Innovation Unlocking e-commerce potential in a digital world

Learn how e-commerce has changed our global economy and about the holding companies behind this growing trend

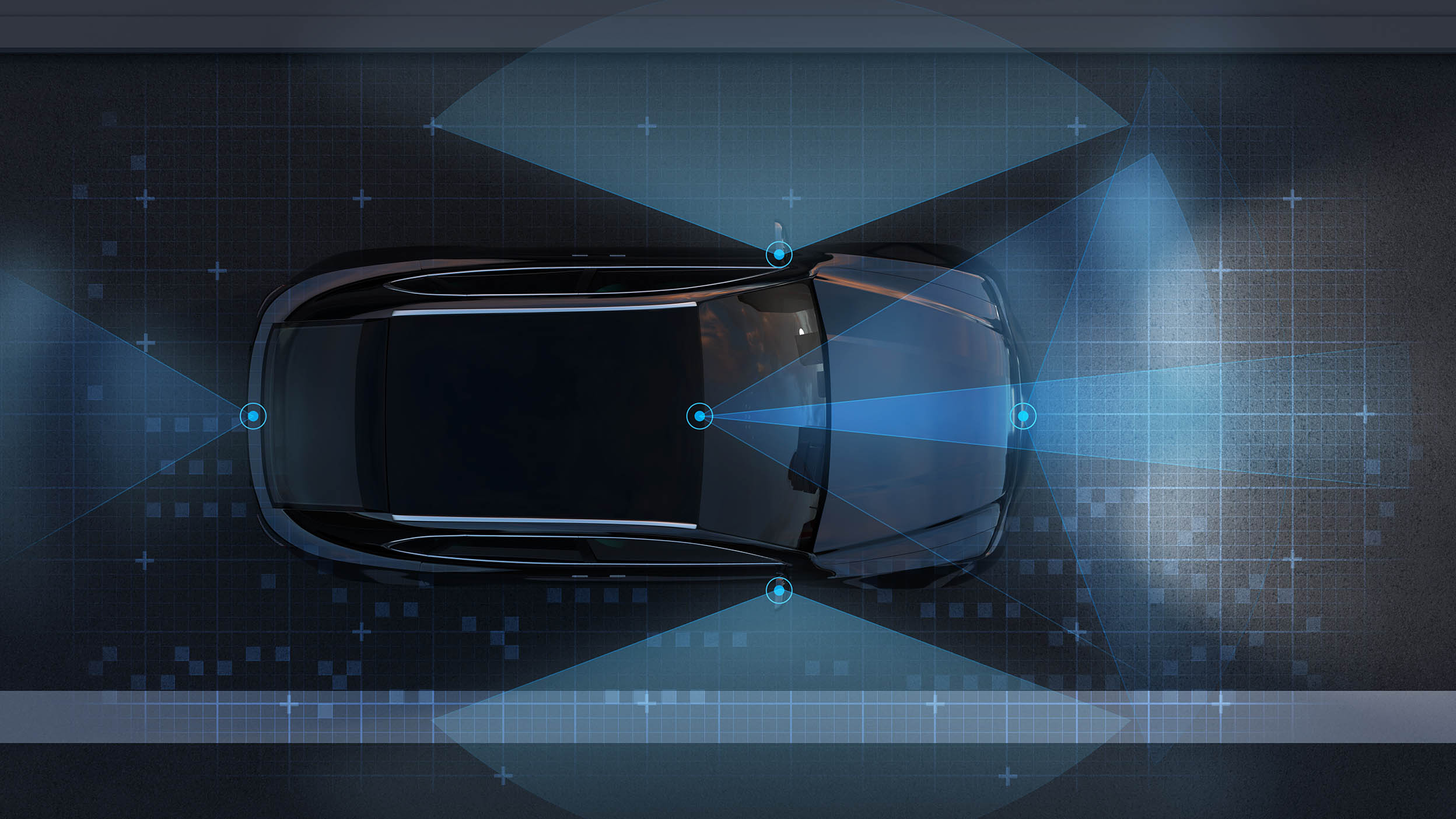

The rise of autonomous vehicles (AVs) is transforming mobility, with advancements in artificial intelligence (AI), sensors, and automation leading the charge. This market, which is still in its early growth stages, offers exciting investment opportunities, and the Nasdaq-100® Index (tracked by Invesco QQQ ETF) provides exposure to companies pioneering self-driving technology.

The global market for AVs, also known as driverless or self-driving vehicles, is projected to grow from $1.92 billion in 2023 to $13.63 billion by 2030.1 These firms are developing solutions that go beyond vehicles, including AI platforms, robotaxis, delivery automation, and infrastructure technologies.

Still, it should be stressed that the AV industry is still young and growth projections tend to be all over the map. “One key restraining factor in the global AV market is the lack of clear and consistent regulatory frameworks,” according to Fortune Business Insights. “The absence of standardized regulations across regions creates uncertainties and obstacles to the widespread deployment of AVs.”

