Stratégies de FNB

Quels que soient vos objectifs financiers, nos FNB peuvent vous aider à investir en toute confiance.

Les signaux prospectifs orientent la répartition dynamique des facteurs en fonction des propriétés cycliques.

Processus de placement fondé sur des règles permettant la transparence – pas de construction en « boîte noire »

Complémentaire à la gestion passive et active, offrant une solution novatrice et rentable sur le marché.

La stratégie multifactorielle dynamique cherche à surpasser l’indice de référence FTSE/Russell pondéré en fonction de la capitalisation boursière sur une base de rendement total et corrigé du risque, tout en maintenant un niveau de risque comparable sur un cycle complet de marché.

| Nom | Symbole | Catégorie d’actif | Vehicle | Télécharger |

|---|---|---|---|---|

| Invesco International Developed Dynamic-Multifactor Index ETF | IIMF IIMF.F |

Actions internationales et mondiales | FNB | Fiche de renseignements |

| Invesco Russell 1000® Dynamic-Multifactor Index ETF | IUMF IUMF.F |

Actions américaines | FNB | Fiche de renseignements |

Darim Abdullah, stratège ETF, explique le fonctionnement de l'approche dynamique multifactorielle d'Invesco, en quoi elle diffère des autres stratégies factorielles et pourquoi les investisseurs devraient les envisager pour leurs portefeuilles.

Au Canada, nous avons deux FNB multifactoriels dynamiques. L’un offre une exposition à l’ensemble du marché boursier américain et porte le symbole IUMF, et l’autre offre une exposition à l’ensemble du marché boursier international développé et porte le symbole IIMF.

00:00:23,825 --> 00:00:29,105

Les deux FNB sont des stratégies de base diversifiées et générales qui utilisent un processus fondé sur des règles pour tirer parti de l’évolution du marché.

00:00:33,989 --> 00:00:37,487

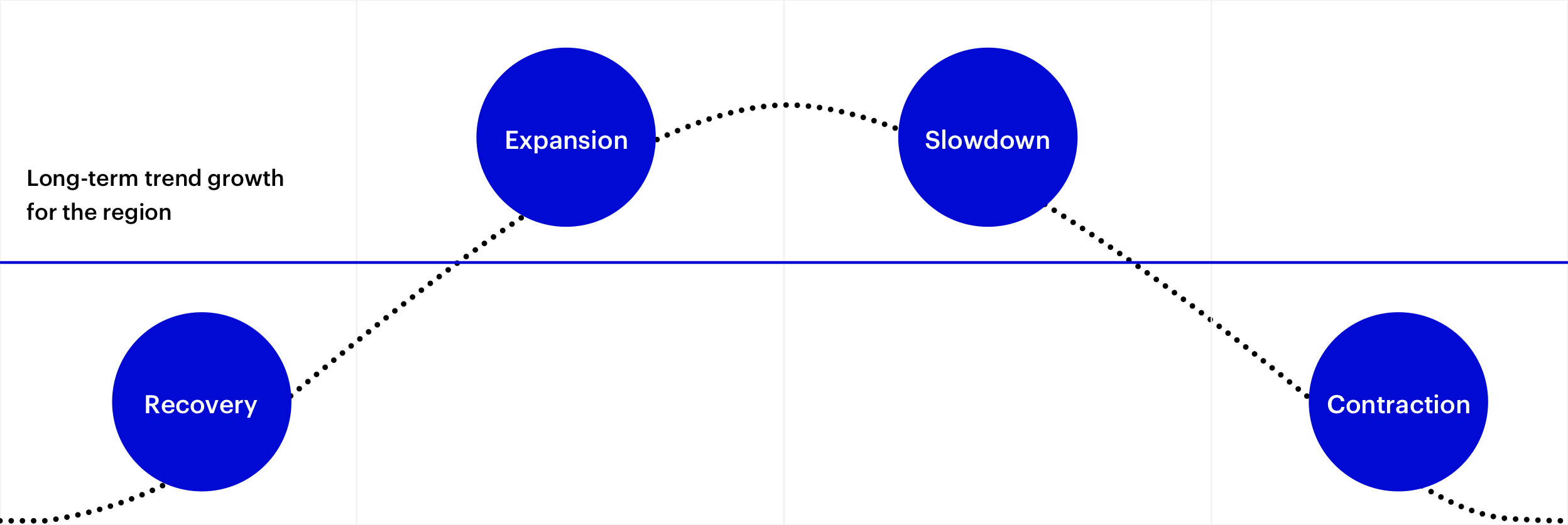

Tout d’abord, en mettant à profit le cadre macroéconomique d’Invesco, la première étape du processus consiste à définir le régime économique actuel, autrement dit le stade du cycle économique : reprise, expansion, ralentissement ou contraction.

00:00:50,918 --> 00:00:54,119

Une fois le régime économique déterminé, les facteurs ou les styles de placement historiquement récompensés qui lui sont associés sont identifiés. La construction du portefeuille suppose ensuite un ajustement dynamique des placements sous-jacents des FNB en ciblant ceux qui sont fortement exposés aux facteurs ou aux styles de placement favorisés par le régime économique actuel.

