China healthcare outlook for 2025

Healthcare expenditure in China is projected to reach RMB 205 trillion yuan by 2030.1 Despite recent challenges, we are positive on this sector for 2025. We believe the innovative drug segment is set to thrive with policy and funding support. Reforms in commercial medical insurance, including potential tax deductions, are expected to provide new funding for high-quality innovative drugs. We think the fiscal stimulus aimed at boosting domestic consumption will benefit medical services and drug retailers. While medical equipment manufacturers will gain from the delayed upgrade program. With the US Biosecure Act overhang removed at least in the short term, we may see China contract research organizations (CROs) and contract development manufacturing organizations (CDMOs) get re-rated. Overall, we think China’s healthcare sector remains attractive, with valuations trading at historical lows.

Policy and funding support for innovative drug development

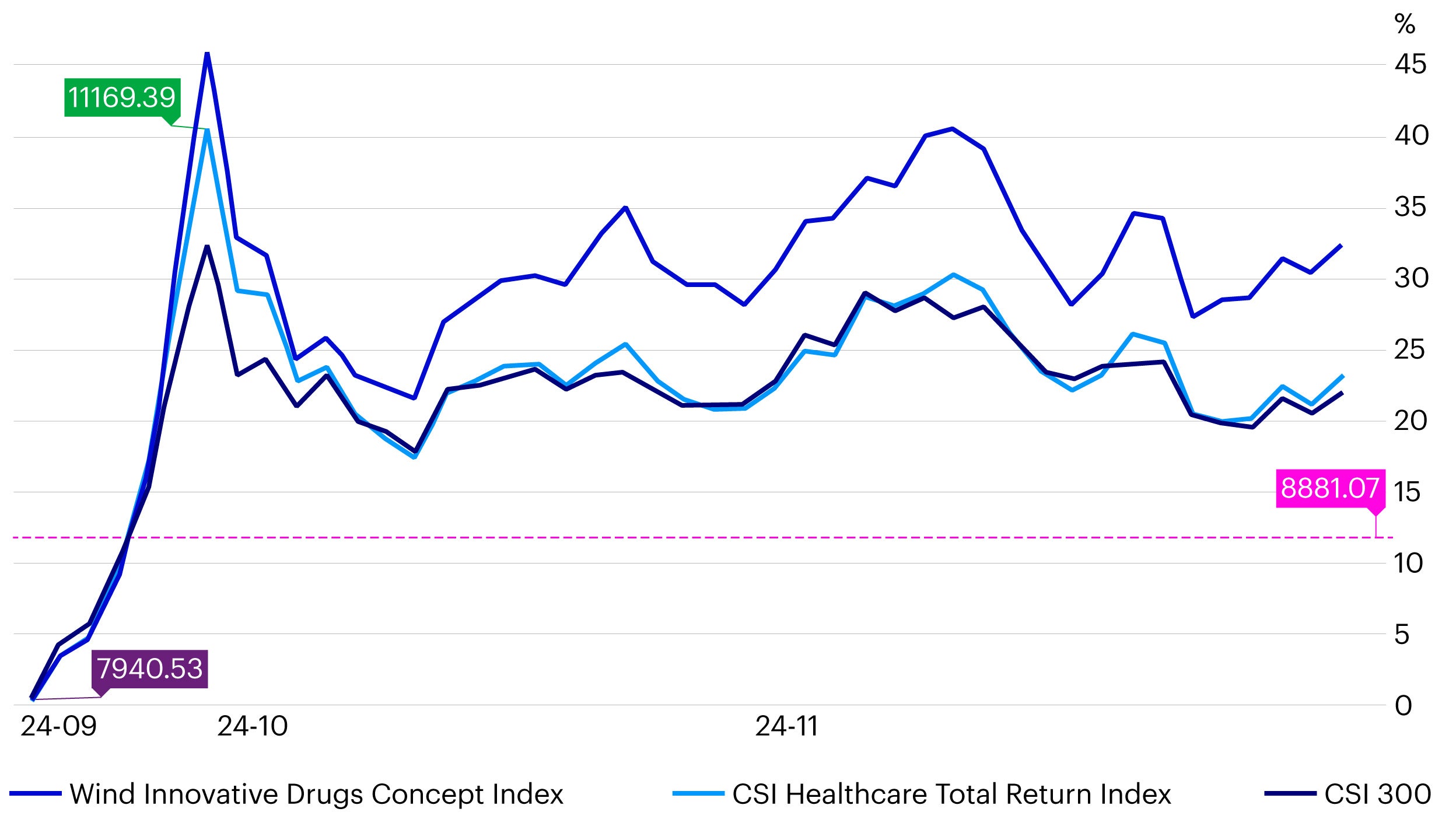

China’s innovative drugs sector has outperformed both CSI Healthcare Total Return Index and CSI 300 since the September-end stock market rally by around 10%.2

