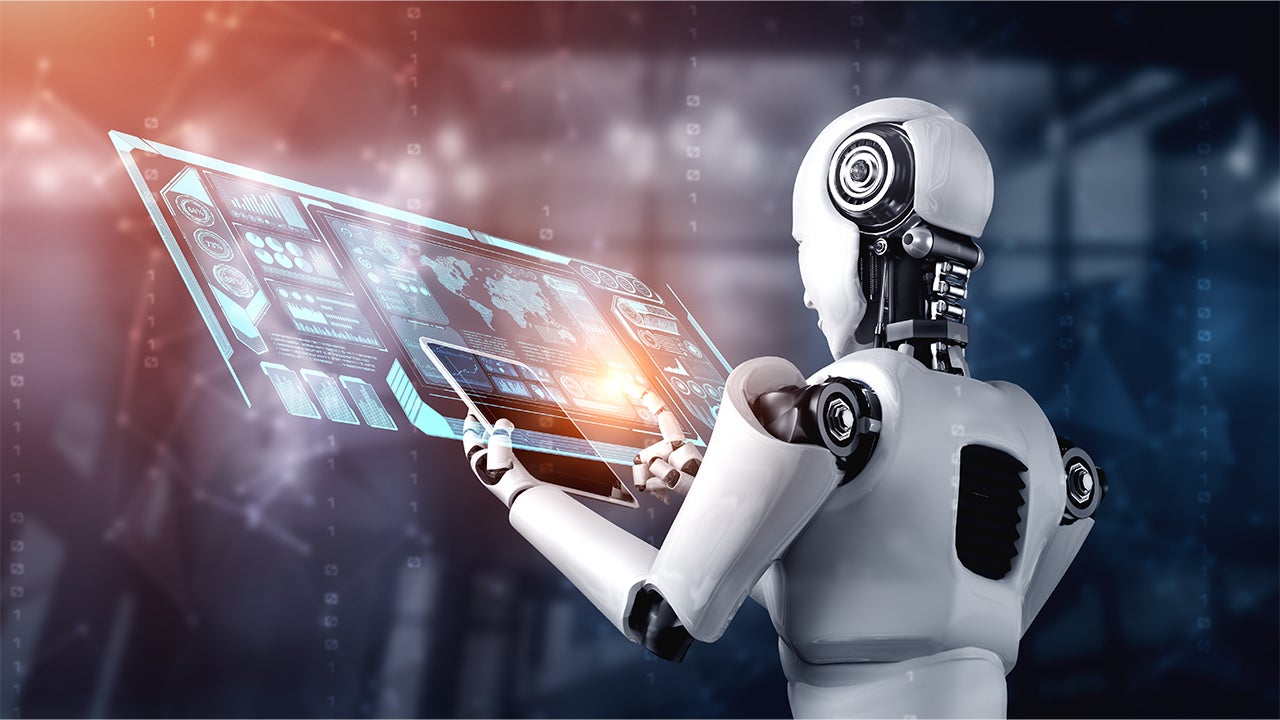

Equities Why ignoring Asian markets might be risky

Asian and emerging markets are often seen as volatile and unpredictable. Recent global events, like trade tensions between the U.S. and China, economic challenges in China, and rising U.S. interest rates, have made investors wary of these regions.

.svg)