2021 The Year of the Ox: Finding prosperous opportunities in China

- China A shares had an outstanding year as China was the only major economy globally to register positive GDP in 2020.

- Successful efforts to contain the pandemic, careful policy calibration and pent up demand for consumption led to strong V-shaped recovery.

- China exports remain strong in 2020 despite calls for supply chain disruption. Recent agreements on new trade pacts would continue to benefit China’s role in global trade.

- We remain constructive on China equities in 2021 but focus on earnings growth rather than valuation expansion.

- We see growth opportunities in healthcare, technology, and renewable energy sectors.

- Watch out for potential tightening of liquidity as a key risk.

China’s economy resilient against the market challenges of 2020

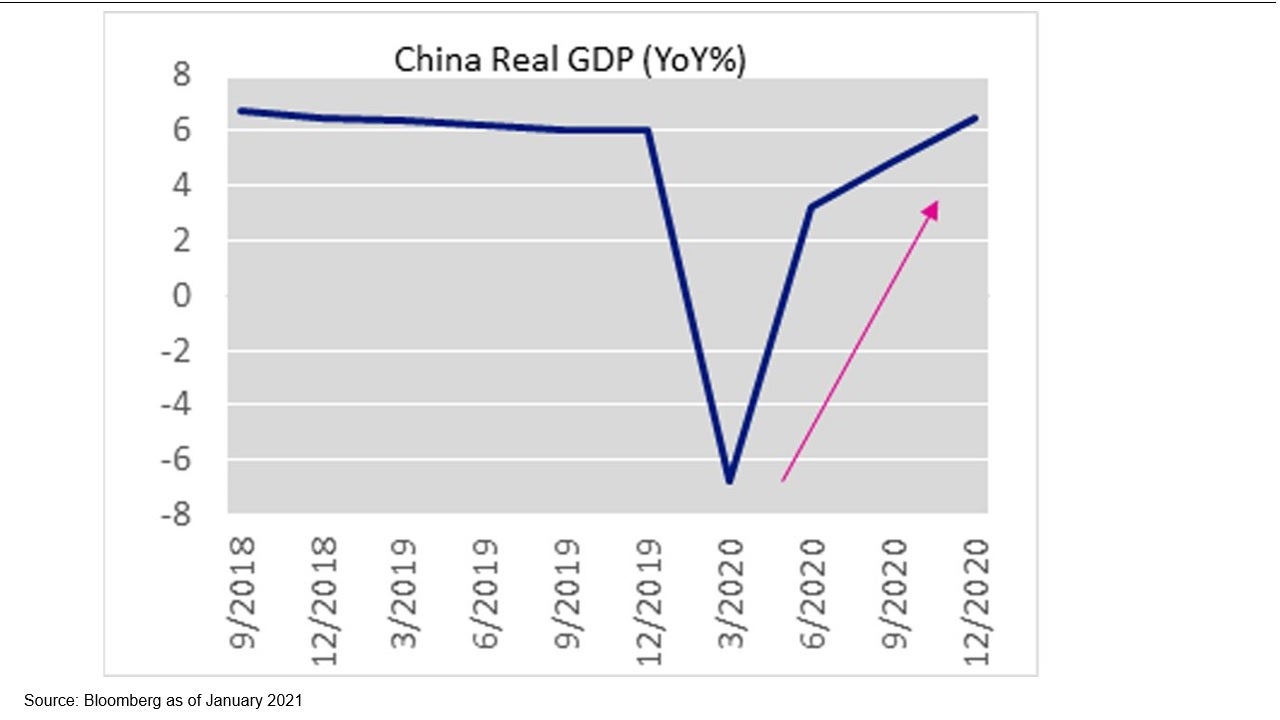

Despite the global pandemic, China was the best performing market globally in 2020. The MSCI China A shares and the MSCI China indices returned nearly +43% and +27% respectively1, thanks to the country’s efficient containment of the pandemic. One key reason for China’s market outperformance was its astounding V-shaped economic recovery with growth rebounding in the second half of the year.

China was the only major economy globally to show positive GDP in 2020 of +2.3% vs. global growth of -4.2%2. Manufacturing began to ramp up since 2Q 2020 with industrial production up +7.3% YoY in December.3 Demand for Chinese products remained robust particularly for medical supplies, technology, and home appliances (due to work from home, online shopping, etc.).

While US restrictions on certain Chinese investments may affect near-term sentiment, it is unlikely to weaken the long-term demand for China assets by global investors. The V-shaped recovery of China’s economy will likely continue, supported by domestic consumption and export growth, as per the twin circulation policy.

What to expect from the investment landscape of China in 2021?