Source: Wind, data as of November 29, 2024.

What is driving growth in the innovative drugs sector?

1. Policy support

Since mid-2024, China has been ramping up policy support for innovative drugs. In a significant move, the National Medical Products Administration (NMPA) introduced the Pilot Work Plan for Optimizing Review and Approval of Clinical Trials for Innovative Drugs at the end of July 2024. This plan aims to bolster innovative drug development across the value chain.

Key highlights of the work plan include:

- Fiscal subsidies: The government will provide subsidies for the development of innovative drugs and devices. For successfully launched products, subsidies will cover research and development expenditures.

- Clinical resource allocation: Public hospitals will allocate clinical resources to support the development of innovative drugs.

- Expedited review process: The clinical trial application review process for innovative drugs will be shortened to within 30 workdays in pilot areas, compared to the current 60 workdays.

These policy measures are seen as highly encouraging, with the potential for other local governments to follow suit. This development is expected to have a positive impact on domestic innovative pharmaceutical and biotech companies.

2. Impact of NRDL is expected to be benign

In late November 2024, the National Healthcare Security Administration (NHSA) revealed the outcomes of the most recent National Reimbursement Drug List (NRDL) negotiations. A total of 117 drugs participated in the negotiations, achieving a success rate of 76%. The average price reduction for these newly listed drugs was 63%, consistent with the price cuts observed in recent years. The updated list will take effect in 2025.

Following this recent inclusion, the NRDL now encompasses 3,159 drugs, covering most medications sold in China. Most products from Chinese drug manufacturers have already undergone price reductions in previous NRDL rounds. Consequently, the impact of NRDL negotiations on the profitability and earnings of Chinese drug makers in 2025 is expected to be negligible.

In recent years, the NRDL has exerted significant pressure on drug prices, affecting both generic and innovative drugs. This has led to a downward trend in average selling prices (ASP) and profit margins. However, we believe the innovative drug segment will embark on a different growth trajectory in the coming years, thanks to support from commercial insurance funding and favorable local government policies.

Source: NHSA, UBS-S. *represents the success rate of first-time negotiation drugs.

3. Commercial insurance coverage

In November, China's State Medical Insurance Bureau convened a meeting with leading pharmaceutical and medical device companies, as well as capital market experts, to discuss strategies for enhancing the development of commercial health insurance. We expect commercial health insurance to be an important pillar of China's total health expenditure over the next five years.

According to one major reinsurance player, the total market size of commercial medical insurance has reached RMB 900 billion, covering 200 to 300 million people. This includes RMB 10 billion from Huiminbao3, RMB 100 billion from mid-end health insurance, and RMB 500 billion from critical illness insurance.4

