Where do we see opportunities in Indian equities in 2025?

In 2025, India is likely to be an investment hot spot as the IMF forecast its GDP to grow 7% in FY 2025, the highest among major economies.1

With the growing size of India equity market, continuous earnings growth and inflows into Indian equity mutual funds, we believe the 3 key structural investment trends in India that we highlighted last year - Financial Inclusion, Consumption Explosion, and Manufacturing Renaissance - will continue to grow.

Recently, we have been exploring companies in emerging sectors in India that show significant growth potential - Energy Evolution, Real Estate and Data Centre. In this article, we will share our insights in these new opportunities.

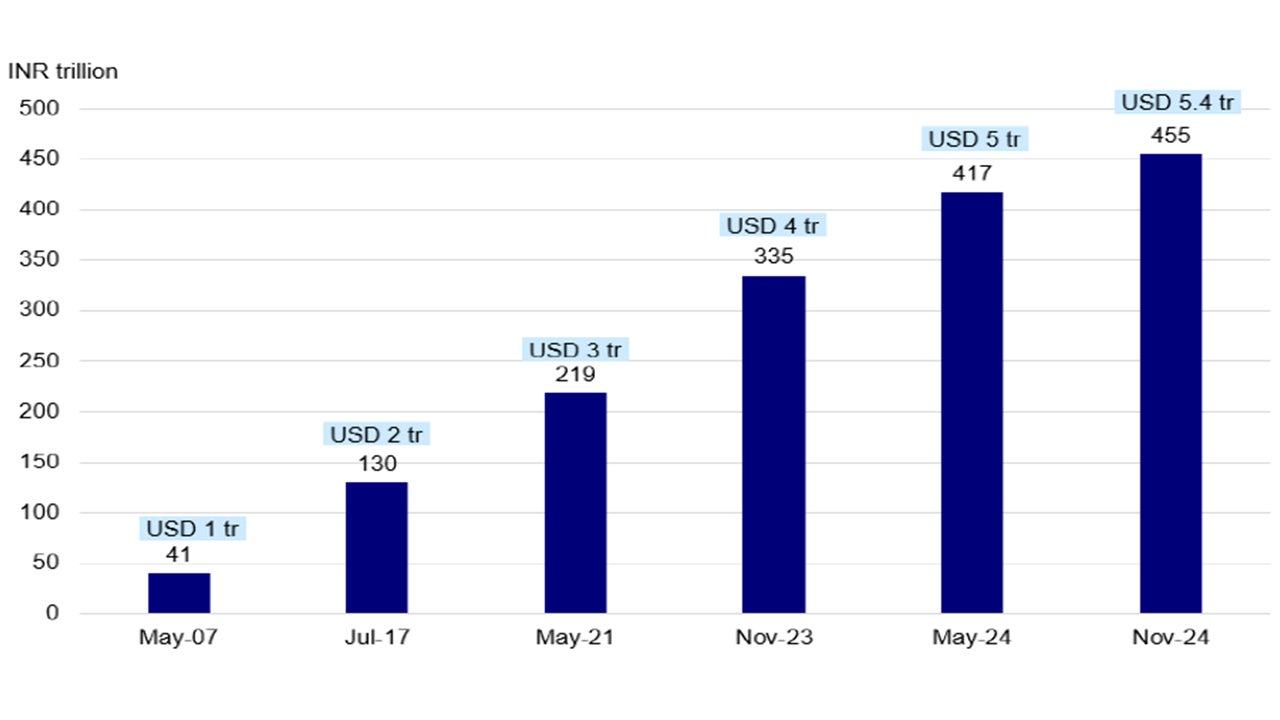

Growing size of India equity market

- India has been one of the fastest-growing equity markets over the past decade – its stock market capitalization surged 6x in the past 10 years, reaching USD 5.4 trillion in November 2024.2

- India’s share of global market capitalization rose to 4.3% in November 2024, up from just 1.6% in 2013, making it the 2nd highest among emerging markets.3

- India’s weighting in the MSCI All Country Asia ex-Japan Index has doubled to 22% from just under 10% since end-2020, thanks to a surge in inflows from foreign investors.4

- This growth has generated diverse investment opportunities across market-cap segments and sub-sectors, broadening the investible universe and providing investors with a wider array of choices.

