What’s driving growth in China’s biotech industry?

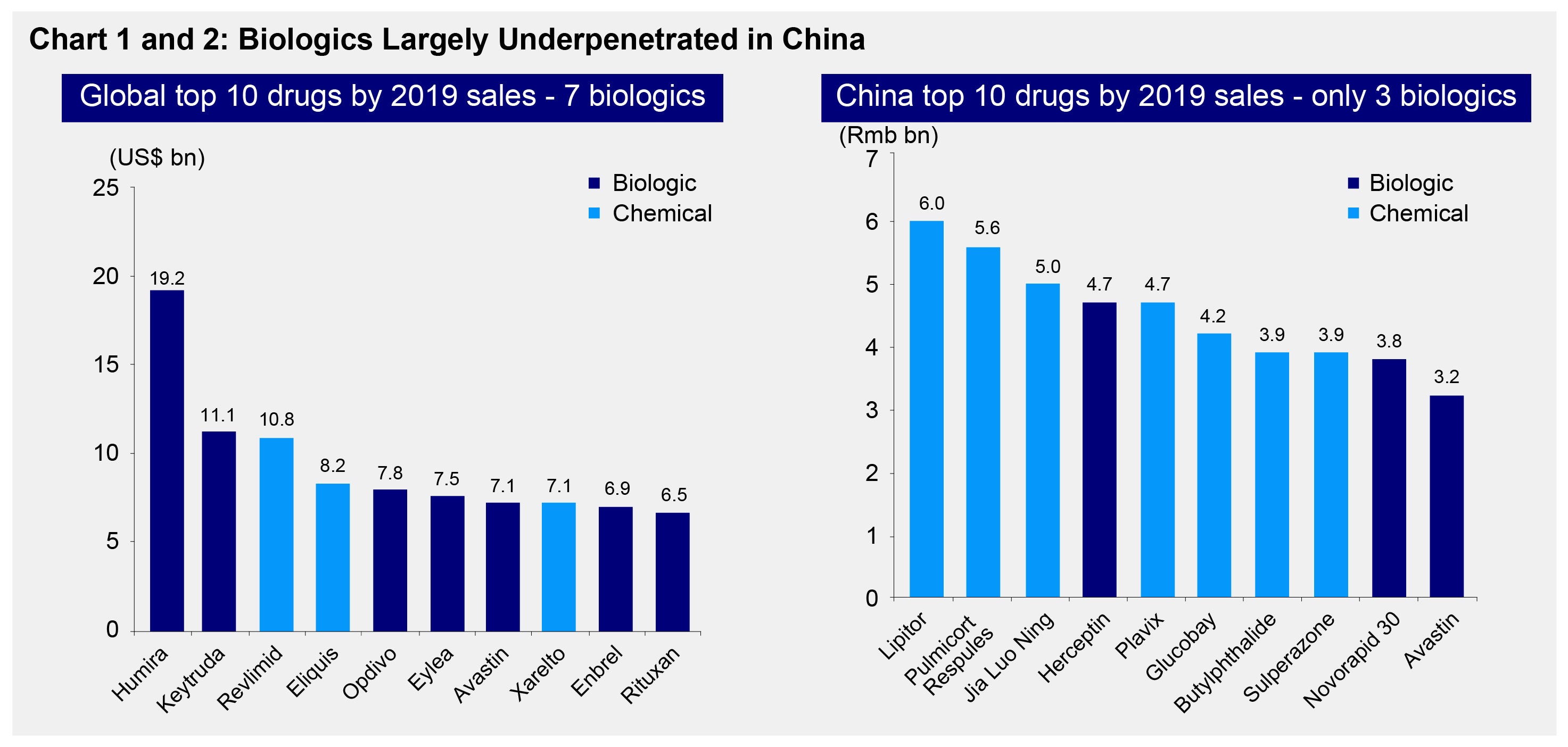

The biotech industry in China is relatively nascent. Even though the country’s healthcare market is the second largest globally1, biotech-driven treatments account for only 12% of the China’s total drug market.2 Companies in this space are also far behind their global counterparts both in terms of revenue and R&D investments. In 2019 for example, sales of the top ten biotech drugs (biologics) globally were in the range of USD 6 to 20 billion while Chinese biologic sales were in the range of RMB 3 to 5 billion (see Chart 1 and 2).

Yet research firms expect that the mainland biotech market will be worth US$96 billion by 2023 (from US$40 billion in 2018).3 This is in part due to the country’s rapidly ageing population and affluent middle class that is willing to spend on quality healthcare products and services as outlined in this earlier piece. Chris Liu, Senior Portfolio Manager within Invesco’s China A Investments team summarizes some other factors driving the growth of this market.

