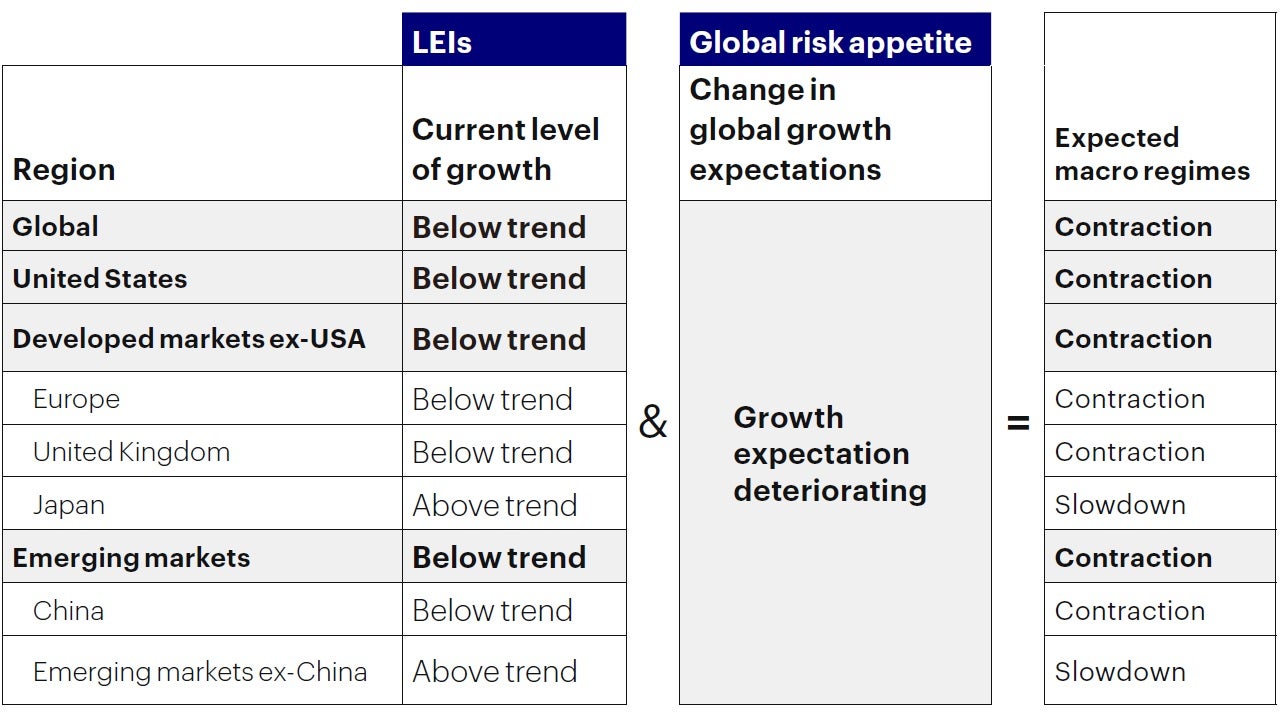

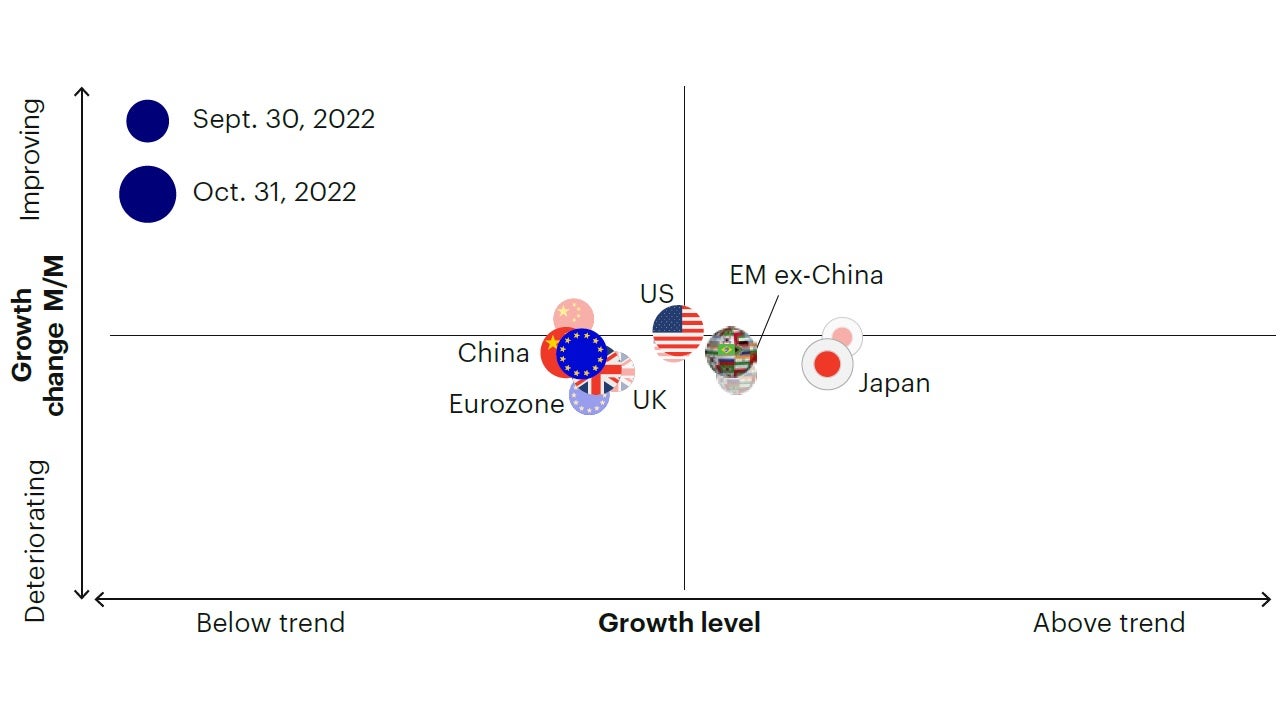

Leading economic indicators suggest global growth to remain below trend. Economic activity weakened in the Eurozone, UK, Japan, and emerging markets, while the US economy has stabilized. Surveys of consumer sentiment remain around all-time lows but stable in both the United States, Eurozone, and United Kingdom. Business surveys, manufacturing activity and the construction sector continue to decline towards their long-term trend, while monetary conditions continue to tighten via higher policy rates, flattening yield curves and falling money supply growth. Risk sentiment improved. Credit spreads compressed by about 100 bps in lower quality sectors and global equity markets, boosted by favorable Q3 corporate results3, have risen approximately 6% in US dollar terms in October, equivalent to the top decile of monthly returns of the past 25 years. However, this improvement in risk appetite was not sufficient to flag an inflection point in the market cycle, and our framework remains in a contraction regime (Figure 1 and Figure 2).

Leading economic indicators suggest global growth to remain below trend. Economic activity weakened in the Eurozone, UK, Japan, and emerging markets, while the US economy has stabilized.

Sources: Bloomberg L.P., Macrobond. Invesco Investment Solutions research and calculations. Proprietary leading economic indicators of Invesco Investment Solutions. Macro regime data as of Oct. 31, 2022. The Leading Economic Indicators (LEIs) are proprietary, forward-looking measures of the level of economic growth. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment.

