Current market dislocations in private credit: Direct lending

Key takeaways

The core middle market includes businesses with enterprise values generally no greater than US $750 million in size.

Generally with direct lending, there are three components to yield: base rate, an upfront fee, and a spread component.

Private equity has continued to amass record sums of capital.

As part of the recent Invesco Asia Pacific Forum, Ronald Kantowitz from Invesco’s Private Credit team spoke with Jeffrey Reemer, Senior Client Portfolio Manager, on how the landscape for direct lending has evolved in recent years and the opportunities he is seeing in this space. Below are some excerpts from this insightful session.

Q: Can you describe your team’s direct lending investment approach?

A: We target a segment that we call the core middle market. I would define this as businesses with enterprise values generally no greater than US $750 million in size. We focus on that segment because over past economic cycles it has delivered consistent and stable performance. Also, when you contrast this segment to the broader opportunity set within direct lending, it has historically offered attractive yields and strong credit protection and therefore is attractive on a risk-adjusted basis.

Our approach skews toward the conservative end of direct lending as we focus on senior secured loan investments. Our assets are at the top of the capital structure and are secured by the assets, including hard assets and the intellectual property, of the businesses that we lend to. We believe this focus allows us to meaningfully mitigate downside risk.

Importantly, we seek to partner with private equity firms who are willing to make significant investments in the businesses that we're going to lend to. We tend to work with private equity firms we’ve had experience with. This allows us to better gauge the type of operational expertise they provide and the quality of the governance they can contribute.

Q: What is the return profile of direct loans in today's market and how has that changed recently?

