Markets and Economy Higher earnings visibility and growth offered by domestic sectors

China’s domestic sector has grown significantly and now constitutes a dominant share of GDP.

Digital trend supported by infrastructure spend and innovative corporate strategies.

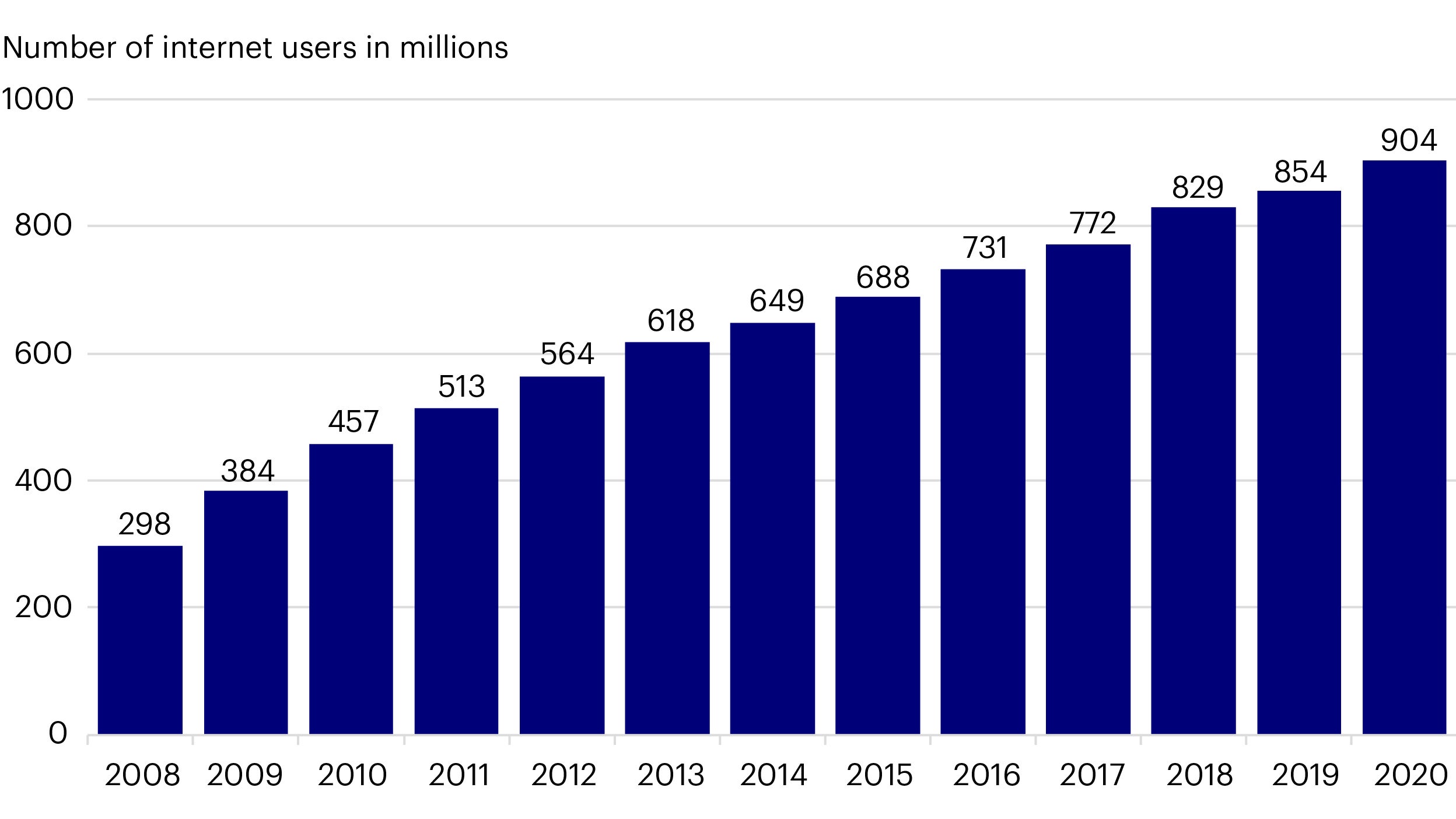

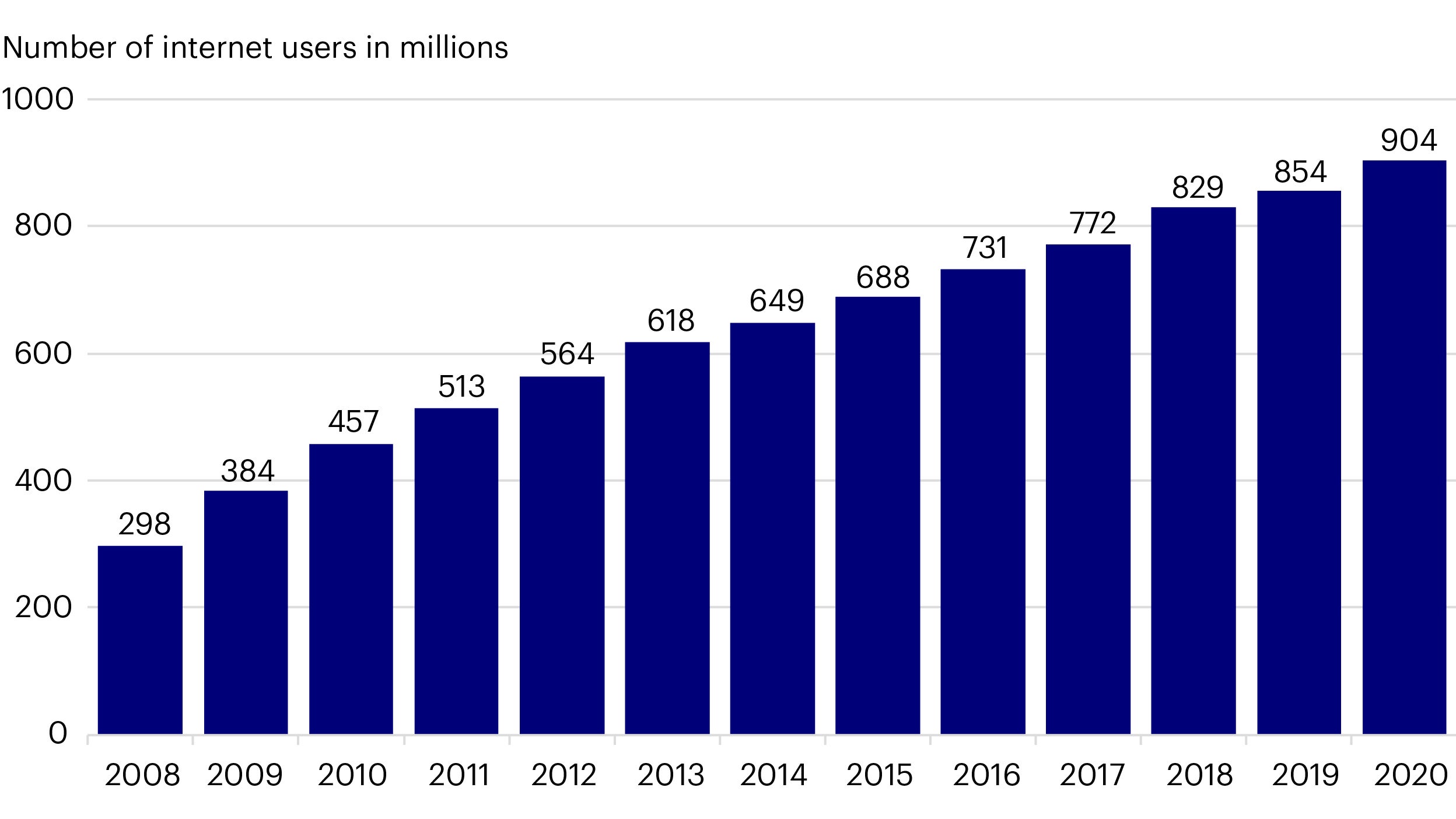

Compared to five years ago, the average download speed of mobile broadband in China has increased by about six times while the fee for mobile internet (mobile phone users accounted for 99% of the internet users) has dropped by over 90 percent. A faster internet service at lower cost has greatly boosted usage growth. China is now a digital society with more than 900 million internet users (figure 1) and it has pledged to invest more than US$3.78 trillion in new digital infrastructure over the next 5 years1. In 2020 alone, as much as US$423 billion has already been allocated to projects including 5G base stations, data centres and artificial intelligence.

The digital trend is very evident. A Chinese consumer’s daily life involves frequent engagements with different types of online platforms offering both products and services. This has encouraged many internet companies to use innovative strategies to engage consumers. The importance of the digital trend can be seen in the MSCI China index composition where the communication services and consumer discretionary sectors constitute more than 20% of the index. The large companies in these sectors are mainly in the internet space.