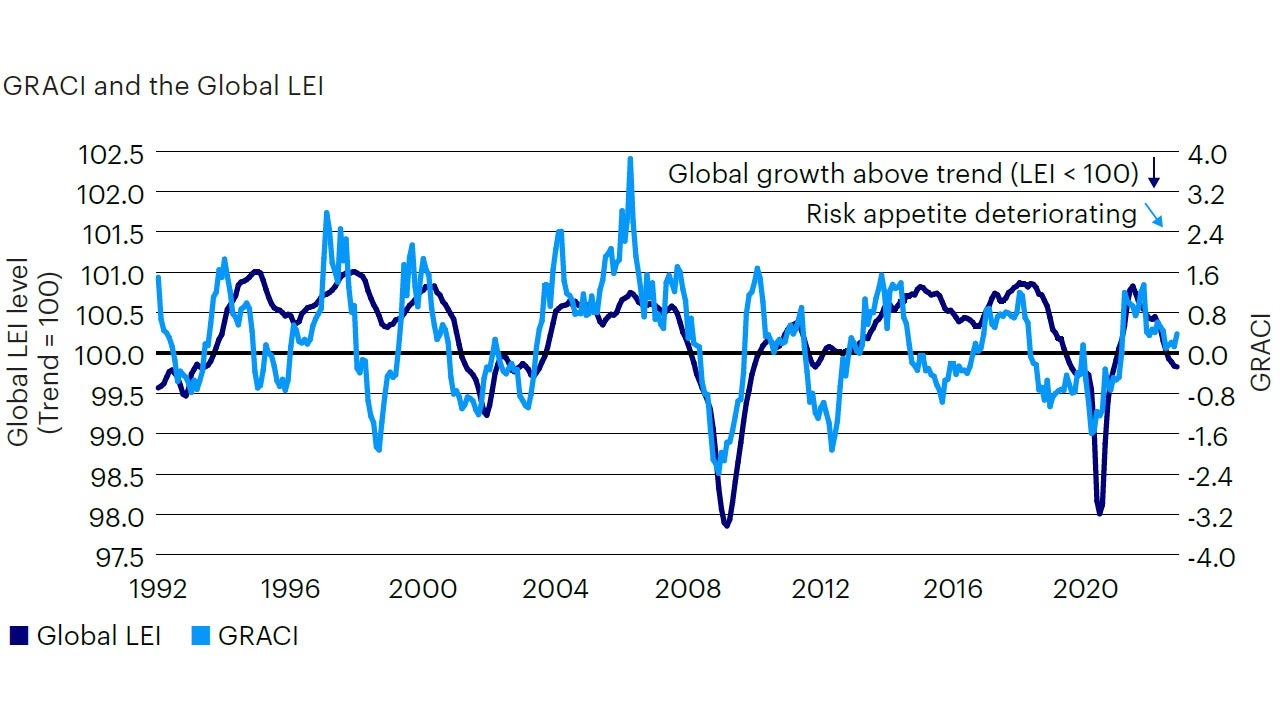

Improvement in risk appetite was not sufficient to flag an inflection point in the market cycle, and our framework remains in a contraction regime.

Sources: Bloomberg L.P., MSCI, FTSE, Barclays, JPMorgan, Invesco Investment Solutions research and calculations, from Jan. 1, 1992 to Oct. 31, 2022. The Global Leading Economic Indicator (LEI) is a proprietary, forward-looking measure of the growth level in the economy. A reading above (below) 100 on the Global LEI signals growth above (below) a long-term average. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment. A reading above (below) zero signals a positive (negative) compensation for risk taking in global capital markets in the recent past. Past performance does not guarantee future results.

Markets have responded favorably to positive surprises, and an earnings season that certainly dispels the threat of an imminent recession.

The S&P500 is on track to post a beat this earnings season with headline EPS growth at approximately 3.8% year-over-year growth vs. initial consensus around 2.6%. Further, sales are holding up better than earnings, on track to increase by 9.7% year-over year in Q3, above consensus by 1%, and rising also on an ex-energy basis at around 6.7%. In the rest of the world, earnings season has been very strong in Japan with overall EPS growth at about 22% year-over-year, and top-line growth at 17% year-over-year. Results have been somewhat softer in Europe, with EPS growth around 5% year-over-year below expectations by about 1%, but revenue growth surprising to the upside at 20% year-over-year. Markets have responded favorably to positive surprises, and an earnings season that certainly dispels the threat of an imminent recession. While this is certainly good news, a focus on forwardlooking estimates paints a softer picture for the corporate sector, suggesting caution still required before calling for a definite inflection point in the market cycle.