History and case for biotech

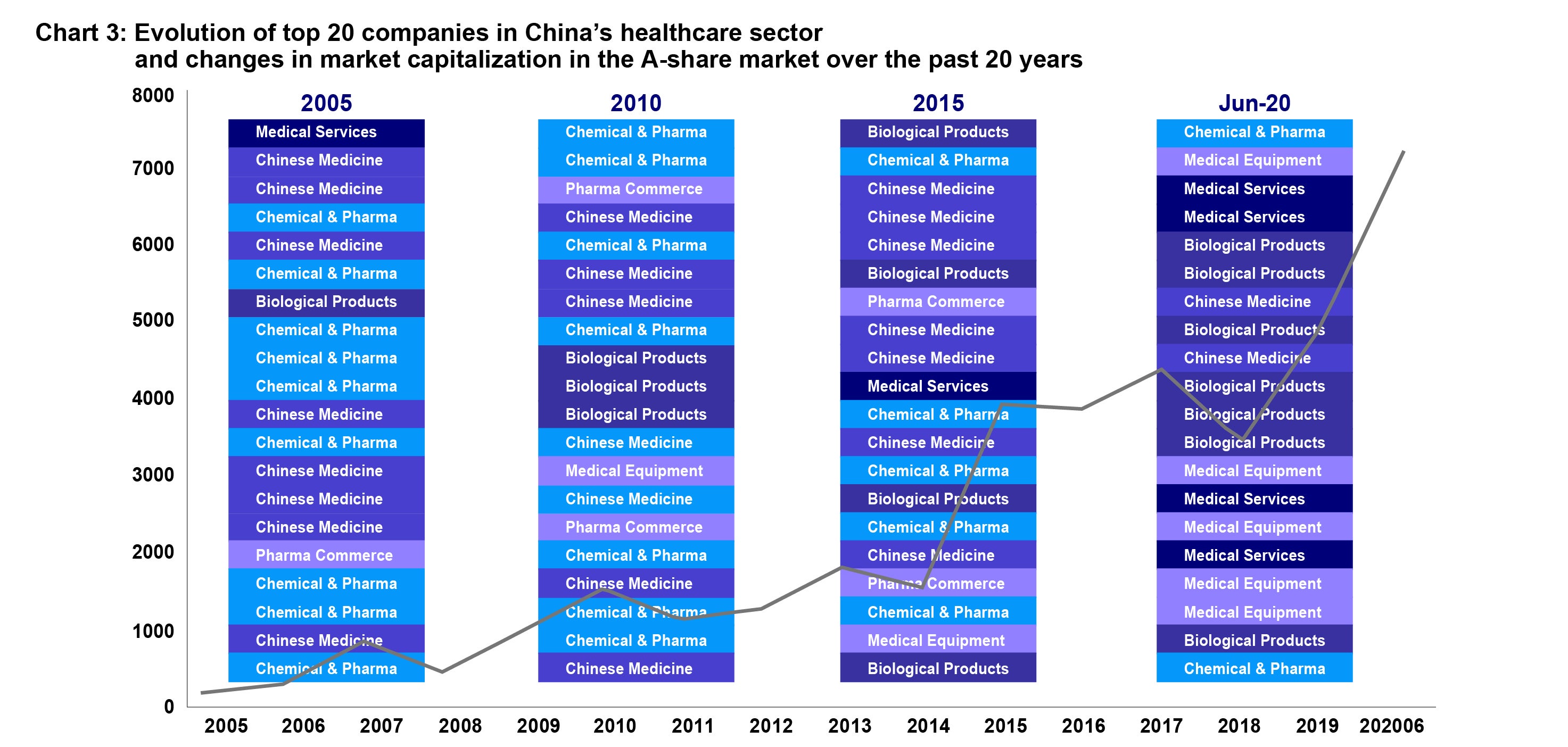

As recently as five years ago, most new drugs in China whether chemical or biopharmaceutical, came from overseas. Chinese drug makers were instead focused on producing generic drugs (once the global patents on these medicines expired. In 2016, for example, generic drugs had a market share of 95%.4 However, in the past five to ten years, Chinese companies have been moving up the value chain (see Chart 3). Before 2010, the top 20 China healthcare companies were mostly generic drug makers, while from 2010-2020, we saw more biological drug companies emerging in the top 20.

Biotech drugs are now favorable as compared to chemical drugs as they have fewer side effects. In 2019 for example, seven out of the top ten bestselling global drugs were biologics (see Chart 1). These drugs are typically used to treat cancer cells and tumors.

