Markets and Economy Chinese stocks surge, concerns about US inflation grow

Catalysts like DeepSeek have sparked a surge in Chinese stocks, while US inflation expectations indicate growing concerns about a resurgence in prices.

“Abenomics,” an ambitious economic plan created by late prime minister Shinzo Abe, laid the groundwork for today’s Japanese stock rally.

Today, I think it’s fair to say that Japan is realizing much of Abe’s vision, as structural reforms appear to be taking hold.

Attractive valuations, cash on the sidelines, and monetary policy could drive Japanese equities higher going forward.

It feels like the late 1980s again. Not because I’m wearing Reebok high top sneakers, Guess jeans and Esprit jackets or listening to Men at Work and Yes, but because there’s a lot of excitement around Japan’s economy — and Japanese equities have experienced a strong rally over the past year.1

Is this a fleeting trend, or a “Japanaissance” in the making?

Japan’s economy and stock market have certainly benefited from the strong fiscal and monetary stimulus it received during the pandemic. However, from my perspective, the groundwork was laid years ago with “Abenomics,” an ambitious economic plan introduced more than a decade ago by late prime minister Shinzo Abe.

Abenomics was designed to pull the Japanese economy out of its decades-long stagnation. This plan involved three key initiatives, known as the three arrows:

This would be a powerful combination that could enable the Japanese economy to escape deflation through monetary and fiscal stimulus, with structural reforms intended to improve confidence and make economic growth sustainable for the longer term.

Fast forward to today. I think it’s fair to say that Japan is realizing much of Abe’s vision, as structural reforms appear to be taking hold. Japan’s Shunto wage negotiations yielded results that were better than expected. Japan’s largest union group, Rengo, and corporations agreed on a 5.28% wage hike — which is much higher than last year’s increase of 3.8% and is even better than expectations of a 4.1% hike by economists surveyed in a recent Bloomberg poll.2

Capital efficiency has improved for Tokyo Stock Exchange-listed companies because of the corporate governance reform initiated a decade ago, and the TSE is pushing for greater progress. What’s more, Japan is continuing to support two of Abe’s three arrows: We’ve seen additional substantial fiscal stimulus under current Prime Minister Fumio Kishida, and he continues to support structural reform. Kishida recently eased regulations and streamlined business practices — enabling foreign investors to complete government applications in English — in order to encourage both domestic and overseas investment.

Some would argue that the strong Japanese stock market rally over the past year has priced in all the improvements in the Japanese economy. However, I would argue that there are additional reasons that could drive Japanese equities higher going forward.

Back in December, my colleague Daiji Ozawa, Chief Investment Officer and Head of Japan Equities, accurately predicted the Nikkei 225 Index would rise above its previous peak back in 1989. He posited that if sustained nominal gross domestic product growth backed by the Bank of Japan’s careful monetary policy normalization and government reforms to enhance the entire investment chain takes place, the Japanese equity market would likely continue to perform well. I couldn’t agree more with this assessment and look forward to more positive developments for the Japanese economy and stock market.

All eyes will be on central banks this week — especially the Bank of Japan, the Bank of England and the US Federal Reserve. They’re all close to altering their respective monetary policy, although the Bank of Japan is expected to move first and begin to normalize monetary policy either this week or in April, with the Shunto negotiations likely to improve the Bank of Japan’s confidence about normalizing sooner rather than later.

We’re also likely to get some valuable guidance this week on when the Federal Reserve and Bank of England will begin cutting rates after some recent and surprising data points. I will be particularly keen to see the Fed’s dot plot, given whispers that it could show only two expected rate cuts this year. Don’t fret if it does; as I’ve said before, the dot plots can be wildly inaccurate — just look at the December 2021 dot plot if you want to calm your nerves.

