Short-term investment outlook - June Update

Factor portfolios based on quantitative characteristics such as value, momentum, quality, size and low volatility have historically generated attractive excess returns, outperforming market cap benchmarks on a risk-adjusted basis.

While single factors have outperformed over the long-term, they have also experienced strong cyclicality, occasionally leading to extended periods of underperformance driven by changing market environments.

We believe investors can exploit these distinct macro sensitivities among factors, developing dynamic rotation strategies driven by forward-looking macro regime frameworks, with the potential to outperform static multifactor portfolios while maintaining diversification to multiple factors.

June 2020 update

- Extraordinary monetary and fiscal policy announcements have helped markets find a bottom in late March, and the steady decline in new Covid-19 infections in the developed world has increased the likelihood of a gradual reopening across major economies in Europe and North America over the next month.

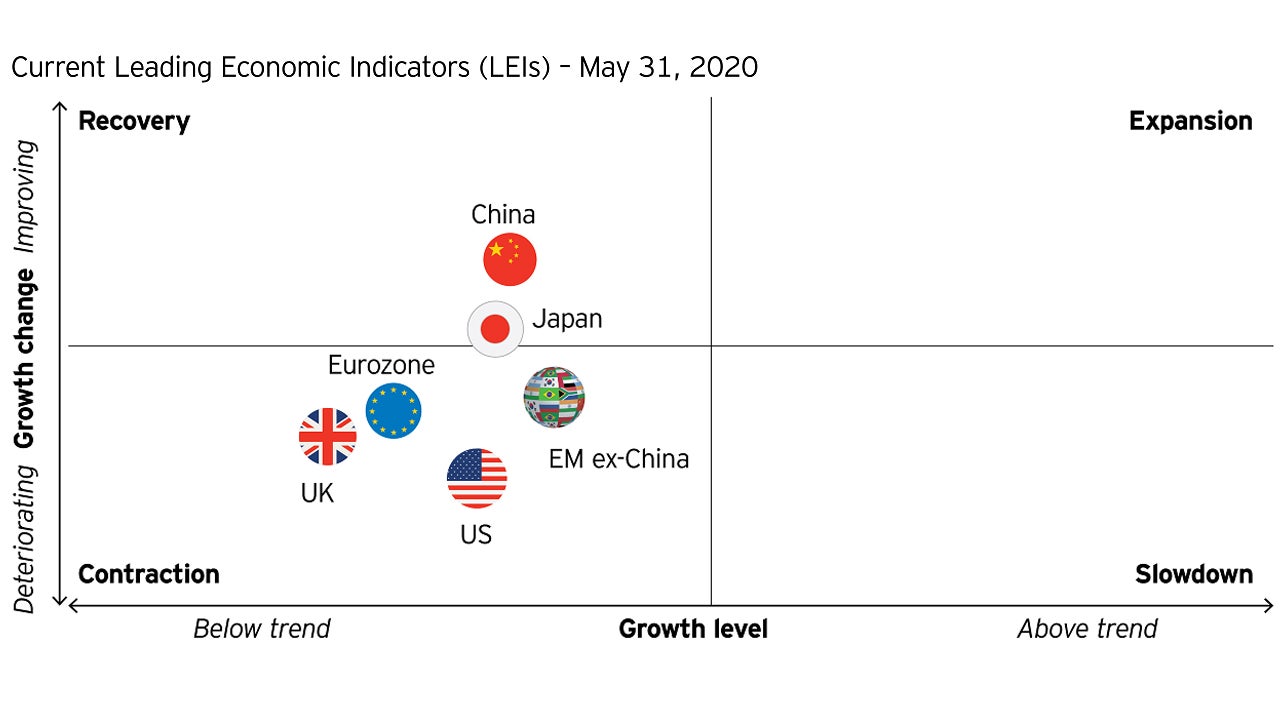

- As a result, markets have quickly repriced improving growth expectations, which lead our macro framework to move to a recovery regime after spending four months in contraction. Based on our leading indicators we are already seeing this recovery materialize in major economies across Asia, which led the way during the downturn and now lead the way in a recovery.

- In this paper we show how we would use these signals to implement changes across asset classes, regions and factor exposures within a global strategy.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Factor investing is an investment strategy in which securities are chosen based on certain characteristics and attributes that may explain differences in returns. There can be no assurance that performance will be enhanced or risk will be reduced for portfolios that seek to provide exposure to certain factors. Exposure to such investment factors may detract from performance in some market environments, perhaps for extended periods. Factor investing may underperform cap-weighted benchmarks and increase portfolio risk.

There is no guarantee that low-volatility stocks will provide low volatility.

Investing in securities of small capitalization companies involves greater risk than customarily associated with investing in larger, more established companies.

A value style of investing is subject to the risk that the valuations never improve or that the returns will trail other styles of investing or the overall stock markets.

Momentum style of investing is subject to the risk that the securities may be more volatile than the market as a whole or returns on securities that have previously exhibited price momentum are less than returns on other styles of investing.

Important information

-

These materials may contain statements that are not purely historical in nature but are “forward-looking statements.” These include, among other things, projections, forecasts, estimates of income, yield or return or future performance targets. These forward-looking statements are based upon certain assumptions, some of which are described herein. Actual events are difficult to predict and may substantially differ from those assumed. All forward-looking statements included herein are based on information available on the date hereof and Invesco assumes no duty to update any forward-looking statement. Accordingly, there can be no assurance that estimated returns or projections can be realized, that forward-looking statements will materialize or that actual returns or results will not be materially lower than those presented.

All material presented is compiled from sources believed to be reliable and current, but accuracy cannot be guaranteed. This is not to be construed as an offer to buy or sell any financial instruments and should not be relied upon as the sole factor in an investment making decision. As with all investments there are associated inherent risks. This should not be considered a recommendation to purchase any investment product. Investors should consult a financial professional before making any investment decisions if they are uncertain whether an investment is suitable for them. Please obtain and review all financial material carefully before investing. The opinions expressed are those of the authors, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.