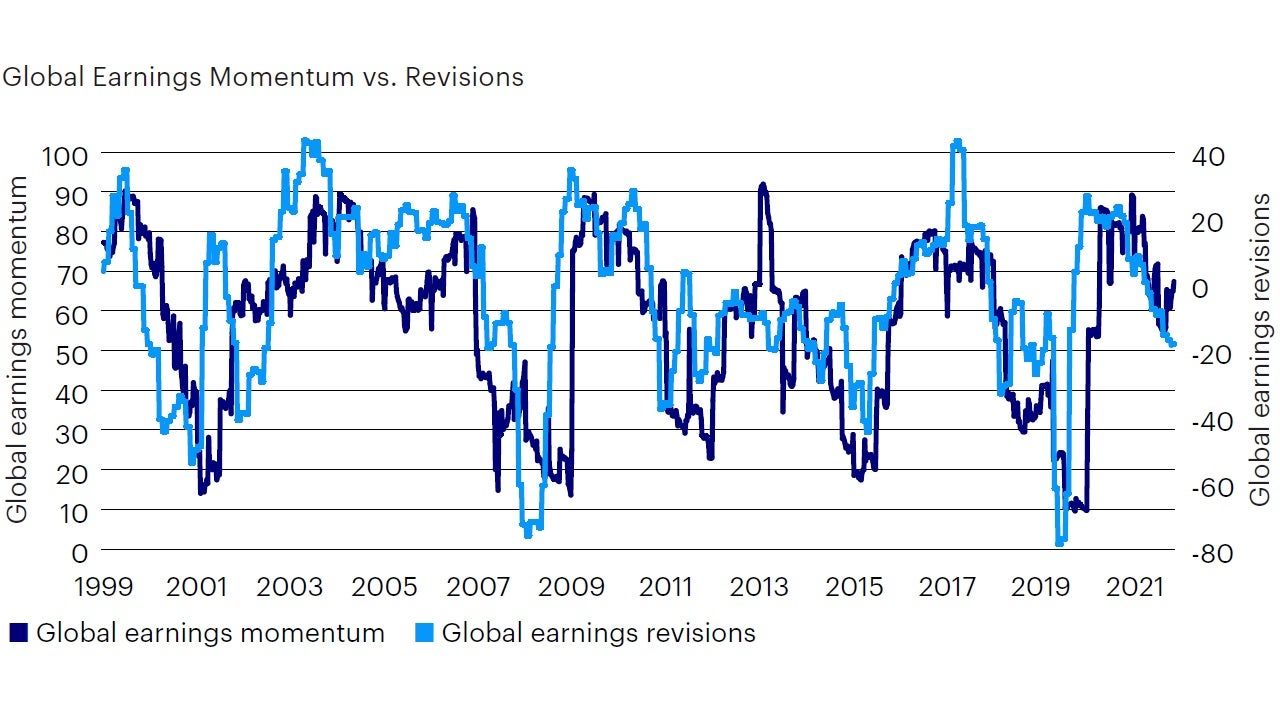

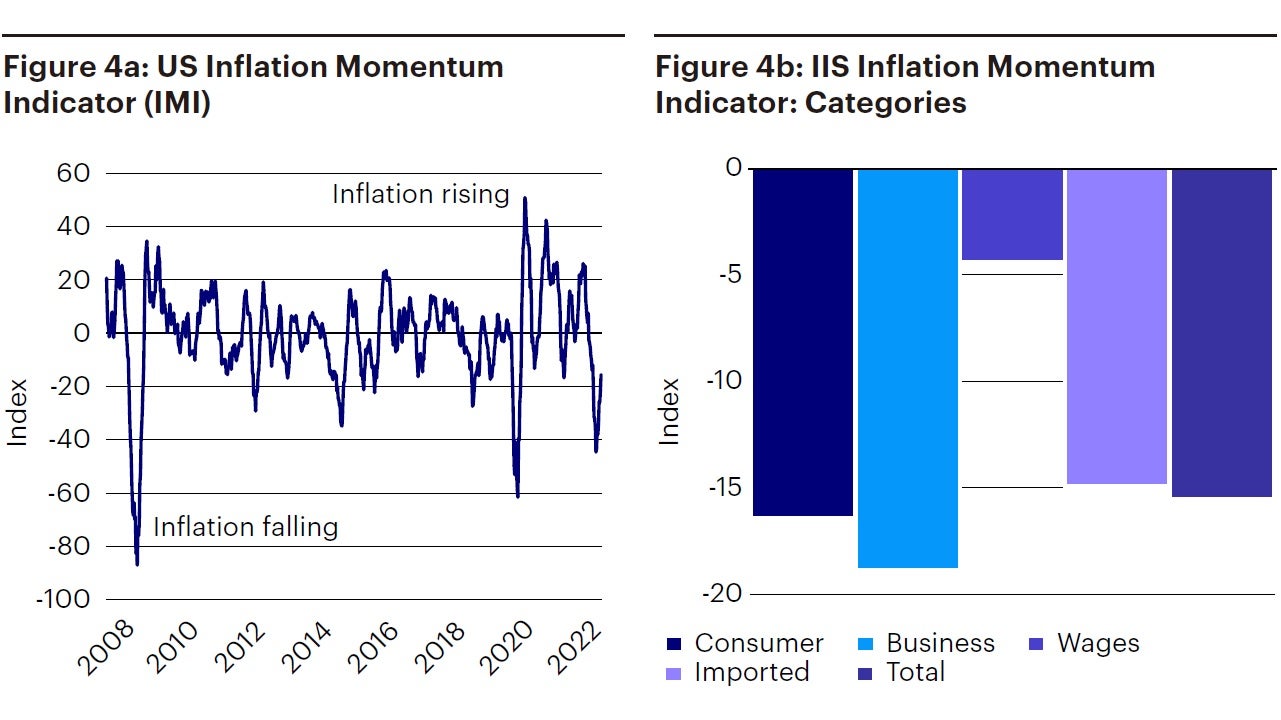

Earnings revision continue to decline both in the US and rest of the world. Since the start of the earnings season, forecasts for S&P 500 EPS growth for all quarters until Q4 2023 have been reduced by 100-150bps per quarter. Margins are under pressure, with consensus estimates seeing a decline in net income margins by about 20-30bps per quarter over the next five quarters. The evolution of these estimates is largely in-line with our leading economic and market sentiment indicators, suggesting the economy is on a soft-landing path at this stage (Figure 3). Recession risk remains elevated, given the low level of growth and headwinds from cumulative policy tightening, but the resilience in the labor market continues to support overall economic activity. On the inflation front, business surveys across the globe indicate peaking prices pressures, in line with our read on three-month inflation momentum, but this deceleration is yet to be reflected in aggregate headline and core CPI statistics which continue to increase across the developed world (Figure 4).

The evolution of these estimates is largely in-line with our leading economic and market sentiment indicators, suggesting the economy is on a soft-landing path at this stage.

Sources: Bloomberg L.P., MSCI, Invesco Investment Solutions research and calculations, from December 1999 to Oct. 31, 2022. Global Earnings Momentum Index is a proprietary measure of acceleration / deceleration in trailing 12-month earnings in the MSCI ACWI Index. A reading above (below) 50 indicates accelerating (decelerating) earnings. Global Earnings Revisions measures the difference in number of stocks with upward vs. downward revisions to forward earnings estimates. Past performance does not guarantee future results.

Business surveys across the globe indicate peaking prices pressures, in line with our read on three-month inflation momentum, but this deceleration is yet to be reflected in aggregate headline and core CPI statistics.

Sources: Bloomberg L.P. data as of Oct. 31, 2022, Invesco Investment Solutions calculations. The US Inflation Momentum Indicator (IMI) measures the change in inflation statistics on a trailing three-month basis, covering indicators across consumer and producer prices, inflation expectation surveys, import prices, wages, and energy prices. A positive (negative) reading indicates inflation has been rising (falling) on average over the past three months.

