Markets and Economy Digitalisation is opening up new value-added opportunities

Digital trend supported by infrastructure spend and innovative corporate strategies.

China’s domestic sector has grown significantly and now constitutes a dominant share of GDP. The domestic economy has staged a recovery following the disruption caused by Covid-19 and remains resilient due to several factors. Firstly, China has imposed strict control measures to contain the outbreak and we believe the government has demonstrated its capability to manage the situation.

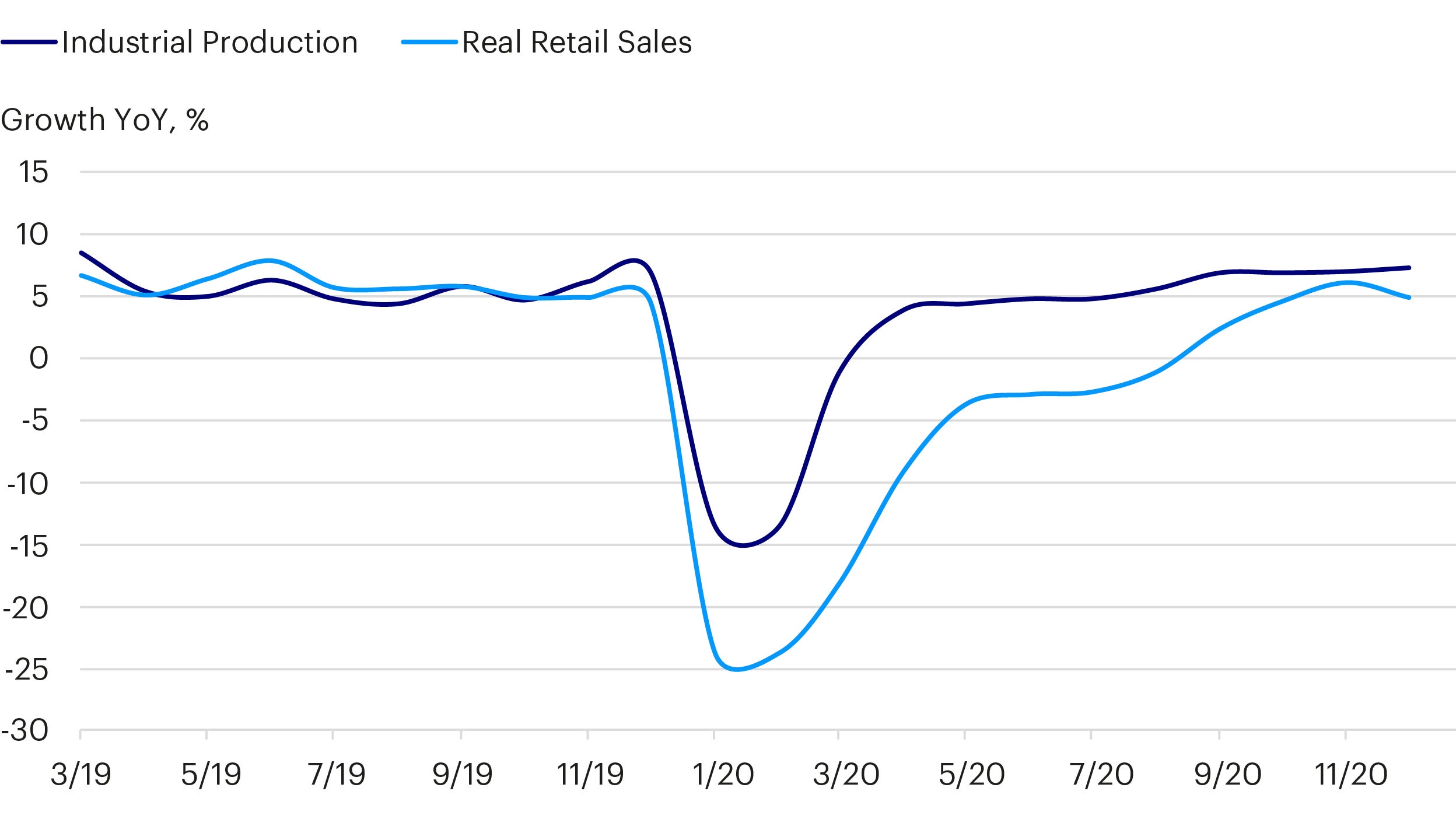

Secondly, policy support is evident with lending rates and banks’ reserve requirements being cut several times to enhance liquidity. At the same time, the budgetary fiscal deficit has increased and special Covid-19 government bonds have been used to boost infrastructure spend and employment. As such, domestic sectors such as industrial production and retail sales have been improving since March 2020 (figure 1) and we expect them to gather momentum as economic activities normalise further.

The past few years have seen a rise in geopolitical tensions between the world’s two largest economies. We are closely monitoring the situation given the change in presidency in the US. We believe tensions between these two countries are unlikely to go away given their strategic rivalry. That said, we believe the new US administration might take a different approach while dealing with competition from China. We believe the risk of further market disruptive policies being introduced has declined.

