China ETFs and Indexed Strategies

What are the options?

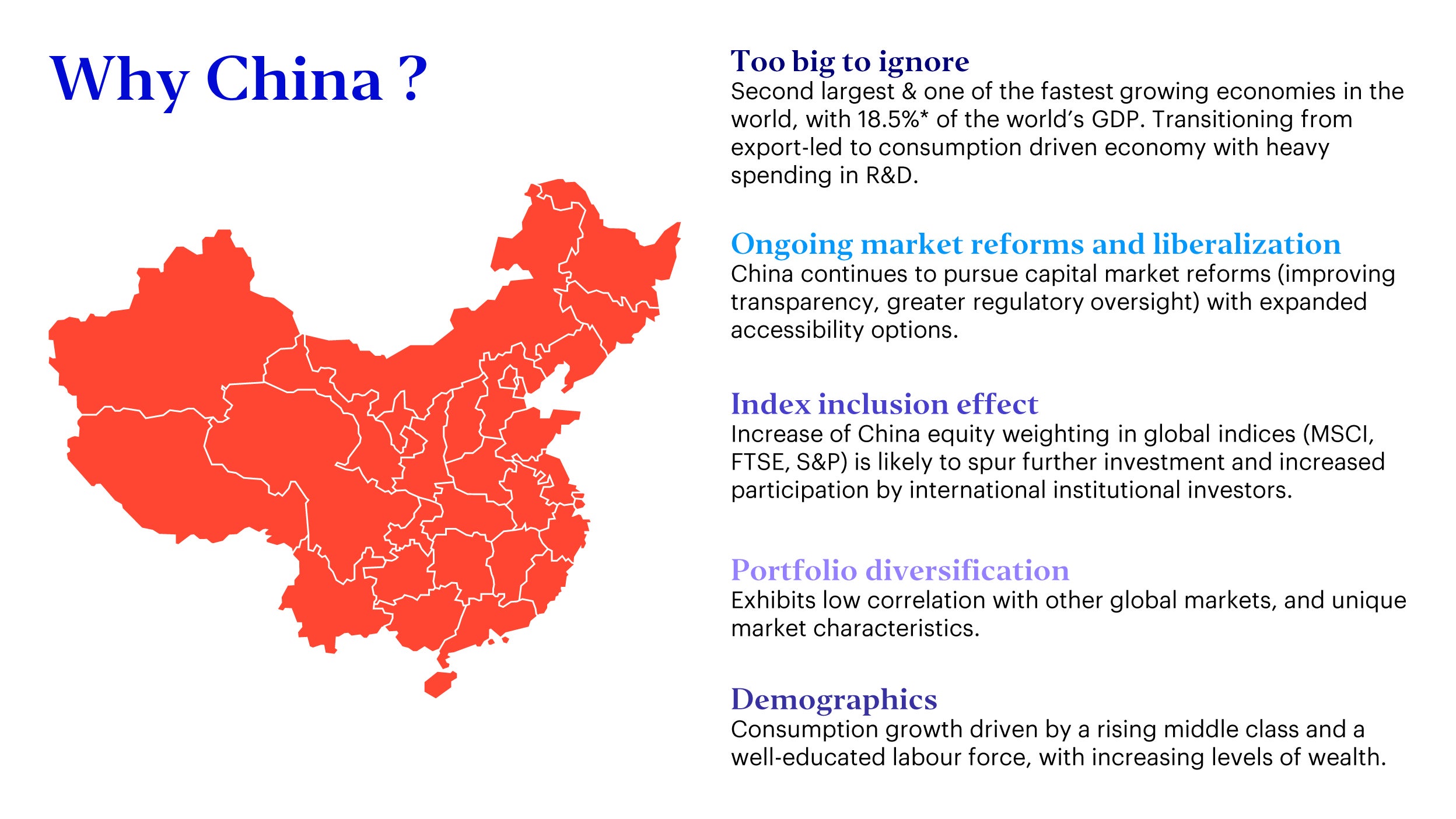

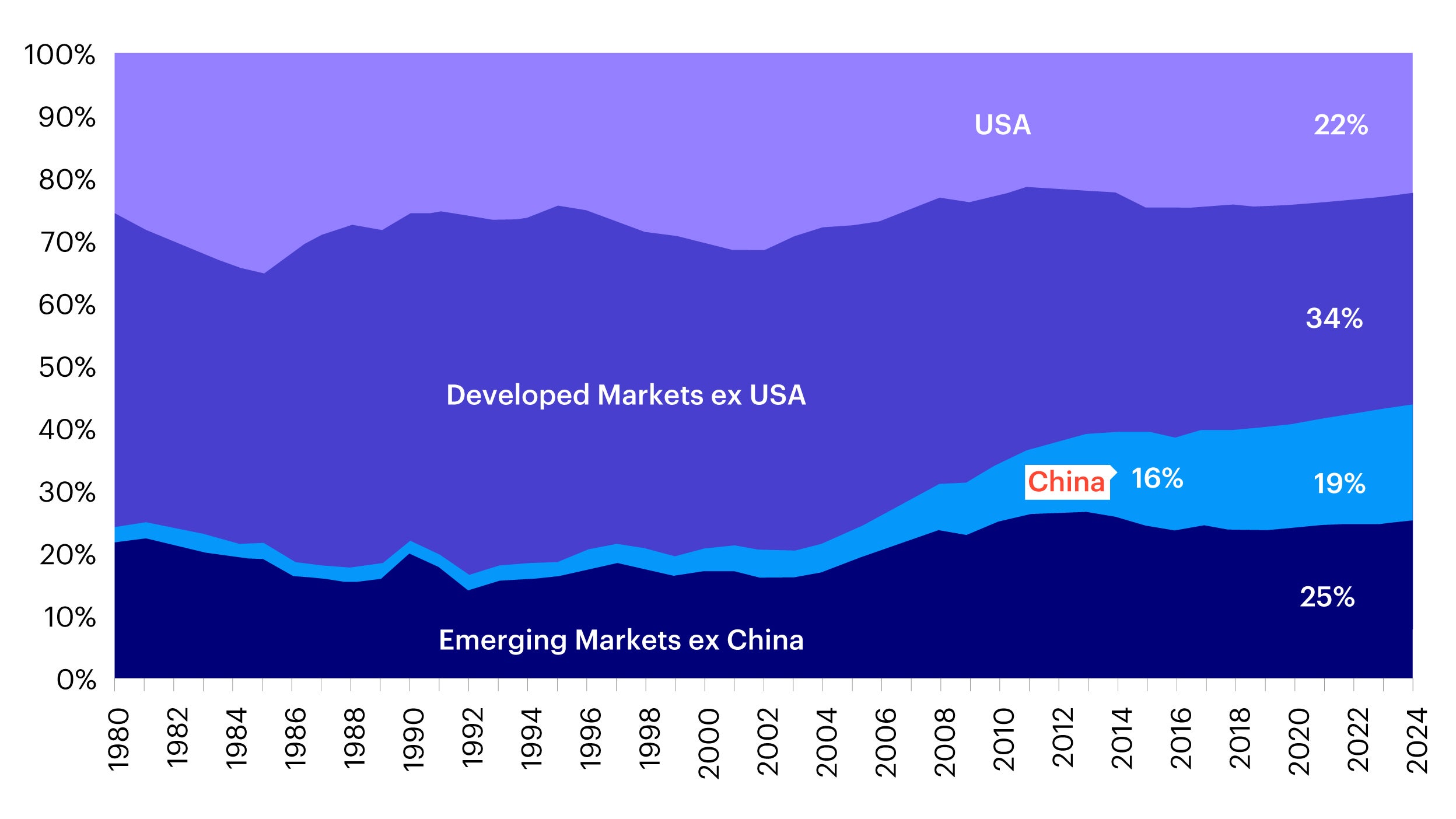

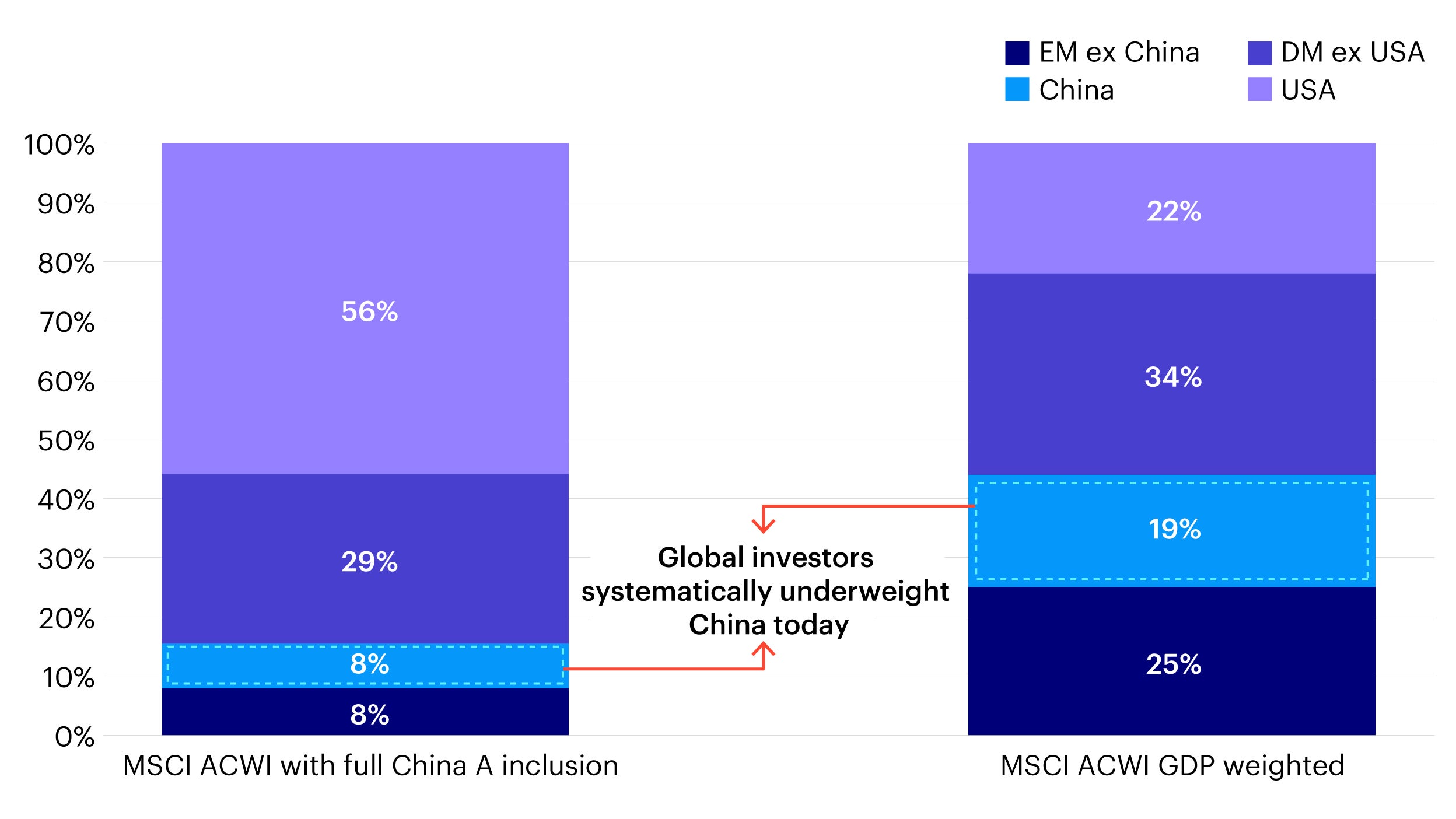

China index-based exchange traded funds (ETFs) offer investors the chance to capitalize on China’s growth story by tracking a uniquely designed basket of publicly listed securities. Global investors in general are underweight Chinese securities, while many emerging markets-focused investors may wish to diversify away from products that will become increasingly loaded with China.

International investors may diversify their portfolios and gain efficient exposure to various onshore and offshore growth themes while leveraging the flexibility, liquidity, and transparency of an ETF structure.

Sources: Invesco, for illustrative purposes only; *World Bank, 2020.

Why consider?

China is on track to overtake the US as the largest economy in the world within the next seven years.1 It already boasts the second-largest equity and bond market globally, with an array of both well-established industry leaders and up-and-coming innovators.2 With the opportunity set as expansive as the country itself, it’s crucial for international investors to gain the most effective exposure. The easiest way to gain exposure to China equities or fixed income markets is to invest in a broad market index. This may be done at a very low cost by using ETFs. As of July 2021, the market size of globally listed ETFs with China only exposure was US$300 billion.3

Sources: Invesco, for illustrative purposes only; *World Bank, 2020.

