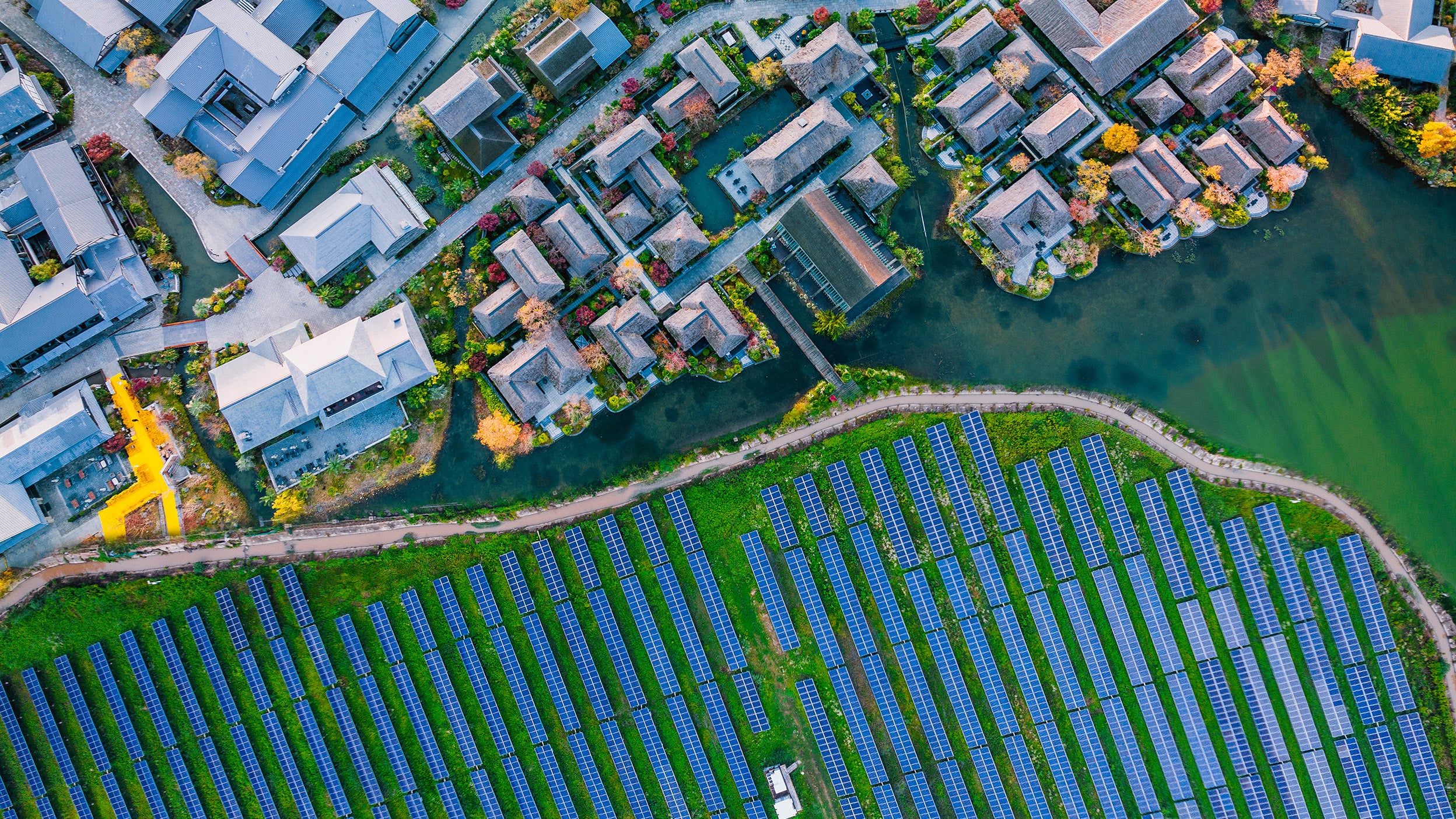

ESG and responsible investing 2024 UK Stewardship Code Report

The Invesco 2024 UK Stewardship Code Report is out. In this year’s report, we detail our commitment to sound stewardship and sustainable investing.

Find out about our views on the latest ESG news and investment trends and allow us to help you navigate the ever-changing ESG landscape.

The Invesco 2024 UK Stewardship Code Report is out. In this year’s report, we detail our commitment to sound stewardship and sustainable investing.