A good example is our holding in an online platform which is capitalising on the growing digitalisation of consumer markets. Despite being a late comer to the food delivery market, the company gained market share from its competitors to become the number one platform for food delivery. Using this position, it has been successful in cross-selling higher-margin lifestyle services in leisure and entertainment.

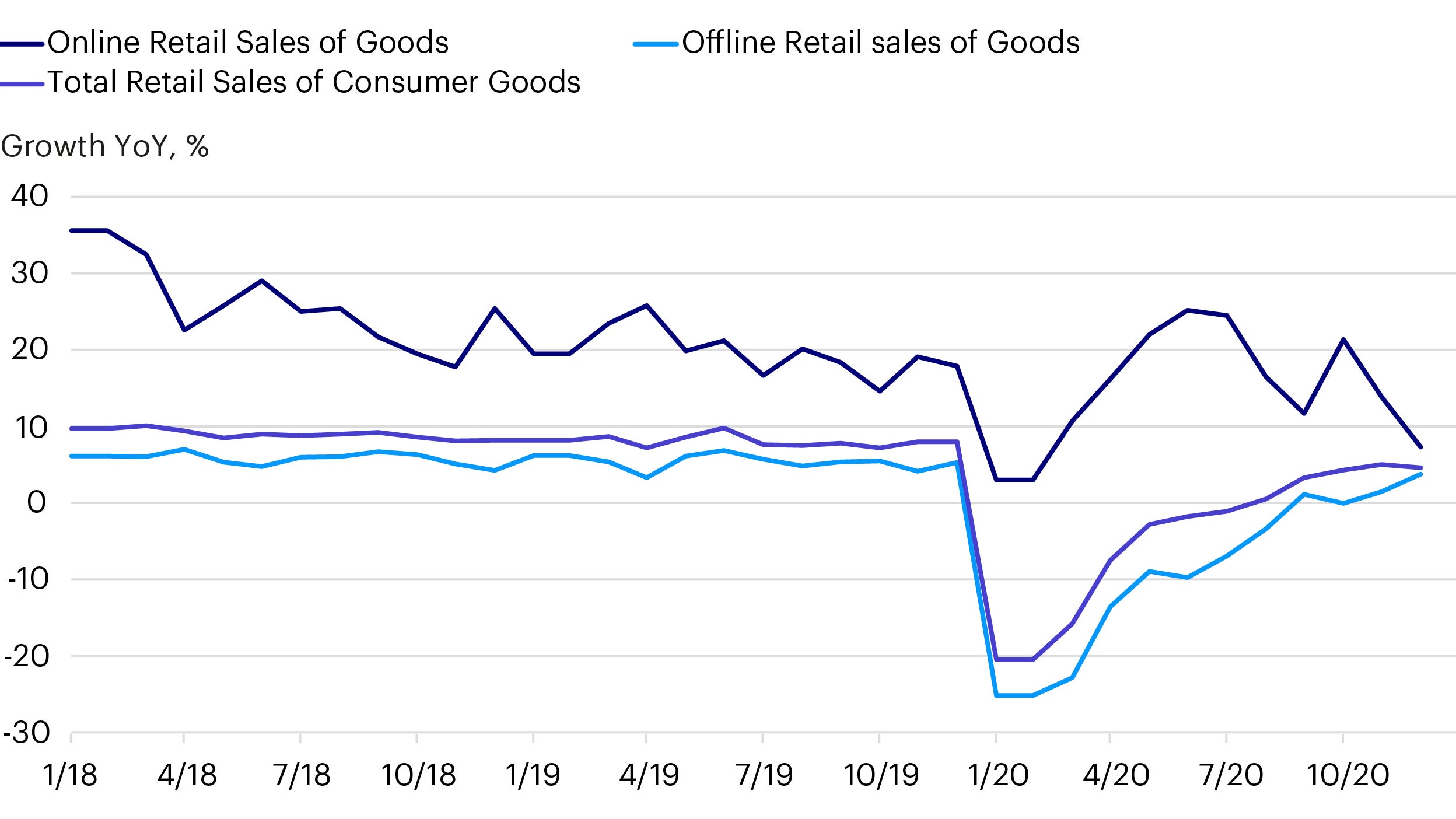

The Covid-19 outbreak is accelerating the digital trend by encouraging the purchasing of products and services on-line. E-commerce platforms acted fast to capitalise on this growth by launching a new shopping festival, Double Five, throughout which customers were provided with discounts and incentives to generate strong sales growth. The Covid-19 outbreak also encouraged other new strategies. For instance, a leading internet conglomerate (a holding) introduced an international version of its cloud-based video conferencing tool in more than 100 countries to capture market share. These strategies resulted in the e-commerce retail sales growth remaining resilient during Covid-19 (figure 2).