China has demonstrated its strong ability in containing the COVID-19 outbreak. China’s economy is expected to remain resilient driven by industrial production in the first half of the year, furthered by stronger consumption in the second half of 2021 as vaccine rollouts are underway. At the National People’s Congress meeting in May 2020, government policies targeted at growth boosted investor confidence, driving both domestic and foreign investment inflows with a record number of equity raising activities last year.[1] We expect Chinese policymakers will continue to push the economy forward using levers of growth with the dual circulation strategy at its core.

On the geo-political front, the market generally expects the current US administration to take a more measured and predictable approach to bilateral relations with China. At the same time, China is also actively recalibrating its strategy by engaging with other regional and global trade partners to minimize the impact of further US China fallout. The recently inked Regional Comprehensive Economic Partnership (RCEP) free trade agreement between 15 Asia Pacific (APAC) economies and the European Union (EU) investment deal are prime examples. These deals signify China is engaging in an open international policy with its neighbors and the world, and we expect additional investment flows and trade between the supply chains of APAC countries as well as European Union going forward.

An eye on liquidity risks if the economy recovers too quickly

In Q1 2020, the Chinese government carried out expansionary fiscal and monetary policies in response to the pandemic. We remain vigilant of any potential tightening of liquidity in the market. While a sharp exit from the current policy is unlikely, a rapid and strong rebound in the Chinese economy could potentially lead to inflationary pressures, eventually moving rates such as the China 10-Year government bond yields back up.

At China’s Central Economic Work Conference in December, authorities look to maintain accommodative macro policies in the short-term. We expect foreign inflows into the A-share market to remain strong with continuous reforms such as China further opening its capital markets, while domestic fund flows continue to shift from wealth management products of banks into Chinese equity funds.

Opportunities in China set to prosper in 2021

We expect further upside potential for the A-share market in 2021 mainly supported by earnings recovery rather than a valuation expansion.

Our key focus sectors in China are those companies developing clean energy, advanced healthcare and pioneer technology. In the healthcare sector, we expect strong export demand for medical supplies from overseas countries to continue in 2021. Vaccine manufacturers could benefit from inoculation rollouts in China and in emerging markets. Healthcare reforms in China will likely push drug producers to spend more on research and development (R&D) of innovative drugs, which will benefit subsectors such as contract research organization (CRO) and contract development and manufacturing organization (CDMO).

Technology companies will likely benefit from the nation’s 5G network rollout in 2021 — those along the supply chain of 5G handsets, big data and Artificial Intelligence of Things (AIoT) products.

As the nation moves towards carbon neutrality, there will be growing demand for solar power as well as auto electronics that benefit from rising electric vehicle sales in China.

Investing in China’s future

The growth drivers of China’s economy will sustain for many years to come, supported by strong domestic consumption. 2021 will present continued uncertainty however opportunities exist for investors to position their portfolios for the long-term. (Refer to How to position China A shares in a portfolio?)

To learn more about investment opportunities in 2021, explore our Insights from investment professionals.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.

1 Source: Bloomberg as of 31 December 2020.

2 Source: Bloomberg as of January 2021. Invesco webinar on 21 January 2021.

3 Source: Bloomberg as of January 2021. Invesco webinar on 21 January 2021.

4 Reuters. Chinese companies take record 50% of global equity raising in first half of 2020. https://www.reuters.com/article/asia-ipo/chinese-companies-take-record-50-of-global-equity-raising-in-first-half-of-2020-idUSL4N2E02K1

当資料ご利用上のご注意

当資料は情報提供を目的として、インベスコ・アセット・マネジメント株式会社(以下、「当社」)のグループに属する運用プロフェッショナルが英文で作成したものであり、法令に基づく開示書類でも特定ファンド等の勧誘資料でもありません。内容には正確を期していますが、必ずしも完全性を当社が保証するものではありません。また、当資料は信頼できる情報に基づいて作成されたものですが、その情報の確実性あるいは完結性を表明するものではありません。当資料に記載されている内容は既に変更されている場合があり、また、予告なく変更される場合があります。当資料には将来の市場の見通し等に関する記述が含まれている場合がありますが、それらは資料作成時における作成者の見解であり、将来の動向や成果を保証するものではありません。また、当資料に示す見解は、インベスコの他の運用チームの見解と異なる場合があります。過去のパフォーマンスや動向は将来の収益や成果を保証するものではありません。当社の事前の承認なく、当資料の一部または全部を使用、複製、転用、配布等することを禁じます。

C2021-03-021

そのほかの投資関連情報はこちらをご覧ください。https://www.invesco.com/jp/ja/institutional/insights.html