Date |

Event |

What it tells us |

3/18 |

Eurozone Consumer Price Index |

Tracks the path of inflation.

|

|

US NAHB Housing Market Index |

Indicates the health of the housing market. |

|

Bank of Japan decision |

Reveals the latest decision on the path of interest rates. |

|

Reserve Bank of Australia decision |

Reveals the latest decision on the path of interest rates. |

3/19 |

Germany ZEW Economic Sentiment |

Measures opinions on the direction of the economy for the next six months. |

|

Eurozone ZEW Economic Sentiment |

Measures opinions on the direction of the economy for the next six months. |

|

US building permits and housing starts |

Indicates the health of the housing market. |

|

Canada Consumer Price Index |

Tracks the path of inflation.

|

3/20 |

UK Consumer Price Index |

Tracks the path of inflation.

|

|

Germany Producer Price Index |

Measures the change in prices paid to producers of goods and services. |

|

US Federal Open Market Committee Meeting |

Reveals the latest decision on the path of interest rates. |

3/21 |

Swiss National Bank decision |

Reveals the latest decision on the path of interest rates. |

|

Bank of England decision |

Reveals the latest decision on the path of interest rates. |

|

UK Purchasing Managers’ Index |

Indicates the economic health of the manufacturing and services sectors. |

|

Eurozone Purchasing Managers’ Index |

Indicates the economic health of the manufacturing and services sectors. |

|

US Purchasing Managers’ Index (S&P Global) |

Indicates the economic health of the manufacturing and services sectors. |

|

Japan Consumer Price Index |

Tracks the path of inflation. |

|

UK retail sales |

Measures consumer demand. |

|

Canada retail sales |

Measures consumer demand. |

With contributions from Daiji Ozawa and Tomo Kinoshita

Source: MSCI as of Dec. 31, 2023. The MSCI Japan Index returned 20.77% for calendar year 2023.

Source: Bloomberg Poll, March 12, 2024

Source: MSCI, as of Feb. 29, 2024, and Bloomberg, as of March 15, 2024

Source: Nikkei Asia, “Japan households' investments drive 80% of asset growth,” Dec. 26, 2023

Catalysts like DeepSeek have sparked a surge in Chinese stocks, while US inflation expectations indicate growing concerns about a resurgence in prices.

The debt ceiling is the legal limit on the amount of federal debt the US government can have outstanding. Defaulting on that debt would have consequences.

Markets absorbed tariff news, tech company earnings, news from the new US Treasury Secretary, disappointing US inflation-related reports, and more.