“Industry expectations for AVs range from optimism about imminent breakthroughs to pessimism that self-driving cars will ever hit the road on a wide scale,” according to Goldman Sachs.2 Improving AI tech will boost the AV industry but widespread adoption “is still at least a few years away as a base case,” the firm noted.

For example, in early 2024, reports surfaced that Apple was cancelling its plans to release an electric self-driving car, a project that had been in the works for years.3 While setbacks like Apple’s canceled project highlight the challenges, ongoing advancements in AI, regulatory progress, and shifting public sentiment will be crucial factors determining when AVs can finally achieve widespread commercial deployment.

With that long-term perspective in mind, below are key companies in the QQQ portfolio that are actively driving the future of autonomous driving.

Although Alphabet, the parent company of Google, is best known for its advertising and cloud computing businesses, its Waymo subsidiary is a leader in AV technology. Waymo has successfully deployed autonomous taxis in cities like Phoenix and San Francisco. A new partnership with Hyundai signals Waymo’s ambition to bring its platform to personal vehicles, further expanding beyond commercial ride-hailing into consumer applications.4 Alphabet’s investment in self-driving technology could position it as a long-term player in this market.

NVIDIA’s AI chips and Drive platform are integral to the self-driving ecosystem, powering AVs with real-time decision-making capabilities. NVIDIA’s platform is widely adopted across the industry by automakers and startups alike, offering solutions for both safety systems and autonomous navigation. The company’s focus on advanced driver-assistance systems (ADAS) reflects its strategy to be a foundational provider in the automotive tech space, as regulatory frameworks push for greater vehicle safety.

Through its Mobileye subsidiary, Intel focuses on vision-based systems and ADAS technology, forming partnerships with BMW and Volkswagen to enhance its autonomous capabilities.5 Mobileye’s innovative sensor technology plays a key role in both collision avoidance and full autonomy. Intel’s decision to retain control of Mobileye highlights its confidence in the future of autonomous driving, reinforcing the company’s investment in vehicle intelligence.

Amazon is making strides in self-driving technology through Zoox, its AV startup. Zoox’s taxi service aims to offer bidirectional driving vehicles optimized for urban settings. In addition to its robotaxi ambitions, Amazon is using automation in its logistics network with self-driving delivery vehicles, streamlining last-mile delivery processes.6 This dual strategy positions Amazon at the intersection of transportation and automation.

Tesla’s push into autonomous driving was unveiled through its highly anticipated robotaxi event. However, investors were hoping for more details around the potentially transformative new business. Market reaction reflected concerns about the viability of Tesla’s self-driving ambitions, despite its ongoing improvements to the Full Self-Driving (FSD) software through over-the-air updates.7 While Tesla continues to push boundaries, recent challenges underscore the complexity of developing fully autonomous systems that can meet consumer expectations and regulatory standards.

Qualcomm provides essential hardware for AVs, including chips for ADAS and vehicle-to-everything (V2X) communication. These technologies enable vehicles to interact with each other and with road infrastructure, improving safety and efficiency. Qualcomm’s automotive platforms position it as a critical player in building the connectivity backbone needed for autonomous driving.

The companies highlighted here showcase a range of solutions, from robotaxis and AI chips to delivery automation and vehicle communication systems. Through QQQ, investors can gain exposure to firms driving advancements in autonomous technology, each contributing uniquely to the future of mobility.

Select the option that best describes you, or view the QQQ Product Details to take a deeper dive.

Learn how e-commerce has changed our global economy and about the holding companies behind this growing trend

Machine learning and quantum computing technologies are impacting many industries, streamlining many processes and attracting long-term growth

As the artificial intelligence story evolves, emerging market tech companies seek to expand their competitive edge in enabling generative AI solutions.

NA3989200

Past performance is not a guarantee of future results.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional/financial consultant before making any investment decisions.

The opinions expressed are those of the author, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

This information is provided for informational purposes and does not constitute an endorsement or recommendation of any companies referenced.

This content should not be construed as an endorsement for or recommendation to invest in Amazon, NVIDIA, Intel, Alphabet, Tesla, or Qualcomm. Neither Amazon, NVIDIA, Intel, Alphabet, Tesla, nor Qualcomm are affiliated with Invesco. Only 6 of 101 underlying Invesco QQQ ETF fund holdings are featured. The companies referenced are meant to help illustrate representative innovative themes, not serve as a recommendation of individual securities. Holdings are subject to change and are not buy/sell recommendations. See invesco.com/qqq for current holdings. As of 10/29/2024, Amazon, NVIDIA, Intel, Alphabet, Tesla, and Qualcomm made up 4.97%, 8.60%, 0.63%, 4.84% (combined for Class A and Class C), 3.11%, and 1.26%, respectively, of Invesco QQQ ETF.