The future of China’s supply chain - uncertain or changing course?

Storm clouds loom over the future of China’s role in the global supply chain. The pitfalls of extensive reliance on Chinese manufacturing within the global supply chain have become more pronounced over the past two years. Fraying US-China relations, epitomized by a trade dispute, along with a once-in-a-lifetime pandemic are not only causing short-term supply and demand shocks but also leaving lingering long-term questions about the future of China’s leading role in the global supply chain. In recent months, however, the imminent ascension of US President-elect Biden into the White House as well as the signing of the landmark Regional Comprehensive Economic Partnership (RCEP) trade agreement may represent a beacon of light for the uncertainty for global supply chains.

In this whitepaper, we explore the fragility of the global supply chain exposed by rising US-China tensions and disruptions caused by COVID-19. We carefully outline the important forces keeping supply chains in place as well as those tearing them at the seams. Finally, we offer an assessment on whether multi-national corporations (MNCs) will double-down on their current China supply chain strategy or look to permanently shift their production out of China. Other questions covered include: Has there been any significant supply chain shifts in the global economy? How has the trade-war, technology de-coupling and COVID-19 contributed to this phenomenon? More broadly, what are the economic impact and investment implications from these changing dynamics?

China’s supply chain status in a post-pandemic world

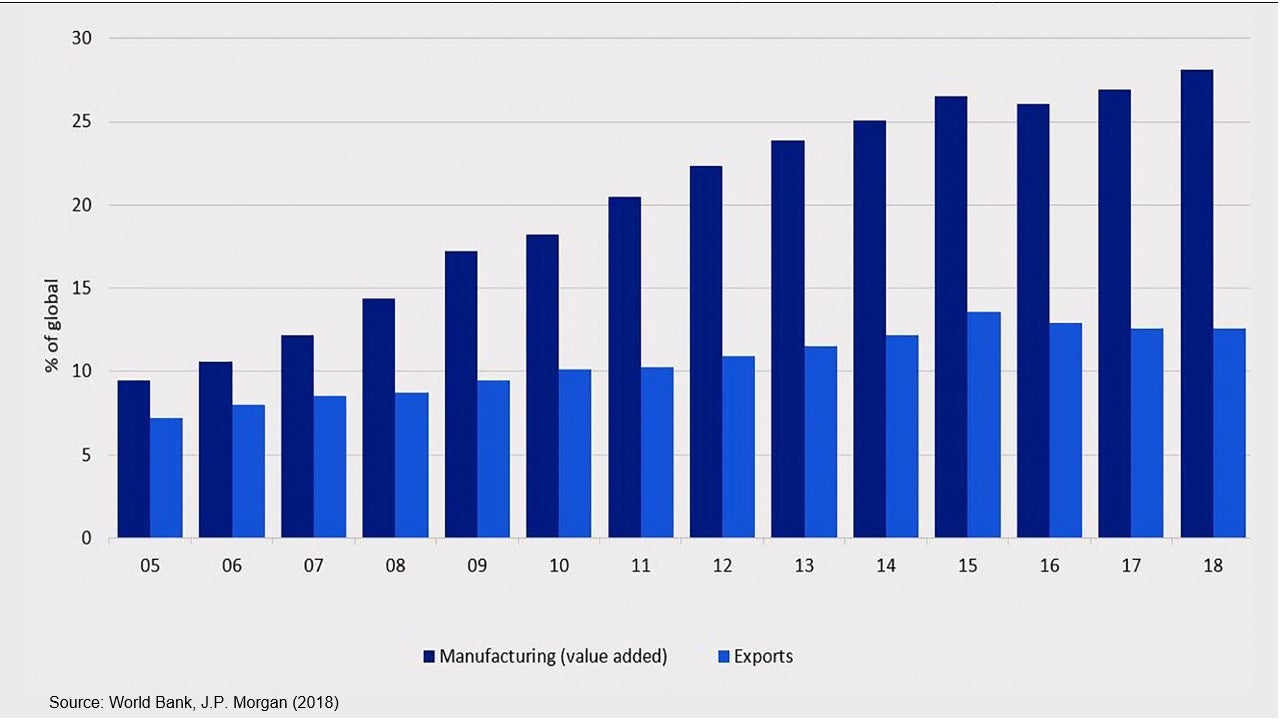

Since joining the World Trade Organization (WTO) in 2001, China has grown rapidly to become a cornerstone of global manufacturing capabilities. Over the past twenty years, China’s manufacturing value-added output recorded an average annual growth of 12.8%1. Today, the total value added by Chinese manufacturing amounts to approximately US$4 trillion, equivalent to 28% of global manufacturing output – 1.7 times more than the US, 2.8 times more than Japan, and 4.4 times more than Germany2. This accounts for nearly 30% of the global manufacturing output (Figure 1).

Recently, however, fraying US-China relations and COVID-19 disruptions have culminated in policy initiatives by key economies threatening to “pull the plug” on China’s manufacturing dominance. For example, the Japanese government is offering a US$2.2 billion fiscal package to assist its firms’ production plants to move out of China3. Meanwhile the White House economic adviser Larry Kudlow is suggesting to “pay for the moving costs” of US firms to leave China4.