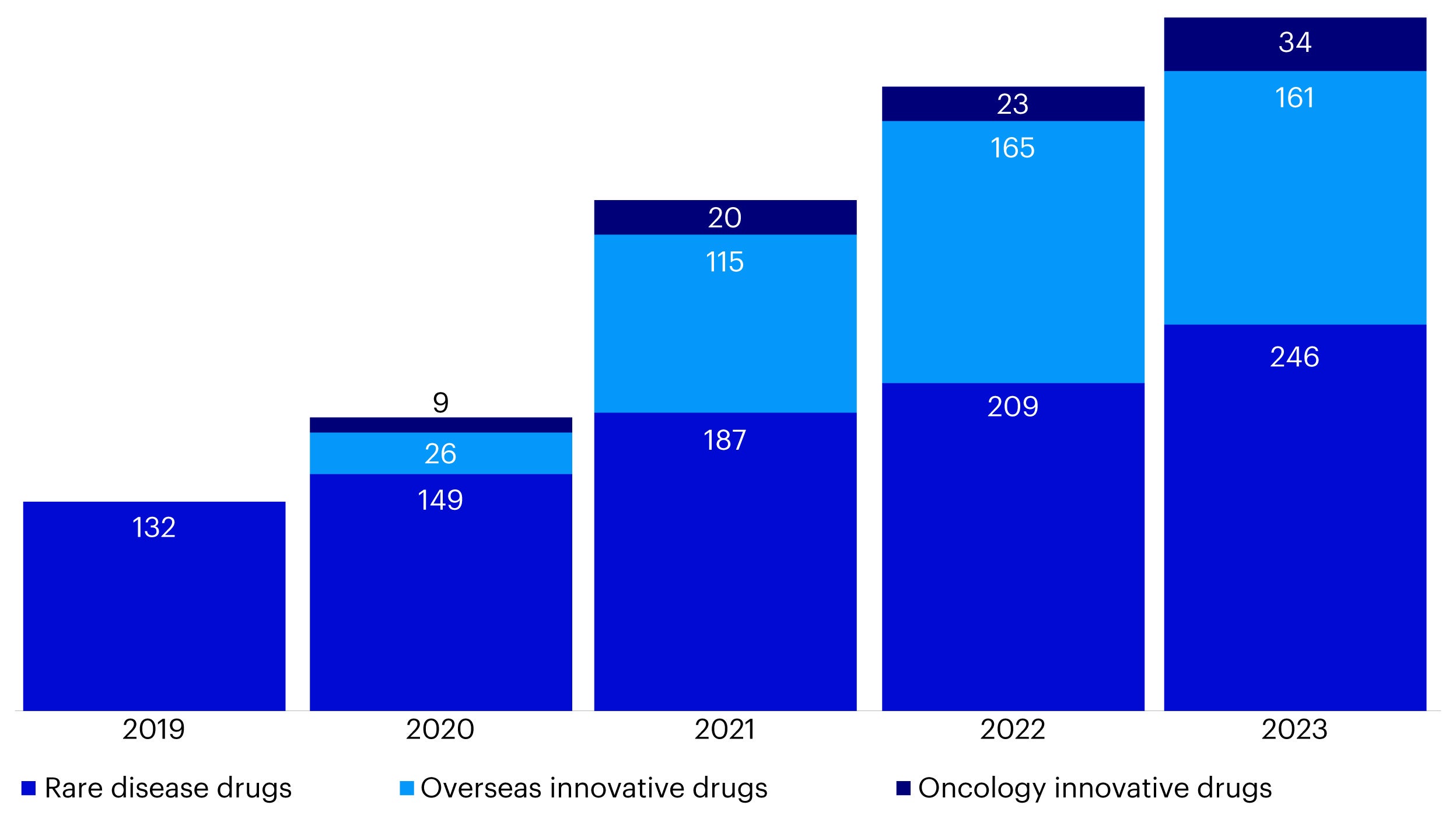

Commercial medical insurance is becoming a crucial source of funding for innovative drug expenses not covered by national medical insurance. In recent years, an increasing number of innovative drugs have been added to commercial medical insurance coverage, further supporting the growth of this sector. (Figure 3).

Source: Citigroup, Company data, The White Paper on Innovative Drug Payment for Commercial Health Insurance in China (2024).

A major bank has forecast that commercial health premiums will grow at a 12% 2023-2030E CAGR reaching RMB 2 trillion by 2030E.5

Future tax deductions could encourage the purchase of commercial health insurance in China. The Ministry of Finance, State Administration of Taxation, and China Insurance Regulatory Commission have announced the nationwide implementation of a pilot policy for individual income tax deductions on commercial health insurance. This initiative allows individuals to deduct up to RMB 2,400 annually from their taxes for eligible health insurance premiums.6 Additional supporting tax policies may be introduced to further increase the penetration of commercial health insurance, making it a more attractive option for consumers.

Investment opportunities in innovative drugs

Within the innovative drug sector, we particularly favor developers of antibody-drug conjugates (ADCs) due to the potential for increased out-licensing deals. Additionally, the GLP-1 supply chain is expected to benefit from localization and import substitution opportunities in China in 2025.

