Economic Impact of China’s Current (Worsening) COVID wave

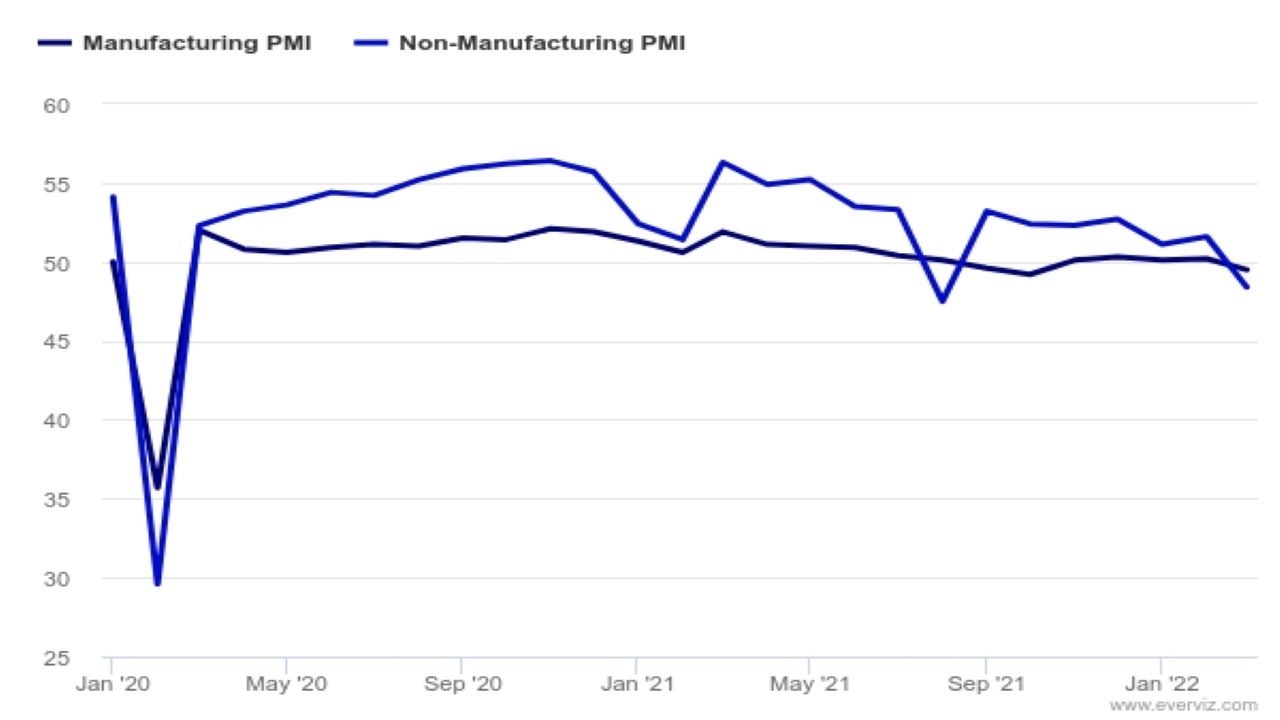

China reported a slight deterioration in its March National Bureau of Statistics (NBS) manufacturing PMI to 49.5 from 50.2 in the prior month as the country experiences its worst ever COVID outbreak.1

Policymakers have recently resorted back to partial and full lockdowns of cities and provinces. We believe the Chinese economy could re-accelerate in 2H 2022 on further monetary easing measures.

Though so far, the impact on manufacturing has been manageable since lockdowns have been sporadic and short-lived, certain segments of the economy may be challenged as China battles the highly contagious Omicron variant while still embarking on a zero-COVID strategy.

For example, Shanghai’s 2-stage lockdown bears watching given the commercial importance of the city. In addition to being the mainland’s financial center, the city of roughly 26mn people is also a hub for electronics and machinery manufacturing.

The lockdown in Shanghai is likely to also affect transportation and logistics to and from one of the world’s busiest ports, which could pressure global supply chains.