Drivers for the interest in biotech:

1. Reduction in the prices of generic drugs

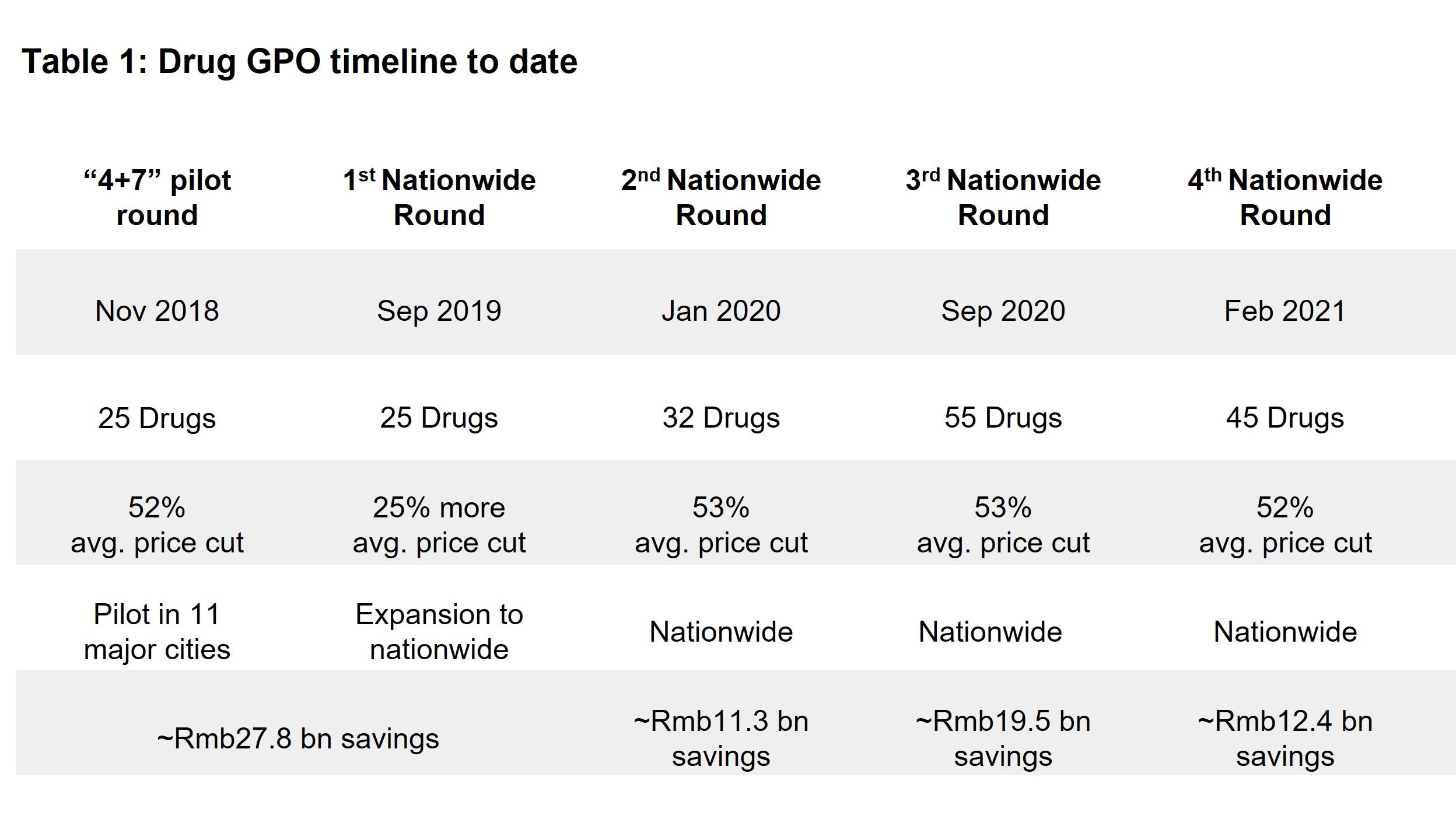

Since 2018, there have been five rounds of National Reimbursement Drug List (NRDL) price negotiations for new drugs (see Table 1). This has been aimed at reducing the price burden for patients looking to get their expenses reimbursed under the national basic medical insurance scheme.

Consequently, generic drug makers in the country have been pushed to innovate to make up for this margin correction. Large Chinese pharma companies are now spending more on R&D and specifically are looking to innovative areas such as oncology drugs. At the same time biotech companies in China are also emerging with a shorter history and more concentrated product pipeline.