00:01:10,718 --> 00:01:12,764

Par exemple, en période de reprise économique, les FNB privilégieraient les placements qui sont relativement sous-évalués et de plus petite taille, en ciblant les facteurs de valeur et de taille qui ont bien fait dans le passé durant une reprise économique.

00:01:26,690 --> 00:01:28,637

En période de ralentissement économique, les FNB ajusteraient leurs placements en privilégiant les placements qui présentent de solides caractéristiques défensives, comme les facteurs de faible volatilité et de qualité.

00:01:40,187 --> 00:01:44,609

Essentiellement, le FNB est dynamique et apporte des changements à ses placements sous-jacents pour mieux s’adapter au au régime économique actuel et pour composer avec l’incertitude du marché.

00:01:54,476 --> 00:01:55,532

Nous croyons que les FNB multifactoriels dynamiques se distinguent des autres stratégies factorielles de deux façons. Premièrement, au moins deux expositions factorielles sont ciblées en tout temps, parfois trois.

00:02:09,425 --> 00:02:12,461

Cette approche multifactorielle différencie nos FNB des autres stratégies fondées sur un seul facteur. Et pourquoi est-il important de considerer les facteurs globalement plutôt qu’individuellement? Nous croyons que c’est important parce qu’un grand nombre de ces facteurs tendent à avoir une corrélation faible à négative entre eux, si bien que le regroupement de plusieurs facteurs peut offrir des avantages potentiels sur le plan de la diversification.

00:02:37,211 --> 00:02:39,686

La deuxième façon dont nos FNB se démarquent, c’est que dans le cadre multifactoriel, la stratégie est vraiment dynamique et passe d’un ensemble de facteurs à un autre selon le régime économique en place. Cela nous distingue aussi des autres stratégies multifactorielles qui ont tendance à être plus statiques.

00:02:55,789 --> 00:02:59,749

La superposition dynamique qui découle du cadre macroéconomique d’Invesco a été un facteur clé de rendement pour les stratégies depuis leur création.

00:03:08,659 --> 00:03:12,091

Nous croyons que les stratégies multifactorielles dynamiques d’Invesco procurent un alpha efficient et une exposition ciblée aux actions américaines et internationals depuis la création des indices sous-jacents, elles ont produit des rendements excédentaires par rapport aux indices boursiers généraux, comme l’indice S&P 500 et l’indice MSCI EAEO.

00:03:28,030 --> 00:03:31,033

De plus, le risque de baisse a été atténué, comme en témoignent leurs ratios d’encaissement des baisses. La capacité de la stratégie à se positioner dans des placements plus défensifs présentant des facteurs de faible volatilité et de qualité supérieure en prévision d’une évolution défavorable des marches a procuré un ratio d’encaissement des baisses intéressant.

00:03:47,137 --> 00:03:52,087

Cela a été particulièrement utile pour la stratégie d’actions américaines en 2022 que de nombreux d’observateurs considèrent comme l’une des années les plus difficiles de l’histoire récente pour les investisseurs. La stratégie d’actions américaines a produit un rendement excédentaire de 4,87 % par rapport à l’indice général S&P 500. Les investisseurs peuvent chercher à tirer parti de ce genre d’approche active et rentable dans les conditions de marché incertaines actuelles.

00:04:14,626 --> 00:04:17,101

Que vous souhaitiez profiter d’une reprise économique ou réduire le risque de placement associé aux replis économiques, les FNB multifactoriels dynamiques d’Invesco peuvent limiter la nécessité d’apporter des changements tactiques en vous proposant une approche simplifiée pour vos placements sur les marchés boursiers américains et internationaux,peu importe leur direction.

Facteurs cycliques et expositions différentes au risque économique. Le cadre évoluera au fil des cycles de marché, selon chaque régime, dans le cadre d’une approche tactique de répartition factorielle.

This graph demonstrates how the team defines the stages of the business cycle based on the expected level and change in economic growth and how we combine proprietary indicators to estimate one of four factor regimes: Recovery, expansion, slowdown, and contraction.

| Régime macroéconomique | Préférences factorielles | Taille | Valeur | Momentum | Volatilité | Qualité |

|---|---|---|---|---|---|---|

| Reprise | La croissance est inférieure à la tendance et s’accélère | X | X | |||

| Expansion | La croissance est supérieure à la tendance et s’accélère | X | X | X | ||

| Ralentissement | La croissance est supérieure à la tendance et ralentit | X | X | |||

| Contraction | La croissance est inférieure à la tendance et ralentit | X | X | X |

Cyclicalité des facteurs

Nous croyons que :

Quels que soient vos objectifs financiers, nos FNB peuvent vous aider à investir en toute confiance.

Des solutions de titres à revenu fixe axées sur le client qui vous aident à composer avec le monde des placements obligataires, qui est en constante évolution.

Faites confiance à Invesco pour accéder à la plus grande économie du monde.

Selon les caractéristiques fondamentales de la taille, de la valeur, du momentum, de la faible volatilité et de la qualité. Rien ne garantit que ces objectifs seront atteints ou qu’une stratégie de placement sera fructueuse. Les investisseurs doivent garder à l’esprit que les marchés boursiers sont volatils et imprévisibles. Rien ne garantit que le rendement historique d’un placement, d’un portefeuille ou d’une catégorie d’actif aura une corrélation directe avec son rendement futur. Source : Invesco Investment Solutions.

NA 3471031