China’s Renewable Energy Market Outlook

Source: Invesco

Last month, the Biden administration announced an import ban on certain Chinese solar manufacturers based in Xinjiang, a timely reminder to global investors that the province produces roughly half of world’s polysilicon supply, a key material for solar panels.1

The move may require US solar panel (photovoltaic or “PV module”) producers to search for alternative polysilicon sources. This may cause some near-term supply chain disruptions, but we think that the supply/demand balance can still tilt towards China’s burgeoning domestic market in the longer term.

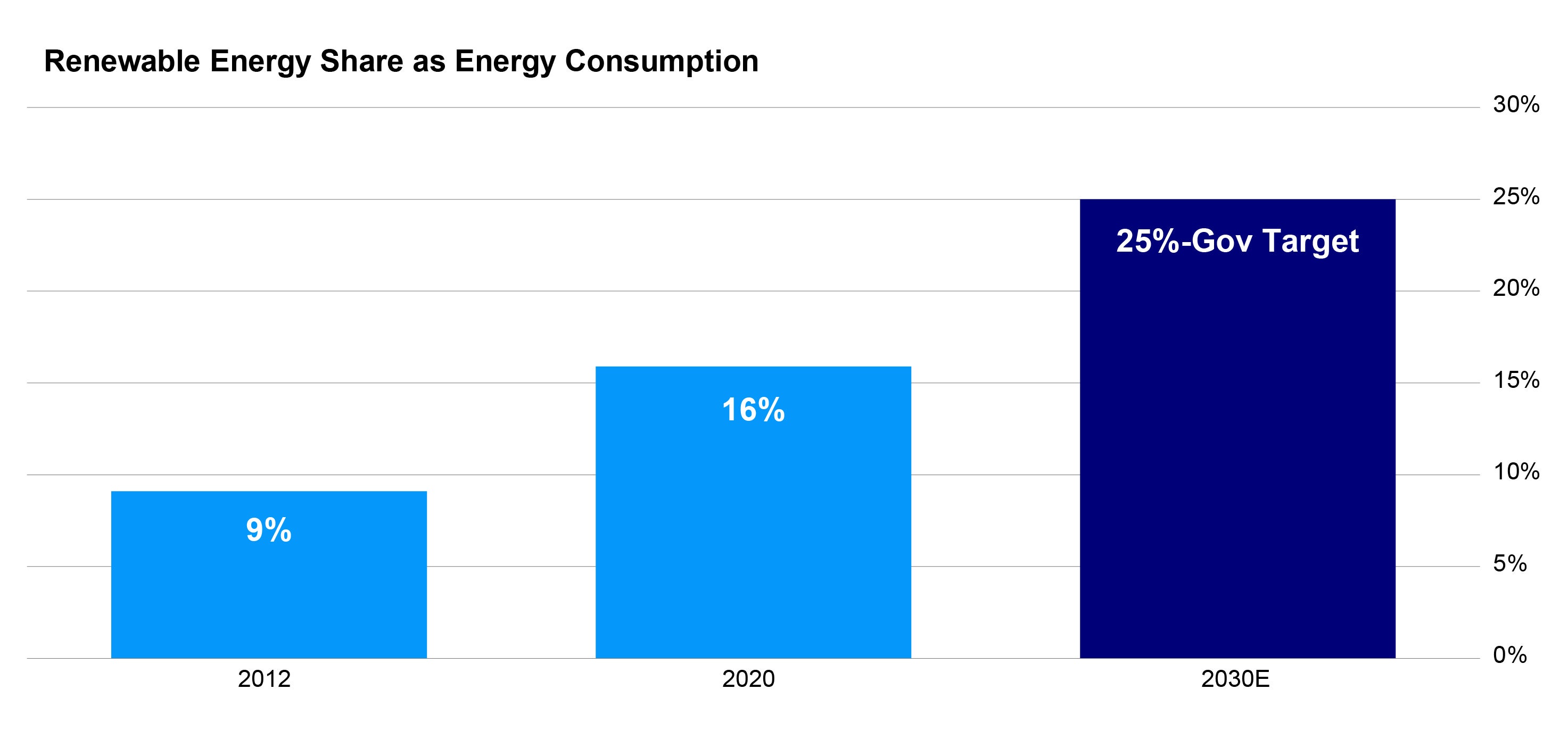

China’s renewable energy industry has achieved remarkable growth over the past decade, with aggregate capacity growing by a compound growth rate of 14% annually since 2012, with the share of total energy consumed rising from 9.1% to 15.9% over the same period.2 Along with President Xi’s pledge to achieve carbon neutrality by 2060, the government has set an explicit medium term target to further raise renewable’s share to 25% by 20303.