While US-China tensions and COVID-19 thrust the future of China’s supply chain into the limelight, the relocation of supply chains out of China is no new phenomenon. Rising manufacturing costs have seen a shift in labor-intensive manufacturing out of China since the early 2000s, with Southeast Asia inheriting a large portion of the manufacturing activities in industries such as footwear and clothing5.

Geopolitics

Geopolitical tensions have certainly accelerated some of these relocation trends. As a result of the continuing US-China trade war, an American Chamber of Commerce (AmCham) survey in late 2019 showed that 17% of US firms in China are relocating or considering relocating their supply chains out of China6. We see three primary reasons for this trend.

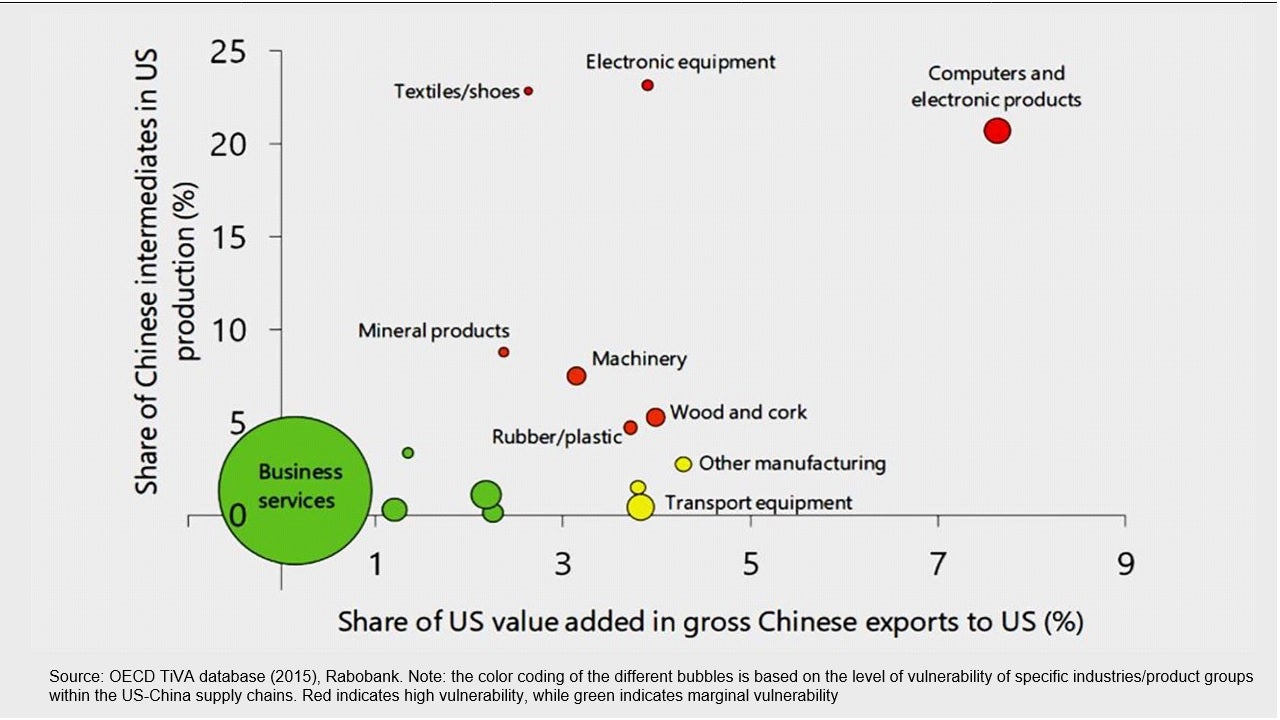

Firstly, the tit-for-tat trade tariffs under a Trump White House have exacerbated the cost of sourcing and manufacturing in China, especially for MNCs reliant on Chinese intermediate goods. With more than 20% of US production in computers, electronic products and equipment, textiles and shoes consisting of Chinese products (Figure 2), over 69% of US electronic manufacturers reported lower profit margins as a result of tariffs7.

Secondly, the US-China technology de-coupling is forcing multinational technology firms to move manufacturing capacities out of China. American technology companies are drafting plans to shift hardware productions out of China8, while Taiwanese9 and Korean10 semiconductor companies are also onshoring manufacturing capacities as well as diversifying into Thailand, Vietnam and India, where exports do not face the same US tariffs11.

Thirdly, the banning of Chinese cotton imports over human rights concerns in Xinjiang suggest that sanctions may extend to issues beyond trade and technology — especially with a president-elect Biden being a strong advocate for human rights. With China’s cotton industry accounting for 22% of global cotton production12, and Xinjiang accounting for 86% of that portion13, this ban will have significant implications on China’s largest commodity export. The ripples of this ban will be felt globally as a staggering one in five garments sold to consumers globally contains cotton from Xinjiang14. This development poses difficulties for countries reliant on Chinese cotton imports such as Vietnam, Pakistan, and Bangladesh, who manufacture the majority of textiles and apparels for the US15.

COVID-19

A closer look at this phenomenon of supply chain relocation reveal COVID-19 disruptions have prompted firms to diversify their concentration risks by reducing reliance on Chinese manufacturing.

Disruptions experienced during the onset of COVID-19 in early 2020 are seeing key economies prioritizing the onshoring or nearshoring of medical, pharmaceutical, and Personal Protective Equipment (PPE) supply chains for emergency and national security purposes. For example, US President Donald Trump signed an Executive Order to bring manufacturing of pharmacological inputs used to make drugs back to the US16 while the Internal Market Chief of the European Union (EU) urged member states to reduce the EU’s dependence on China17 for medical and pharmaceutical supplies.

