Fixed Income Why we like equities in our income strategies

Lewis Aubrey-Johnson discusses how the Invesco Pan European High Income Fund is benefitting from its equity holdings.

The focus on income of our mixed-asset funds means that bond exposure is predominantly tilted toward corporate bonds, typically high yield and higher yielding investment grade.

A core part of the investment approach is understanding the underlying credit risks within an issuer. The fund managers are assisted in gaining this understanding by a team of highly experienced and dedicated credit analysts.

Typically, the analyst will actively contribute investment ideas to the portfolio. This involves them presenting their ideas to the fund manager and then through discussion a decision is made as to whether or not a particular bond is right for the fund.

As well as proposing new ideas, the analysts also monitor existing holdings within their sector so that they can be sure that the balance of risk and reward of a bond remains appropriate. If they think that a change in a position should be considered, they will discuss it with fund manager who will then decide on the appropriate course of action.

Along with meeting company management and taking on board the views of rating agencies, the credit analysts undertake their own in-depth detailed fundamental analysis of an issuer and issue. Among the factors considered are any operational considerations, a company’s balance sheet, cash flow, the particular covenants and protections of a bond and the bond’s position in the issuer capital structure. The analysts will also take a view on the relative value between issuers.

Good credit analysis requires a holistic understanding of both the company and the bond being analysed. Ultimately, what we are trying to determine is whether or not the potential return we expect to receive from a holding a bond adequately compensates us for the risks of holding it. Environment social and governance factors have therefore been an important consideration within our credit analysis long before the term ESG entered common parlance.

In practice, this means that there may be times when we want to steer clear of a bond because of concerns we have over its governance or poor social or environmental operations that are negatively impacting the business.

Equally well, there may be times when negative sentiment toward a sector causes a bond to reprice. But, if we have confidence in the business and think the market has over-reacted, then this can provide an investment opportunity that we might seek to exploit.

We will only invest our clients’ money when we think we are being adequately compensated for doing so. From experience, we know that bond markets can temporarily present significant imbalances of risk and reward, which can be exploited.

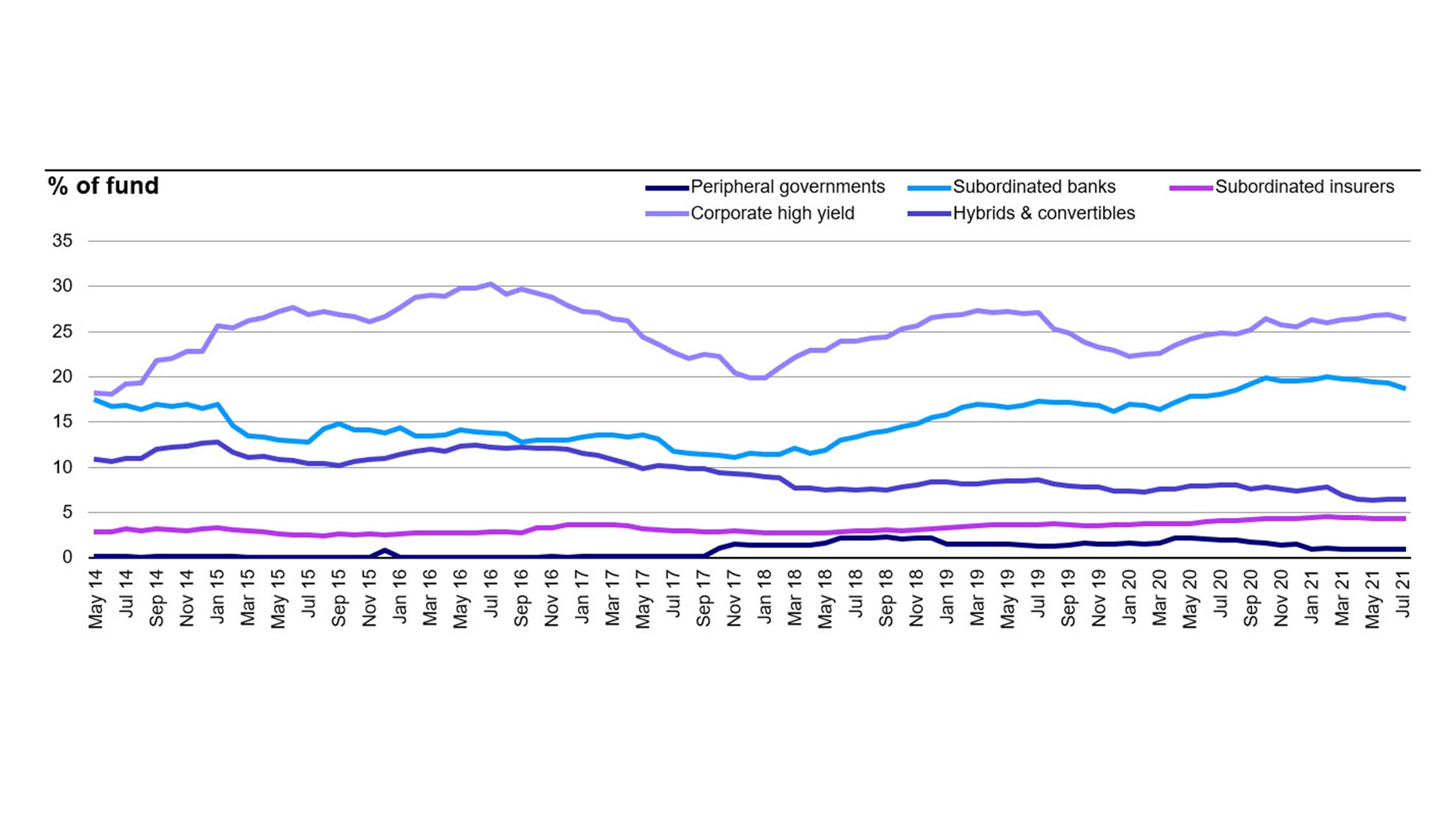

These imbalances exist across financial markets. Some of the building blocks of the fund’s long-term performance track record and contributors to income have been financial capital, peripheral governments, high yield, hybrids and equities.