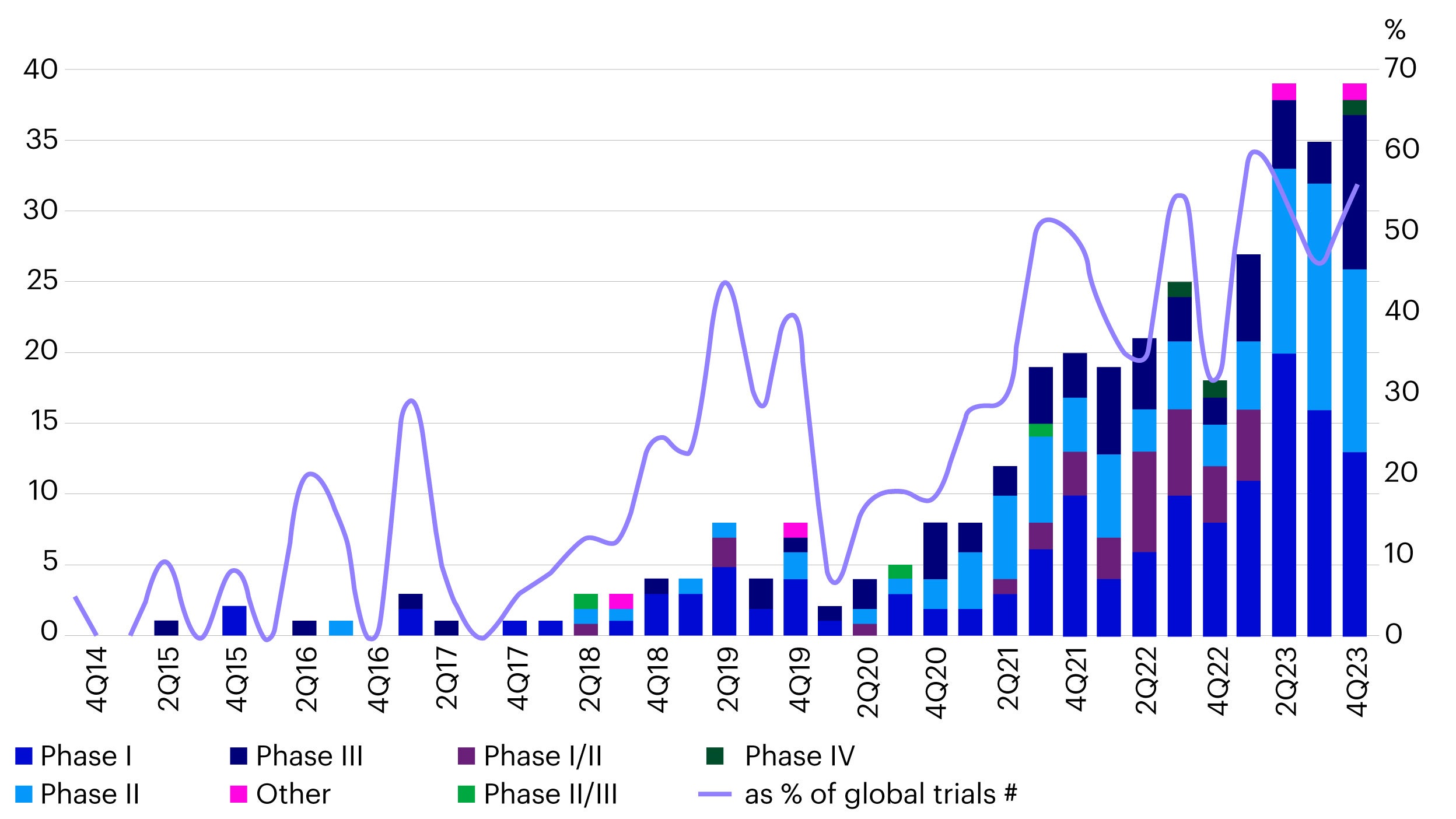

China has emerged as the global research and development hub for ADC drugs. In 2023, China accounted for 60% of all newly registered global ADC clinical trials, a significant increase from less than 20% in 2020 (Figure 4).7 This rapid growth underscores China's strengthening position in the global pharmaceutical landscape.

Source: Pharmcube, data as of March 2024.

