Understanding ESG Part 3: Regulation and the adviser community

Asset managers and their clients are increasingly incorporating environmental, social and governance considerations – collectively known as ESG – into their investment decisions. This reflects the spectacular rise of responsible investing – an investment ethos that delivers benefits beyond the bottom line and recognises that modern-day investment should be a matter of long-term ownership and sound stewardship.

In this article we look at how regulation is now constantly reshaping the ESG landscape. Policymakers around the world are contributing to a fast-emerging global framework for responsible investing, with Europe at the vanguard of innovation and action. Many new rules have already been implemented, and many more are on the way. Although the picture is still developing, there is no doubt that advisers – including those in the UK – need to be ready to place ESG at the heart of their engagements with clients.

More momentum, more demands

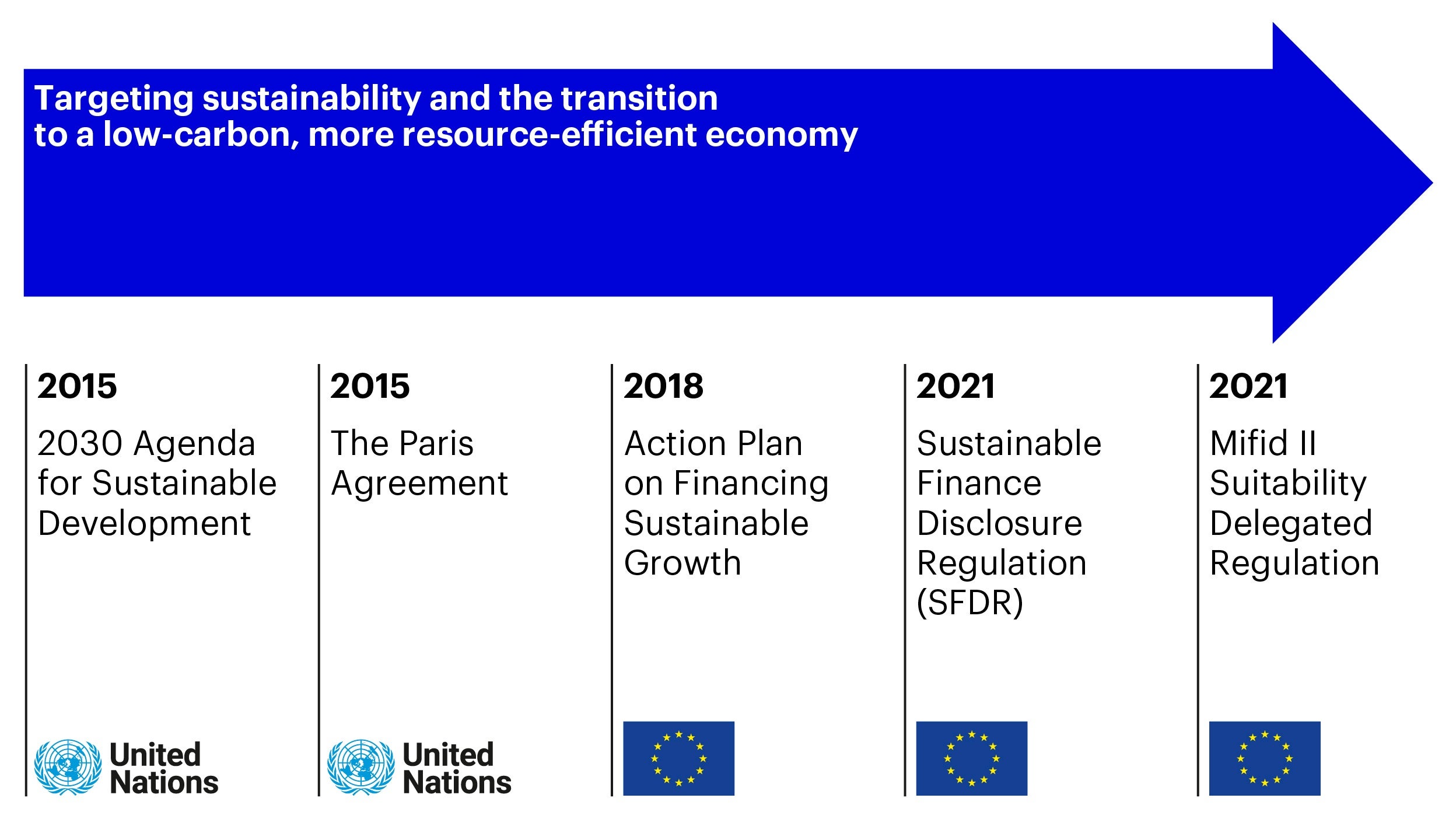

High-level, international support for ESG has grown substantially during the past several years. The exact point at which policymakers and regulators started to take a significant interest is debatable, but 2015 stands out as a major watershed.

