China, Explained: A closer look at the liquidity of Chinese bond issuers

Global investors remain worried about the liquidity in the Chinese bond market after a rise in debt defaults during this challenging pandemic year. We asked Invesco’s Head of Asia Pacific Fixed Income, Freddy Wong, to discuss the current liquidity environment and outlook of China’s bond market.

Q. What is the current landscape for Chinese bond issuers in terms of funding and borrowing?

With the outbreak of COVID-19 this year, Chinese regulators have carried out monetary easing measures to spur credit growth. The banks continue to provide a steady supply of longer-term credit to corporates, supporting businesses and investments. We also expect informal lending by corporates to further decline thanks to the government’s efforts to clamp down on shadow banking, creating a healthier credit environment for investors. The growth rate of China’s shadow banking assets has fallen from over +15% YoY to almost -5% in the last three years1 and will likely shrink further as regulators plan for more restrictions on the sector’s wealth management products at the end of 20212.

Q: Why is there a recent rise in default rates of China’s state-owned enterprises (SOEs)?

Looking back, 2019 was a difficult year for corporate issuers, with defaults in the onshore market reaching a record high — 65 names defaulted on RMB126 billion of bond payments3. Some defaults were quite unexpected by investors who believed these companies were either financially solid or assumed that the issuers would enjoy strong government support in the event of an economic downturn.

While some issuers that are systemically important to the country did receive government support, such as the bailout of three sizeable banks, we believe policymakers will continue to promote a more market-based resolution before bailing out struggling SOEs, as they have done in the past.

For years, China has spoken about instilling more fiscal discipline into SOE corporates, state banks and local governments. Any form of support is to ensure long term sustainability and stability of its financial system. Moving towards a market-based approach is the government’s goal and principle, allowing investors to evaluate default risks and debt recovery appropriately and create a more efficient credit market.

Q: What is your view on Chinese SOE bonds?

We believe the recent onshore bond defaults of a few originally AAA-rated SOEs are idiosyncratic events, which should not cause systemic risk to the financial system. The depressed sentiment however may trigger technical driven selloffs or the tightening of credit lines for certain SOEs or local government financing vehicles4 (LGFVs) with weak fundamentals.

Furthermore, on 12 November 2020 the US government issued an Executive Order prohibiting the investment of over 30 publicly traded Chinese companies that are connected to the Chinese military according to the US Department of Defense. There is risk that more issuers will be added to the existing list or more adverse policy measures will be announced.