Investment positioning

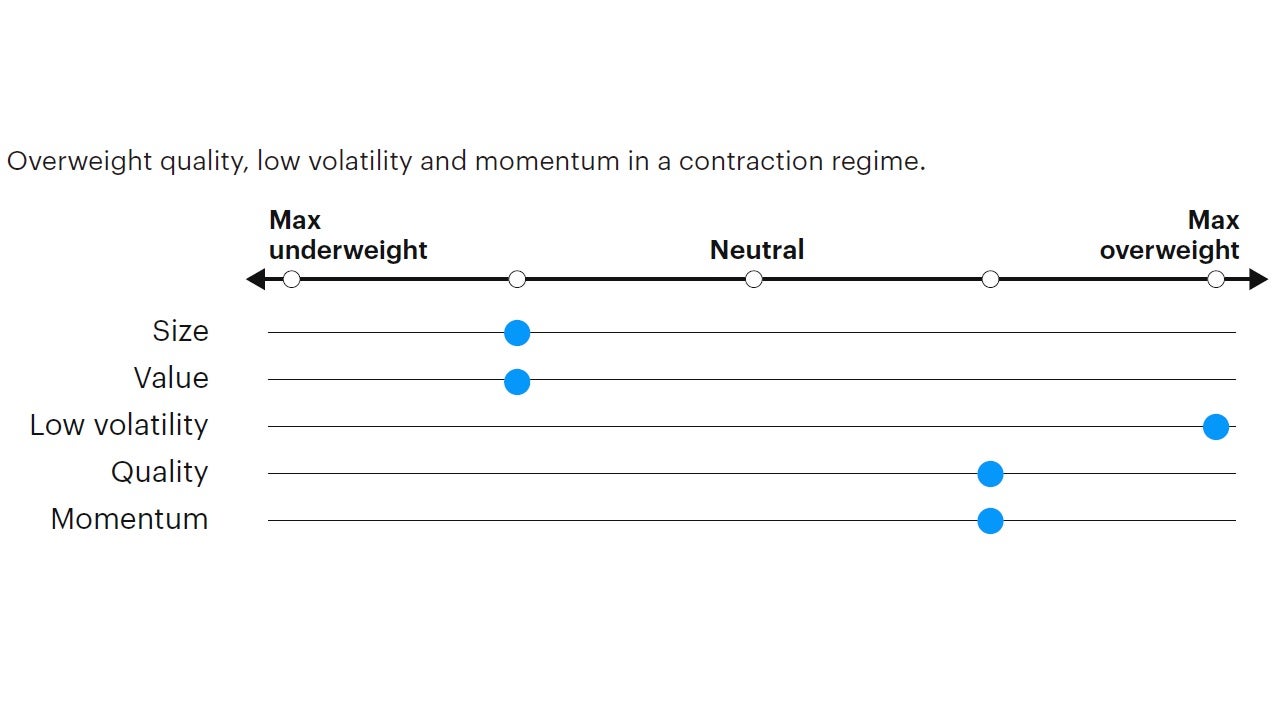

We expect these defensive characteristics to outperform in an environment of below-trend and slowing growth, declining inflation, and peaking bond yields.

We favor investment grade credit and duration in long-dated government bonds, expecting more flattening in the yield curve.

We have reduced the US dollar exposure back to neutral as global growth is performing in-line with consensus and yield differentials between the US and the rest of the world have stabilized.

We maintain an underweight risk stance relative to benchmark, expressing a defensive bias across most levers in the portfolio, but reduced the US dollar exposure back to neutral vs. benchmark. We remain underweight equity in favor of fixed income, which now offers attractive 6% yields in investment grade or 8-9% yields in risky credits. Within fixed income we remain underweight credit risk4 and overweight duration relative to benchmark (Figure 5, 6, 7). In particular:

