China Fixed Income

What are the options?

China fixed income includes a range of instruments. As international investors have become more familiar with China's offshore fixed-income market, here we focus on the lesser-known onshore market that's denominated in renminbi (RMB).

Similar to other markets, there are broadly three types of issuers in the China onshore bond markets: governments, banks, and corporates. Bonds issued by governments and policy banks are named “rates bonds” by local investors, whereas bonds issued by commercial banks and corporates are called “credit bonds”. The key difference is that rates bonds are considered to have minimal credit risks, thus enjoy a significantly lower risk weight for bank investors.

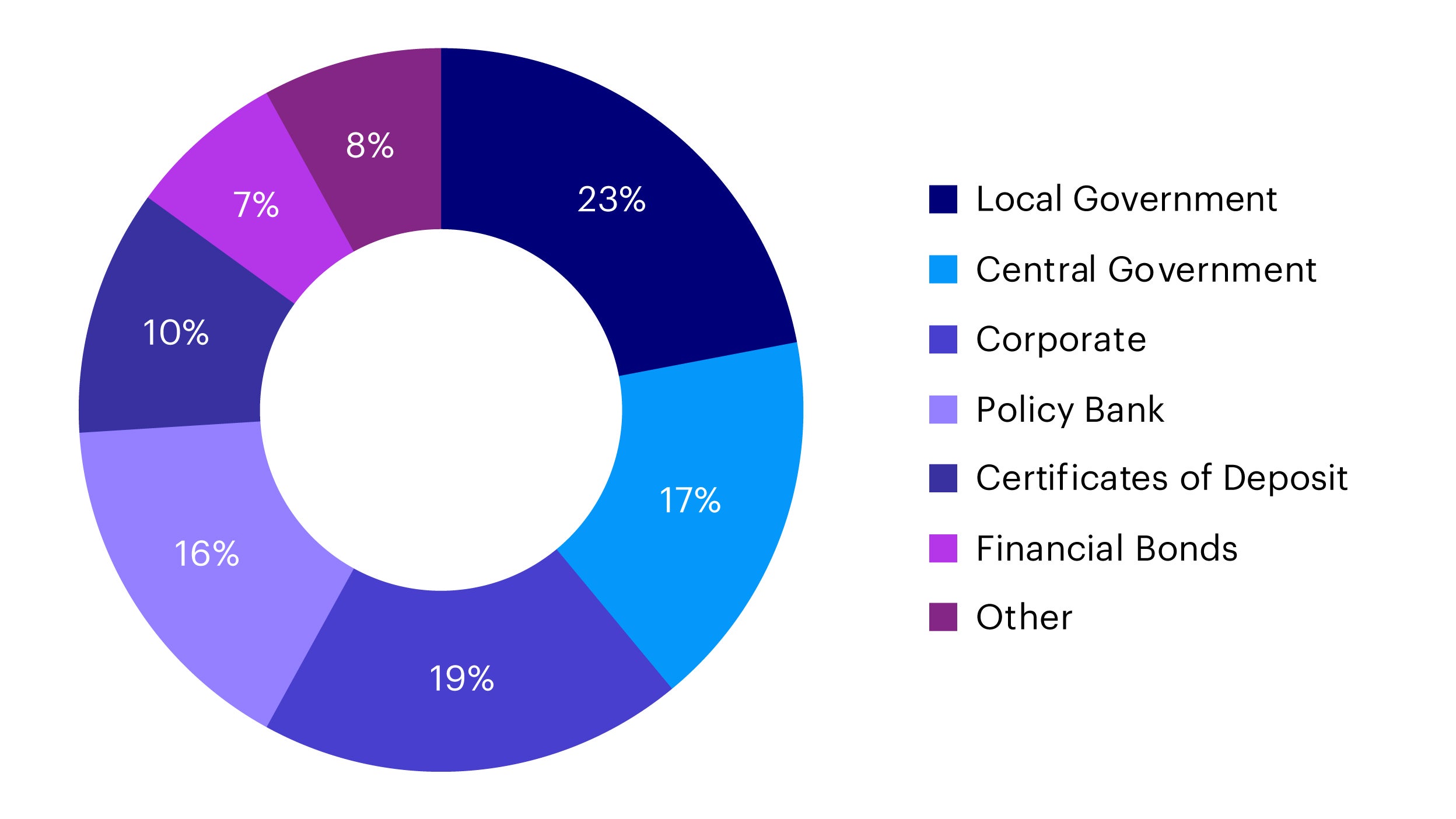

Central government bonds, local government bonds and policy bank bonds in total account for 56% of bonds outstanding in China, followed by certificates of deposit and financial bonds, which are around 10% and 7% respectively of total market size. The remainder includes bonds issued by corporates, such as medium-term notes, commercial paper, enterprise bonds and corporate bonds in the exchange market.

