00:00:00:01 – 00:00:36:25

Ryan McCormack (Invesco QQQ)

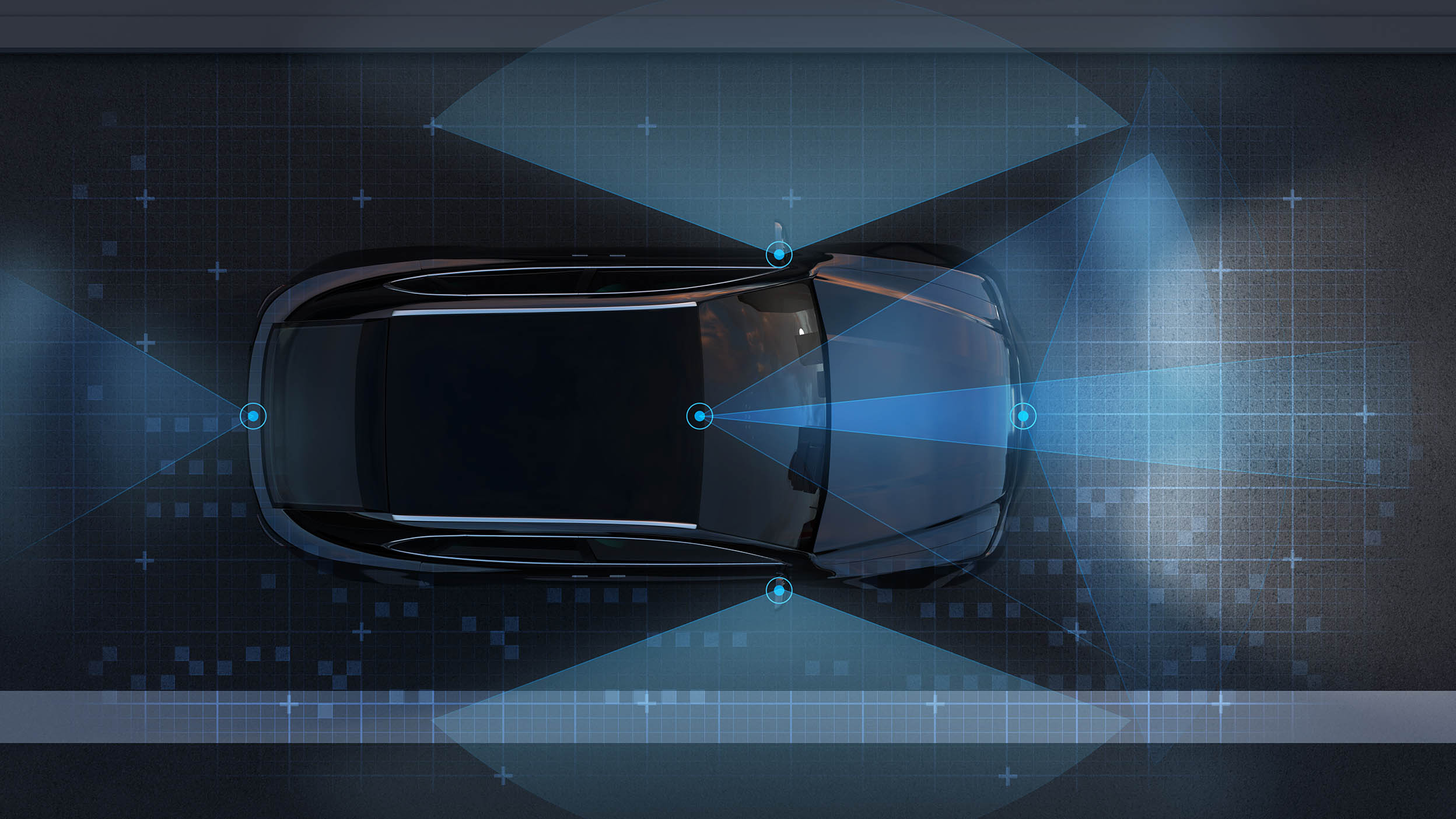

Most companies now had to shift their mindset when it comes to cybersecurity. This isn't just having an antivirus program on your mainframe computer. With all these different interconnected parts, all being able to access the Internet, those are all new access points where somebody can access your network.

The story of QQQ is one of innovation. Invesco QQQ is different from most other ETFs in that it directly tracks the Nasdaq-100.

