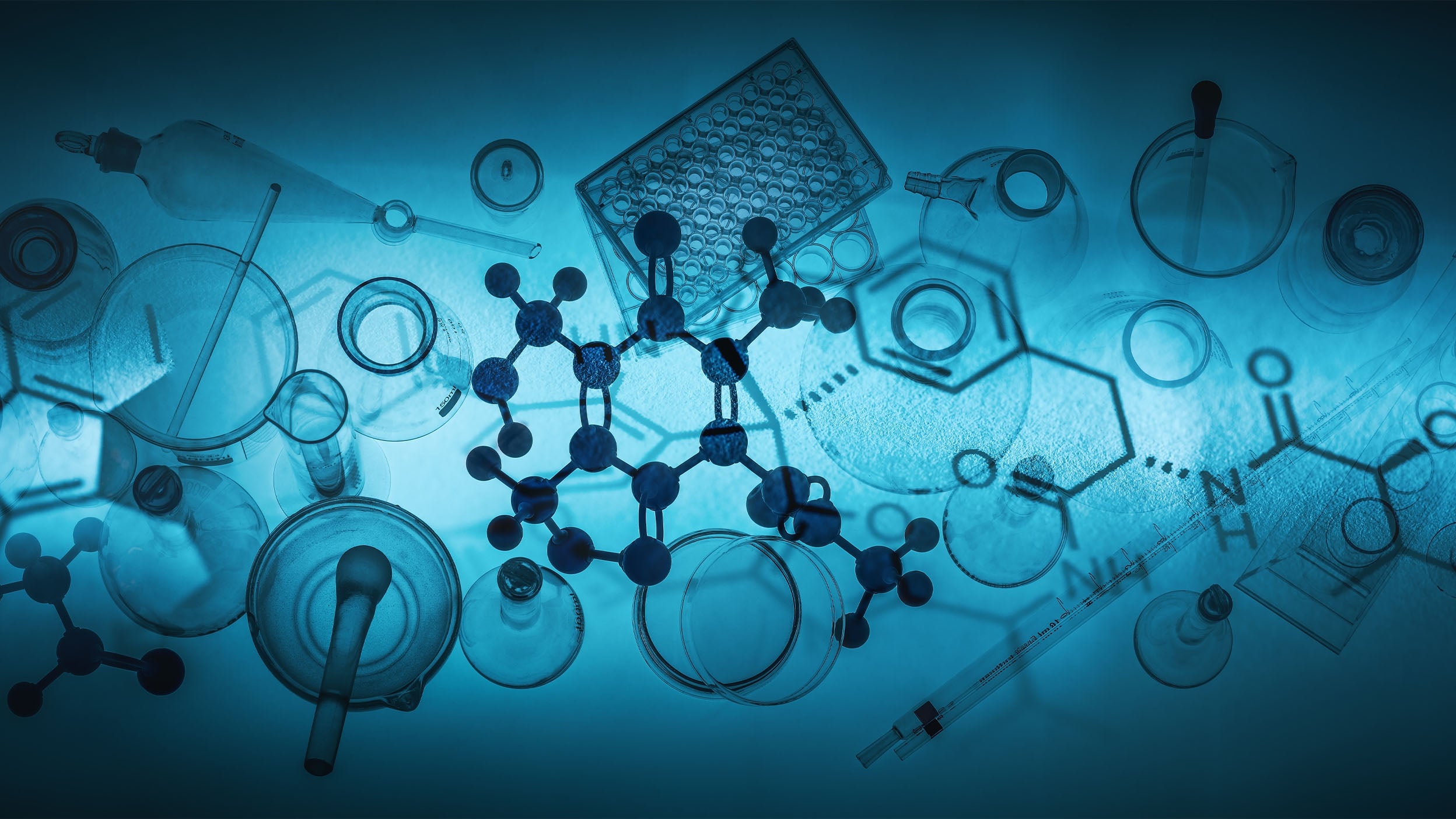

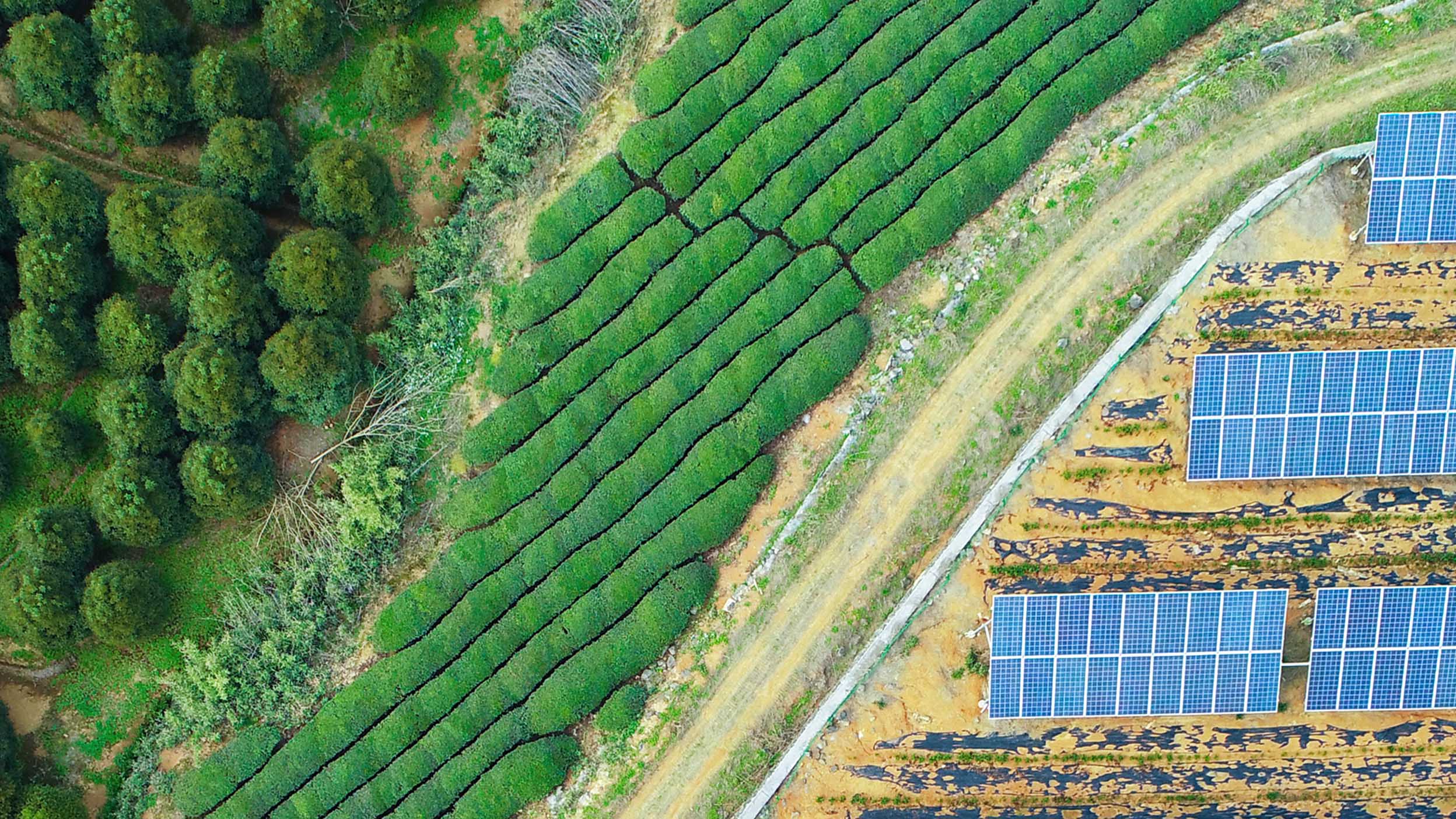

What’s driving growth in China’s biotech industry?

Research firms expect that the mainland biotech market will be worth US$96 billion by 2023. Chris Liu, Senior Portfolio Manager within Invesco’s China A Investments team summarizes some factors driving the growth of this market.