Innovation Innovation in food: Preparing tomorrow’s menu

Learn how companies within the Nasdaq 100 Index are redefining the food industry

Growth-oriented investors have many themes to choose from in today’s rapidly evolving technological landscape. In particular, machine learning and quantum computing may be positioned for potential long-term growth.

These two emerging fields hold promise for modernizing various industries and for innovative companies that can take advantage.

We’ll explore the potential opportunities in this area and how some leading companies are positioning themselves in these transformative technologies.

Machine learning is an important branch of the artificial intelligence (AI) boom that allows computers to “think” based on experience and data.

Machine learning algorithms power the ubiquitous chatbots we interact with online as well as the self-driving cars on our streets. The technology has applications to boost efficiencies across a wide range of industries, including healthcare, manufacturing, design, and banking. By quickly analyzing massive amounts of data, machine learning can be used to make predictions, personalize content, automate tasks, and more.

The global machine learning market size was estimated at $38 billion in 2022 and it is projected to rise to nearly $800 billion by 2032.1

Source: Precedence Research, July 2023.

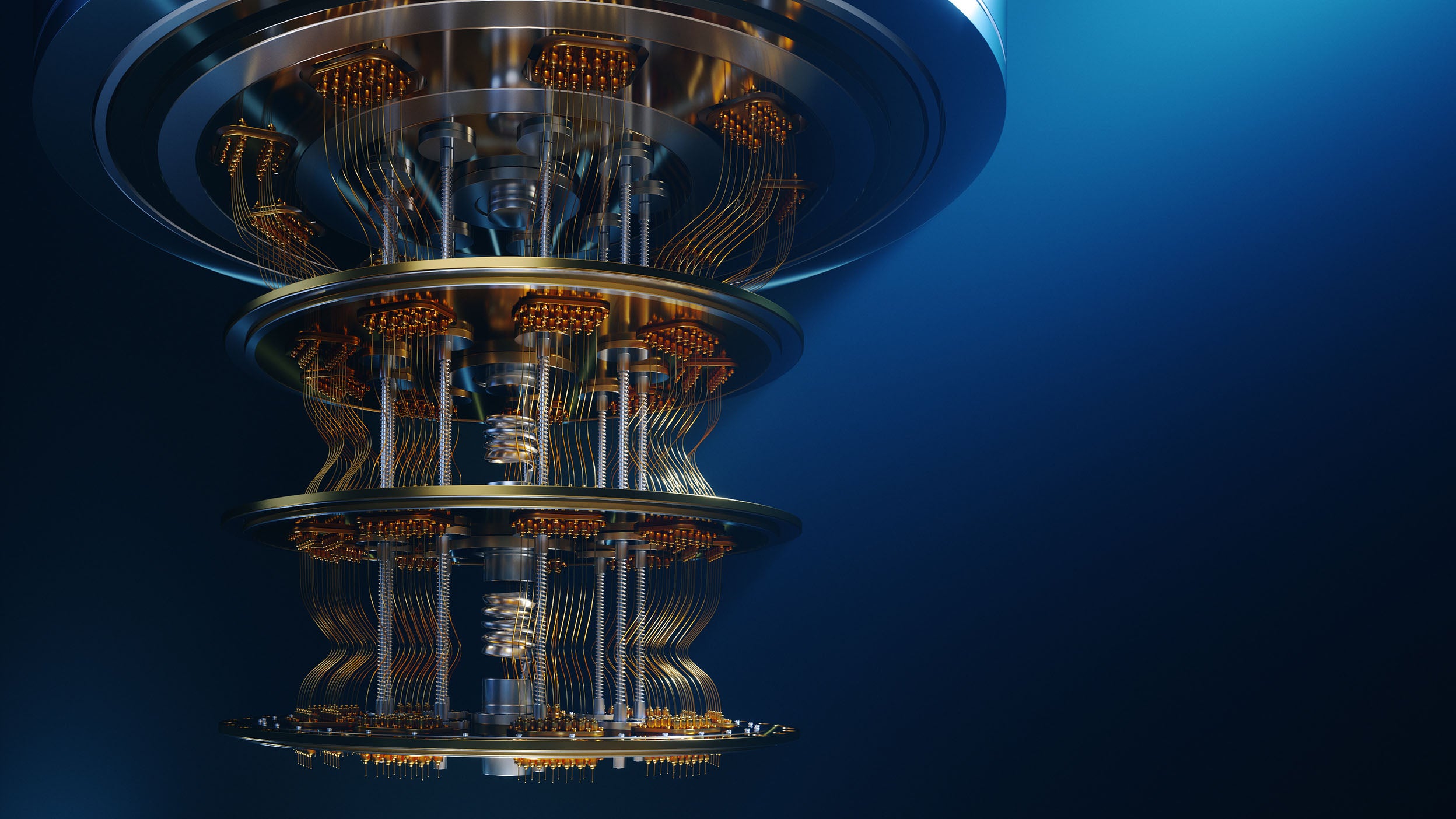

Quantum computing, meanwhile, uses the principles of physics to solve very complex problems much faster than traditional computers. While this revolutionary technology is still in its early stages, it has commercial applications across many industries, including pharmaceuticals, supply chain management, and transportation networks, to name a few. Indeed, companies are hungry for more computing power to support the proliferation of AI and e-commerce.

Invesco QQQ ETF, designed to follow the Nasdaq-100 Index®, provides exposure to several innovative leaders in both machine learning and quantum computing.

Adobe: AI and machine learning is embedded across the company’s suite of creative and marketing software products. Adobe Sensei is a machine learning and AI technology that aggregates data, generates insights, streamlines processes, and automates mundane tasks. For example, Sensei uses machine learning to intelligently remove unwanted objects from your favorite smartphone photos.

Intel: Intel, one of the key players in machine learning, develops powerful processors optimized for AI capabilities. The company's Xeon processors are built for AI acceleration, making Intel an important potential provider of hardware solutions for machine learning applications in the years to come.

Amazon.com: The company’s Amazon Web Services (AWS) offers machine learning services such as SageMaker to build, train, and deploy machine learning models. Amazon is also innovating in quantum computing with its Amazon Bracket service geared to help researchers, scientists, and developers get started in quantum computing.