- For example, at present, India has 11 mega-sized companies (~INR5t+ market capitalization) vs. 0 in 2014.5

Source: Motilal Oswal, Nov 2024

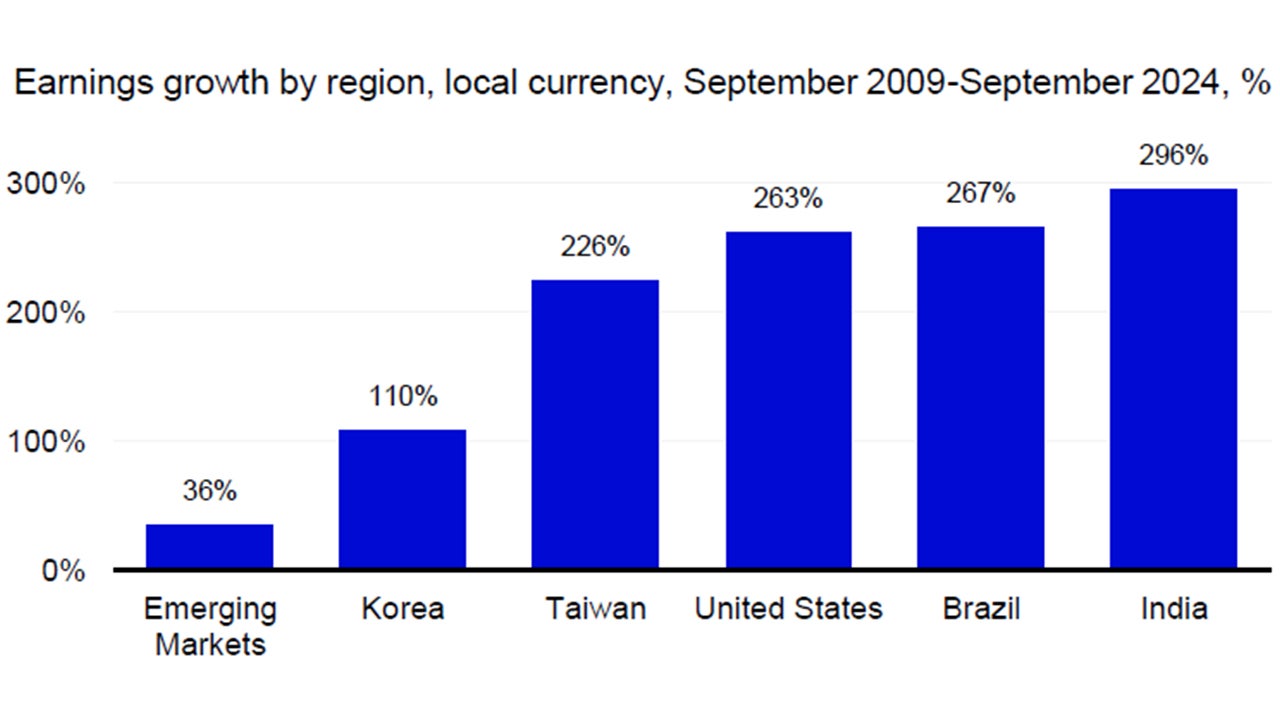

India – A long-term wealth creator

- We see a growing appetite for equity investing and robust domestic flows into the Indian equity market and mutual funds.

- Domestic equity mutual funds have seen six consecutive months of inflows exceeding USD 4 billion, with a record high of USD 5 billion in October 2024.6

- Earnings growth has been decent among the emerging markets and world economy in the past 15 years.

Source: JPM, Bloomberg Sep 2024

Emerging investment ideas in India

Apart from 3 key trends in India - Financial Inclusion, Consumption Explosion, and Manufacturing Renaissance - that we highlighted last year, recently, we have been exploring companies in emerging sectors in India that show significant growth potential.