In recent years, an increasing number of multinational companies have signed significant licensing deals with Chinese developers of ADCs. These deals have been substantial in size, and we anticipate even more out-licensing agreements for ADC drugs in 2025, following the strong performance in 2024.

China already has the world's largest number of overweight (including obese) adults, and the most type 2 diabetes (T2DM) sufferers. Estimates suggest that the total number of people that are either overweight or have diabetes in China could reach 919 million by 2034.8 While GLP-1 drugs have been widely used to combat these diseases in Europe and the US, they are still in the early stages of commercialization in China. Currently, most GLP-1 drugs sold in China are from foreign brands. However, a few Chinese drug companies made significant progress in clinical trials for GLP-1 drugs in 2024, and these players are expected to capture market share from foreign brands in 2025 by offering lower priced options.

China’s stimulus package to benefit healthcare sector

China's most recent September 2024 economic stimulus package is set to positively impact various sectors, including healthcare. We outline the key highlights:

- Medical equipment upgrade program: The upgrade program for medical equipment, which began slowly in the second half of 2024 due to a delayed implementation timeline and funding uncertainties, is expected to gain momentum in Q1 2025. This could provide a revenue boost for Chinese healthcare equipment manufacturers, with large medical imaging and radiotherapy equipment likely to comprise most of the program.

- 10 trillion RMB debt swap stimulus: The 10 trillion RMB debt swap stimulus is anticipated to indirectly benefit the healthcare sector, particularly drug distribution subsectors. With increased government funding, distributors will be able to reduce their long receivables days from hospitals, improving cash flow and financial stability within the sector.

- Consumer stimulus: The market anticipates additional consumer stimulus measures in 2025, which will benefit medical service sectors such as private dental and eye hospitals, as well as medical beauty companies. This increased consumer spending is expected to drive growth and expansion in these areas.

Overall, China's stimulus package is poised to provide significant support to the healthcare sector, fostering growth and development across various subsectors.

External challenges to China’s healthcare sector in 2025

On December 7, 2024, the National Defense Authorization Act (NDAA) for fiscal year 2025 was released by the US House Armed Services Committee (HASC) and Senate Armed Services Committee (SASC). Notably, the Biosecure Act and any China Contract Research Organization (CRO) or Contract Development and Manufacturing Organization (CDMO) names were absent from the bill. It is anticipated that the Biosecure Act may take some time to be reintroduced in 2025.

