Fund Manager Andrew Hall

BSc in Economics from Nottingham University and the Investment Management Certificate from the CFA Society of the UK.

A valuation led global equity fund focused on sustainable, long-term winners that are mispriced or underappreciated by the market.

The investment landscape has changed significantly as higher interest rates and inflation volatility are likely to persist for some time.

In this market environment, our clear philosophy of investing in superior businesses with strong balance sheets, run by trusted and aligned managers can cushion volatility and market turmoil.

The portfolio's global universe allows our investment team to focus on building a portfolio without compromise.

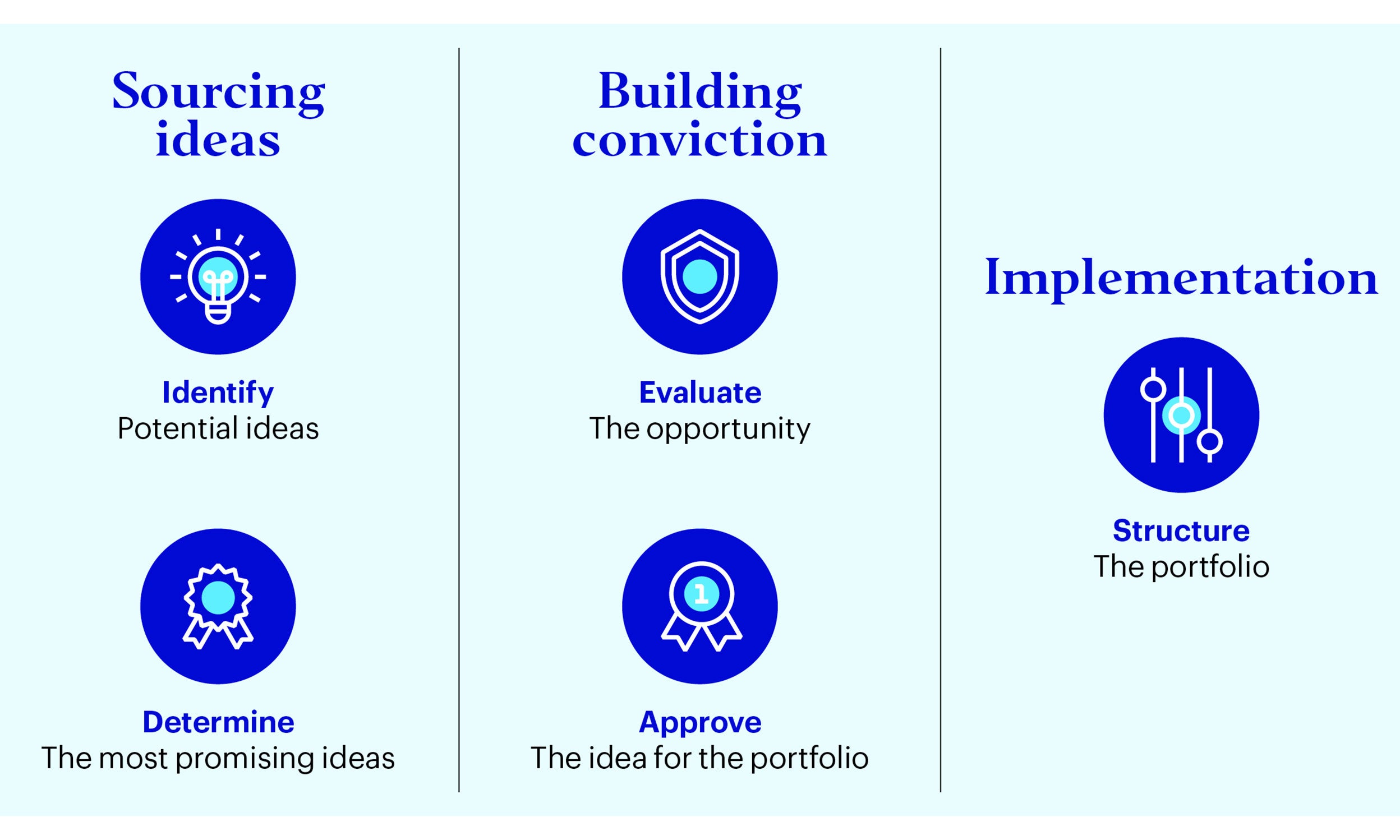

The teams’ IDEAS framework provides a robust and repeatable process, that focuses on rigorous bottom up research. Augmented by collaboration and challenge.

High conviction bottom-up approach with a clearly defined philosophy and a robust, repeatable process.

Strong focus on mitigating downside risks by 1) rigorous fundamental industry and company research and 2) granular analysis of accounting quality and balance sheets.

A core global fund which aims to deliver idiosyncratic alpha over the investment cycle.

With no significant factor or style bias, the fund is set up to navigate different investment environments.

The fund is managed by Andrew Hall and Emily Roberts out of Henley-on-Thames. Andrew has over 20 years of industry experience and Emily over 10 years. Learn more about the Invesco Global Equities Investment Team.

Andrew Hall, Fund ManagerAs Ben Graham described in ‘The Intelligent Investor’, the market is mostly efficient at the pricing of securities but on occasion ‘Mr Market’ is an investor prone to erratic swings of pessimism and optimism. Our philosophy is designed to allow us to profit from the rare opportunities that ‘Mr Market’ throws up, to identify sound businesses that are not priced as such.

We focus on sustainable, long-term winners that are mispriced or underappreciated by the market.

Global investing enables you to access investment opportunities that are not present domestically. Spreading your investments across geographies also benefits diversification, as volatility in one market is likely not affecting other markets. Thus, by investing globally you increase the potential for returns while reducing risk at the same time.

You can invest in the global stock market by investing in actively managed mutual funds or exchange traded funds (ETFs). Invesco offers a broad range of actively managed funds and ETFs.

We identify stocks with valuations that have not been reflected by the market but future prospects may be recognised by it later. We have no preconceived bias towards stocks, sectors or countries, rather we look for the best investments at any point in time.

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. The Fund may use Stock Connect to access China A Shares traded in mainland China. This may result in additional liquidity risk and operational risks including settlement and default risks, regulatory risk and system failure risk. The fund may use derivatives (complex instruments) in an attempt to reduce the overall risk of its investments, reduce the costs of investing and/or generate additional capital or income, although this may not be achieved. The use of such complex instruments may result in greater fluctuations of the value of the fund. The Manager, however, will ensure that the use of derivatives within the fund does not materially alter the overall risk profile of the fund. Although the Fund invests mainly in established markets, it can invest in emerging and developing markets, where there is potential for a decrease in market liquidity, which may mean that it is not easy to buy or sell securities. There may also be difficulties in dealing and settlement, and custody problems could arise.

This marketing communication is for Professional Clients only and is not for consumer use. Investors should read the legal documents prior to investing. Data as at 31 August 2023, unless otherwise stated. This is marketing material and not financial advice. It is not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. Views and opinions are based on current market conditions and are subject to change. For the most up to date information on our funds, please refer to the relevant fund and share class-specific Key Investor Information Documents, the Supplementary Information Document, the financial reports and the Prospectus, which are available using the contact details shown. A summary of investor rights is available in English from www.invescomanagementcompany.lu. The management company may terminate marketing arrangements. Not all share classes of this fund may be available for public sale in all jurisdictions and not all share classes are the same nor do they necessarily suit every investor.

EMEA3122186/2023