Markets and Economy European stock markets surge as US stock market sags

European nations prepare to invest in defense and infrastructure, while the US faces the possibility of recession brought on by government spending cuts.

Fresh perspectives on economic trends and events impacting the global markets.

Get timely investment ideas, an overview of what’s happening in the markets, and tips to help optimize your portfolios in our monthly playbook.

European nations prepare to invest in defense and infrastructure, while the US faces the possibility of recession brought on by government spending cuts.

The market is gauging the economic inefficiencies that may result from the Trump administration’s new tariffs and the retaliatory measures from other countries.

The US economy appears to be slowing quickly as consumers brace for tariffs, higher prices, and a possible government shutdown.

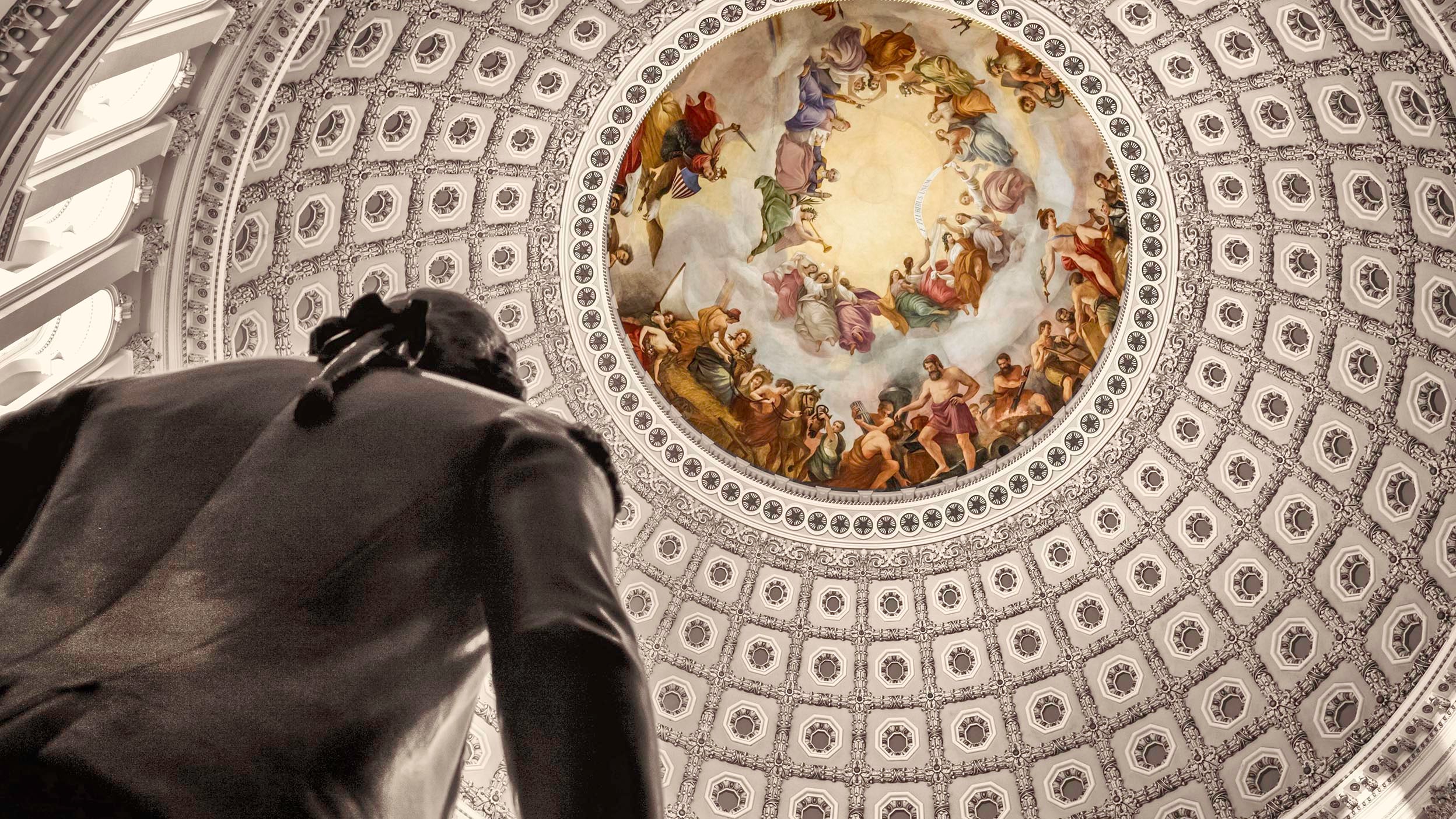

A government shutdown can create short-term market volatility, but they tend to resolve quickly with little market impact for long-term investors.

DeepSeek has challenged artificial intelligence (AI) assumptions with cutting edge performance and significant efficiency gains. What do these results mean for AI?

We discuss the future of US inflation, the outperformance of European stocks, the potential impact of new tariffs, and the independence of the Federal Reserve in this month’s column.

Unemployment concerns and rising inflation expectations contribute to falling US consumer sentiment, while the German election could be a positive catalyst for European equities.

Catalysts like DeepSeek have sparked a surge in Chinese stocks, while US inflation expectations indicate growing concerns about a resurgence in prices.

The debt ceiling is the legal limit on the amount of federal debt the US government can have outstanding. Defaulting on that debt would have consequences.

Get straightforward insight from our market and economic experts on what investors need to know about soft landings, inflation, the economy, government debt, election season, and more.

Insights from our income experts on investing opportunities around the globe.

Our latest thinking on opportunities and potential ways to use ETFs in a portfolio.

Learn about investing in ETFs, including the basics, benefits, and choosing one.

Candid conversations with fund managers, market strategists, and more.

AEM723/ AEM731

This link takes you to a site not affiliated with Invesco. The site is for informational purposes only. Invesco does not guarantee nor take any responsibility for any of the content.