Two global initiatives emerged that year. The first, which we discussed in part 1 of this series, was the United Nations Sustainable Development Goals (UN SDGs), a seminal encapsulation of the key challenges facing our planet and its inhabitants. The second was the Paris Agreement on climate change, the most wide-ranging bid to tackle the existential threat posed by global warming. Both have since become central to many responsible investing decisions.

In 2016, when it first published its Global Guide to Responsible Investment Regulation, the Principles for Responsible Investment (PRI) produced a map showing the application of ESG-centric directives and requirements in settings from South Africa to South Korea, from Canada to Kazakhstan and from Brussels to Brazil. Alongside the SDGs and the Paris Agreement, numerous country-specific programmes and projects were already under way. Yet we now know that this snapshot captured only the beginnings of a trend that has gained momentum ever since – nowhere more so than in Europe.

Launched in 2018, the European Commission’s Sustainable Finance Action Plan offers an especially ambitious vision. A far-reaching roadmap for generating the hundreds of billions of euros in private capital necessary to fund sustainable growth in the EU each year, it outlines three principal objectives: to reorient capital flows towards sustainable investment; to manage the financial risks arising from climate change, resource depletion, environmental degradation and social issues; and to foster transparency and long-termism in financial and economic activity. In July 2021 they built on this with the renewed Sustainable Finance Strategy, identifying further actions that will help Europe to recover sustainably from the COVID-19 pandemic and enable the financial sector to help meet their ESG obligations.

Today, building on these foundations, the European Commission continues to drive much of the progress in this arena. The Sustainable Finance Disclosure Regulation (SFDR), which imposes mandatory ESG disclosure rules on asset managers and other market participants, went “live” in March 2021. Under the MiFID II Suitability Delegated Regulation, which is expected to come into force in 2022, ESG would become an essential component of all financial advice. Further demands, many of them affecting advisers, are all but inevitable in the years ahead.

The regulatory road towards sustainability

Global cooperation on ESG can be said to have its roots in the United Nations Sustainable Development Goals – also known as the 2030 Agenda for Sustainable Development – and the Paris Agreement on climate change. Europe has since continued to set the pace in advancing the cause of responsible investing.

These and other ESG regulatory initiatives are discussed in more detail in two Invesco publications: Sustainable Finance Disclosure Regulation: Getting Ready for 10 March 2021 and Shifting Gears: Preparing for the New Sustainable Finance Regulations in Europe. Both explore the complexities and implications of this fast-changing arena.

Source: European Commission.

Further demands, many of them affecting advisers, are all but inevitable in the years ahead.

The UK: outlier or frontrunner?

It would be quite wrong to infer that Brexit will spare advisers in the UK from taking into account these ever-mounting regulations and the raft of requirements they entail. In fact, in its 2019 Green Finance Strategy, the government signalled its intention to “at least match” the ambitions originally enshrined in the EU’s Sustainable Finance Action Plan and to devise a set of guiding principles with objectives reflecting those laid out in SFDR and MiFID II.

Addressing an online conference in November 2020, Financial Conduct Authority CEO Nikhil Rathi stressed the role of responsible investing in enabling the transition to a net-zero economy. “As this market grows,” he said, “we want to ensure that consumers can trust sustainable products. To do this, firms needs to be clear on their obligations around design, delivery and disclosure – and consumers should receive the right information and advice.” Speaking in the same month, Chancellor Rishi Sunak revealed plans to lead the way by introducing mandatory climate-related disclosures (TCFD) across the economy by 2025.

In July 2021, the Chancellor went further, announcing the development of new Sustainability Disclosure Requirements (SDRs), which will require companies, pension schemes, financial services firms and their investment products to report on the impact they have on the climate and environment, as well as the sustainability-related risks and opportunities facing their business. A roadmap for the development and implementation of the SDRs is expected to be published in the run-up to COP 26 in November 2021. Alongside the SDRs, the Chancellor also announced plans to develop, in conjunction with the FCA, plans for a new sustainable investment label (a quality ‘stamp’) which will aim to allow retail consumers to compare the impacts and sustainability of different investment products.