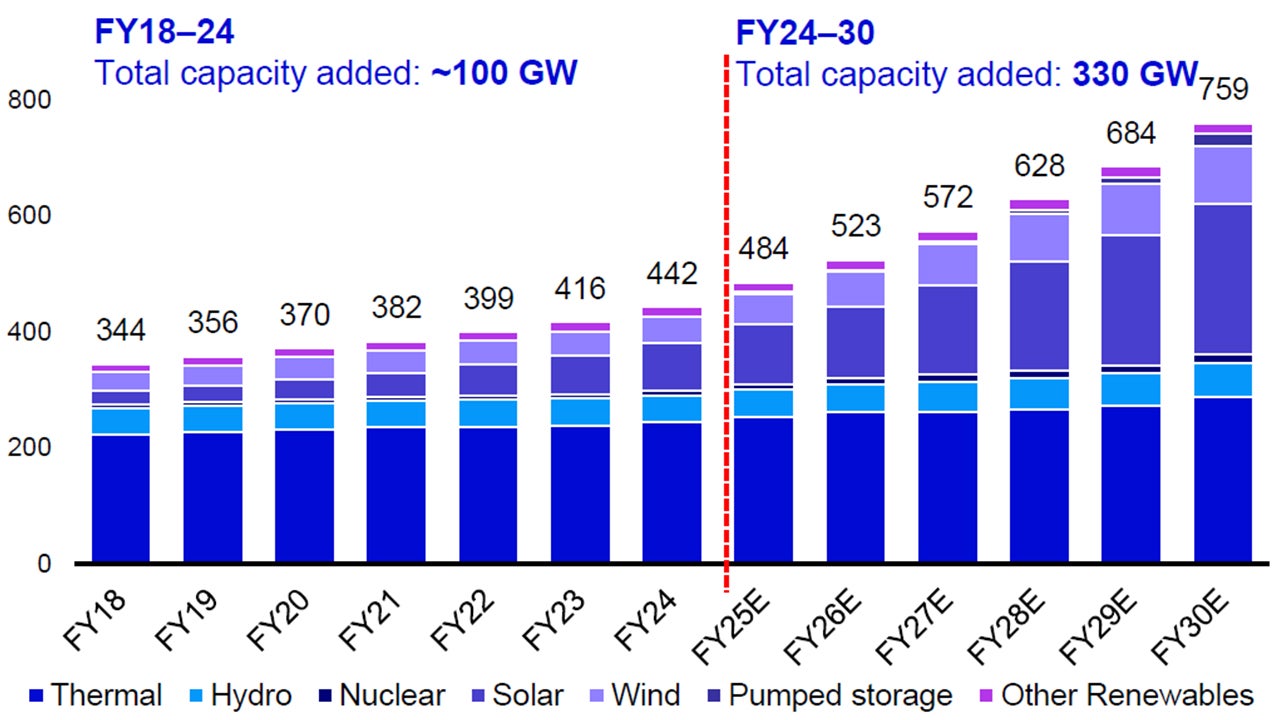

Energy Evolution

- Power generation is expected to surge due to the growing demand for urbanization and data centres. High-performance computing and cooling agents required substantial amount of power consumption.

- We believe that capital expenditure in the power sector is on an upward trend, with over three times the capacity added in the last six years.

- We anticipate that power equipment, cables and engineering solutions will benefit from this trend.

Source: CEA, Bernstein estimates and analysis, Sept 2024

Real Estate

- The real estate sector in India is on an upward trend, driven by growing demand from institutions, rapid urbanization and supportive government initiatives.

- The expansion of Global Capability Centers and the rise of the IT and manufacturing industries in India have boosted demand for commercial real estate.

- Increasing number of data centers presents opportunities for the real estate sector, as it necessitates the construction of new facilities that require substantial space and infrastructure.

- The residential real estate market has rebounded post-pandemic, with a shift in buyer preferences. High-value properties (above Rs ten million) increased from 16% to 43%, showing a preference for premium offerings among affluent buyers.7

Data Centre

- India’s data center market is rapidly growing, fueled by a large, young population, increasing digitalization and high demand for digital services and data storage.

- Driven by government initiatives with increasing investment in digital infrastructure and a large talent pool of IT professionals in India, many global corporations are establishing local operations to take advantage of lower labor and operational costs.

- The India data center industry is projected to attract $5.7 billion in investment by 2026.8 We believe that the rise of data centers in India will significantly benefit from advancements in supercomputing equipment.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

References:

-

1

Source: IMF, October 2024 World Economic Outlook.

-

2

Source: Motilal Oswal, Nov 2024

-

3

Source: Motilal Oswal, Nov 2024

-

4

Source: MSCI, Nov 2024

-

5

Source: Motilal Oswal, Nov 2024

-

6

Source:GoldmanSachs,22Nov2024

-

7

Source: Business standard, Nov 2024

-

8

Source: JLL, Jun 2024