Furthermore, MNCs with long production lines are also looking to diversify sourcing and manufacturing activities. COVID-19 lockdowns caused some American and Japanese automobile manufacturers to suspend production due to difficulties in sourcing supplies and materials from Chinese supplier18. This has incentivized MNCs with long supply chains, such as automobiles and electronics firms, to reduce their overreliance on Chinese intermediate goods and strengthen the resilience of their supply chains against exogenous shocks.

Mitigating Factors

Despite a flurry of talks about MNCs relocating their manufacturing activities, a cross-industry relocation of supply chains out of China is unlikely for several reasons.

1. Strong domestic consumption with significant growth momentum

Firstly, companies that are drawn to China’s huge domestic market initially are unlikely to leave as China’s consumer market with significant growth momentum becomes ‘too big to ignore’19. In 2017, across 24 consumption categories accounting for US$10 trillion of global consumption, China held an 18% share of the global consumption market on average20. By 2022, China’s consumer market value is expected to reach US$8.4 trillion21. A recent study22 showed that between 2010 to 2017, Chinese consumer spending accounted for 31% of global household consumption growth, overtaking the US based on GDP PPP23 in 2017. With growing affluence24 and middle-income group of between 500 to 700 million people25 — greater than the total population of the US — and with a developing e-commerce platform26, China is expected to contribute 44% of global consumption spending by 204027. This is 3.5 times the expected contribution of the US, and 2.7 times more than the combined contribution of the rest of Asia.

A fast-growing middle-income population and supportive government policies, as highlighted during China’s recent Five-Year Plenum, are driving China towards a consumption-oriented economy — with domestic consumption becoming the main engine to China’s economic growth. In 2018, four-fifths of China’s 6.5% GDP growth was driven by household consumption28. While a Biden presidency is likely to see a return to stable trading environments, domestic consumption will continue to be the main driver of China’s economic growth. The 14th Five-Year-Plan, set out by the Chinese government, will focus on “internal circulation” — leveraging on China’s massive consumer market — to mitigate evolving external risks29.

Furthermore, recent investments by automobile manufacturers and technology companies30 suggest MNCs in certain industries are looking to adopt “In China, For China” strategies to capitalize on this growing consumer market. For example, two major auto manufacturers have set up new mega-factories in Liaoning and Shanghai. The revenues of these MNCs already rely heavily on Chinese consumption with China accounting for around 40% of global mobile phone and automobile consumption in 201731.

2. Foreign Direct Investment (FDI) inflows and FDI stock remain strong

Secondly, from a capital flows standpoint, there remains no concrete evidence of this diversification in production at least for the moment.

