China Real Estate

What are the options?

There are four major real estate sectors in China: office, retail, industrial/logistics, and residential/apartments. Investment strategies in Chinese real estate are determined by macroeconomic trends, capital market cycles, regulatory developments and operational considerations.

Source: Invesco, for illustrative purposes only.

Other sectors

There are other niche options such as senior housing, data centers, hotels and car park spaces etc. These are more operationally intensive, where we often see the best margins coming not from owning but running them.

Beyond properties, debt financing is another option. This involves offering bridge financing options to developers who need short-term funds. This channel is exposed to dynamics that go beyond the real estate sector and into finance and pricing in the market.

Why consider?

- China is the largest real estate market in Asia Pacific. It is also the second largest globally after the US, valued at US$686 billion.1 As China continues to widen its doors, making it a more inviting destination for investment globally, we believe it will make the market a greater target for other Asian-based investors who are encountering increasing difficulty in finding attractively priced opportunities in major regional cities.

- Beijing and Shanghai are among the most liquid markets globally. China’s Tier-1 cities have seen strong improvements in market liquidity, with Shanghai being the fifth most active investment market globally (since 2015).2 Better liquidity conditions have made the market more attractive to investors which in turn drives the growth and maturity of the market.

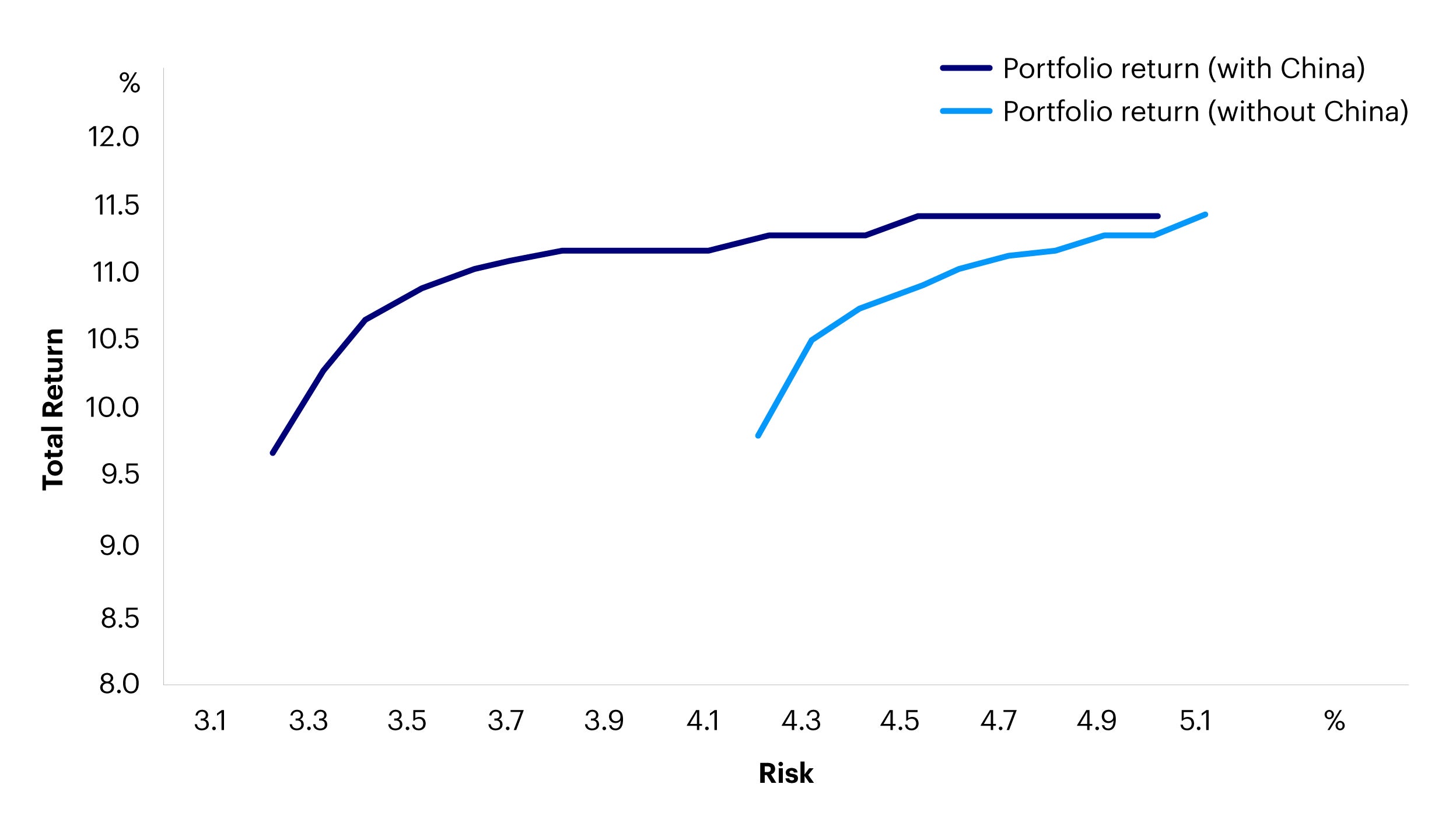

- Diversification benefits: Property-level total returns in China offer some of the lowest cross-regional correlations of any country in Asia Pacific. As shown below, adding Chinese real estate to a pan-Asian portfolio potentially has the dual benefit of not only lowering risk through improved diversification but enhancing returns as well.

Note: The efficient frontier is based on a hypothetical portfolio comprising of Australia, Japan, Hong Kong, Singapore, South Korea, New Zealand and China (each weighting less than 30%). Calculation is based on the longest available total return data from MSCI: Australia (1985-2017), Japan (2002-2017), Korea/Hong Kong (2006-2017), China/Singapore (2007-2017), New Zealand (1994-2017). Source: Invesco Real Estate based on data from MSCI, as of November 2018. There is no guarantee that these hypothetical results will be achieved in the future.

Investment Insights

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Property and land can be difficult to sell, so investors may not be able to sell these investments when they want to. The value of property is generally a matter of an independent valuer’s opinion and may not be realized.

Footnotes

-

1

Based on direct real estate portfolios held as investments for delivering a mix of income and capital returns from MSCI as of Y/E 2021.

-

2

Based on the total direct commercial real estate investment transactions in 4Q15-3Q18, excluding land, development, and residential transactions. Source: JLL, 2018.