To achieve that goal, solar and wind energy can be the main drivers, due to their undeniable advantages in scalability, cost, and safety. They are also the clear favorites of the central government.

President Xi set an explicit target that the combined installed capacity of wind and solar power will reach at least 1,200 gigawatts by 2030, growing over 200% from 2020.4 The government also vowed to increase the share of energy consumption generated by wind and solar from the current 9.7% to 16.5% in 2025.5 To achieve this goal, the state recently ordered power transmission firms to accelerate the connection between wind and solar capacity to the power grid which could enable further clean energy access6.

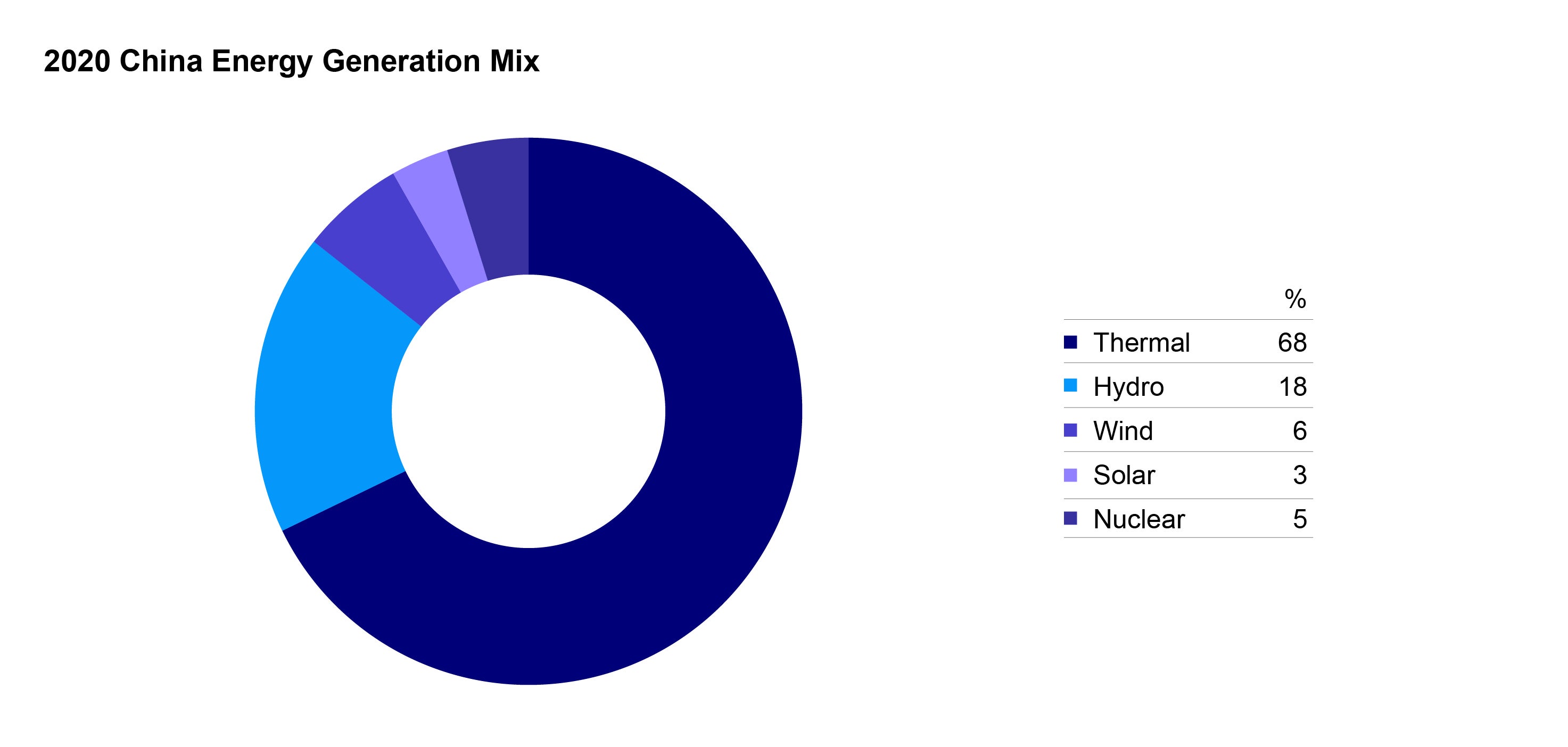

No wonder that in 2020, solar and wind energy accounted for over 86% of newly installed renewable capacity in China as measured by gigawatts.7