2. Enhancement and streamlining of regulatory standards

The National Healthcare Security Administration (NHSA) was set up in 2018, responsible for managing all basic health insurance schemes in the country. This represented a milestone in China’s health sector reform to further improve the efficiency of the healthcare system in areas such as cost controls, service quality and value for money.5 Since their launch, the NHSA has added more non-generic drugs to the list of those that qualify for patient reimbursement.6 Specifically, anticancer “PD-1” drugs have been included into drug list which are a key focus area for biotech players.7

The National Medical Products Administration (NMPA), a bureau set up for approval process of new drugs, was also rebranded in 2018 and has since been employing a clearer and more efficient drug-approval system based on global standards (while it took much longer to get new drugs approved with the previous system8). This transformation is also expected to shift the healthcare industry’s focus from generic to innovative drug development.9

3. Access to capital

As of mid-2018, Hong Kong’s stock exchange amended its listing rules to allow for qualified biotech companies to list on the exchange without earnings. This was a significant step in providing Chinese biotech firms with more access to capital to fuel R&D. Later in 2019, the Shanghai Stock Exchange officially launched the STAR Market (the Science and Technology Innovation Board), with a focus on supporting high and new technology industries and strategic emerging industries.10 As part of this, the China Securities Regulatory Commission has been able to fast-track approval for the listing of high-tech unicorns including biotechs.11 Apart from public channels, private equity and venture capital investment in this space is also growing rapidly.12

4. Prospect of global market demand

Onshore biotech firms are currently competing heavily with foreign players to capture domestic market share. However, many are also setting their sights farther afield and are looking to tap into the vast global market in the long run. In 2019 for example, a domestic biotech company’s lymphoma treatment was approved by the US FDA - the first China-discovered innovative cancer drug to win such approval.13 Earlier this year the same company signed a $2.2-billion deal with a global pharmaceutical giant to license their PD-1 drug in major markets outside of the country.14 A few other biotech companies have also had licensing deals with global MNCs to obtain FDA approval for their new biological drugs to be sold in the US and other countries.

Unique opportunities in China’s biotech sector

We believe the growing biotech market represents an untapped opportunity for investors. Chinese biotech companies have a few competitive advantages that could help them gain more market share in the future:

1) High quality sizeable domestic talent pool with STEM-related backgrounds (9 million fresh graduates in China in 202115)

2) Cost of onshore clinical trials is lower than other countries which can speed up the drug development process. With a population of 1.4 billion people, the cost of summoning a sizeable patient sample is lower.16

3) China’s expertise in AI can give biotech companies a competitive edge to speed up the drug discovery phase (and can make up for what they lack in experience relative to US firms).

^1 Pharma groups spend billions to tap into booming China healthcare, March 2021,

https://www.ft.com/content/c2bec4c8-3345-4792-a915-9e906f6d4d64

^2 From Innovation to Revolution: Chinese Biotech Industry, March 2020,

https://www.am.miraeasset.com.hk/insight/innovation-revolution-chinese-biotech/

^3 Ibid.

^4 Pharmaceutical Industry in China: Policy, Market and IP, September 2019, https://link.springer.com/chapter/10.1007/978-981-13-8102-7_10

^5 Health financing, https://www.who.int/china/health-topics/health-financing

^6 Pharma groups spend billions to tap into booming China healthcare, March 2021, https://www.ft.com/content/c2bec4c8-3345-4792-a915-9e906f6d4d64

^7 China Healthcare Sector: NRDL negotiation results confirm NHSA continues to be willing to pay for innovation, Credit Suisse, December 2020

^8 China cuts red tape, increases potential for breakthrough medicines, August 2018, https://www.ibj.com/articles/69961-china-cuts-red-tape-increases-potential-for-breakthrough-medicines

^9 Ibid.

^10 HKEX and Star Market: How do new drug developers choose?, November 2019, https://law.asia/hkex-star-market-drug-developers/

^11 How does Shanghai’s STAR Market support innovation enterprises’ IPOs, July 2020,

https://www.ey.com/en_cn/china-opportunities/how-does-shanghai-s-star-market-support-innovation-enterprise-s-ipos

^12 Investing In China’s Biotech Revolution, September 2019, https://www.globalxetfs.com.hk/content/files/Investing_in_China_Biotech_Revolution.pdf

^13 China's BeiGene gets FDA approval for drug to treat rare form of lymphoma, November 2019,

https://www.reuters.com/article/us-beigene-fda-idUSKBN1XO2UI

^14 Novartis, BeiGene in $2.2-Bn Licensing Deal for Oncology Drug, January 2021,

https://www.dcatvci.org/pharma-news/6939-novartis-beigene-in-2-2-bn-licensing-deal-for-oncology-drug

^15 Fresh grads in China face 'complex, arduous' job searches as record 9m leave universities in 2021, May 2021, https://www.globaltimes.cn/page/202105/1223464.shtml

^16 Asia: Preferred Destination For Clinical Trials, February 2017,

https://novotech-cro.com/sites/default/files/170217_FrostSullivan_Asia%20white%20paper_full.pdf