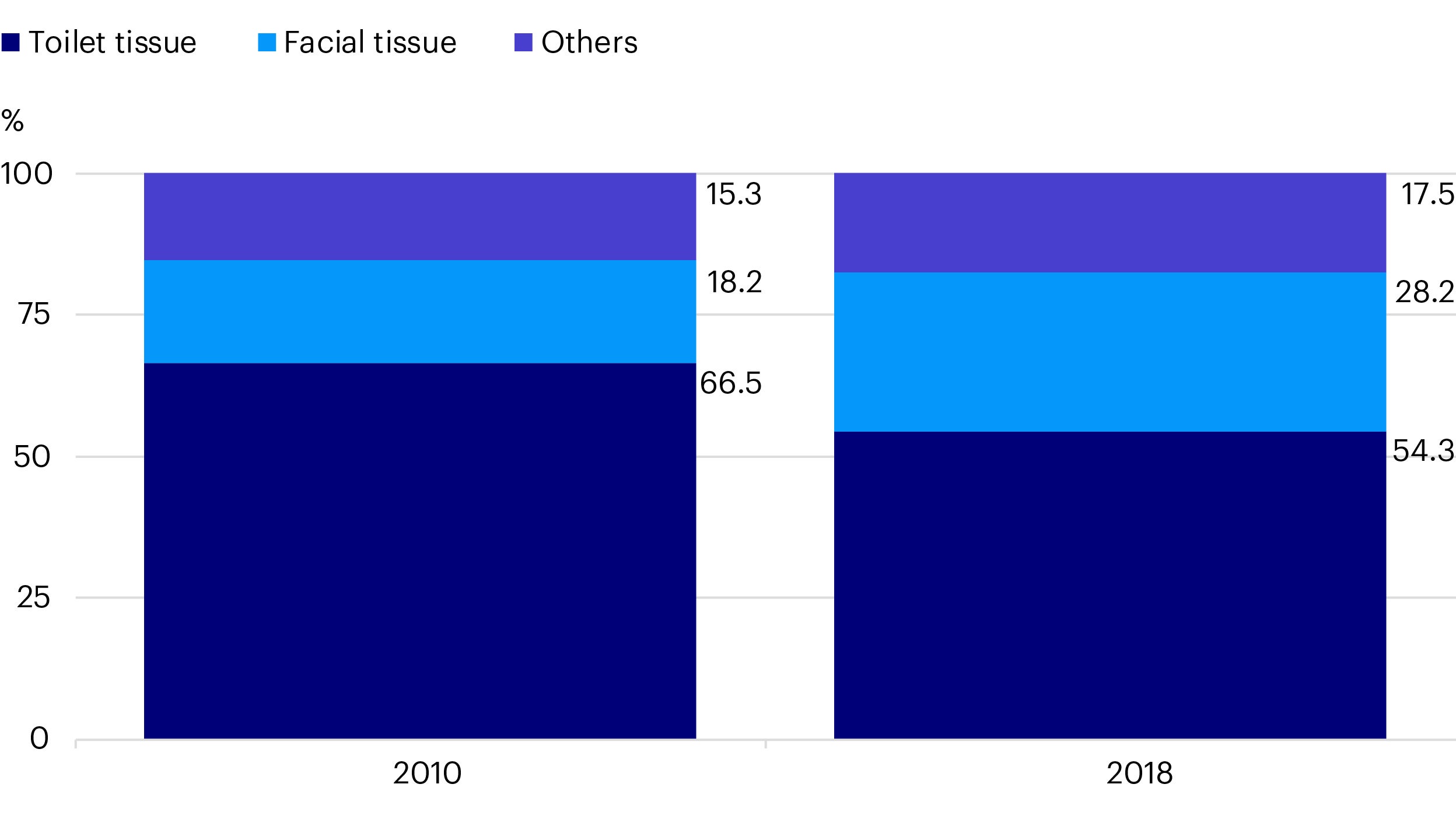

Given the strength of the domestic economy and continued geopolitical tensions, we have positioned the strategy to capitalise on domestically focused companies, by selecting stocks benefiting from structural growth trends. We believe these stocks offer higher earnings visibility and growth, and will deliver sustained returns for investors. Our analysts on the ground have noticed a strong increase in consumers’ wealth which is driving up overall spend as well as demand for more high-end products. Since the latter can be sold at higher prices than lower-end products, some companies are improving their product offerings to meet this demand. This has led to our investment in a large tissue producer, a long term holding in the fund.

This company is moving its product mix towards mid-to-high end tissues and is doing so, within a growing market. The per capita tissue consumption in China has grown at a CAGR of 8% (2010-2018) versus global growth of 3%1. In particular, non-toilet tissues including facial tissues, as well as higher-end products, have experienced rapid demand growth (CAGR of 13%) over the same period. Against this backdrop, the company has focused on facial tissues while continuing to launch higher quality toilet tissue products (figure 2). We believed that the company’s valuation did not fully reflect its potential to deliver double-digit organic sales growth while maintaining a healthy margin, as it continued to position its business to benefit from this strong premiumization trend.

1 Source: Citi Investment Research as of October 2019.

Digital trend supported by infrastructure spend and innovative corporate strategies.

Our investment strategy favours private enterprises. They are highly competitive and innovative, constantly utilising new technologies to deliver market leading products and services.

1 Source: Citi Investment Research as of October 2019.