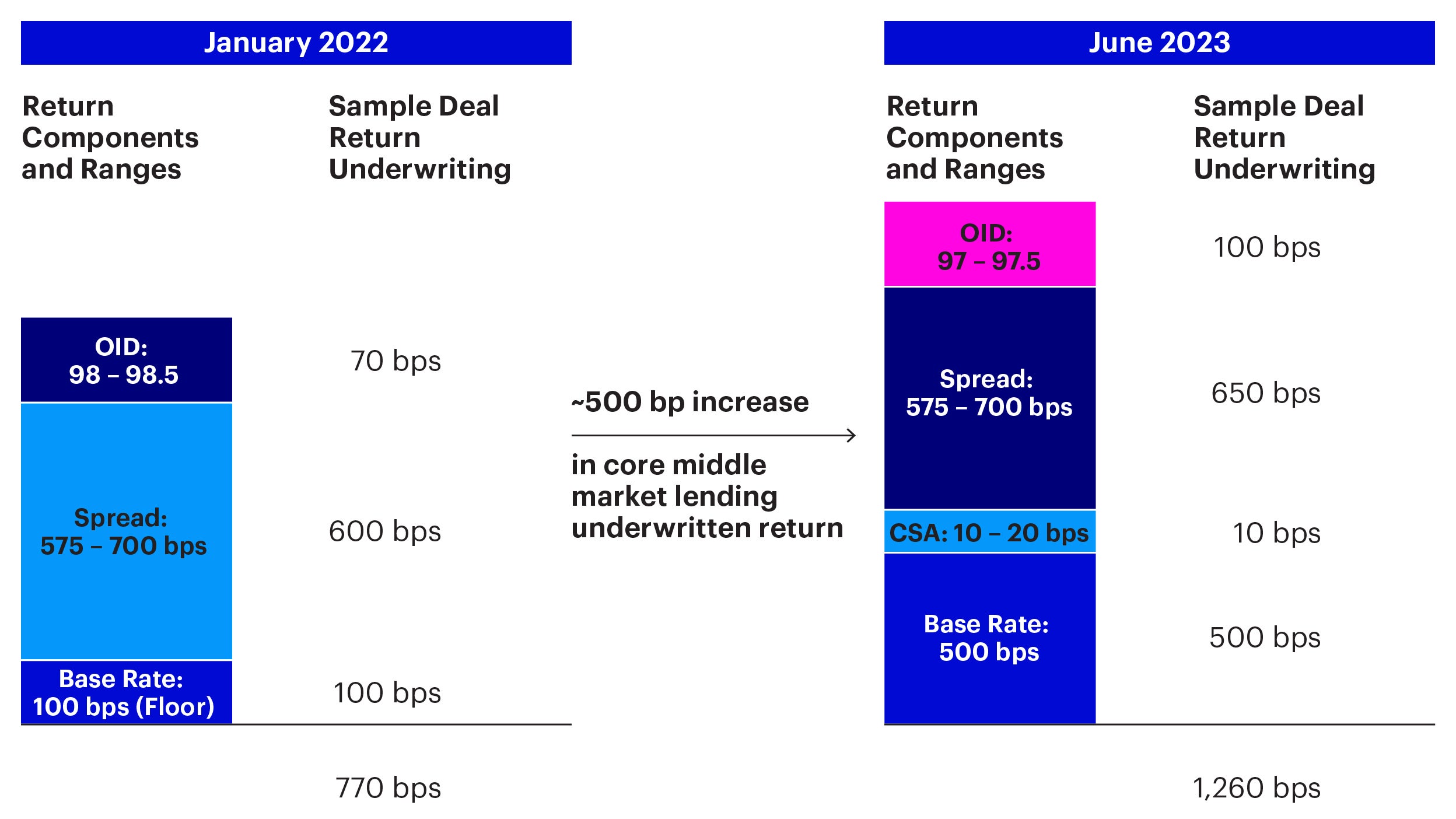

A: Generally, with direct lending, there are three components to yield: base rate, an upfront fee, and a spread component. As direct loans are floating rate assets, they float off the 3-month LIBOR (London Interbank Offered Rate) or SOFR1 (Secured Overnight Financing Rate), and there's a spread on top of that.

Historically, on an unlevered basis, yields for this asset class ranged from 7.5 to 8.0%.2 Given the benign interest rate environment we’ve been in for several years, we would have relied on a 100-basis point LIBOR or SOFR floor and then a spread on top of that generally of 550 to 650 basis points. Then typically there’s been an upfront fee of about 2% or an OID (Original Issue Discount) of 98.

Over the course of the last 18 months, each of these components has widened out due to the rising rate environment. The floating element of yield has grown by over 400 basis points while spreads have a risen around 25 basis points. Additionally, our OID’s have widened out by 50-100 basis points. So today, unlevered yields for the direct lending asset class generally range from 12 to 13%.3

Source: Invesco as of August 29, 2023; as observed and executed upon by Invesco Direct Lending team. ‘CSA’ represents credit spread adjustment. ‘OID’ represents original issue discount. For illustrative purposes only; past performance is not a guarantee of future results.

Q: What is your view on the opportunity set for direct lending?

A: The opportunity set for direct lending in the US continues to remain significant. On the supply side, there are over 200,000 middle market companies in the US that represent one-third of private sector GDP and employ nearly 50 million individuals.4 This is a large market with a consistent demand and need for capital.

When we think about the demand side of the equation, the opportunity set is robust. Private equity has continued to amass record sums of capital. These firms have a finite period with which to invest that capital and cannot execute their strategies without financing support.

What has changed is the risk profile. We're in an environment of rising interest rates, low unemployment, wage pressure, raw material cost challenges and in certain cases supply chain disruptions. Also, there is a general expectation that we're going to continue to see market headwinds as we enter the back half of 2023 into 2024. So, the bar is much higher, making asset selection critical.

Strategy, structure, documentation and importantly who we partner with are all very important. If we are not comfortable that the business we plan to invest in can successfully navigate through a challenging economic environment for the next three to five years, we're not going to make that investment.

Footnotes

-

1

The Secured Overnight Financing Rate is a benchmark interest rate for dollar-denominated derivatives and loans.

-

2

As of January 2022

-

3

As of 30 June 2023

-

4

Year-End 2022 Middle Market Indicator - Historically High Growth Rates Continue with Few Signs of Slowing, January 2023, https://www.middlemarketcenter.org/Media/Documents/MiddleMarketIndicators/2022-Q4/FullReport/NCMM_MMI_YEAR-END_2022_012323.pdf

Direct Lending

Our Direct Lending team has decades of experience in sourcing, underwriting, and executing senior secured loans in the core middle market. Our capabilities have made us a trusted partner in the space.