Equities Highs and lows: the valuation question

How worried should investors be when gauging the likelihood of small-caps’ continued outperformance?

Investing in small-caps – like any form of investing – brings challenges. It is essential to understand what these might be, especially at a time when the world has experienced an unprecedented global shock that has been met by a raft of extraordinary policy responses.

“Obviously, the pandemic still presents a risk,” Esselink told the webinar. “We don’t see an imminent recession, but we have to accept there could be a taper tantrum or inflation spikes as we get further into this recovery. We also need to keep an eye on the very strong outperformance in the US and how we use currencies in risk-managing our overall strategy.”

For Hartsfield, too, the spectre of inflation cannot be ignored. “We’re already seeing wage pressure in the US, in part because government supplements have encouraged workers on the sidelines to stay there until their benefits expire,” he said. “It can be quite difficult for smaller companies to hire staff and grow their business when wage pressure really kicks up.”

As observed earlier, excessive valuations could present another problem as optimism over a successful recovery from the COVID-19 crisis intensifies. “We do have concerns that some highly rated stocks could see setbacks if we transition to an environment in which interest rates rise and discounts go up,” West told the webinar.

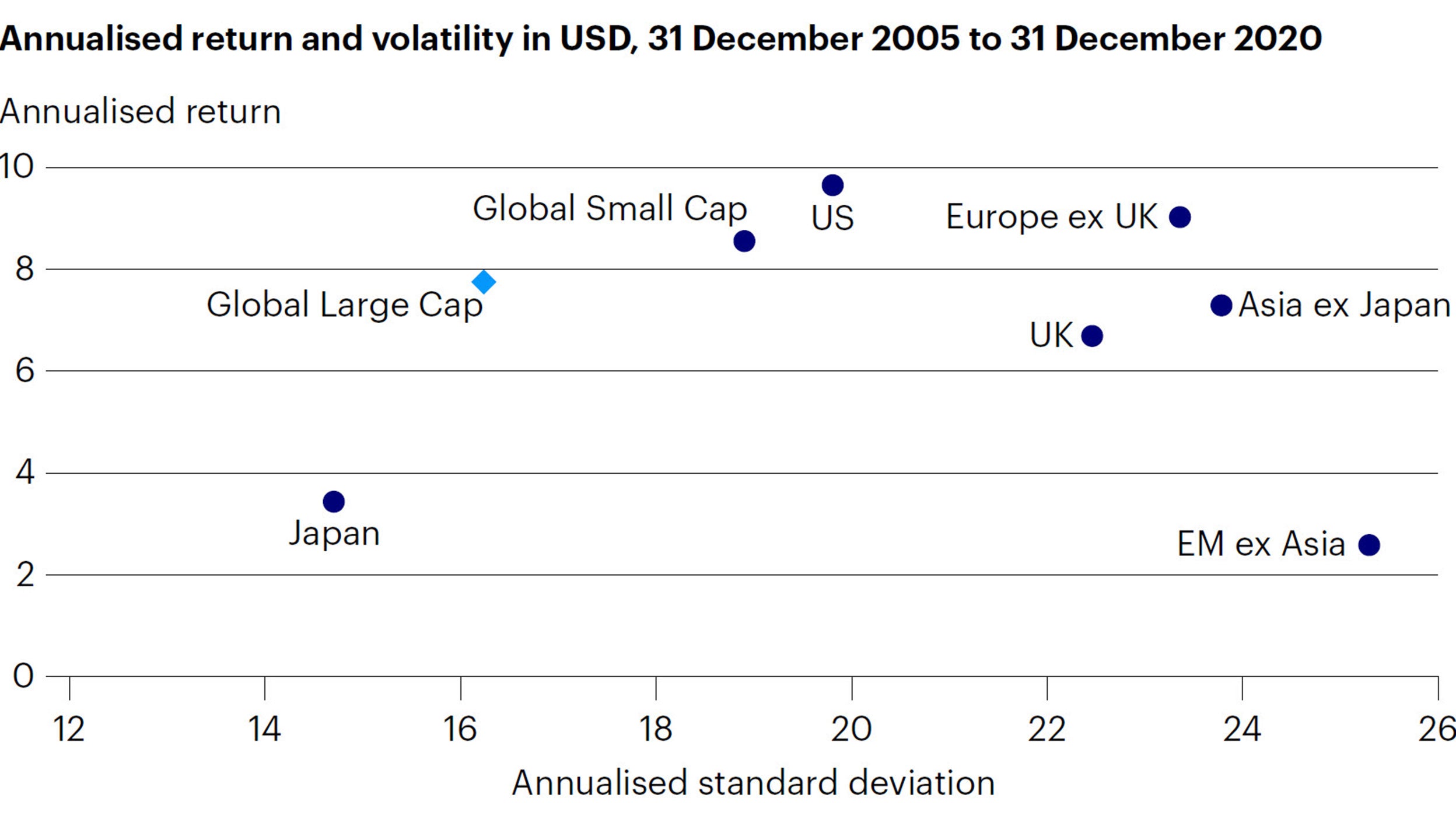

Yet set against such challenges is the opportunity to achieve attractive outperformance. In tandem, as figure 1 shows, small-caps can prove powerful in terms of diversification and overall risk reduction – especially if held in a portfolio comprised of regional components. “One of the most interesting aspects of small-caps is that you lose a lot of the volatility but keep the good performance when you put all these regional and local small-caps into one global portfolio,” Esselink told the webinar.

So is now really the time to give small-caps the attention they have frequently failed to receive in the past? “We see a number of good years for global growth ahead, and we believe this should make for an accommodating environment for small-cap investing,” Esselink said. “It may be that those who invest now have missed the beginning of the cycle, but we certainly don’t believe we’re at the end.”

We see a number of good years for global growth ahead, and we believe this will make for an accommodating environment for small-cap investing.

How worried should investors be when gauging the likelihood of small-caps’ continued outperformance?

Valuation is not the only consideration that is taken into account when constructing Invesco’s small-cap strategies.

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Investing in smaller companies may result in a higher level of risk than investing in larger companies. Securities of smaller companies may be subject to abrupt price movements and may be less liquid, which may mean they are not easy to buy or sell.

This is for Professional Clients in the UK only. This document is not for consumer use, please do not redistribute.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

Whilst the fund managers consider ESG aspects they are not bound by any specific ESG criteria and have the flexibility to invest across the ESG spectrum from best to worst in class.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/ investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Issued by Invesco Asset Management Limited, Perpetual Park, Perpetual Park Drive, Henley-on-Thames, Oxfordshire RG9 1HH, UK. Authorised and regulated by the Financial Conduct Authority.