Innovation The Nasdaq-100: More than meets the eye

Explore some of the biggest names in the Nasdaq-100 index. They span sectors to innovate in new ways and diverse businesses.

The Nasdaq-100 Index is known for innovation. Based on market capitalization, about 55% of the index falls into the technology sector—a natural home to companies shaping the future.1 But the emphasis on innovation doesn’t stop with tech companies. Many of the index’s non-tech components—including those found in the consumer staples, consumer discretionary, health care, utilities and industrials sectors—have actively been using cutting-edge methods to help drive their growth.

In fact, technology is thriving in some unexpected places in the Nasdaq-100. While investors may not think of the grocery aisle as an obvious place for groundbreaking technology, food and beverage industry leaders like PepsiCo, Mondelez International and Kraft Heinz Corp. are using new technologies to revolutionize how they produce, process, market and distribute their products.

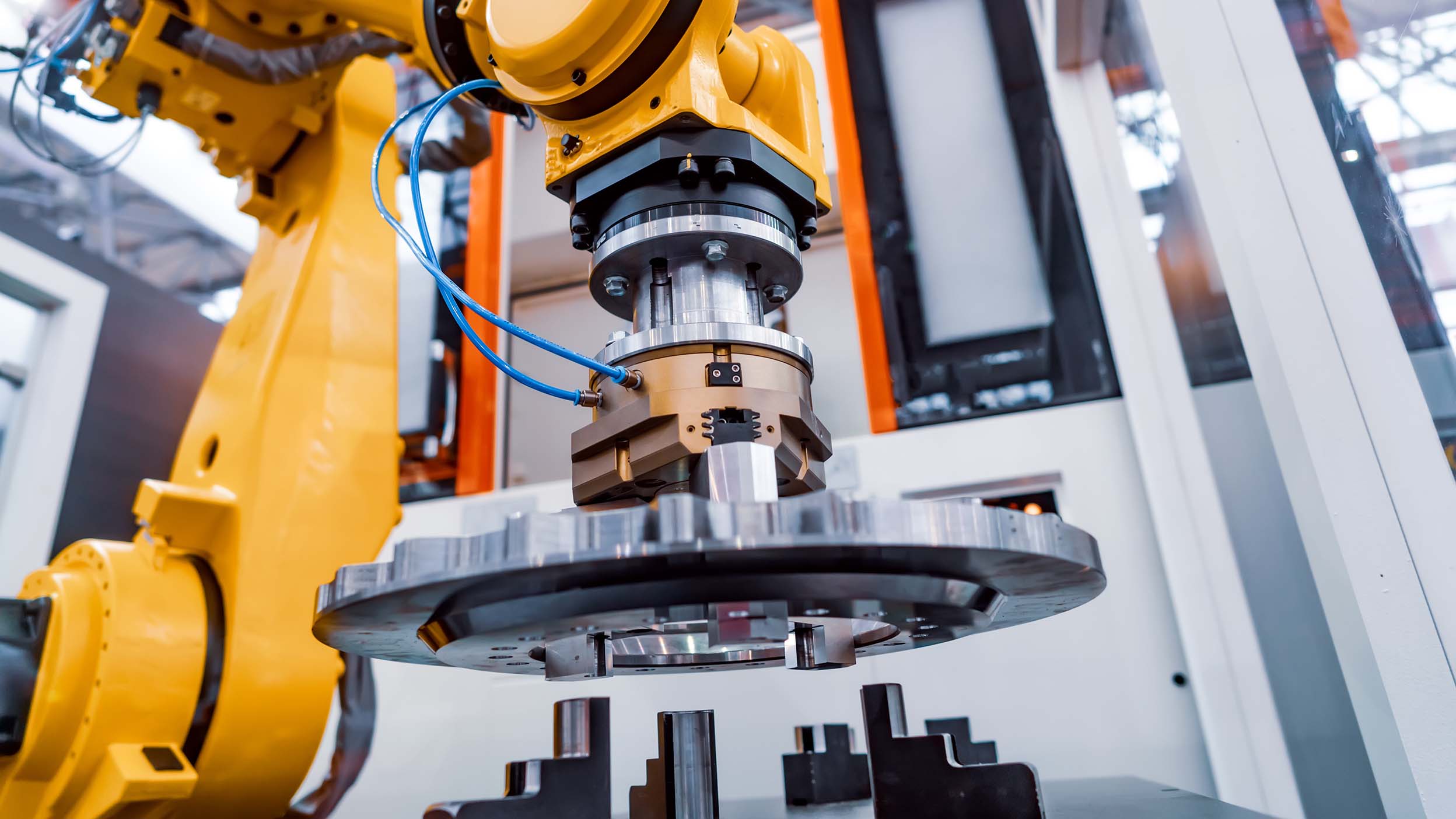

As highlighted in the sampling below, these innovations are manifested in food formulations, cloud-computing applications, artificial intelligence (AI), data analytics, as well as the use of robotics, 3D printing and even drones.

