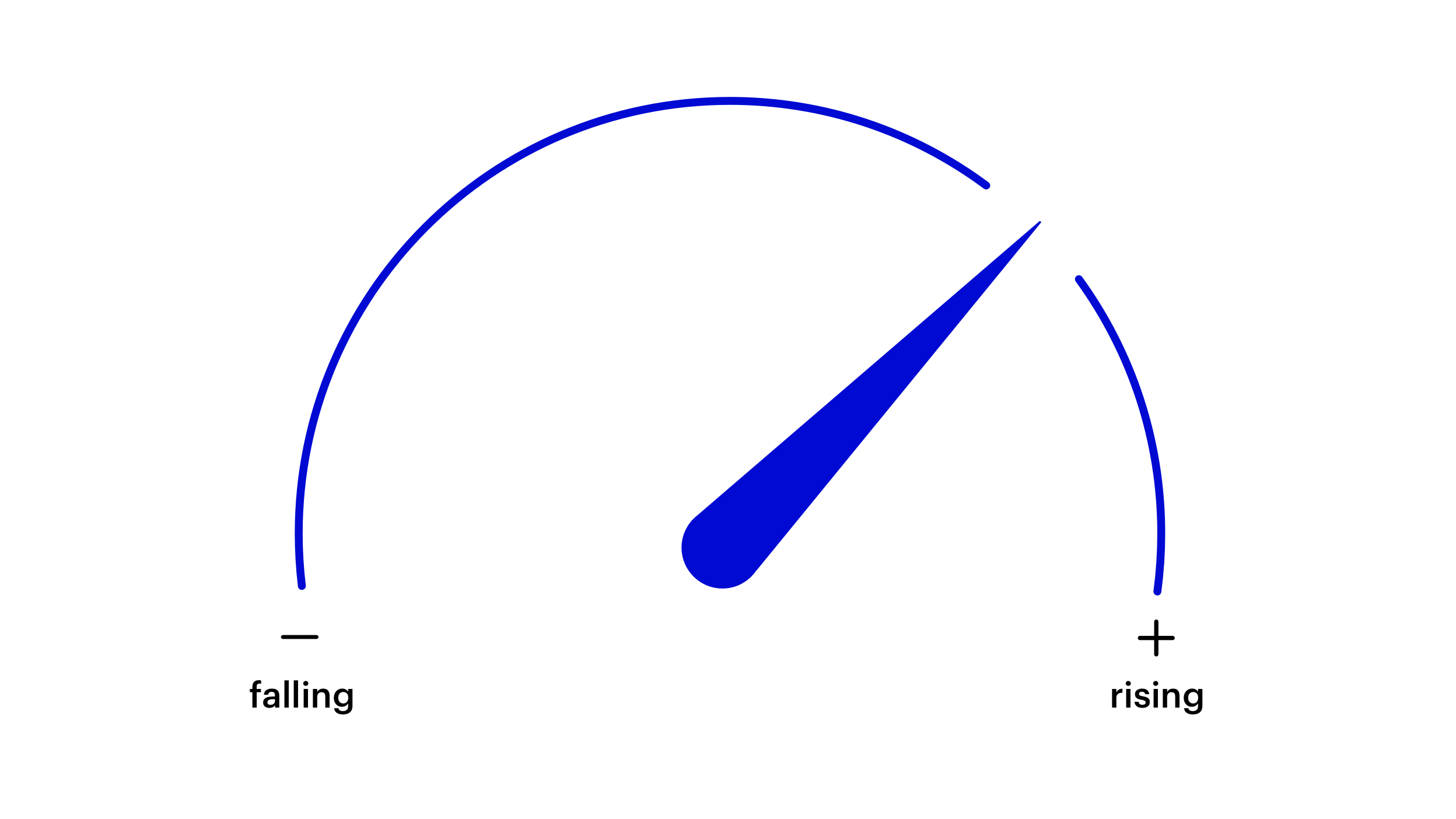

Heightened market volatility and uncertainty warrants a more dynamic approach to equity

Mo Haghbin, Head of Invesco Solutions, interviewed by Ted Seides on the Capital Allocator’s podcast discussing evolving investor preferences as relates to public equities.