Source: MSCI, GDP data from MSCI as of 18 July 2019, MSCI ACWI index weightings as at 31 December 2020. For illustrative purposes only.

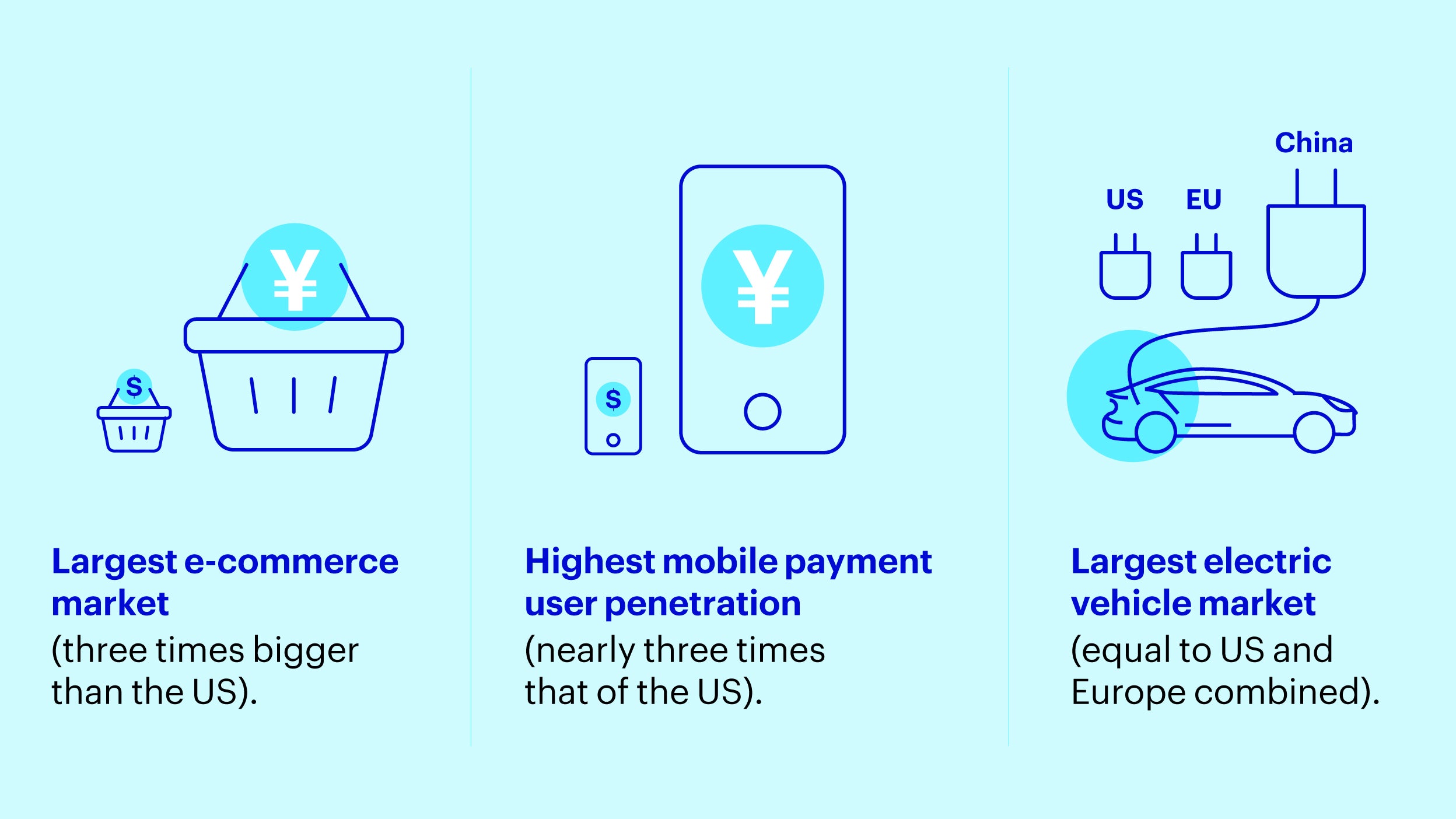

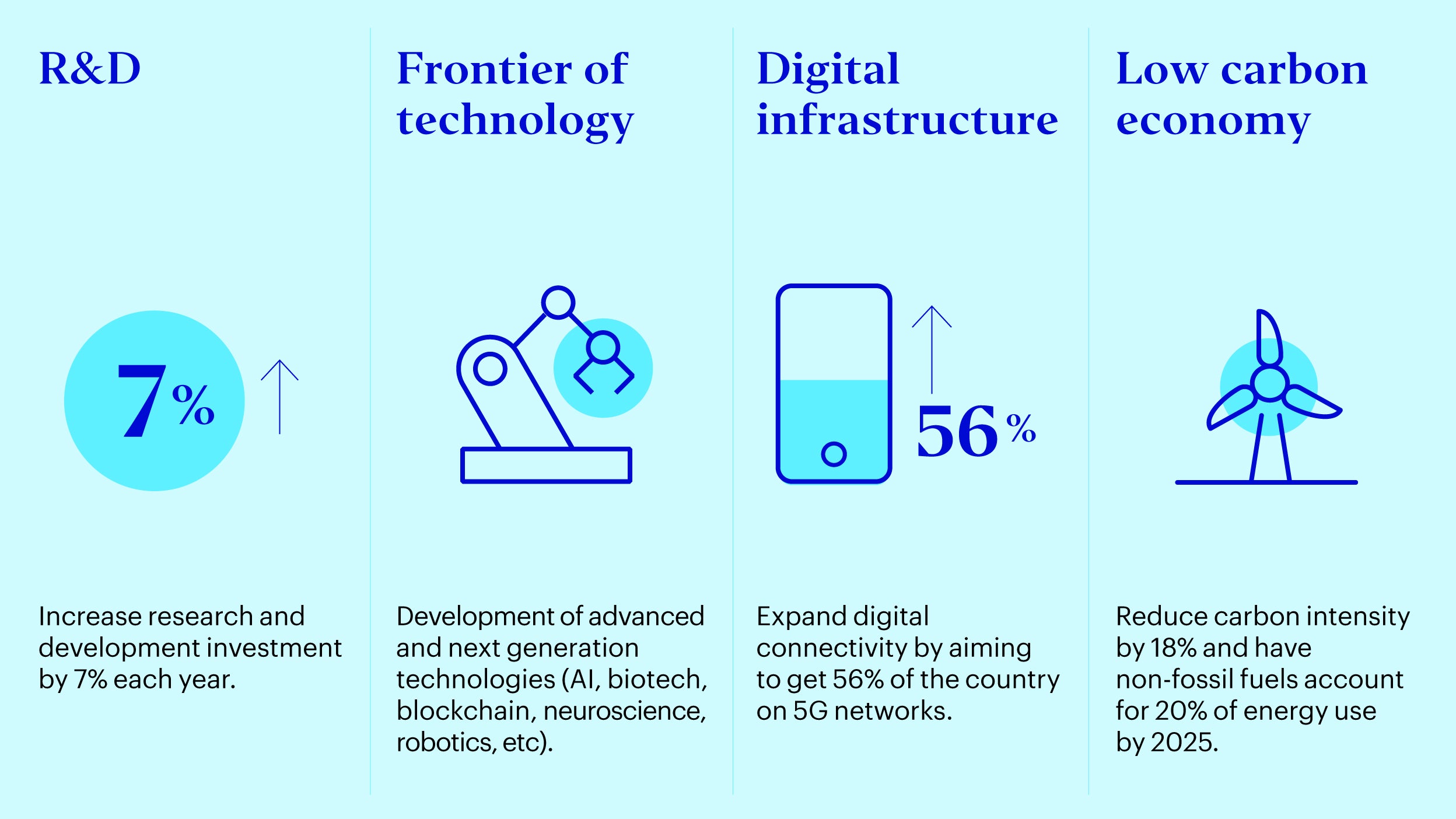

As the world’s second largest economy, China is quickly becoming a global leader in innovation and technology. The country has been transforming from an “old” manufacturing and export economy to a “new” economy focusing on domestic consumption and services. The ongoing economic structural change is very much by design, supported by the country’s large market scale and government policies. China has unveiled its tech ambitions in its latest Five-Year Plan, as the country continues to strengthen its domestic growth and achieve “self-reliance” in science and technology.

Source: MSCI, China and the Race for Global Tech Leadership, 2021.

Source: MSCI, China and the Race for Global Tech Leadership, 2021.

Investment Insights

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

There are risks involved with investing in ETFs, including possible loss of money. Index-based ETFs are not actively managed, and the return of index-based ETFs may not match the return of the underlying index.