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations) and investors may not get back the full amount invested. The fund invests in emerging and developing markets, where there is potential for a decrease in market liquidity, which may mean that it is not easy to buy or sell securities. There may also be difficulties in dealing and settlement, and custody problems could arise. The fund may use Stock Connect to access China A Shares traded in mainland China. This may result in additional liquidity risk and operational risks including settlement and default risks, regulatory risk and system failure risk. Although the fund does not actively pursue a concentrated portfolio, it may have a concentrated number of holdings on occasions. Accordingly, the fund may carry a higher degree of risk than a fund which invests in a broader range of companies or takes smaller positions in a relatively large number of holdings. The fund may use derivatives (complex instruments) in an attempt to reduce the overall risk of its investments, reduce the costs of investing and/or generate additional capital or income, although this may not be achieved. The use of such complex instruments may result in greater fluctuations of the value of the fund. The Manager, however, will ensure that the use of derivatives within the fund does not materially alter the overall risk profile of the fund.

All data is as at 31/08/2020 and sourced from Invesco unless otherwise stated.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

For more information on our funds and the relevant risks, please refer to the share class-specific Key Investor Information Documents (available in local language), the Annual or Interim Reports , the Prospectus, and constituent documents, available from www.invesco.eu. A summary of investor rights is available in English from www.invescomanagementcompany.lu. The management company may terminate marketing arrangements.