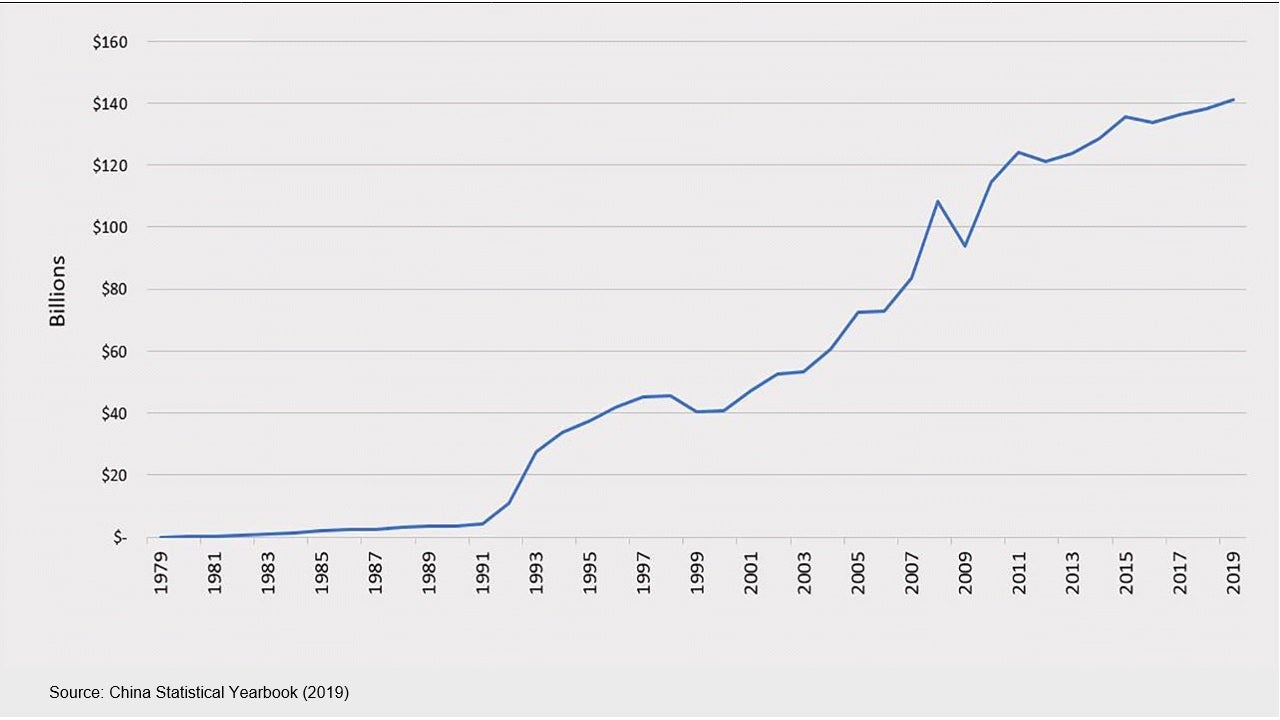

In fact, FDI inflows into China reached an all-time high of US$141 billion in 2019 (Figure 3)32 — almost equivalent to Vietnam’s accumulated FDI stock standing at US$161 billion33. High FDI inflows indicate that firms will remain committed to operating in China at least in the short run, with 20% of US firms maintain that China still ranks as “first priority” in their near-term investment plans, and another 39% as their “top-three” priority34.

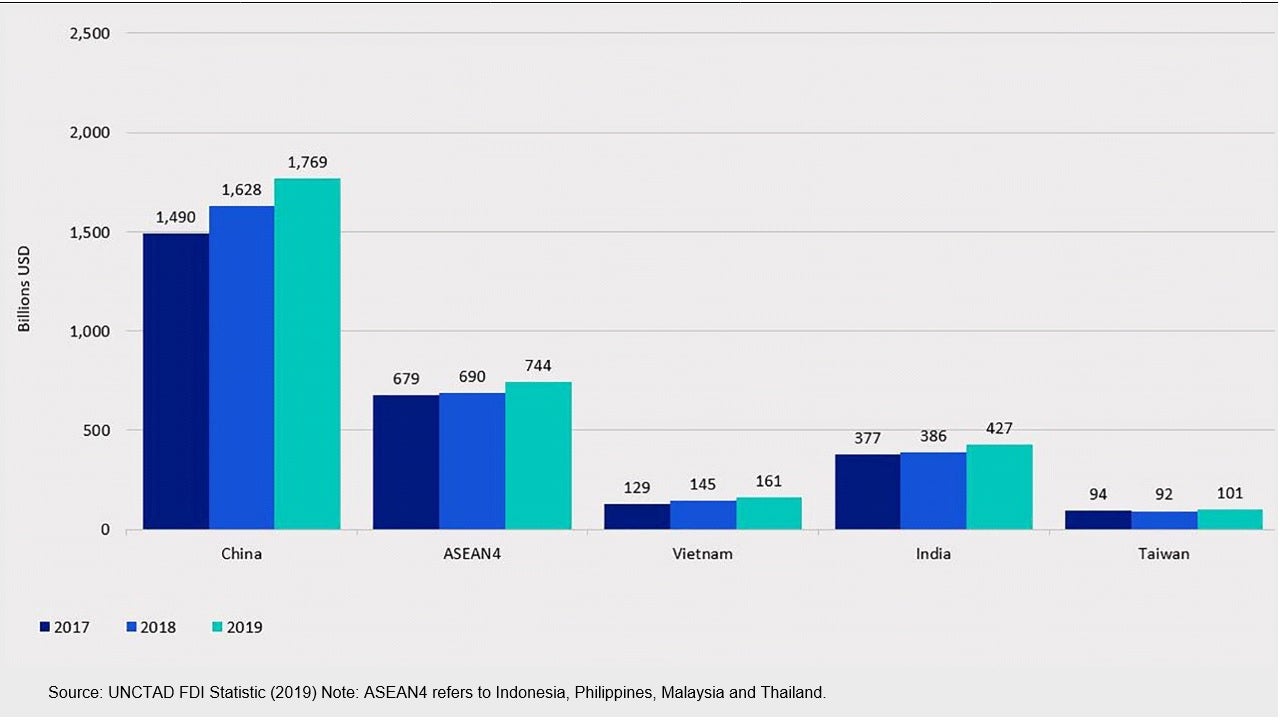

Even if some degree of supply chain reshuffling looks inevitable, it might not come as soon as expected. China’s outstanding FDI stock of US$1.8 trillion35 (Figure 4) — almost ten times larger than that of Vietnam and US$1 trillion more than that of Indonesia, Philippines, Malaysia, and Thailand combined (ASEAN4) —suggest that re-building supply chains requires substantial investment in addition to the years of developing infrastructure and critical sourcing relationship36. In an AmCham survey conducted earlier this year, over 40% of members said they would maintain previously planned levels of investment and only two percent said they would consider exiting the Chinese market in the next three to five years37.

China first in, first out and improving geopolitics

Finally, any proposed supply chain shifts may have been delayed as a result of China being first in and first out of COVID-19 as well as indications of a return to more predictable global trading environment.