00:00:37:00 – 00:01:02:00

Emily Spurling (Nasdaq)

The Nasdaq-100 is comprised of the top 100 non-financial companies listed on Nasdaq — companies with a legacy of innovation. Nasdaq thinks about cybersecurity as a horizontal technology that transcends industries.

Cybersecurity challenges that we face today present the opportunity to push the envelope of innovation. Some of the leaders that come to mind are CrowdStrike, Zscaler and Fortinet, as well as many others.

00:01:02:14 – 00:01:08:21

Kavitha Mariappan (Zscaler)

We help people stay safe and continue to be able to innovate, whether it's for work or play.

00:01:09:00 – 00:01:15:19

Michael Sentonas (CrowdStrike)

Cybersecurity today is not a nice to have. It's a necessity for every organization around the world, for every person around the world.

00:01:15:22 – 00:01:23:23

John Maddison (Fortinet)

Cybersecurity is a very dynamic industry. A lot of different technologies which we need to bring to bear to help our customers secure their future.

00:01:24:10 – 00:01:46:00

Kavitha Mariappan (Zscaler)

What Zscaler does is we really are about zero trust security. We look at protecting every organization and user that accesses information on the Internet to securely and safely do their best work. We manage over 270 billion transactions over the Internet daily, as well as block over 100 million threats daily.

00:01:46:05 – 00:02:11:16

Michael Sentonas (CrowdStrike)

If we look at the amount of breaches that hit the press, it's only getting more challenging for organizations. And it's something that I'm really proud of: the work that CrowdStrike has done and continues to do.

We built a company back in 2011. Our focus was to not use legacy approaches to stopping cyber attacks, and we've really focused on building advanced AI algorithms.

00:02:12:00 – 00:02:50:05

John Maddison (Fortinet)

Well, I think Fortinet, what we do is take a very pragmatic view of how fast customers are going and where they're going. We don't think customers are going to one particular specific domain to provide security. It won't be a cloud-only world, it won’t be an on-premise only world, it won't be a data center-only world.

And my analogy there is it used to have a camera, an MP3 player, maybe an alarm clock. Well, they put it all together and converged it into one iPhone. So you've taken multiple products and made it one, which is much more effective from an ROI perspective or cost. It'll be a mix and a hybrid of all those technologies to make sure you can protect everything inside the company.

00:02:50:15 – 00:03:05:15

Michael Sentonas (CrowdStrike)

If you look at the way that we use technology, we really have been building technology around the world to allow us to work from anywhere. The concept of remote work is not a new one. People have been trying to build capability to allow employees to connect and be productive from anywhere.

00:03:06:00 – 00:03:13:20

Kavitha Mariappan (Zscaler)

So much of our life’s actions and business today happens digitally. It is also available out there for threat actors to violate.

00:03:14:00 – 00:03:30:00

John Maddison (Fortinet)

If we go back 20 years ago, there was a big focus on antivirus over laptops because the data was there, and the cybercriminals were trying to get the data from there. And then the data started spreading into the data center and across the network, so then network security vendors became really important.

00:03:30:06 – 00:03:39:05

Kavitha Mariappan (Zscaler)

We're talking about a revolution, about how people needed to rethink, how security needed to look at securing all their core assets and processes.

00:03:39:07 – 00:03:57:09

Michael Sentonas (CrowdStrike)

There's been a lot of shift in cyber attacks in the last ten years. The complexity, the volume, the targeted victims, the amount of money that's being made.

Ten years ago, people would talk about $500 or $1,000 being made by the cyber attackers. Today we talk about $5 million, $10 million attacks.

00:03:57:20 – 00:04:11:12

John Maddison (Fortinet)