As highlighted in figure 1, a key sector for the fund is subordinated banks.

These securities are designed to be loss absorbing under certain scenarios. The loss absorption mechanism varies across each issue from coupon suspension, equity conversion, temporary write down to full and permanent write-down (i.e. loss).

Because of these features AT1 bonds are higher risk instruments and they are currently one of the higher yielding areas of the bond market. Through our rigorous credit analysis process, we aim to understand the idiosyncrasies of each security so that we can take a view on its appropriateness to our investment strategy.

Typically, we prefer large, systematically important issuers and issuers with significant retail businesses, which we think offer valuable diversification of revenue streams, reducing volatility. We prefer AT1s that convert to equity rather than those that lead to write-down. In our view, this means there is a better alignment of interest between banks and regulators.

We prefer instruments where the conversion trigger is closer to the regulatory capital minimum as this reduces the risk of conversion. We would also rather quarterly coupons to annual coupons as this offers the potential for coupon payments to recommence sooner if suspended.

Outside of the financial sector, the fund’s higher yielding bond exposure is focused on corporate high yield. Some of these are high quality holdings that have predictable earnings profiles and strong cash flows such as utilities, cable groups and consumer staples businesses.

In addition to these core high yield issuers, the fund will also invest in more speculative positions. Often, the performance of these bonds tends to be independent of moves in the wider high yield bond market, with returns instead determined by company specific factors.

An example of such a speculative position might be a company that has restructured and that we now think has the potential to become more cash generative as a result of the changes. These bonds can often offer much higher yields than the rest of the market – sometimes double digits – reflecting the challenges the company has faced.

Distinguishing between the genuine turnaround stories and those bonds that are simply bad credits is the key to this approach. The fund managers are helped in this challenge by a great team of credit analysts. Their job is to scrutinise the company’s financial position to understand what is making the company tick and whether or not its current valuation accurately reflects its ability to meet its financial commitments.

Some of the fund’s corporate high yield exposure, particularly holdings in telecom and utility companies is through hybrid bonds. The subordination risk, call risk and the risk of coupon deferral of these bonds mean that they offer a higher level of income in often high quality issuers.

This additional yield coupled with the call feature of these bonds means that a typical hybrid security has a lower duration (interest rate sensitivity) than the senior bond.

As investors we need to be aware of the reasons why the income is higher than for a conventional bond and assure ourselves that the additional income provides sufficient compensation for the increased risks. Because of the additional risks hybrid bonds generally have a higher sensitivity to broader market movements than the senior bonds.

That said; if we have done the due diligence and are happy with the company and the additional terms then hybrid bonds can provide an attractive income boost to funds.

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations) and investors may not get back the full amount invested. Debt instruments are exposed to credit risk which is the ability of the borrower to repay the interest and capital on the redemption date. Changes in interest rates will result in fluctuations in the value of the fund. Investments in debt instruments which are of lower credit quality may result in large fluctuations in the value of the Fund. The fund may invest in distressed securities which carry a significant risk of capital loss. The fund may invest in contingent convertible bonds which may result in significant risk of capital loss based on certain trigger events. The fund may invest in a dynamic way across assets/asset classes, which may result in periodic changes in the risk profile, underperformance and/or higher transaction costs.

Data as at 28.02.2021, unless otherwise stated. This marketing communication is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

For more information on our funds and the relevant risks, please refer to the share class-specific Key Investor Information Documents (available in local language), the Annual or Interim Reports, the Prospectus, and constituent documents, available from www.invesco.eu. A summary of investor rights is available in English from www.invescomanagementcompany.lu. The management company may terminate marketing arrangements.

This marketing document is not an invitation to subscribe for shares in the fund and is by way of information only, it should not be considered financial advice. This does not constitute an offer or solicitation by anyone in any jurisdiction in which such an offer is not authorised or to any person to whom it is unlawful to make such an offer or solicitation.

Persons interested in acquiring the fund should inform themselves as to (i) the legal requirements in the countries of their nationality, residence, ordinary residence or domicile; (ii) any foreign exchange controls and (iii) any relevant tax consequences. As with all investments, there are associated risks. This document is by way of information only. Asset management services are provided by Invesco in accordance with appropriate local legislation and regulations.

The fund is available only in jurisdictions where its promotion and sale is permitted. Not all share classes of this fund may be available for public sale in all jurisdictions and not all share classes are the same nor do they necessarily suit every investor. Fee structure and minimum investment levels may vary dependent on share class chosen. Please check the most recent version of the fund prospectus in relation to the criteria for the individual share classes and contact your local Invesco office for full details of the fund registration status in your jurisdiction.

Please be advised that the information provided in this document is referring to Invesco Pan European High Income Fund Class A (quarterly distribution - EUR) exclusively. This fund is domiciled in Luxembourg.