It’s the solar industry where Chinese manufacturers are particularly competitive, having made major efficiency gains in both the production process and in the electricity generation of PV modules themselves. China now produces 78% of the world’s solar cells and 72% of solar modules8. Over the past decade, the average cost of newly commissioned solar photovoltaic system fell by over 70%, and the International Renewable Energy Agency (IRENA) estimated that around 40% of these capacities had costs (excluding any financial support) lower than fossil fuel-fired options9. Costs for renewable energy are expected to continue declining due to improvement in energy efficiency, economies of scale, and reductions in cost.

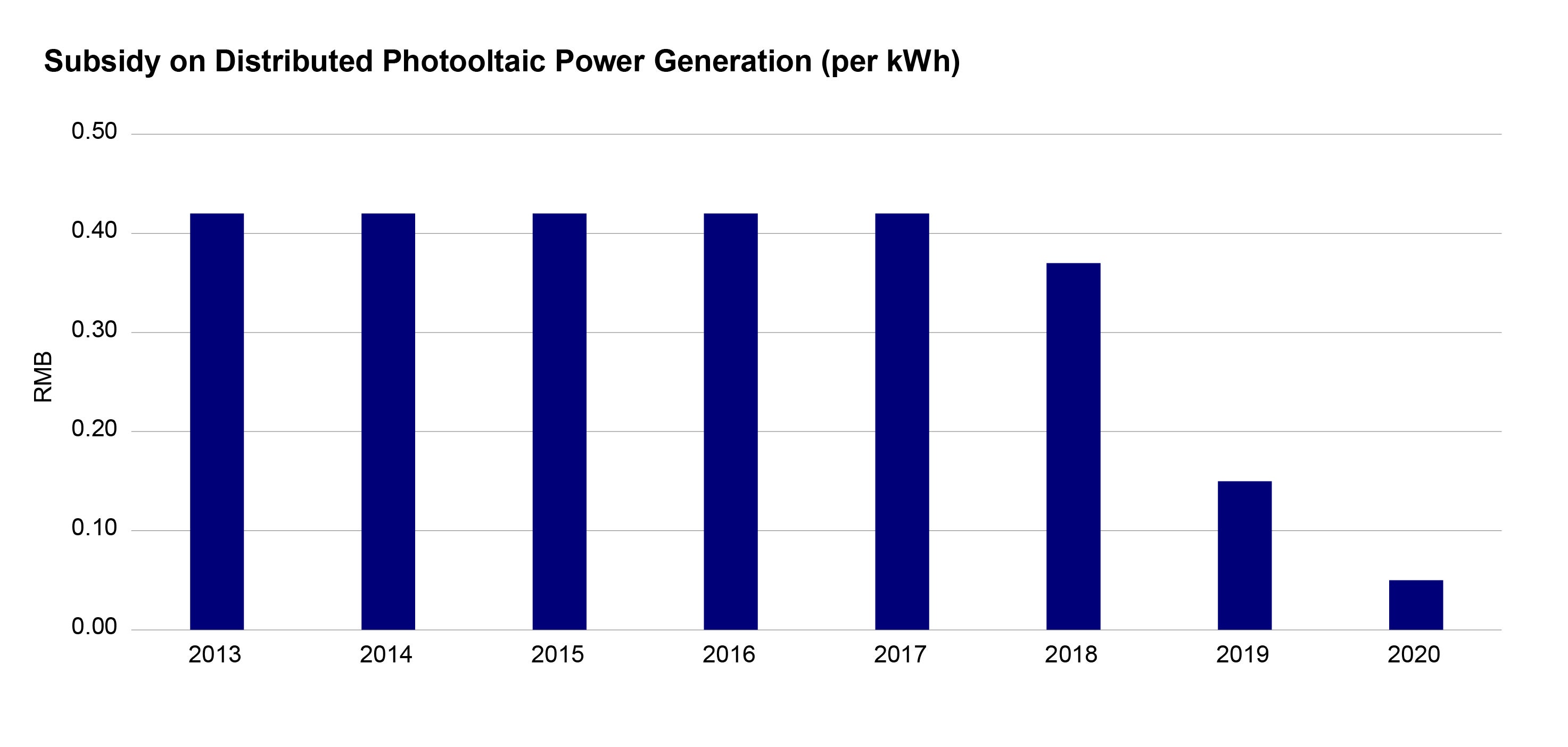

These efficiencies can support secular growth and maintain profit margins in the industry as subsidies fade away. The unit subsidy for renewable energy has been reducing rapidly; for example, the subsidy for a typical solar project reduced from over 40 cents per kilowatt hour in 2013 to five cents in 2020.

The government has made clear its intention to phase out subsidies altogether, albeit gradually and with continued public support10. The National Energy Administration (NEA) is consulting the market on a power grid auction mechanism which gives priority to solar and wind power generators that are willing to lower the price of new projects or accept a haircut on the subsidy.11 The National Development and Reform Commission has also announced they will stop giving subsidies for certain types of new solar and wind projects from 1 August 2021.12

To be sure, hydropower is expected to continue to play a role in China’s renewable electricity generation. It is currently the largest renewable power source in the country, providing 17.8% of the country’s electricity consumed13, with an additional gigawatt of power coming on board via the massive Baihetan dam. Looking ahead though, these projects are likely to face steepening investment costs due to the need to develop further inaccessible areas, and the indirect social costs on resident displacement and biodiversity damage add to government’s reservation in pushing for further hydro dam constructions.14

Another carbon-free source of energy is nuclear, which currently generates 4.8% of total electricity15, but this industry continues to be constrained by safety concerns and the accompanying social ramifications. Scalability is also limited by the need to locate close to the ocean, as most of the current nuclear plants are located in coastal areas.16