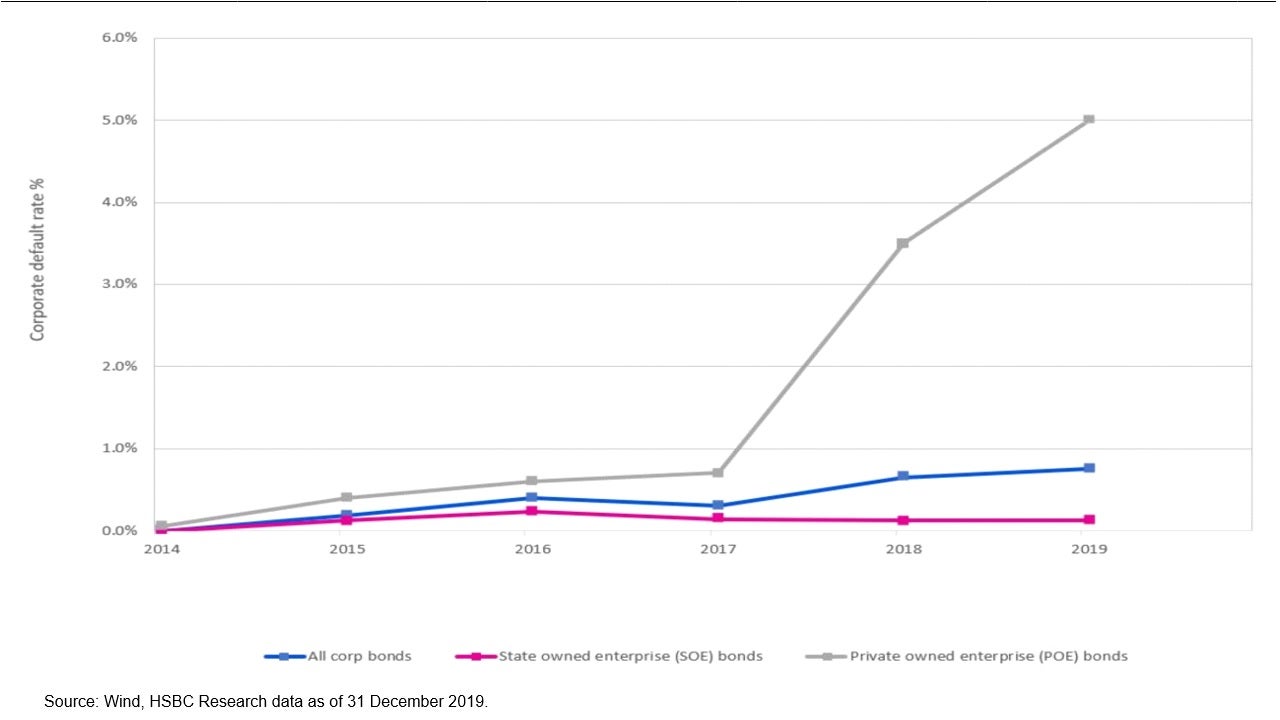

We believe Chinese banks/institutions could step in to support the sold-off bonds eventually or the government may take the necessary measures if market sentiment turns too jittery. It is worth noting that while the SOE default rate has picked up, it is still extremely low at less than 0.5% as of the end of 20195 and lower than that of private-owned entities (POEs).

Q: How does your team analyze Chinese default risks or issuer profile? How do you mitigate downside risks?

We believe it is important to identify which default events are idiosyncratic and which ones are systemic; hence credit selection remains the key. Our credit analysts and portfolio managers continue to conduct rigorous credit research on the fundamentals of the underlying holdings, identifying high quality SOEs and those LGFVs that are strategically important to state policies and initiatives. A risk that investors typically pay less attention to is whether a company can issue bonds at any time during the market cycle. For instance, investors tend to be the price taker during periods of strong market momentum and may overlook whether the company can access capital market financing during bear market scenarios. Having the ability to raise capital during any market cycle is one area we research on, as well as consistently reviewing our risk management process and underlying securities.

Q: What opportunities are you seeing in the Chinese bond market?

In the offshore USD bond market, we prefer high quality SOE/LGFV names in the investment grade (IG) space. While the short-term technical factors could be weak, we do not see deterioration in the credit quality of China’s SOE sector which still provides attractive risk-adjusted returns in our view.

We also see attractive valuations in some of the China property high yield (HY) bonds despite recent policy tightening, favoring high quality property bonds given their resilience and attractive carry.

We think the onshore Chinese government bond market will continue attracting interest from foreign investors. Its recent inclusion into the major index, FTSE Russell could drive inflows from passive investors looking to increase exposure to the Chinese onshore market, while active investors like its attractive yields and diversification benefit.

After enduring a challenging year, the Chinese bond market continues to grow rapidly, topping USD17 trillion in total market value6 as of November 2020, poised as the second largest bond market in the world full of opportunities for 2021.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.

1 Moody’s Investor service and PBOC data as of June 2020. Core shadow banking includes entrusted loan, trust loan and undiscounted bankers’ acceptance in the total social financing (TSF).

2 CityWire Asia. China extends deadline for new asset management rules. https://citywireasia.com/news/china-extends-deadline-for-new-asset-management-rules/a1387083

3 HSBC Research data as of December 31, 2019.

4 Local government financing vehicle (LGFV) is a financing company which is owned by local government in China and may issue bonds to finance public infrastructure projects or public works.

5 Wind, HSBC research data as of end of 2019.

6 Bank of America Merrill Lynch research as of November 30, 2020.

当資料ご利用上のご注意

当資料は情報提供を目的として、インベスコ・アセット・マネジメント株式会社(以下、「当社」)のグループに属する運用プロフェッショナルが英文で作成したものであり、法令に基づく開示書類でも特定ファンド等の勧誘資料でもありません。内容には正確を期していますが、必ずしも完全性を当社が保証するものではありません。また、当資料は信頼できる情報に基づいて作成されたものですが、その情報の確実性あるいは完結性を表明するものではありません。当資料に記載されている内容は既に変更されている場合があり、また、予告なく変更される場合があります。当資料には将来の市場の見通し等に関する記述が含まれている場合がありますが、それらは資料作成時における作成者の見解であり、将来の動向や成果を保証するものではありません。また、当資料に示す見解は、インベスコの他の運用チームの見解と異なる場合があります。過去のパフォーマンスや動向は将来の収益や成果を保証するものではありません。当社の事前の承認なく、当資料の一部または全部を使用、複製、転用、配布等することを禁じます。

C2020-12-157

そのほかの投資関連情報はこちらをご覧ください。https://www.invesco.com/jp/ja/institutional/insights.html