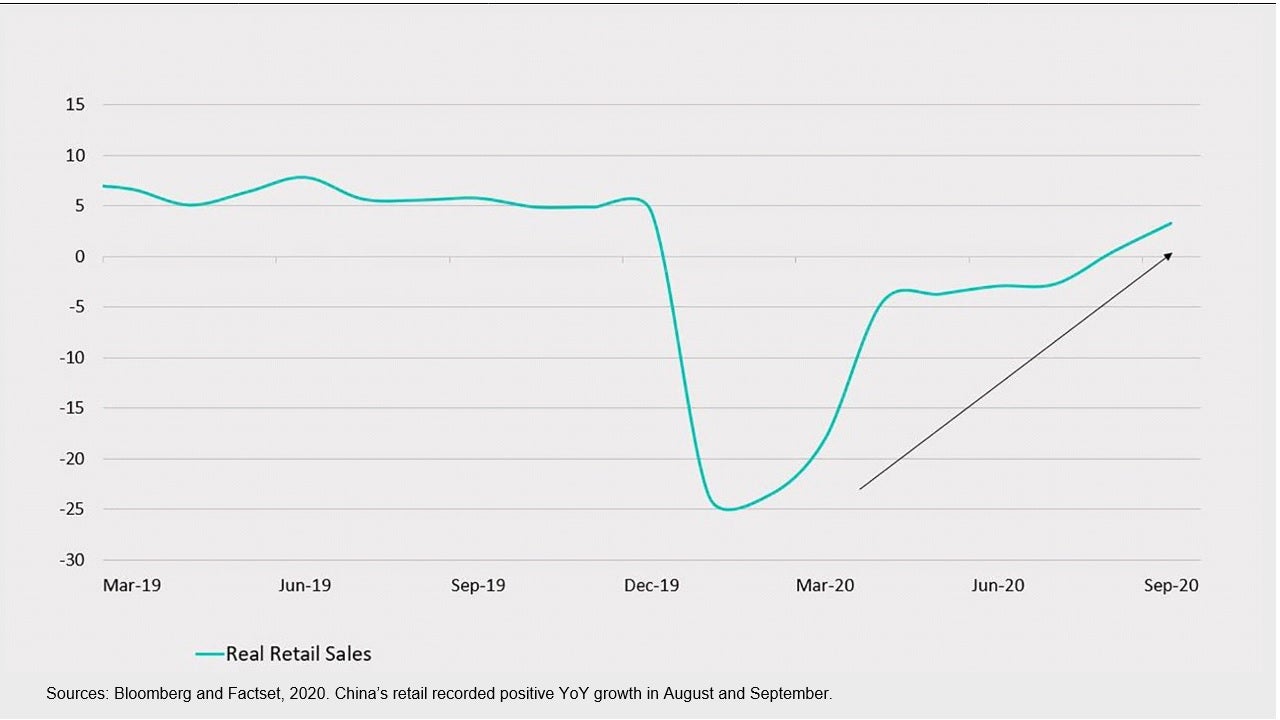

The flattening of China’s COVID-19 infection curve since March 2020 has allowed its manufacturing activities and consumption to normalize ahead of the global trend. This has seen China’s exports as a fraction of global exports increase in 202038. In a September survey by AmCham, more than 78% of 172 companies stated that they no longer face supply chain disruptions within China39. China’s V-shaped consumption recovery, highlighted by a rebound in retail sales (Figure 5), means foreign MNCs will want to capitalize on China’s early economic recovery relative to the rest of the world. This has helped to slowdown the expected trend by companies to diversify their production bases. In addition, logistic disruptions and tightening of corporate cash flows have prompted firms to delay relocation plans.

While a normalization of global consumption and business environment — on the back of COVID-19 vaccine availability in 2021 — may see an influx of relocations, the recent RCEP trade agreement as well as a possible re-set of US-China relationship under a Biden presidency, could also reduce the incentive for MNCs to shift their supply chains out of China.

The forming of RCEP establishes the world’s largest trading bloc, accounting for 30% of global GDP40. While the economic impact of the deal is marginal, it counters the narrative that China is becoming more insular, with its recent five-year “dual circulation” economic plan that relies more on its domestic economy. This deal not only showcases that China is very much back in the global trade game, but more importantly demonstrates China’s willingness to remain engaged with its trading partners despite the rising geopolitical tensions. RCEP and the anticipated stabilizing of US-China trade tensions under a Biden administration provide the perfect conduit to improve both fraying relations of intra-Asia and of US-China, which will no doubt prompt many MNCs to retain their supply chains in China.

Conclusion

Despite geopolitical developments and COVID-19 induced talks of supply chains shifting away from China, the observed relocation trend is one of diversification and not of abandonment.

Contrary to a mass exodus of manufacturing activities out of China, anecdotal evidence suggests that MNCs are starting to adopt “In China, For China”41 and “China Plus One”42 approaches. The splintering of US-China technology sector has caused Taiwanese and American technology companies to separate its China supply chain from non-China supply chain to serve the local Chinese market43 while addressing US national security concerns. Bifurcating supply chains mean MNCs can capitalize on the growth of China’s large domestic market while limiting tariff risks in the era of US-China tensions post COVID-19. On the other hand, “China Plus One” strategies aim to move parts of their supply chain to a third country to serve as a backup option44. While MNCs have reason to keep China as a significant part of their manufacturing capabilities, “China Plus One” helps to diversify overconcentration risk and gives the flexibility needed to mitigate exogenous disruptions to their businesses.