Important information

NA3454870

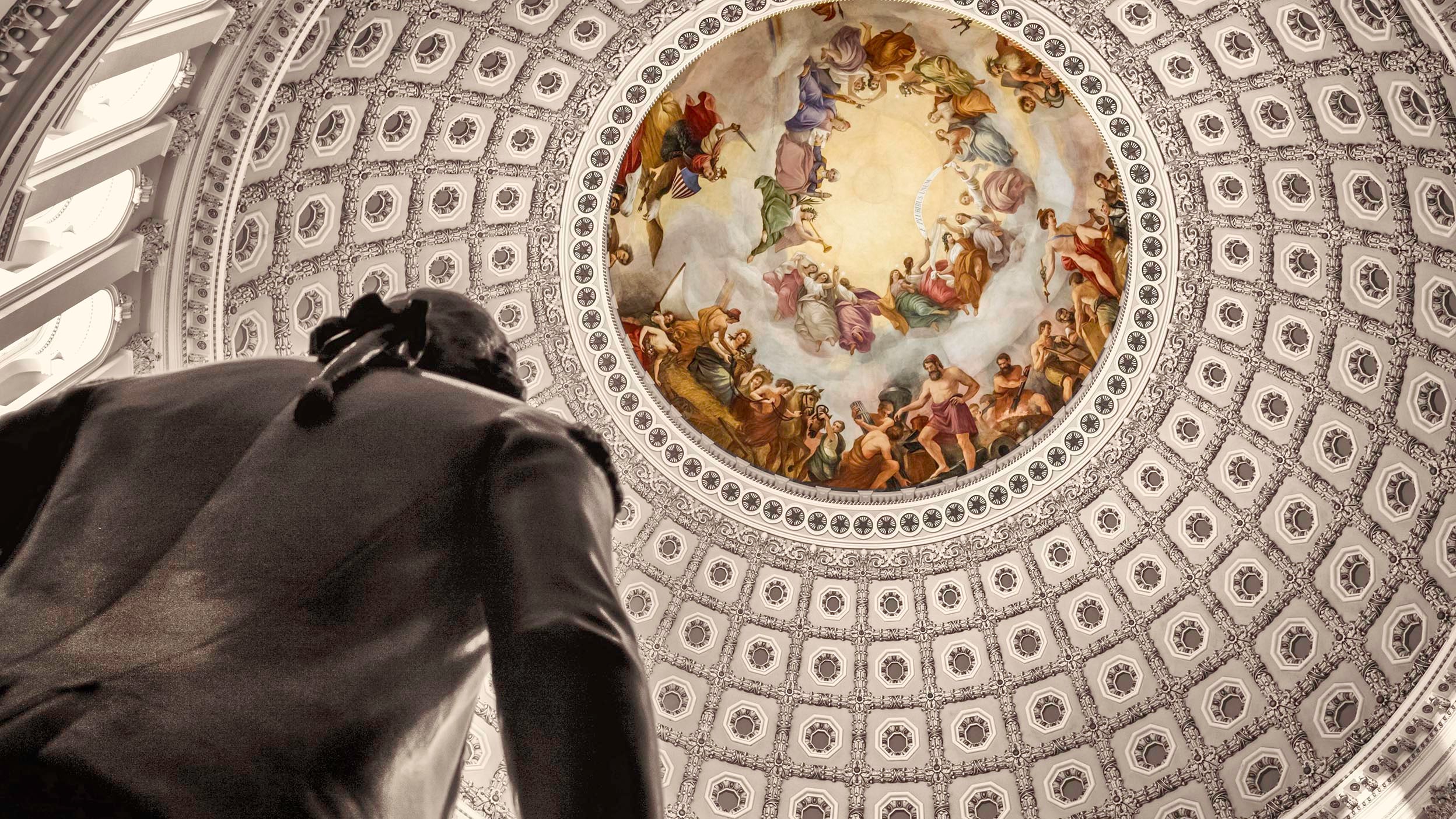

Image: Jackyenjoyphotography / Getty

All investing involves risk, including the risk of loss.

Past performance does not guarantee future results.

Investments cannot be made directly in an index.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions.

In general, stock values fluctuate, sometimes widely, in response to activities specific to the company as well as general market, economic and political conditions.

The risks of investing in securities of foreign issuers, including emerging market issuers, can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues.

The S&P 500® Index is an unmanaged index considered representative of the US stock market.

The MSCI Japan Index measures the performance of the large- and mid-cap segments of the Japanese market.

The Nikkei 225 Index is a price-weighted average of 225 top-rated Japanese companies listed in the first section of the Tokyo Stock Exchange.

The price-to-earnings (P/E) ratio measures a stock’s valuation by dividing its share price by its earnings per share.

Shunto refers to the annual wage negotiations between unions and employers in Japan.

Quantitative easing is a monetary policy used by central banks to stimulate the economy when standard monetary policy has become ineffective.

Qualitative easing is a policy designed to shift the composition of the assets on a central bank’s balance sheet toward less liquid and riskier assets while keeping the size of the balance sheet steady.

Dividend yield is the amount of dividends paid over the past year divided by a company’s share price.

Gross domestic product (GDP) is a broad indicator of a region’s economic activity, measuring the monetary value of all the finished goods and services produced in that region over a specified period of time. Nominal GDP is not adjusted for inflation.

The Federal Reserve’s “dot plot” is a chart that the central bank uses to illustrate its outlook for the path of interest rates.

The opinions referenced above are those of the author as of March 18, 2024. These comments should not be construed as recommendations, but as an illustration of broader themes. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

This link takes you to a site not affiliated with Invesco. The site is for informational purposes only. Invesco does not guarantee nor take any responsibility for any of the content.