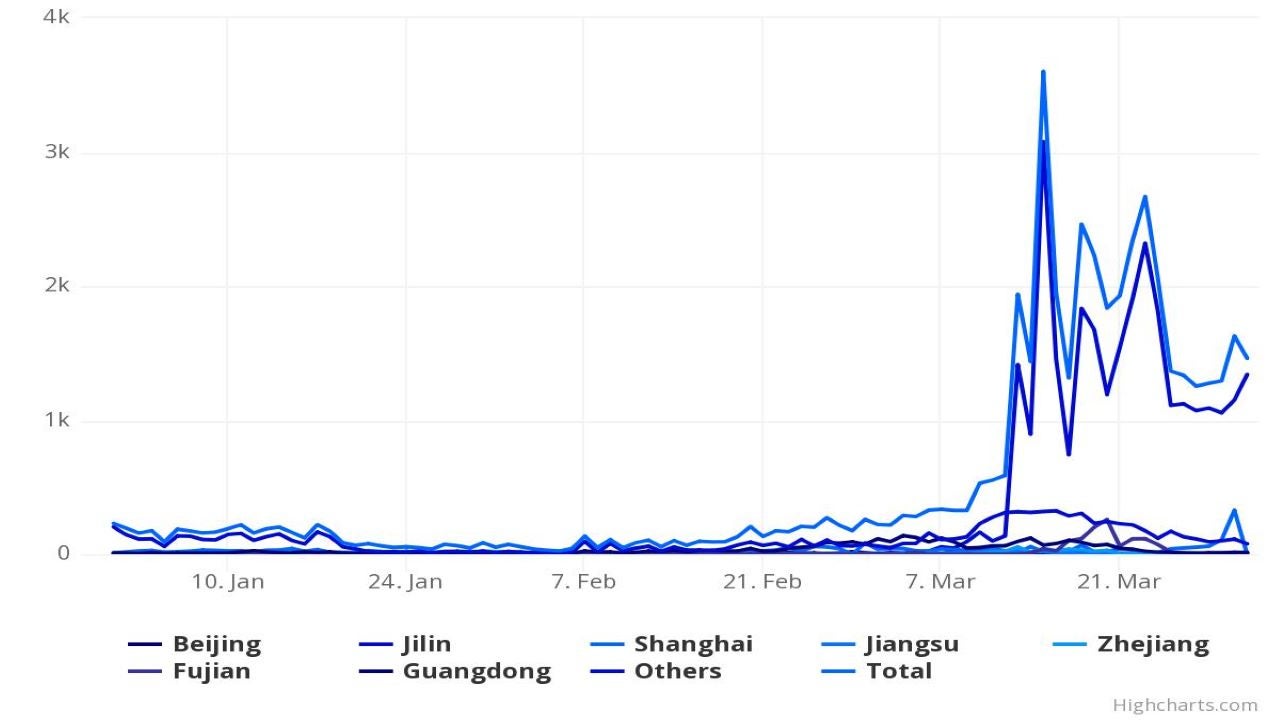

Source: DXY (Lilac Garden Family Clinics) and China National Health Commission. Data as of 30 March 2022.

More targeted lockdowns and less stringent social distancing restrictions

While many places in Asia have started to meaningfully pivot towards an endemic “living with COVID” policy, China has taken a far more cautious approach.

Chinese policymakers recently announced a “zero-COVID at societal level” policy that now shifts the pandemic objective from zero COVID cases to zero untraceable cases.

The net result could be more targeted lockdowns and less stringent social distancing restrictions – which in turn could lead to shorter lockdowns more resilient supply chains.

The current wave of infections and lockdowns are more challenging for service companies and could further impair household spending.

Already, non-manufacturing PMI for March resulted in a sharper fall to 48.4 from 51.6 in February, which was entirely driven by a decline in services sectors.2 Sectors such as transportation, hotel and catering have been the most impacted by mobility restrictions.

Source: China Federation of Logistics & Purchasing. Data as of March 2022.

Outlook - economy likely to re-accelerate in 2H 2022

The Chinese economy's strong start to the year could stall near-term due to pandemic disruptions in March although we expect policymakers are likely to further ramp up monetary and fiscal policy support in Q2 2022.

The People’s Bank of China (PBoC) reiterated in the Q1 2022 monetary policy meeting that “active responses” will be taken to provide support to the real economy. That suggests any downturn should be relatively brief.

We believe the Chinese economy could re-accelerate in the back half of 2022. Despite the PBoC banker’s survey suggesting that loan demand moderated in Q1 2022, it’s likely that further easing measures and encouraging words from authorities could lead to a rebound in credit growth over the next few quarters.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Footnotes

-

1

China National Bureau of Statistics (NBS). Data as of Mar 2022.

-

2

China National Bureau of Statistics (NBS). Data as of Mar 2022.

当資料ご利用上のご注意

当資料は情報提供を目的として、インベスコ・アセット・マネジメント株式会社(以下、「当社」)のグループに属する運用プロフェッショナルが英文で作成したものであり、法令に基づく開示書類でも金融商品取引契約の締結の勧誘資料でもありません。内容には正確を期していますが、必ずしも完全性を当社が保証するものではありません。また、当資料は信頼できる情報に基づいて作成されたものですが、その情報の確実性あるいは完結性を表明するものではありません。当資料に記載されている内容は既に変更されている場合があり、また、予告なく変更される場合があります。当資料には将来の市場の見通し等に関する記述が含まれている場合がありますが、それらは資料作成時における作成者の見解であり、将来の動向や成果を保証するものではありません。また、当資料に示す見解は、インベスコの他の運用チームの見解と異なる場合があります。過去のパフォーマンスや動向は将来の収益や成果を保証するものではありません。当社の事前の承認なく、当資料の一部または全部を使用、複製、転用、配布等することを禁じます。

IM2022-024

そのほかの投資関連情報はこちらをご覧ください。https://www.invesco.com/jp/ja/institutional/insights.html