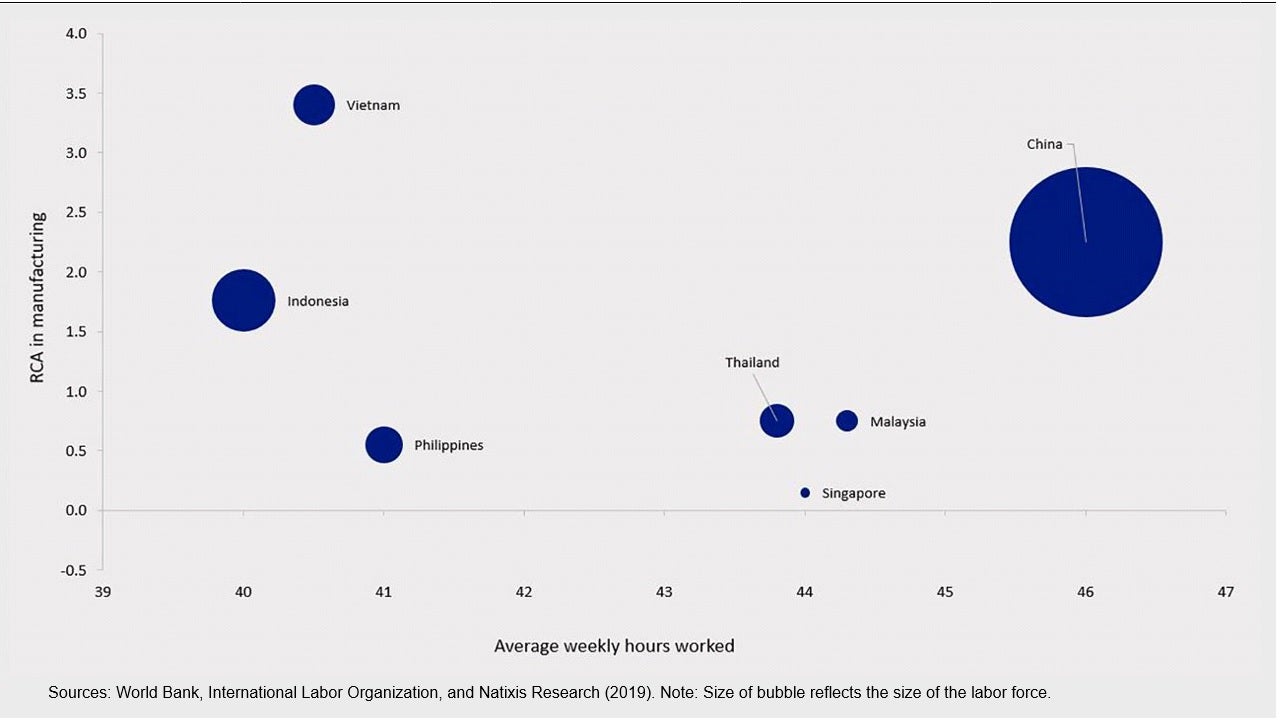

Even if supply chains are relocating, replicating Chinese manufacturing will be challenging and will take time. These shifts will be nuanced and industry specific. Tad Ishikawa, General Manager of Mitsubishi Corporation, stated that the size and skillset of the Chinese labor force will be difficult to replicate even if companies wanted to onshore their manufacturing capabilities. In 2019, China’s labor force was 14 times larger than that of Vietnam’s45 at 780 million (Figure 6). The average Chinese employee also works five hours more than the average Vietnamese employee46 per week and China ranks higher than neighboring ASEAN countries in terms of labor productivity47. He also mentioned that a large fraction of Japanese corporations who are moving out of China are SMEs without significant manufacturing processes within China48.

Surveys by AmCham and JETRO revealed that 59% of US firms49 and 90% of Japanese50 leaving China are going to developing countries in South East Asia. While the Mighty Five (MITI-V), namely Malaysia, India, Thailand, Indonesia and Vietnam are expected to inherit China’s crown for low-cost manufacturing activities, China still exports two times more goods than the five countries combined51. China’s market size, labor productivity, infrastructure, extensive and sophisticated supply chains means relocations of manufacturing will be broadly difficult, especially in high value-added areas. Thus, while low-cost manufacturing activities will continue to shift out of China, large-scale cross-industry shifts are unlikely.

Finally, China is unlikely to stand idly by while its supply chain and manufacturing industry, which accounts for 28% of its nominal GDP, slips away. Over the past years, the Chinese government has proactively initiated the removal of foreign ownership limits both in the manufacturing and financial industries to level the playing fields for foreign companies in order to attract foreign capital inflows52. For example, the lifting of foreign ownership on securities firms in 201953 and the removal of the 50% foreign investors cap on auto-manufacturing JV’s this July54 have increased foreign investments and prompted multi-national car manufacturers to set up factories within China. The recent RCEP agreement strengthens China’s intention to continue playing a critical role in the global supply chain and manufacturing ecosystem. While these changes will not completely prevent supply chain shifts, they could slow the process.