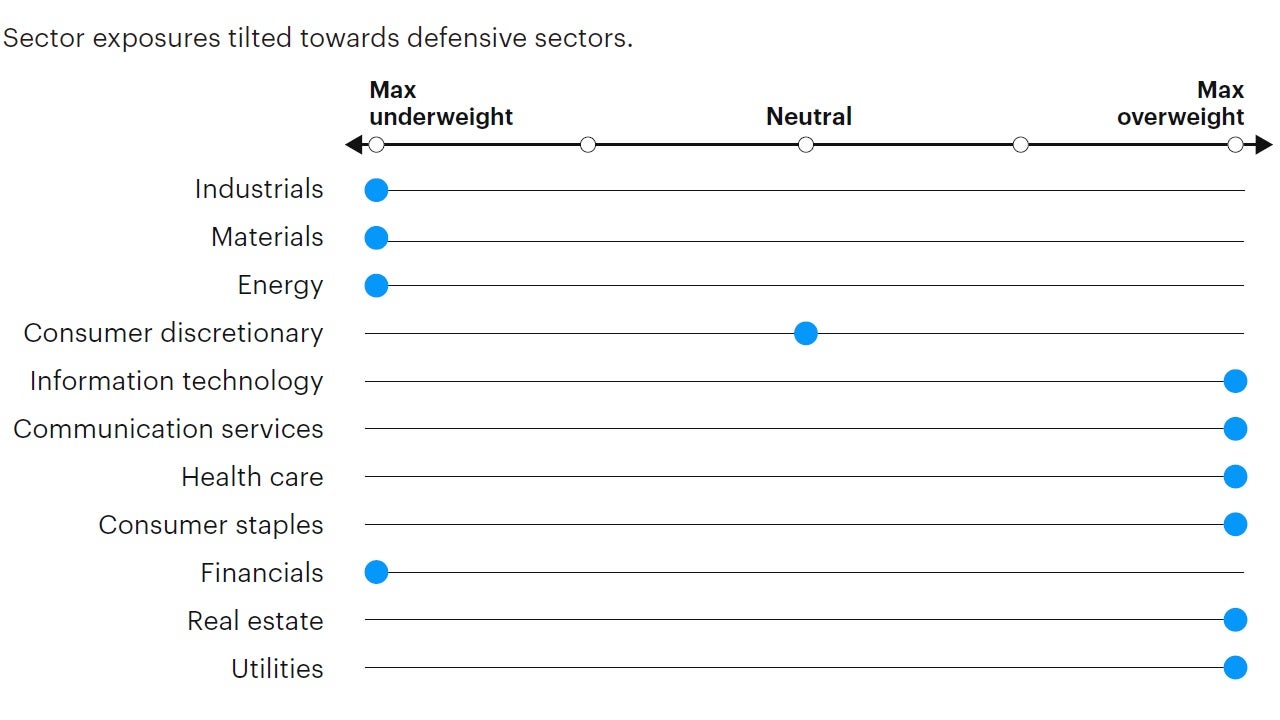

- Within equities we underweight value, small and mid-cap equities, favoring defensive factors like quality, low volatility, and momentum, resulting in defensive sector exposures with higher duration characteristics and lower operating leverage such as information technology, communication services health care and consumer staples, at the expense of financials, industrials, and materials. We expect these defensive characteristics to outperform in an environment of below-trend and slowing growth, declining inflation, and peaking bond yields. From a regional perspective, we maintain a moderate underweight in emerging markets relative to developed markets, as declining growth and tightening financial conditions provide headwinds to emerging markets. We remain neutral between US and developed ex-US equities.

- In fixed income we are underweight risky credit as a contractionary regime has historically led to underperformance in high yield, bank loans and emerging markets relative to higher quality debt with similar duration. While high yield spreads have tightened by about 100bps over the past month, we remain cautious given the macro backdrop, and wait for an inflection in the cycle before increasing exposure. We favor investment grade credit and duration in long-dated government bonds, expecting more flattening in the yield curve. We expect further compression in breakeven inflation expectations given declining price pressures, overweighting nominal treasuries relative to inflation-linked bonds.

In currency markets we have reduced the US dollar exposure back to neutral as global growth is performing in-line with consensus and yield differentials between the US and the rest of the world have stabilized over the past few months. Within developed markets we favor the euro, the British pound, Norwegian kroner and Swedish krona relative to the Swiss Franc, Japanese yen, Australian and Canadian dollars. In EM we favor high yielders with attractive valuations as the Colombian peso and Brazilian real, while we underweight the Korean won, Taiwan dollar and Chinese renminbi.

Source: Invesco Investment Solutions, Oct. 31, 2022. DM = developed markets. EM = emerging markets. FX = foreign exchange. For illustrative purposes only.

