Equities Invesco’s approach: smaller companies

Valuation is not the only consideration that is taken into account when constructing Invesco’s small-cap strategies.

Concerns about elevated valuations across nearly all markets have increasingly accompanied the economic recovery from the COVID-19 crisis. How worried about this issue should investors be when gauging the likelihood of small-caps’ continued outperformance?

“It’s difficult to assess what the consensus is in this current environment, and it’s also difficult to understand which costs will remain and which will go away,” Juan Hartsfield, Growth Small Cap Senior Portfolio Manager, told the webinar. “But if we look at this from a standpoint of individual stocks, within our investment style, we’re still finding stocks with very compelling valuation upside.”

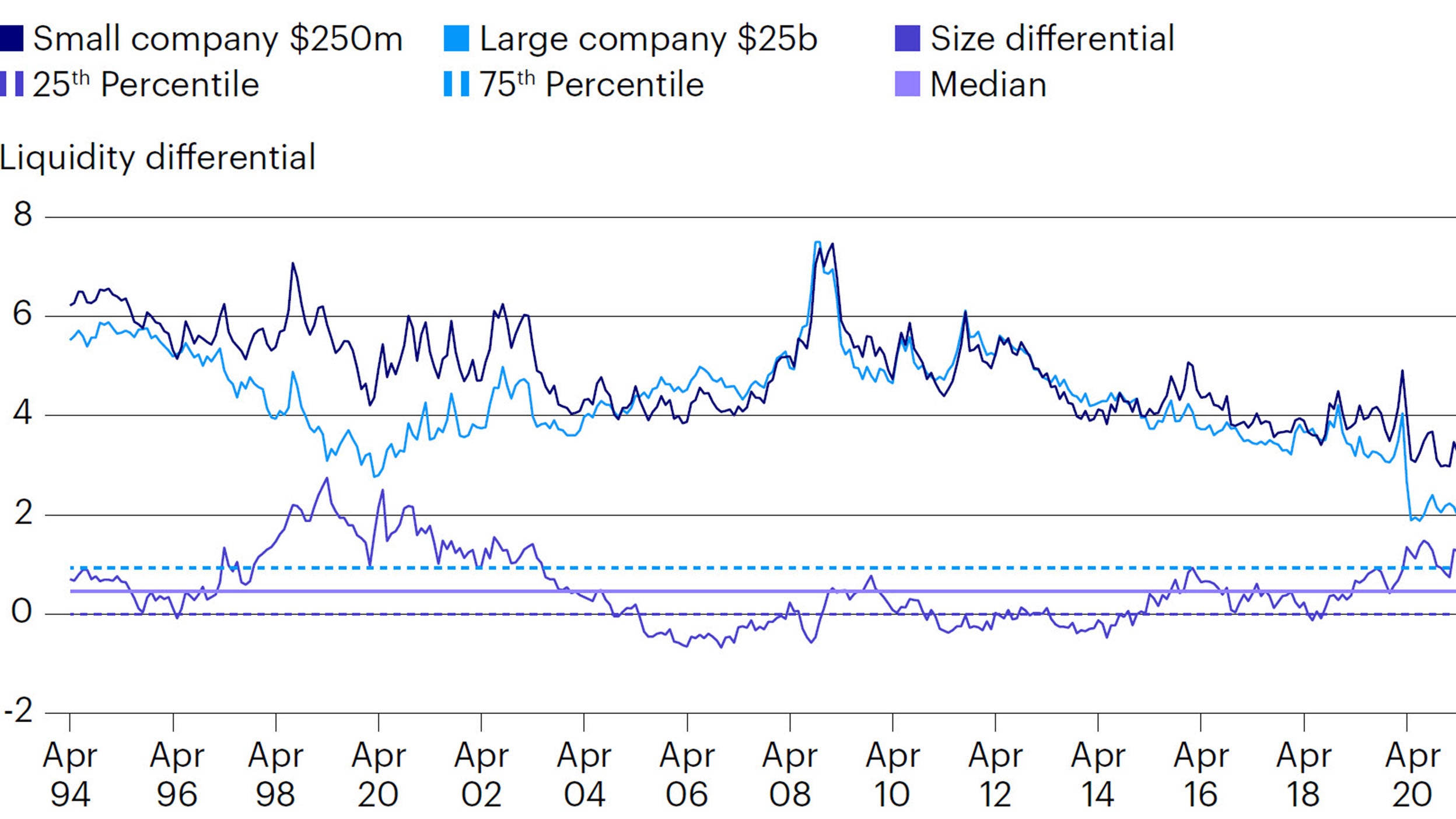

Figure 1 charts the liquidity differential between small-cap and large-cap evaluations since the mid-1990s. As Hartsfield pointed out, the situation today echoes that at the turn of the century – when small-caps went on to hold sway over large-caps for an extended period.

“We’re at a point now where we’ve not been since the early 2000s, and on that occasion it marked the start of a really strong small-cap rally,” Hartsfield told the webinar. “Maybe in the short term we could see small-caps tread water, simply because their outperformance since March 2020 has been so rapid. Structurally, though, there’s an argument for thinking they could do well relative to large-caps in the years to come.”

Robin West, UK Small Cap Fund Manager, acknowledged the need for prudence in some instances. “We’re cautious about some of the very highly rated stocks,” he said. “That’s especially the case where valuation is predicated on discounting at very low rates in an environment where interest rates may rise.”

Meanwhile, at the other end of the scale, good value could still be found in many pandemic-hit stocks, said West. “We think many of these companies have solid recovery potential and can come out of this with their market positions enhanced,” he told the webinar. “We’re seeing increasing earnings upgrades, which should also help drive the market.”

We’re at a point now where we’ve not been since the early 2000s, and on that occasion it marked the start of a really strong small-cap rally.

Valuation is not the only consideration that is taken into account when constructing Invesco’s small-cap strategies.

It is essential to understand the challenges, especially at a time when the world has experienced an unprecedented global shock that has been met by a raft of extraordinary policy responses.

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Investing in smaller companies may result in a higher level of risk than investing in larger companies. Securities of smaller companies may be subject to abrupt price movements and may be less liquid, which may mean they are not easy to buy or sell.

This is for Professional Clients in the UK only. This document is not for consumer use, please do not redistribute.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

Whilst the fund managers consider ESG aspects they are not bound by any specific ESG criteria and have the flexibility to invest across the ESG spectrum from best to worst in class.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/ investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Issued by Invesco Asset Management Limited, Perpetual Park, Perpetual Park Drive, Henley-on-Thames, Oxfordshire RG9 1HH, UK. Authorised and regulated by the Financial Conduct Authority.