The Covid-19 backdrop also led to the emergence of new markets such as the telemedicine market. During the crisis, e-commerce platforms, which had previously just delivered drugs or booked appointments, began to provide treatment and advice. For example: a subsidiary of our holding in a large online platform claimed that monthly consultations had grown tenfold since the outbreak: an arm of another large platform (a holding) launched a free “online clinic”; and WeDoctor, an app backed by a leading internet conglomerate (a holding) mobilised 20,000 physicians to work online during the epidemic thereby encouraging the use of its platform going forward.

The digital trend is very evident. A Chinese consumer’s daily life involves frequent engagements with different types of online platforms offering both products and services. This has encouraged many internet companies to use innovative strategies to engage consumers. The importance of the digital trend can be seen in the MSCI China index composition where the communication services and consumer discretionary sectors constitute more than 20% of the index. The large companies in these sectors are mainly in the internet space.

A good example is our holding in an online platform which is capitalising on the growing digitalisation of consumer markets. Despite being a late comer to the food delivery market, the company gained market share from its competitors to become the number one platform for food delivery. Using this position, it has been successful in cross-selling higher-margin lifestyle services in leisure and entertainment.

The Covid-19 outbreak is accelerating the digital trend by encouraging the purchasing of products and services online. E-commerce platforms acted fast to capitalise on this growth by launching a new shopping festival, Double Five, throughout which customers were provided with discounts and incentives to generate strong sales growth. The Covid-19 outbreak also encouraged other new strategies. For instance, a leading internet conglomerate (a holding) introduced an international version of its cloud-based video conferencing tool in more than 100 countries to capture market share. These strategies resulted in the e-commerce retail sales growth remaining resilient during Covid-19 (figure 2).

The Covid-19 backdrop also led to the emergence new markets such as the telemedicine market. During the crisis, e-commerce platforms, which had previously just delivered drugs or booked appointments, began to provide treatment and advice. For example: a subsidiary of our holding in a large online platform claimed that monthly consultations had grown tenfold since the outbreak: an arm of another large platform (a holding), launched a free “online clinic”; and WeDoctor, an app backed by a leading internet conglomerate (a holding) mobilised 20,000 physicians to work online during the epidemic thereby encouraging the use of its platform going forward.

1 Source: Haitong Securities as of May 2020.

China’s domestic sector has grown significantly and now constitutes a dominant share of GDP.

Our investment strategy favours private enterprises. They are highly competitive and innovative, constantly utilising new technologies to deliver market leading products and services.

1 Source: Haitong Securities as of May 2020.

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations) and investors may not get back the full amount invested. The fund invests in emerging and developing markets, where there is potential for a decrease in market liquidity, which may mean that it is not easy to buy or sell securities. There may also be difficulties in dealing and settlement, and custody problems could arise. The fund may use Stock Connect to access China A Shares traded in mainland China. This may result in additional liquidity risk and operational risks including settlement and default risks, regulatory risk and system failure risk. Although the fund does not actively pursue a concentrated portfolio, it may have a concentrated number of holdings on occasions. Accordingly, the fund may carry a higher degree of risk than a fund which invests in a broader range of companies or takes smaller positions in a relatively large number of holdings. The fund may use derivatives (complex instruments) in an attempt to reduce the overall risk of its investments, reduce the costs of investing and/or generate additional capital or income, although this may not be achieved. The use of such complex instruments may result in greater fluctuations of the value of the fund. The Manager, however, will ensure that the use of derivatives within the fund does not materially alter the overall risk profile of the fund.

All data is as at 31/08/2020 and sourced from Invesco unless otherwise stated.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

For more information on our funds and the relevant risks, please refer to the share class-specific Key Investor Information Documents (available in local language), the Annual or Interim Reports , the Prospectus, and constituent documents, available from www.invesco.eu. A summary of investor rights is available in English from www.invescomanagementcompany.lu. The management company may terminate marketing arrangements.