Source: Invesco Investment Solutions, Oct. 31, 2022. For illustrative purposes only. Neutral refers to an equally weighted factor portfolio.

Source: Invesco Investment Solutions, Oct. 31, 2022. For illustrative purposes only. Sector allocations derived from factor and style allocations based on proprietary sector classification methodology. As of June 2022, Cyclicals: energy, financials, industrials, materials; Defensives: consumer staples, health care, information technology, real estate, communication services, utilities; Neutral: consumer discretionary.

Footnotes

-

1

Global 60/40 benchmark (60% MSCI ACWI, 40% Bloomberg Global Aggregate USD Hedged).

-

2

Credit risk defined as duration times spread (DTS).

-

3

MSCI All Country World Index used as measure of global equity markets.

-

4

Credit risk defined as duration times spread (DTS).

当資料ご利用上のご注意

当資料は情報提供を目的として、インベスコ・アセット・マネジメント株式会社(以下、「当社」)のグループに属する運用プロフェッショナルが英文で作成したものであり、法令に基づく開示書類でも金融商品取引契約の締結の勧誘資料でもありません。内容には正確を期していますが、必ずしも完全性を当社が保証するものではありません。また、当資料は信頼できる情報に基づいて作成されたものですが、その情報の確実性あるいは完結性を表明するものではありません。当資料に記載されている内容は既に変更されている場合があり、また、予告なく変更される場合があります。当資料には将来の市場の見通し等に関する記述が含まれている場合がありますが、それらは資料作成時における作成者の見解であり、将来の動向や成果を保証するものではありません。また、当資料に示す見解は、インベスコの他の運用チームの見解と異なる場合があります。過去のパフォーマンスや動向は将来の収益や成果を保証するものではありません。当社の事前の承認なく、当資料の一部または全部を使用、複製、転用、配布等することを禁じます。

受託資産の運用に係るリスクについて

受託資産の運用にはリスクが伴い、場合によっては元本に損失が生じる可能性があります。各受託資産へご投資された場合、各受託資産は価格変動を伴う有価証券に投資するため、投資リスク(株価の変動リスク、株価指数先物の価格変動リスク、公社債にかかるリスク、債券先物の価格変動リスク、コモディティにかかるリスク、信用リスク、デフォルト・リスク、流動性リスク、カントリー・リスク、為替変動リスク、中小型株式への投資リスク、デリバティブ.金融派生商品.に関するリスク等)による損失が生じるおそれがあります。ご投資の際には、各受託資産の契約締結前書面、信託約款、商品説明書、目論見書等を必ずご確認下さい。

受託資産の運用に係る費用等について

投資一任契約に関しては、次の事項にご留意ください。【投資一任契約に係る報酬】直接投資の場合の投資一任契約に係る報酬は契約資産額に対して年率0.88%(税込)を上限とする料率を乗じた金額、投資先ファンドを組み入れる場合の投資一任契約に係る報酬は契約資産額に対して年率0.605%(税込)を上限とする料率を乗じた金額が契約期間に応じてそれぞれかかります。また、投資先外国籍ファンドの運用報酬については契約資産額に対して年率1.30%を上限とする料率を乗じた金額が契約期間に応じてかかります。一部の受託資産では投資一任契約に加えて成功報酬がかかる場合があります。成功報酬については、運用戦略および運用状況などによって変動するものであり、事前に料率、上限額などを表示することができません。【特定(金銭)信託の管理報酬】当該信託口座の受託銀行である信託銀行に管理報酬をお支払いいただく必要があります。具体的料率については信託銀行にご確認下さい。【組入有価証券の売買時に発生する売買委託手数料等】当該費用については、運用状況や取引量等により変動するものであり、事前に具体的な料率、金額、上限または計算方法等を示すことができません。【費用合計額】上記の費用の合計額については、運用状況などによって変動するものであり、事前に料率、上限額などを表示することができません。

20221109-2583656-JP

そのほかの投資関連情報はこちらをご覧ください。https://www.invesco.com/jp/ja/institutional/insights.html