So it still remains to be seen whether the likes of SFDR and MiFID II Delegated Acts will pass into law here, given the UK’s withdrawal from the EU. But the latest announcements from the Chancellor demonstrate that the UK Government intends to develop a similar – and potentially even more ambitious – framework for sustainability disclosures which will reshape the UK’s ESG landscape in the very near future. And in addition, work is now underway to develop a UK version of the EU’s ‘green taxonomy’, which will help define environmentally-sustainable activities, taking the scientific metrics from the EU’s taxonomy as its basis.

As a result, the UK should not be seen, post-Brexit, as an ESG outlier. It may be behind the curve in some aspects – for example, Germany launched its own sovereign green bonds in 2020 and the UK’s first green gilt is not expected to be issued until September – but there is no question that sustainability is now very high on the agendas of regulators and ministers alike, that it is likely to stay there and that advisers will need to pay extremely close attention to further developments. Indeed, with the Government’s commitment to cut greenhouse gas emissions by 78% by 2035, going on to achieve net zero emissions by 2050, if anything it’s reasonable to expect an acceleration of ESG efforts from here, as the UK looks to set the example among the G7 countries.

Sustainable finance in the UK

In November 2020, outlining the UK’s post-Brexit ambitions for the country’s financial services sector, Chancellor Rishi Sunak highlighted the following key goals with regard to sustainability:

- To become the first country in the world to make TCFD-aligned disclosures fully mandatory across the economy by 2025

- To launch the UK’s first sovereign green bonds, subject to market conditions, before the end of 2021

- To implement a green taxonomy that will serve as a framework for determining which activities can be defined as environmentally sustainable

- To join the International Platform on Sustainable Finance

- To develop a package of “equivalence” measures with a view to managing cross-border financial services with the EU and beyond

Source: gov.uk, 9 November 2020

It still remains to be seen whether the likes of SFDR and MiFID II Delegated Acts will pass into law here, given the UK’s withdrawal from the EU.

What this means for advisers

Perhaps the first lesson for advisers is that the march of ESG regulation simply cannot be ignored. The second lesson, which is directly related to the first, is that the time to give serious thought to how the advice process is set to change has already arrived.