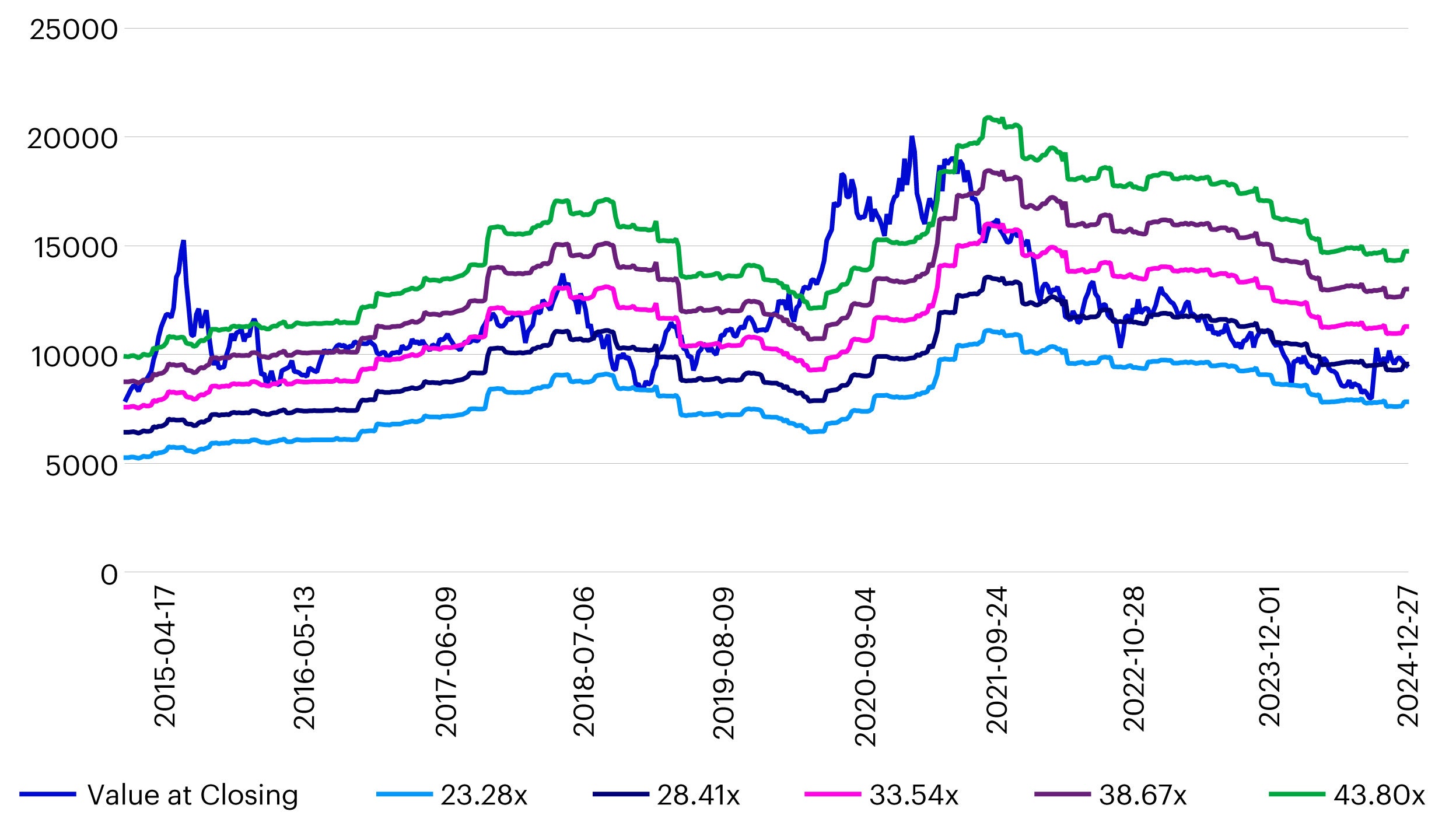

The removal of the Biosecure Act overhang is expected to improve sentiment towards China CRO/CDMO companies in the short term. Valuations in this subsector appear attractive following a sharp correction in recent years.9

While higher US tariffs on Chinese goods in 2025 are widely expected, the impact on China's healthcare sector is likely to be limited. Chinese CRO/CDMO companies generate most of their revenue from services, which are not subject to tariffs. Additionally, Chinese innovative drug makers do not sell drugs directly in the US; they primarily rely on out-licensing deals with multinational companies, which are also unaffected by tariffs. Lastly, Chinese MedTech companies have minimal export exposure to the US and have been establishing new facilities outside of China in recent years.

Conclusion

In 2025, the innovative drug segment is poised to excel, bolstered by differentiated policy and funding support. Recent reforms in commercial medical insurance, including potential tax deductions, are expected to provide a new source of funding for China's healthcare system. This funding could be directed towards high-quality innovative drugs developed by Chinese pharmaceutical and biotech companies.

The anticipated fiscal stimulus in 2025 is likely to focus on boosting domestic consumption, benefiting healthcare subsectors such as medical services and drug retailers. Medical equipment manufacturers are set to gain from the delayed implementation of the upgrade program for medical equipment, expected to pick up momentum in Q1 2025.

With the short-term removal of the US Biosecure Act overhang, China CRO/CDMO companies may experience a re-rating. Overall, we believe that China's healthcare sector remains highly attractive, with valuations trading at historically low levels.

Source: Wind, data as of December 2024.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.

Footnotes

-

1

Analysis of the structure and trend prediction of China’s total health expenditure, Public Health, September 2024, https://www.frontiersin.org/journals/public-health/articles/10.3389/fpubh.2024.1425716/full

-

2

Wind, data as of November 29, 2024.

-

3

Huiminbao is a term for supplementary cover to the country's government-run basic health insurance scheme and generally offers critical illness covers.

-

4

Source: China Re Management, Citi Research, data as of December 2024.

-

5

China Healthcare/Insurance, Commercial Insurance to be key payer, for innovation and sustainability, Citi Research, November 2024.

-

6

Ibid.

-

7

Phamcube, data as of March 2024.

-

8

UBS-S estimates, data as of August 2024.

-

9

Wind, data as of December 2024