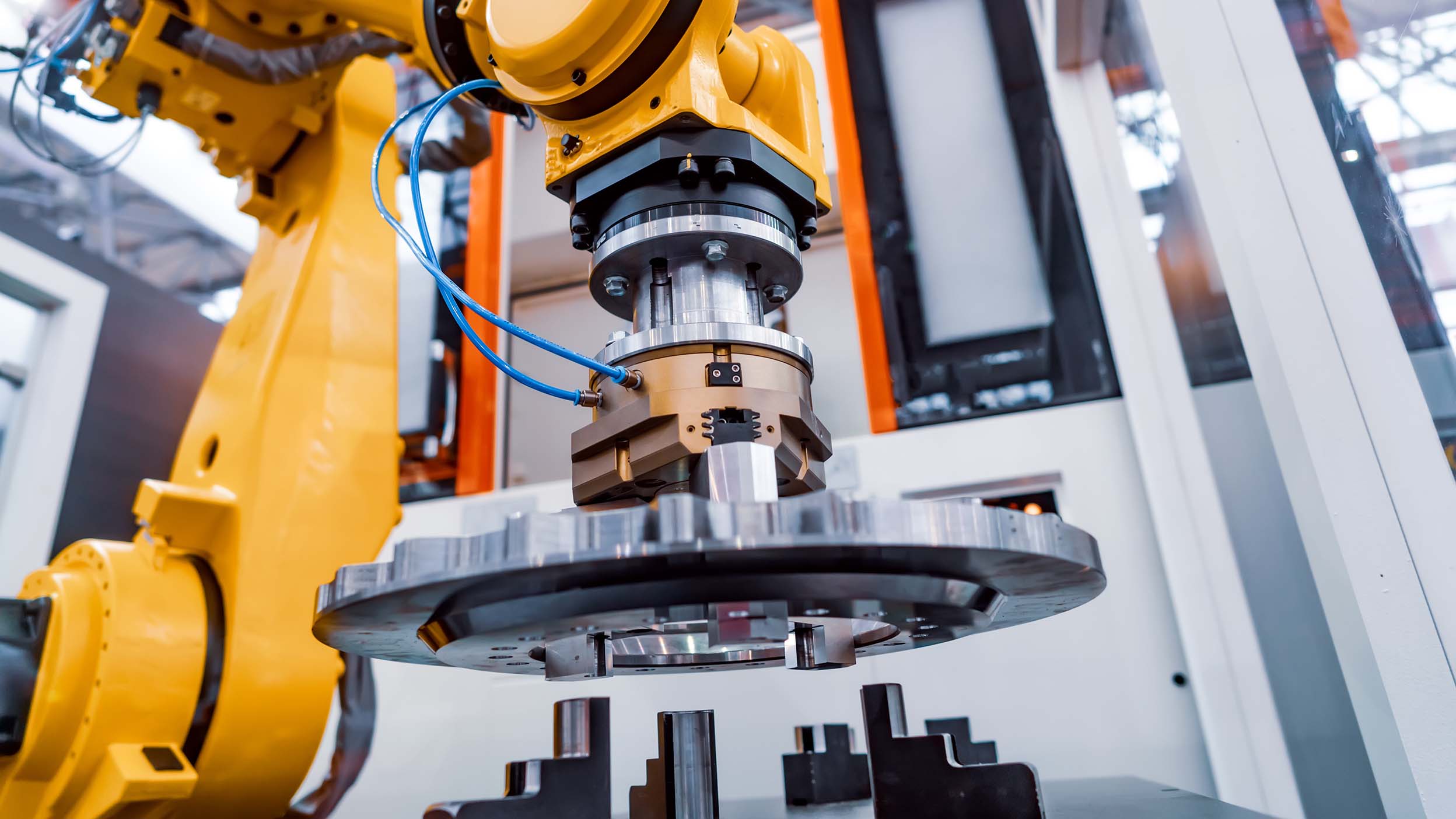

Today's companies, they rely on the infrastructure. A lot of those companies can be completely halted if they apply some ransomware or encrypt a controller, which could bring down the whole factory. The company could be losing hundreds of millions of dollars a day.

00:04:12:00 – 00:04:31:16

Michael Sentonas (CrowdStrike)

We provide cybersecurity services, threat intelligence and solutions to stop breaches, and we provide those capabilities to organizations around the world. We use a cloud-based architecture, so wherever a user is, wherever their machines are connecting to, you can connect to them, you can secure them, you can get full visibility.

00:04:31:17 – 00:04:54:17

Kavitha Mariappan (Zscaler)

I think it’s an interesting time to be solving these problems, right? Artificial intelligence and machine learning, being able to analyze a multitude of data, to be able to infer signals and solve very interesting problems. As we look at 5G, as we look at the multitude of devices that are out there, whether, you know, we're looking at IoT or OT, there are going to be so many interesting areas of innovation.

00:04:55:00 – 00:05:24:00

John Maddison (Fortinet)

From Fortinet's perspective, we feel customers will never go down one track. They will be very hybrid for a long time, if not forever. And then security needs to make sure and accommodate that strategy and the customer. Some things will be in the cloud, some things will be provided by the cloud, some things will be on-premise, some things will be in agents.