As the largest beneficiary of globalization, China will inevitably suffer some losses along with the times of change. While rising costs, potential sanctions, technology restrictions and geopolitics mean low-cost production, PPE and tech industries are likely to move out of China, these demerits need to be weighed against China’s vast domestic market, infrastructure, logistic networks and supply of workers which may have a competitive edge over its emerging market (EM) peers. Although many uncertainties lie ahead, we believe that China will continue to undergo the much-needed reforms to strengthen its position in the global supply chain network.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

1 World Bank, 2019. https://data.worldbank.org/indicator/BX.KLT.DINV.CD.WD

2 Boston Consulting Group: China’s Next Leap in Manufacturing. https://www.bcg.com/publications/2018/china-next-leap-in-manufacturing

3 https://www.bloomberg.com/news/articles/2020-04-08/japan-to-fund-firms-to-shift-production-out-of-china

4 https://www.reuters.com/article/us-usa-china-kudlow/full-immediate-expensing-would-lure-u-s-firms-back-from-china-trump-adviser-kudlow-idUSKCN21R387

5 Manufacturing Global: Vietnam becomes main manufacturer for Adidas and Nike footwear.https://www.manufacturingglobal.com/logistics/vietnam-becomes-main-manufacturer-adidas-and-nike-footwear

6 PWC: COVID-19 creating supply chain challenges for US companies in China, as majority of firms see a return to normal within three months. https://www.pwccn.com/en/press-room/press-releases/pr-170420.html

7 IP: Tariff War Fallout. U.S. Electronics Manufacturers Worried About Higher Tariffs and Laboring to Mitigate Impacts. https://www.ipc.org/media/2522/download

8 Financial Times: Apple considers supply chain shift out of China. https://www.ft.com/content/0dfeecec-9274-11e9-aea1-2b1d33ac3271

9 Foxconn Says Prepared to Move Apple Production Out of China if Necessary https://www.wsj.com/articles/iphone-assembler-foxconn-brushes-off-risks-of-u-s-china-trade-tensions-11560244585

10 South Korean companies shift production out of China. https://asia.nikkei.com/Business/Business-trends/South-Korean-companies-shift-production-out-of-China

11 Forbes: Is Apple Slowly Moving Out Of China? Its Supplier Is. https://www.forbes.com/sites/kenrapoza/2020/08/14/is-apple-slowly-moving-out-of-china-its-supplier-is/#6e5e6c0cff96

12 SCMP: US ban on China’s Xinjiang cotton ‘would wreak havoc’, leading apparel group says. https://www.scmp.com/economy/china-economy/article/3102008/us-ban-chinas-xinjiang-cotton-impossible-enforce-leading

13 Business Insider: Human rights groups urge Trump to ban Chinese cotton over Xinjiang forced labor camps. The implications of a ban 'would be enormous' in Beijing, one expert said. https://www.businessinsider.com/us-cotton-ban-increase-pressure-china-end-forced-labor-xinjiang-2020-9

14 Business Insider: ‘Virtually the entire apparel industry’ – from Gap to H&M to Adidas – is profiting from forced Uighur labor, activists say. https://www.businessinsider.com/uighur-forced-labor-global-brands-profited-activists-letter-2020-7

15 Fibre2Fashion: Xinjiang's role in China's cotton textile trade in 2019-20. https://www.fibre2fashion.com/news/textile-news/xinjiang-s-role-in-china-s-cotton-textile-trade-in-2019-20-269900-newsdetails.htm

16 WSJ: Trump Signs Executive Order to Boost U.S. Production of Essential Medicine. https://www.wsj.com/articles/trump-to-sign-executive-order-to-boost-u-s-production-of-essential-medicine-11596723074

17 Financial Times: EU industrial supply lines need strengthening, commissioner warns. https://www.ft.com/content/5e6e99c2-4faa-4e56-bcd2-88460c8dc41a

18 COVID-19 and the effects on supply chains in Vietnam. https://www.vietnam-briefing.com/news/covid-19-effects-supply-chains-vietnam.html/

19 SCMP: China consumer market ‘too big to ignore’, to attract domestic and foreign M&A activity amid trade war https://www.scmp.com/business/china-business/article/3012156/china-consumer-market-too-big-ignore-attract-domestic-and

20 Mckinsey: China and the world. https://www.mckinsey.com/~/media/mckinsey/featured%20insights/china/china%20and%20the%20world%20inside%20the%20dynamics%20of%20a%20changing%20relationship/mgi-china-and-the-world-full-report-june-2019-vf.ashx

21 Oxford Economics: China’s consumers shake the (retail) world. http://blog.oxfordeconomics.com/chinas-consumers-shake-the-retail-world

22 Mckinsey: China and the world. https://www.mckinsey.com/~/media/mckinsey/featured%20insights/china/china%20and%20the%20world%20inside%20the%20dynamics%20of%20a%20changing%20relationship/mgi-china-and-the-world-full-report-june-2019-vf.ashx

23 SCMP: China overtakes US as No 1 in buying power, but still clings to developing status. https://www.scmp.com/economy/china-economy/article/3085501/china-overtakes-us-no-1-buying-power-still-clings-developing

24 GlobalData: Affluent population in China to surpass 56 million mark in 2022. https://www.globaldata.com/affluent-population-in-china-to-surpass-56-million-mark-in-2022-says-globaldata/

25 SCMP: China’s five-year plan to focus on independence as US decoupling threat grows. https://www.scmp.com/economy/china-economy/article/3085683/coronavirus-china-five-year-plan-focus-independence-us

26 China Daily: China posed to overtake US as largest consumer market. https://www.chinadaily.com.cn/a/201912/20/WS5dfc3e4aa310cf3e3557f845.html

27 Oxford Economics: China’s consumers shake the (retail) world. http://blog.oxfordeconomics.com/chinas-consumers-shake-the-retail-world

28 NY Times: American Companies Need Chinese Consumers. https://www.nytimes.com/2019/01/07/opinion/apple-china.html

29 Reuters: China pursues economic self-reliance as external risks grow: advisers. https://www.reuters.com/article/us-china-economy-strategy-idUSKCN25031K