Source: Wind, Invesco. Data as of September 30, 2020.

Breakdown of China onshore bond types

| Type | Sector | Key Issuers |

|---|---|---|

| Rates Market | ||

| Government bonds | Sovereign | Ministry of Finance |

| Policy bank bonds | Quasi-Sovereign | China Development Bank, Agricultural Development Bank of China, Export–Import Bank of China |

| Local government bonds | Provincial and Local Governments | Provinces and Municipalities |

| Credit Market | ||

| Corporate Bonds (including MTN) | Corporates | Domestic Non-Financial Corporates |

| Financial bonds | Financials | Domestic deposit-taking institutions, securities and insurance companies |

| Enterprise bonds | Corporates | Unlisted corporates and private placements (mostly state-owned) |

| Money Market | ||

| Certificates of Deposit | Financials | Domestic Banks |

| Commercial Paper | Corporates | Domestic Non-Financial Corporates |

| Other | Other | Asset-backed securities, Converts, Other |

Source: State Street Global Advisors, HSBC, Win.d, 2019

Why consider?

- Size: The Chinese bond market is the second largest globally after the US. China’s market represents a diversified universe of issuers and exceeds US$17 trillion in total amount outstanding.1

- Index inclusion: While demand is growing, the current foreign ownership ratio in the Chinese bond market is still relatively low at 3% (and 9% for government bonds specifically).2 April 2019 saw the beginning of the phasing-in of Chinese bonds into the Bloomberg Barclays Global Aggregate Bond Index. In February 2020, Chinese government bonds were added into the JPM GBI-EM Bond Index and October 2020 saw the beginning of a 5.7% inclusion of rates bonds into the FTSE Russell World Government Bond Index.3

- RMB is growing in global significance: China aims to drive the RMB’s internationalization and boasts a much larger, and more unified government bond market compared to other major currencies such as yen and euro. The Chinese currency’s growing global significance should help in mitigating currency risk for RMB-denominated fixed-income securities.