PepsiCo, the largest food and beverage company in North America, is one of the 10 largest companies in the Nasdaq-100. The company includes major global brands such as Pepsi, Lay's, Quaker, Gatorade, 7 Up, Doritos, Cheetos and Ruffles.

PepisCo has long relied on emerging technologies to enhance its operational and service capabilities through AI, big data, analytics, cloud computing and robotics.

Data analytics

Investments in tech startups

3D printing

Kraft Heinz is the third-largest food and beverage company in North America. Familiar brands include Grey Poupon, Jell-O, Kool-Aid, Kraft, Maxwell House, Oscar Mayer and Velveeta, many of which exceed $1 billion in size. For several years, the company has been engaged in a digital transformation tasked with driving better data-driven decisions as consumer behavior migrates to online channels.

AI and machine learning

Product formulation innovations

3D printing

Mondelez is a global confectionery, snack food and beverages company that manufactures cookies, chocolate, gum, candy and many other food items under popular brands like Oreo and Chips Ahoy! cookies; Nilla wafers; Wheat Thins, Ritz and Premium crackers; and Cadbury chocolates. In recent years, the company has focused on employing innovative technologies, including extended reality, blockchain, natural language preoccesing, drones, computer vision and low-code/no-code development.

Digital commerce

Cloud computing

Drones

As the examples above have shown, technology can play an integral role in Nasdaq-100 companies outside of the technology sector. Our focus on the consumer staples sector has highlighted how automation in supply chain management has accelerated the movement of raw materials and finished goods to market more efficiently. Similarly, technologies such as robotics and 3D printing have expedited packaging and process development. Meanwhile, integrating augmented reality (AR), robotics (and even drones) into the manufacturing process has served to save time, reduce contamination and ease labor shortages.

Looking forward, companies engaged in food processing and distribution will continue to pursue technological innovation as they address supply chain challenges and drive efficiencies across the global food system. Such creative food science solutions will be critical to the delivery of safe, nutritious, and sustainable foods for a world population exceeding eight billion people.

Market capitalization is the total value of all a company's shares of stock. It is calculated by multiplying the price of a stock by its total number of outstanding shares.

Source: PepsiCo, Inc.

Source: PepsiCo, Inc.

Source: Nexa3D

Source: Cloud Tech

Source: Food Dive

Source: Fast Company

Source: Plastics Today

Source: Food Business News

Source: Food Business News

Source: ComputerWeekly.com

Select the option that best describes you, or view the QQQ Product Details to take a deeper dive.

Explore some of the biggest names in the Nasdaq-100 index. They span sectors to innovate in new ways and diverse businesses.

GPUs are playing a large role in the technological revolution that is powering AI and supporting the growth of many technology companies.

Learn how the Nasdaq-100 index and Invesco QQQ ETF give investors access to companies that are driving innovation across the global economy.

NA2763710

All data sourced from Bloomberg L.P. as of 3/31/2023 unless otherwise noted. An investor cannot invest directly in an index.

Past performance is not a guarantee of future results.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional/financial consultant before making any investment decisions.

The opinions expressed are those of the author, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

This information is provided for informational purposes and does not constitute an endorsement or recommendation of any companies referenced.

This content should not be construed as an endorsement for or recommendation to invest in PepsiCo, Inc., The Kraft Heinz Company and Mondelez International, Inc. Neither PepsiCo, Inc., The Kraft Heinz Company and Mondelez International, Inc. are affiliated with Invesco. Only 3 of 101 underlying Invesco QQQ ETF fund holdings are featured. The holdings are meant to help illustrate representative innovative themes, not serve as a recommendation of individual securities. Holdings are subject to change and are not buy/sell recommendations. See invesco.com/qqq for current holdings. As of 4/20/2023, PepsiCo, Inc., The Kraft Heinz Company and Mondelez International, Inc. made up 1.97%, 0.37%, 0.75%, respectively, of Invesco QQQ ETF.

Russell 1000 Growth Index includes those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values.

Russell 1000 Value Index includes those Russell 1000® companies with lower price-to-book ratios and lower expected growth values.