30 The myth of Apple production leaving China. https://news.cgtn.com/news/2020-07-26/The-myth-of-Apple-production-leaving-China-SqNzadcXAI/index.html

31 Mckinsey: China and the world. https://www.mckinsey.com/~/media/mckinsey/featured%20insights/china/china%20and%20the%20world%20inside%20the%20dynamics%20of%20a%20changing%20relationship/mgi-china-and-the-world-full-report-june-2019-vf.ashx

32 China Daily: China's FDI reaches record high of $139b. http://www.chinadaily.com.cn/a/201906/14/WS5d035639a3103dbf14328484.html

33 United Nations Conference on Trade and Development: FDI Statistics. https://unctad.org/en/Pages/DIAE/FDI%20Statistics/FDI-Statistics.aspx

34 2020 China Business Climate Survey Report. https://www.amchamchina.org/downloaddocument/42eb291aa4c7f8a538cb5696337c49bd7254fc61.pdf

35 United Nations Conference on Trade and Development: FDI Statistics. https://unctad.org/en/Pages/DIAE/FDI%20Statistics/FDI-Statistics.aspx

36 Sourcing Journal: Moving Supply Chains Out of China Isn’t So Easy. https://sourcingjournal.com/topics/thought-leadership/moving-supply-chains-out-of-china-136116/

37 2020 China Business Climate Survey Report. https://www.amchamchina.org/downloaddocument/42eb291aa4c7f8a538cb5696337c49bd7254fc61.pdf

38 Morgan Stanley: China gaining market share as global trade rebounds. https://news.cgtn.com/news/2020-07-14/Morgan-Stanley-China-gaining-market-share-as-global-trade-rebounds-S7Pt6TjtAY/index.html

39 SCMP: Coronavirus supply chain disruptions easing for companies in South China. Sep 2020. https://www.scmp.com/economy/china-economy/article/3102366/coronavirus-supply-chain-disruptions-easing-companies-south

40 ASEAN.org: Summary of RCEP Agreement. https://asean.org/summary-regional-comprehensive-economic-partnership-agreement/

41 China Briefing: In China, For China – Limiting Tariff Risks, Serving Chinese Consumers. https://www.china-briefing.com/news/in-china-for-china-limiting-tariff-risks-serving-chinese-consumers/

42 Fiducia Management Consultants: China Plus One in Practice. https://www.fiducia-china.com/china-plus-one-in-practice/

43 The great uncoupling: one supply chain for China, one for everywhere else. https://www.ft.com/content/40ebd786-a576-4dc2-ad38-b97f796b72a0

44 The China plus One Strategy in Vietnam. https://www.asiabriefing.com/store/book/china-plus-one-strategy-vietnam-7930.html

45 World Bank, 2019. https://data.worldbank.org/indicator/SL.TLF.TOTL.IN

46 International Labor Organization (ILO) statistics 2018. https://ilostat.ilo.org/data/

47 International Labor Organization (ILO): Labor Productivity. https://ilostat.ilo.org/topics/labour-productivity/

48 Ishikawa, Tad. AmCham Future of Supply Chains in China Webinar. Oct 9th 2020.

49 SCMP: Trump has called on US firms to leave China, but no mass exodus among ‘well-rooted’ companies. https://www.scmp.com/economy/china-conomy/article/3100793/trump-has-called-us-firms-leave-china-no-mass-exodus-among

50 Nikkei Asia: Japanese companies shift focus to ASEAN due to US-China rows https://asia.nikkei.com/Business/Business-trends/Japanese-companies-shift-focus-to-ASEAN-due-to-US-China-rows

51 World Bank. https://wits.worldbank.org/countrysnapshot/en/WLD/textview

52 XinHua News: China nurtures fertile ground for foreign investors. http://www.xinhuanet.com/english/2020-08/28/c_139323021.html

53 Xinhua News: China lifts foreign ownership limits on securities, fund management firms. http://www.xinhuanet.com/english/2020-04/01/c_138938273.html

54 China Daily: Equity cap in commercial vehicle JVs to be removed. https://www.chinadailyhk.com/article/135210

当資料ご利用上のご注意

当資料は情報提供を目的として、インベスコ・アセット・マネジメント株式会社(以下、「当社」)のグループに属する運用プロフェッショナルが英文で作成したものであり、法令に基づく開示書類でも特定ファンド等の勧誘資料でもありません。内容には正確を期していますが、必ずしも完全性を当社が保証するものではありません。また、当資料は信頼できる情報に基づいて作成されたものですが、その情報の確実性あるいは完結性を表明するものではありません。当資料に記載されている内容は既に変更されている場合があり、また、予告なく変更される場合があります。当資料には将来の市場の見通し等に関する記述が含まれている場合がありますが、それらは資料作成時における作成者の見解であり、将来の動向や成果を保証するものではありません。また、当資料に示す見解は、インベスコの他の運用チームの見解と異なる場合があります。過去のパフォーマンスや動向は将来の収益や成果を保証するものではありません。当社の事前の承認なく、当資料の一部または全部を使用、複製、転用、配布等することを禁じます。

C2020-12-156

そのほかの投資関連情報はこちらをご覧ください。https://www.invesco.com/jp/ja/institutional/insights.html