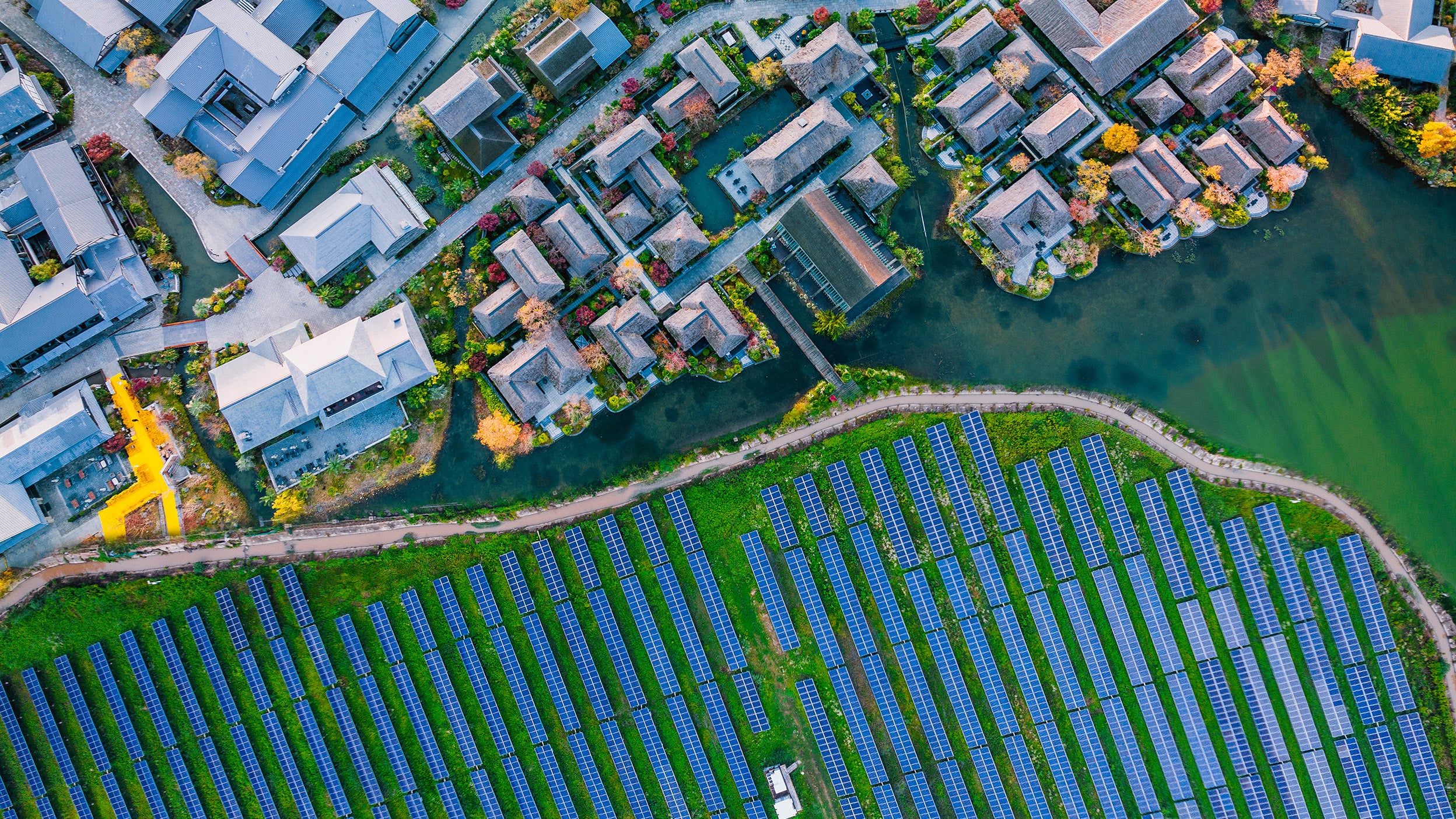

Nageen Javaid, Invesco Associate Client Portfolio Manager, discusses the role of bonds in the transition. As achieving net zero carbon emissions by 2050 has become a central goal for governments, corporations, and environmental advocates worldwide.

Sign up to our newsletter to receive the latest investment insights, our upcoming events and webinars, and information about our products and capabilities.