Microsoft: The software giant’s Azure Machine Learning service is designed to help businesses build machine learning models and generative AI. Also, Azure Quantum offers high-powered hardware, software, and solutions in a single cloud service.

Alphabet: Google employs machine learning in many of its services and products. For example, machine learning is used to power Google’s search algorithms and the cat video recommendations you may see on YouTube. Google’s Quantum AI Lab in Santa Barbara houses a quantum data center, fabrication facility, and research workspace.

Apple: Apple continues to integrate machine learning into its products and services. Apple’s virtual assistant, Siri, taps into machine learning algorithms to understand natural language queries, recognize speech patterns, and provide personalized responses and recommendations. Apple’s Photos app also uses machine learning to recognize faces and objects.

Machine learning and quantum computing could present interesting opportunities for investors looking to participate in these next-generation technologies. Invesco QQQ offers a way for investors to get exposure to these emerging sectors as well as gain access to some of the most innovative companies in the world from other industries beyond technology.

Precedence Research, July 1, 2023.

Select the option that best describes you, or view the QQQ Product Details to take a deeper dive.

Learn how companies within the Nasdaq 100 Index are redefining the food industry

The rise of artificial intelligence (AI) is impacting big tech. Learn more about how industries, from hardware manufactures to software developers, are utilizing AI.

Digital assets, such as blockchain and cryptocurrency, are becoming a major industry. In this guide, we provide investors insight into the asset class.

NA3561460

Past performance is not a guarantee of future results.

Investments focused in a particular sector, such as technology, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional/financial consultant before making any investment decisions.

The opinions expressed are those of the author, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

This information is provided for informational purposes and does not constitute an endorsement or recommendation of any companies referenced.

This content should not be construed as an endorsement for or recommendation to invest in Adobe Inc, Intel Corp, Amazon.com Inc, Microsoft Corp, Alphabet Inc, or Apple Inc. Neither Adobe Inc, Intel Corp, Amazon.com Inc, Microsoft Corp, Alphabet Inc, nor Apple Inc are affiliated with Invesco. Only 6 of 101 underlying Invesco QQQ ETF fund holdings are featured. The companies referenced are meant to help illustrate representative innovative themes, not serve as a recommendation of individual securities. Holdings are subject to change and are not buy/sell recommendations. See invesco.com/qqq for current holdings. As of 5/2/2024, Adobe Inc, Intel Corp, Amazon.com Inc, Microsoft Corp, Alphabet Inc, and Apple Inc made up 1.62%, 0.97%, 5.58%, 8.60%, 5.64%, 7.78%, respectively, of Invesco QQQ ETF.