And so we need to make sure that whatever the customer does with this infrastructure, and its data, and its people, and its users, we can follow and protect that.

00:05:24:02 – 00:05:28:02

Michael Sentonas (CrowdStrike)

Our mission is simply put, we stop breaches. That's what we do for our customers.

00:05:28:15 – 00:05:40:20

Kavitha Mariappan (Zscaler)

The way we think about it is continuing to co-develop and innovate with our customers, but always being there ahead of our customers so that we can deliver the right innovations for them before they need it.

00:05:41:00 – 00:05:52:09

John Maddison (Fortinet)

I think some of the most enjoyable moments are when I'm talking to customers and they explain to me how our technology has helped them drive their business forward, but at the same time protect them.

00:05:52:15 – 00:05:56:22

Emily Spurling (Nasdaq)

The innovation we see at these cybersecurity companies help all companies broadly.

00:05:57:00 – 00:06:05:08

Ryan McCormack (Invesco QQQ)

As technology continues to evolve, the need for cybersecurity solutions, new cybersecurity solutions will likely evolve alongside it.

00:06:09:00 – 00:06:17:01

Invesco QQQ Disclosure

Consider the Fund's investment objective risks, charges and expenses before investing. Visit Invesco.com for a prospectus with information. Read it carefully before investing.

On-Screen Disclaimer Language

(Section 1)

NOT A DEPOSIT | NOT FDIC INSURED | NOT GUARANTEED BY THE BANK | MAY LOSE VALUE | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

THIS CONTENT SHOULD NOT BE CONSTRUED AS AN ENDORSEMENT FOR OR A RECOMMENDATION TO INVEST IN FORTINET, CROWDSTRIKE, ZSCALER.NEITHER FORTINET, CROWDSTRIKE, NOR ZSCALER ARE AFFILIATED WITH INVESCO.

There are risks involved with investing in ETFs, including possible loss of money. ETFs are subject to risks similar to those of stocks. Investments focused in a particular sector, such as technology, are subject to greater risk, and are more greatly impacted by market volatility, then more diversified investments.

Before investing, consider the Fund's investment objectives, risks, charges and expenses. Visit invesco.com for a prospectus containing this information. Read it carefully before investing.

Only three of 101 underlying Invesco QQQ ETF fund holdings are featured. Participation is meant to help illustrate representative innovation themes, not serve as a recommendation of individual securities. As of 10/02/23, CrowdStrike Holdings Inc Class A made up .33%, Fortinet Inc. made up .39%, and Zscaler Inc made up .20% of Invesco QQQ.

As of 10/02/23 Invesco QQQ top ten holdings are: Apple Inc. 10.87%, Microsoft Corporation 9.56%, Amazon.com Inc. 5.34%, NVIDIA Corporation 4.24%, Meta Platforms Inc Class A 3.82%, Tesla Inc. 3.19%, Alphabet Inc. Class A 3.18%, Alphabet Inc. Class C 3.14%, Broadcom Inc. 2.96% and Costco Wholesale Corporation 2.17%. Holdings are subject to change and should not be considered buy/sell recommendations. See invesco.com for current holdings.

The Nasdaq-100 Index comprises the 100 largest non-financial companies traded on the Nasdaq. An investment cannot be made directly into an index.

Artificial Intelligence (AI) is the simulation of human intelligence processes by computer systems.

The internet of things (IoT) is a network of interrelated devices embedded with technologies for the purpose of connecting and exchanging data with other devices and systems over the internet.

Operational technology (OT) is technology that monitors and controls specific devices and processes within industrial workflows.

Nasdaq and Invesco are not affiliated.

Invesco Distributors, Inc. NA3022917

(Section 2)

Nasdaq®, Nasdaq-100 Index®, Nasdaq-100°, and QQQ® are registered trademarks of Nasdaq, Inc. (which with its affiliates is referred to as the "Corporations") and are licensed for use by Invesco.

The Product (s) have not been passed on by the Corporations as to their legality or suitability. The Product(s) are not issued, endorsed, sold, or promoted by the Corporations. The Corporations make no warranties and bear no liability with respect to the product(s).

The information contained in the video is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy.

The Corporations do not make any recommendation to buy or sell any security or any representation about the financial condition of any company.

Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing.

ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.