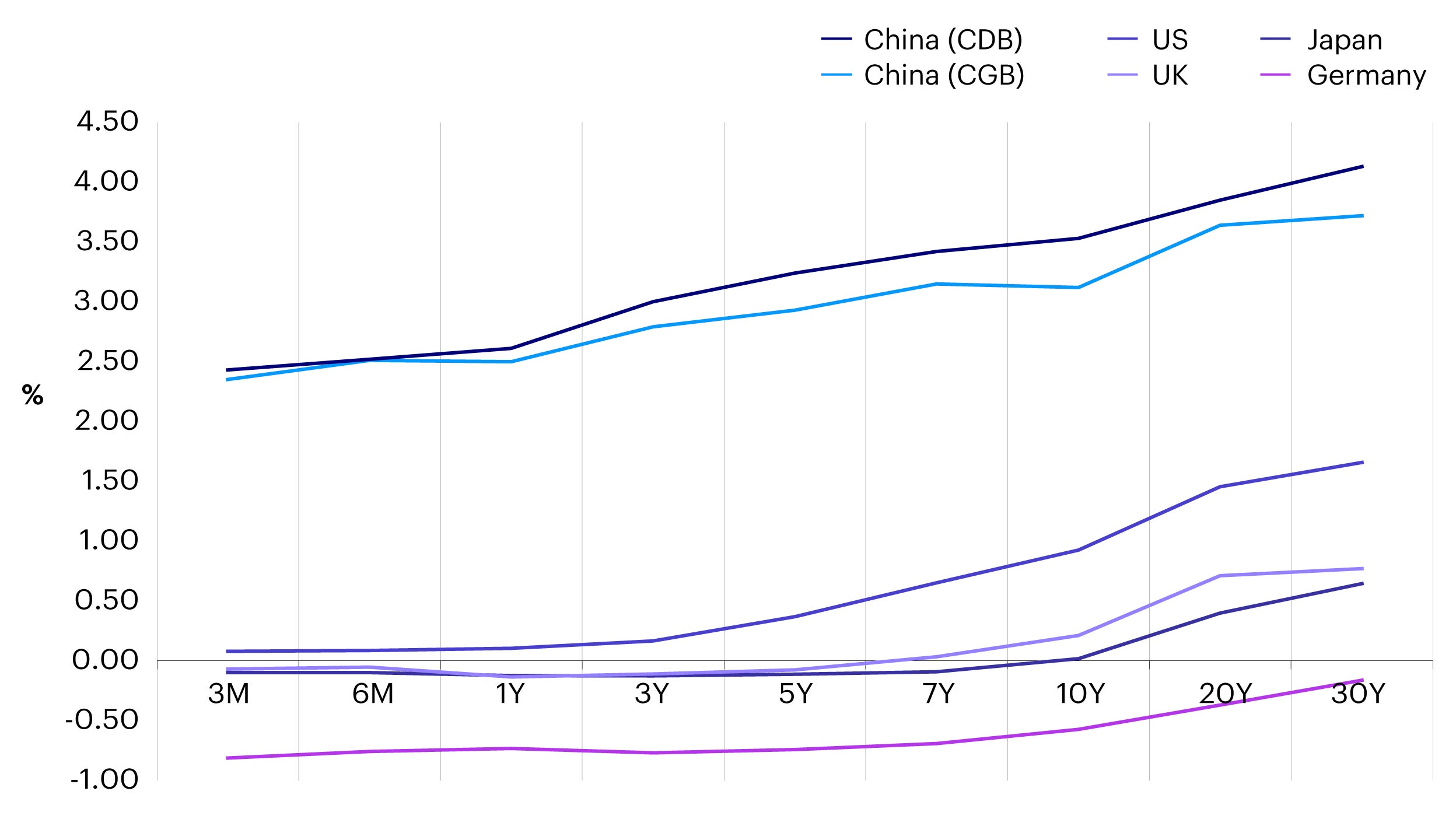

- Diversification: Compared to its peers in the Global Aggregate Index, Chinese bonds offer much lower correlation with other fixed income markets in the world. A key factor driving foreign investors’ demand for China rates bonds (including government and policy bank bonds) has been diversification benefits away from other major markets.

- Low exchange-rate volatility: While many foreign investors in the past have expressed concerns over FX risks related to RMB-denominated assets, historically the RMB has presented a significantly lower volatility compared to both major developed and emerging market currencies. This implies lower foreign exchange risk than other local currencies for bond investors.

