2024 UK Stewardship Code Report

The Invesco 2024 UK Stewardship Code Report is out. In this year’s report, we detail our commitment to sound stewardship and sustainable investing.

For more than 30 years Invesco has been associated with responsible investing, and today delivers this through equity, fixed income, multi-asset, real estate and customised strategies.

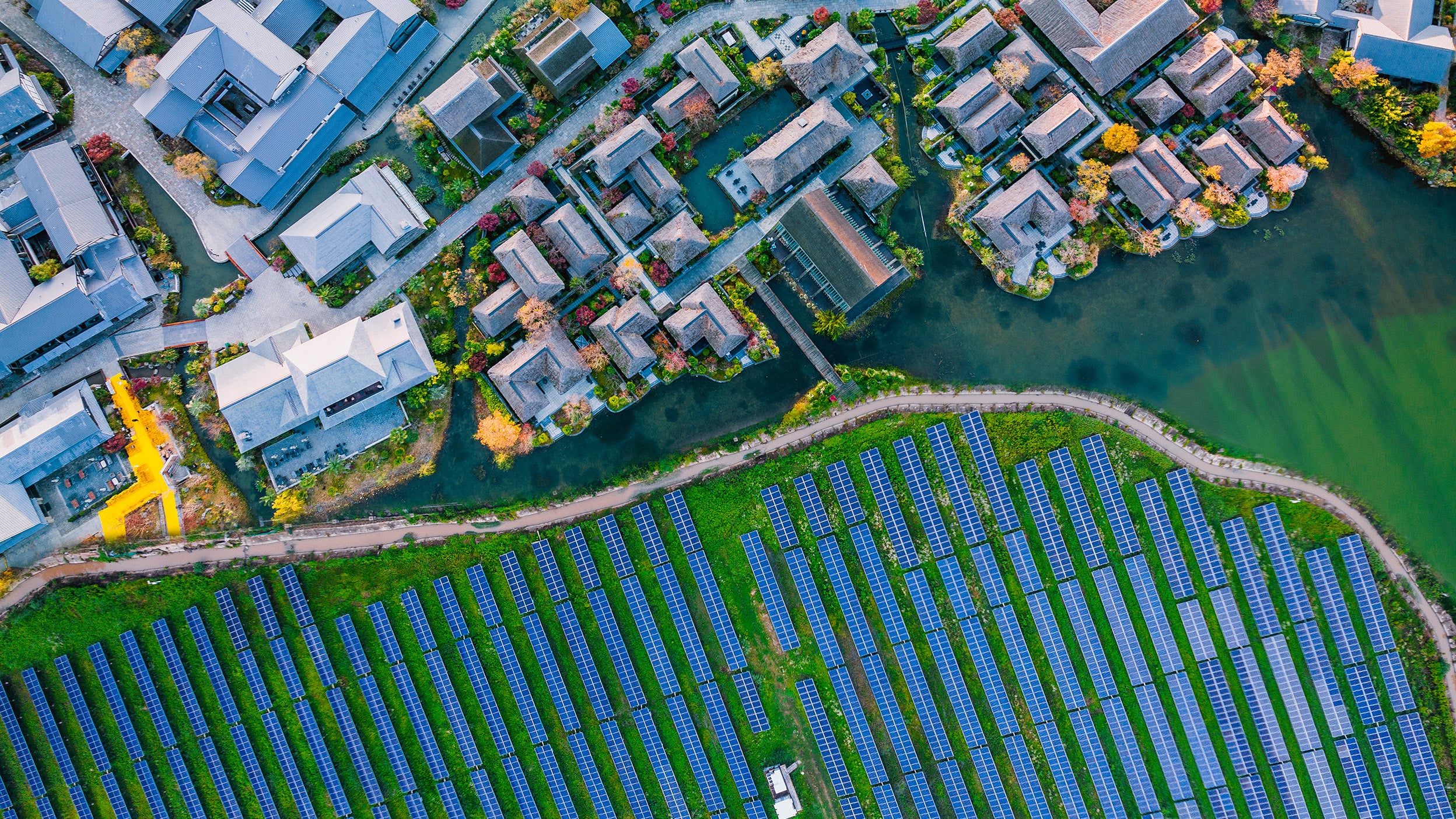

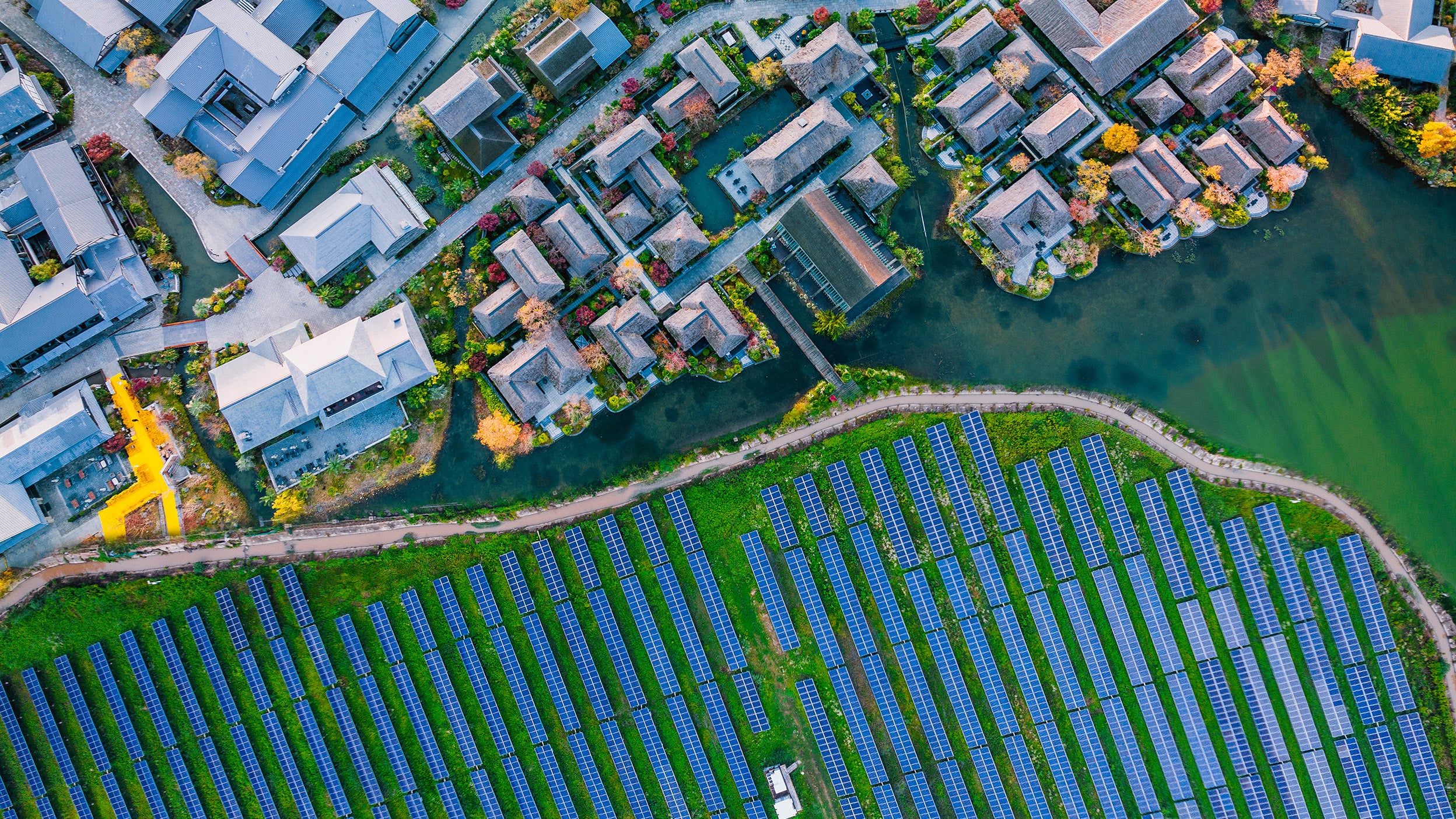

Explore ESG with InvescoWe understand that for some investors, the investments they make today are aimed at making a better tomorrow.

That’s why our investment managers tailor their approach for each asset class based on client objectives. Where appropriate this includes the integration of Environmental Social and Governance (ESG) practices into their investment processes.

We’re also committed to working with you so that together we can lead the conversation in this rapidly evolving area, including by providing insights and education.

We carried out 2,200+ engagement with companies on ESG topics in 2023, voting on 9,000+ companies annually1.

Signatories to the PRI (Principles for Responsible Investment) since 20132.

The Invesco 2024 UK Stewardship Code Report is out. In this year’s report, we detail our commitment to sound stewardship and sustainable investing.

Nageen Javaid, Invesco Associate Client Portfolio Manager, discusses the role of bonds in the transition. As achieving net zero carbon emissions by 2050 has become a central goal for governments, corporations, and environmental advocates worldwide.

Investor-led, investor-driven

As active, long-term investors, we seek to encourage the companies in which we invest to adopt best-in-class ESG practices.

We believe proxy voting is the hallmark of active ownership and serves as a powerful mechanism to drive responsible investment, engagement and investment stewardship.

Invesco’s investor-led, investor-driven proxy voting approach helps to ensure that each meeting is voted in our clients’ best interests.

Discover insights, education, ideas and capabilities designed to help you achieve ESG investment goals.

Let us know using this form and one of our specialist team will quickly get back to you.