There’s no reason to expect that renewable energy – particularly wind and solar - manufacturing and installation will slow in China anytime soon, given both the attractive economics of the sector and government support. The key issue to watch in the near term is how the government strikes a delicate balance between reducing subsidies yet promoting renewable energy development.

By all accounts, the government’s policy support remains unwavering and solid, but its planned reduction in subsidies could create a bit of near-term volatility without a sure-fire incentive. These shifts could in turn create opportunities for industry leaders to consolidate smaller players and thus improve economies of scale. Indeed, the winds of change will only blow stronger and the sun is still rising for renewables in China.

This article was authored with contributions from David Xu, Summer Analyst.

A version of this article appeared in South China Morning Post on 21 July 2021.

^1 https://www.bloomberg.com/news/articles/2021-06-23/u-s-to-block-some-solar-goods-made-in-china-s-xinjiang-region?sref=1H7PBH2o

^2 http://www.gov.cn/xinwen/2021-04/02/content_5597401.htm

^3 http://www.xinhuanet.com/finance/2021-04/21/c_1127354695.htm

^4 https://news.bjx.com.cn/html/20210202/1134042.shtml

^5 http://www.xinhuanet.com/finance/2021-04/21/c_1127354695.htm

^6 https://www.reuters.com/business/sustainable-business/china-add-least-90-gw-wind-solar-capacity-grid-2021-2021-05-20/

^7 https://news.bjx.com.cn/html/20210629/1160966.shtml

^8 https://www.statista.com/chart/24687/solar-panel-global-market-shares-by-production-steps/

^9 https://www.irena.org/costs/Power-Generation-Costs/Solar-Power

^10 http://www.nea.gov.cn/2021-03/30/c_139846095.htm

^11 https://www.bloomberg.com/news/articles/2021-03-03/china-turns-the-screws-on-renewables-just-when-it-needs-them?sref=1H7PBH2o

^12 https://www.reuters.com/article/china-renewable-subsidies-idAFL2N2NT04M

^13 https://shoudian.bjx.com.cn/html/20210301/1138773.shtml

^14 https://capitalscoalition.org/social-environmental-costs-of-hydropower-are-underestimated-study-shows/

^15 https://shoudian.bjx.com.cn/html/20210301/1138773.shtml

^16 https://world-nuclear.org/information-library/country-profiles/countries-a-f/china-nuclear-power.aspx