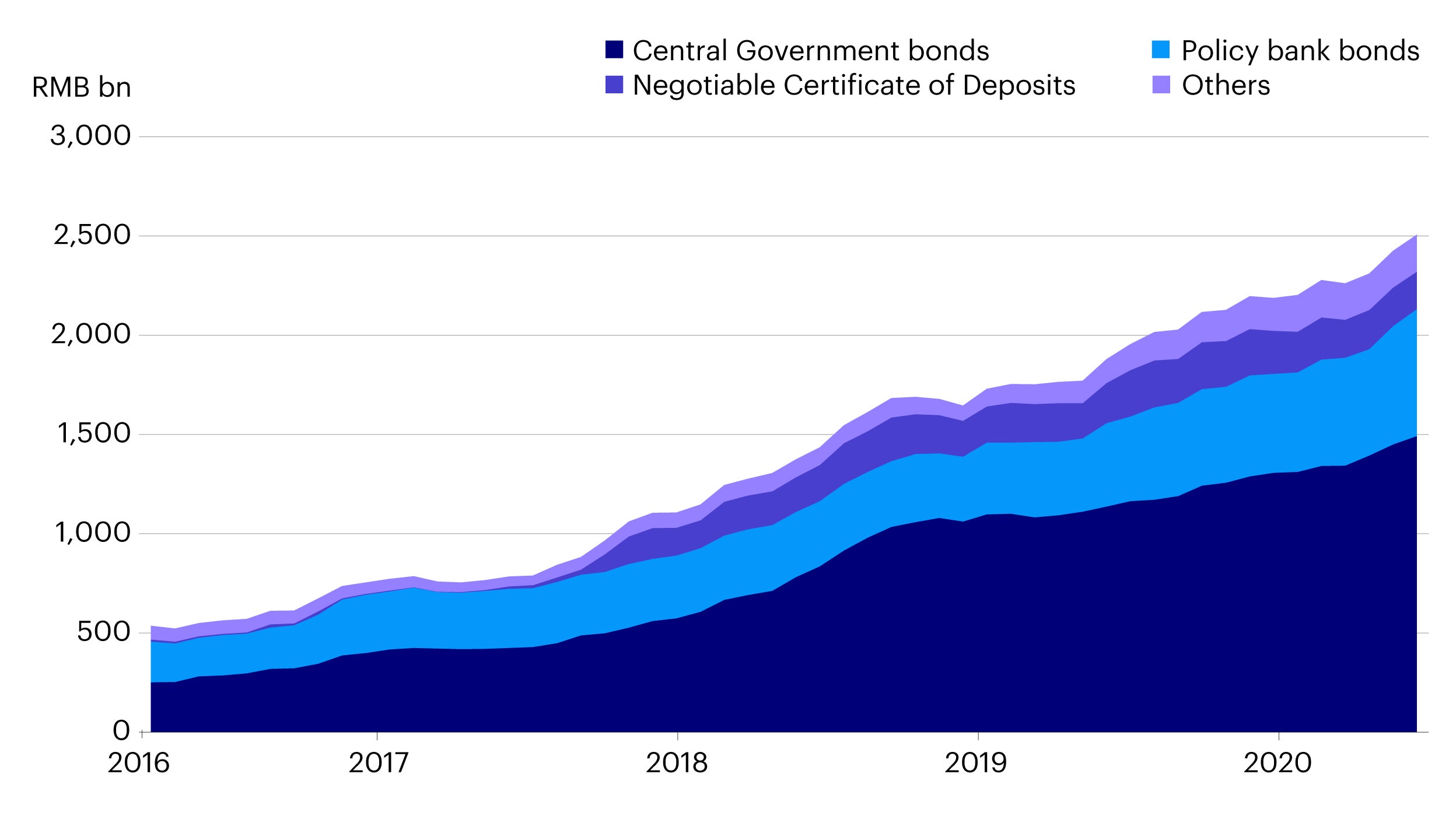

- Deep liquidity: Trading liquidity of China onshore rates bonds is comparable to, if not better than, those of many major developed and emerging markets. Liquidity of policy bank bonds and banks’ certificates of deposits (CDs) is particularly strong, with daily trading volume of RMB364 billion (US$56 billion) and RMB200 billion (US$31 billion) respectively.4

Sources: CEIC, Invesco, as of end June 2020. Bank NCDs are Negotiable Certificates of Deposit.

Source: Bloomberg L.P. Invesco, data as of December 30, 2020. Note: CGB refers to China Government bonds, CDB refers to China Development Bank bonds, which are considered as central government risk and traded as rates products. Past performance is not a guarantee of future results.

Ways to access

Foreign investment in Chinese fixed income markets has previously been constrained by various structural restrictions. Steps announced by the People’s Bank of China in 2016 to open the China Interbank Bond Market (CIBM) to foreign investors, and in 2017 to simplify foreign access via Bond Connect, have changed this. Together with Qualified Foreign Investor (QFI) - formerly QFII (Qualified Foreign Institutional Investor) and RQFII (Renminbi Qualified Foreign Institutional Investor) - there are now three channels for foreign investors to participate in China’s onshore bond market.

Comparison of bond market access options

| CIBM Direct | Bond Connect | QFI (Formerly QFII/RQFII) | |

|---|---|---|---|

| Account | Onshore settlement account opened with onshore custodian banks; China Foreign Exchange Trade System (CFETS) / China Central Depository & Clearing Co. (CCDC) / Shanghai Clearing House (SHCH) | Offshore account, opened with Hong Kong Central Moneymarkets Unit (CMU) | Onshore settlement account opened with Central Depository & Clearing Co. (CCDC) / Shanghai Clearing House (SHCH) |

| Registration | Bond Settlement Agreement Registration with People's Bank of China (PBoC) Shanghai | Submit Application to Bond Connect Company Limited (BCCL), CFETS, and PBoC | Submit QFI Qualification Application (Online) to CSRC through Onshore Custodian |

| Investment quota | No quota restrictions; but investments subject to registered amount indicated by investors | No quota restrictions | No quota restrictions |

| Trading platform | OTC trading with agent bank who trades on investors’ behalf on CFETS, and as of 1st Sep 2020, via request-for-quote (RFQ) with China Interbank Market (CIBM) market makers | International trading platforms such as Tradeweb and Bloomberg (with a trading link to CFETS) via request-for-quote (RFQ) from appointed market makers | Trade via exchanges |

| Eligible fixed income products | Cash bonds, FX derivatives, and onshore interest rate derivatives | Cash bonds in primary and secondary market, FX derivatives | As of Sep 2020, investment scope extended to bond/rates/ FX /derivatives (e.g. swaps, futures, and forwards etc.) |

| Foreign exchange management | Both RMB and foreign currencies can do FX hedging in onshore FX market | Both RMB and foreign currencies. Can do FX hedging via trade settlement banks in HK |

|

Source: Citic Securities, February 2021

Investment Insights

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.