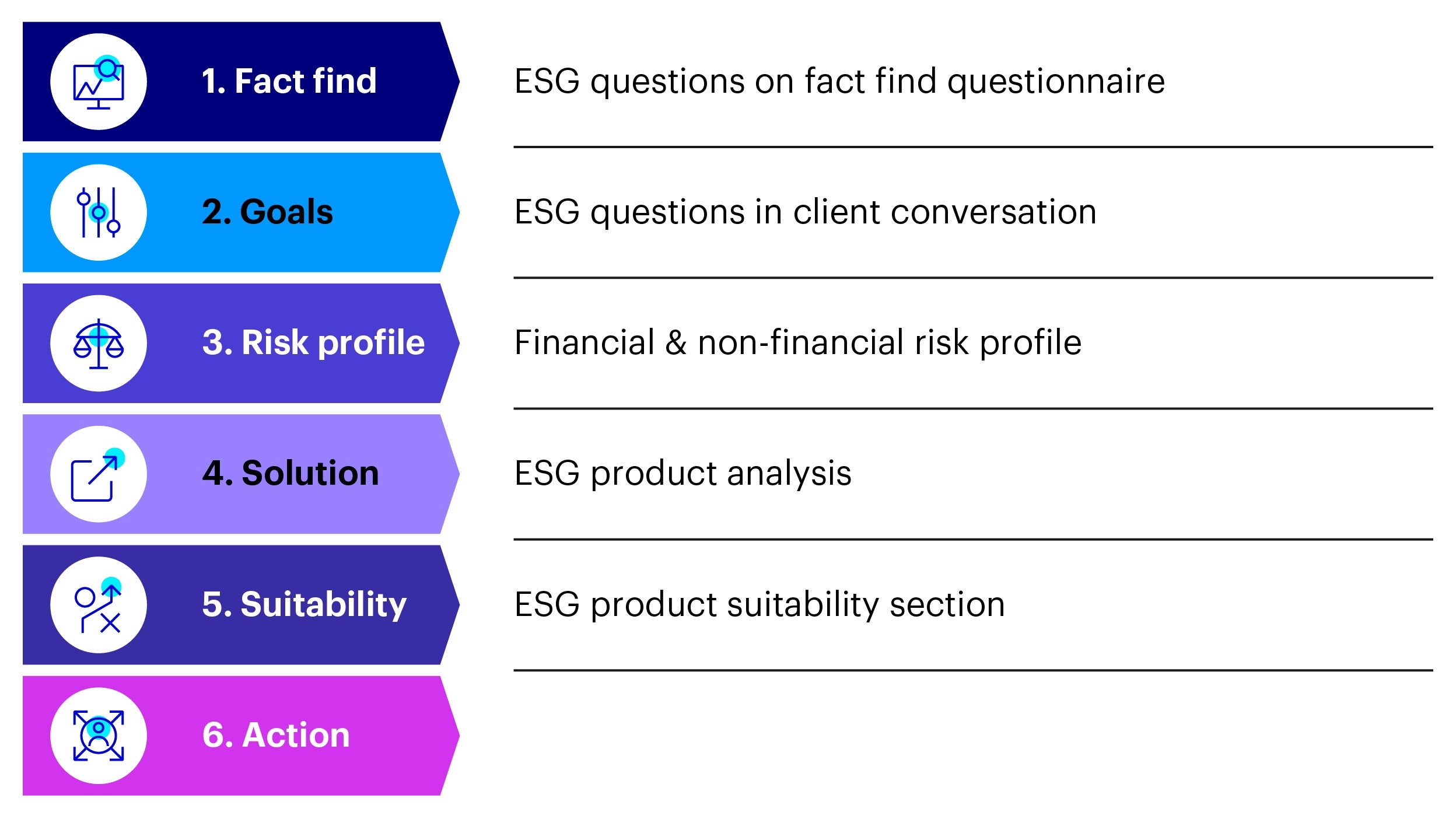

Traditionally, advisers in the UK have been required to obtain information about a client’s knowledge and experience relevant to specific investment products or services; information about a client’s financial situation, including ability to bear losses; and information about investment objectives and risk tolerance. Going forward, they will need to obtain much more information about a client’s attitudes towards the sustainable impacts of investments.

This is likely to have implications at every stage of the advice process, as illustrated in the chart below. ESG considerations should feature in fact-finding questionnaires and client conversations; they should be key to a client’s profile and, by extension, the products and services proposed as solutions. This does not mean that ESG should dominate the process – but it does mean that it should be a vital part of the process.

It is important to note that ESG will need to be integrated into the overall investment journey even in instances where a client may not want an overtly ESG-centric solution. This is because advisers will have to demonstrate their own awareness of the issues around responsible investing and sustainable finance more generally. To quote MiFID II regulations: “Advisers should take sustainability risks into account in the selection process of the financial product presented to investors before providing advice, regardless of the sustainability preferences of the investors.”

Judging by the events of the past few years, another lesson that advisers might usefully bear in mind is that change is already near-constant and does not invariably have to stem from the regulatory and policymaking communities. The initiatives on the immediate horizon are obviously poised to accelerate the investment industry’s paradigm shift towards sustainability, yet these, too, are likely to be superseded by further innovations. Ultimately, the true leaders in this field could be those firms and advisers with a willingness to go beyond minimum requirements and set new ESG standards of their own.

New regulations, new responsibilities

ESG considerations are set to feature in every stage of the investment journey and every phase of the advice process as regulatory requirements around sustainability intensify. It will be impossible for advisers to overlook them, even if some clients may not choose such a focus.

Source: Invesco; for illustrative purposes only.

This does not mean that ESG should dominate the process – but it does mean that it should be a vital part of the process.

Conclusion

In this article we have provided a broad overview of how ever-greater regulatory pressure is reshaping the ESG landscape. The specifics of various initiatives are too numerous and complex to cover here, but the general direction of travel can be easily summarised: regulation is already in effect, much more is on its way, and advisers need to refine their approaches accordingly.

Little is set in stone at this point, and the regulatory picture will very likely remain in a state of flux as policymakers and investment firms alike continue to redefine standards and raise the ESG bar. Nonetheless, advisers cannot ignore these developments: they should act now. In addition to the Invesco publications mentioned earlier, Incorporating ESG into Your Advice Process and our ESG Glossary may assist you in better understanding both the scale of the changes taking place and the extent of the impact they are likely to have on the adviser community – including its members in the UK.

Structured CPD

Thank you for reading this article. To complete the training module for 30 minutes of structured CPD, please take the online test.

Once completed, you will receive your CPD certificate within 24 hours.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

-

All information as at 31 July 2021 unless otherwise stated.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.