How SFDR will embed ESG risks across firms and products

The recently launched Sustainable Finance Disclosures Regulation (SFDR) mandates that all asset managers, insurance companies, pensions funds and financial advisers (“firms”) must disclose how they consider sustainability risks, that is, financially material ESG risks, in their investment decision making or advice. This is both at a firm-level but also for each of the products that it provides. Where firms consider that sustainability risks are not relevant for a particular product, they will need to disclose why.

As part of the product disclosure, firms will also be required to provide details regarding the “likely impacts of sustainability risks on the returns of the financial product” and to disclose how their remuneration policies are consistent with the integration of sustainability risks. These disclosures were required from 10 March 2021, on websites (for firm-level disclosures) and in product pre-contractual disclosures (for product-level disclosures).

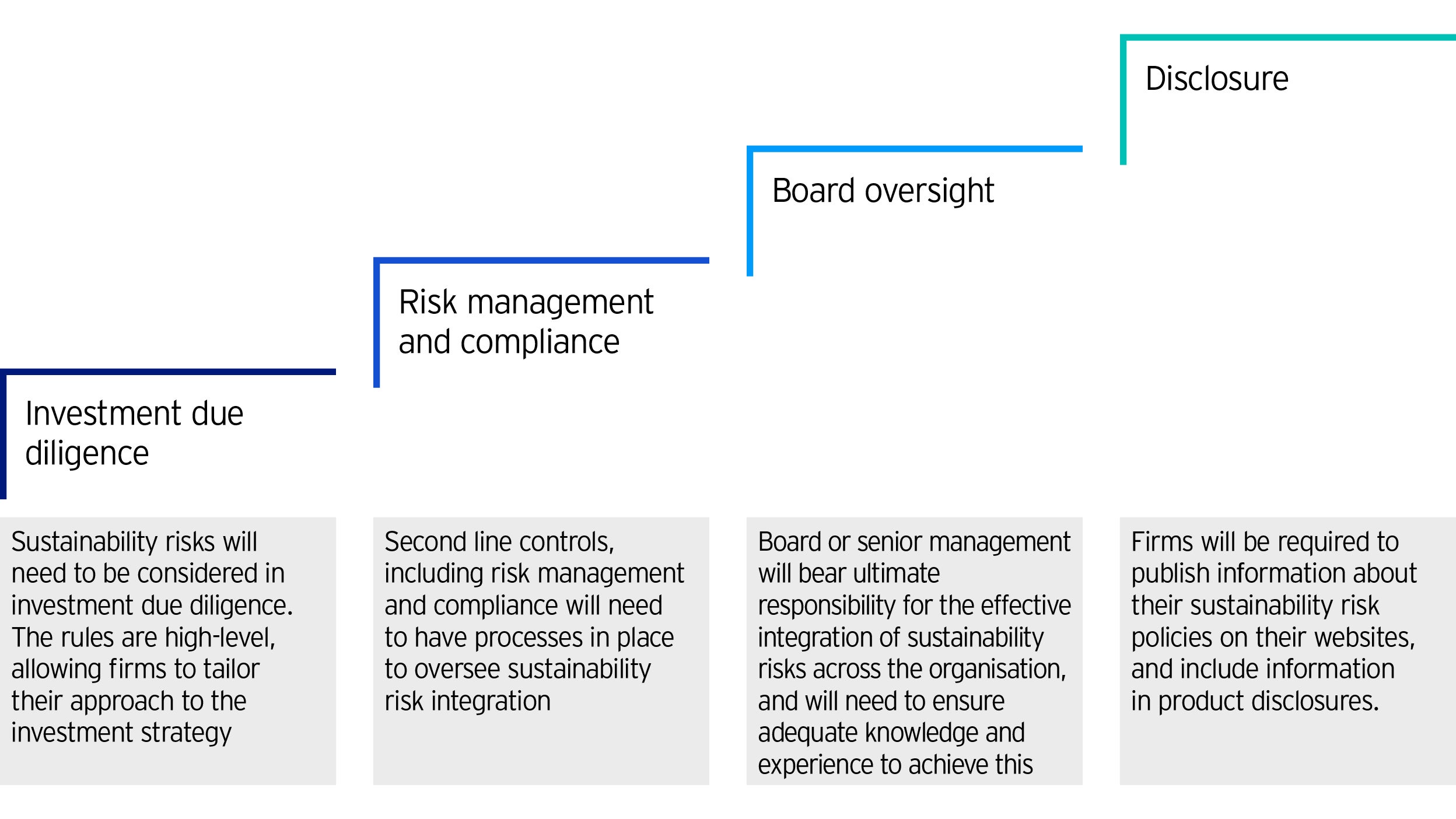

While the SFDR does not prescribe how such integration should take place, the European Commission is preparing amendments to fund and insurance regulation (under UCITS, MiFID, AIFMD and Solvency 2 - occupational pensions already have obligations under IORP 2) that will make it explicit that firms are expected to consider sustainability risks across the firm, making ESG integration the new normal in the EU. The rules are expected to require firms to consider sustainability risks in their investment due diligence, their risk management processes and in their conflicts of interest policy, all of which needs to be overseen by the Board or senior management. Based on earlier drafts submitted for consultation, the rules are likely to remain high-level, providing flexibility for firms to tailor their approaches to different investment strategies and business models. The final rules are expected to be adopted in March or April 2021, with firms having one year to implement the new requirements.

Rules for the consideration of ESG risks by banks and investment firms are also under development by the European Banking Authority, with a first report expected in June 2021 that will provide advice to the European Commission on how sustainability risks should be considered in prudential regulation. The European Central Bank, as the single supervisor for the largest banks in the Eurozone, has also published guidance for banks regarding the integration of climate and environmental risks.

While many firms may already have processes in place for the integration of ESG risks in their investment process, the upcoming rules are likely to lead to many firms reviewing their internal processes to deepen and formalise their approaches, including greater involvement of the second and third lines of defence in the form of risk management, compliance and internal audit, as well as Board oversight of these processes. Given the breadth of functions that are likely to need to play a role on this process, training and education on the fundamentals of ESG across firms will likely be valuable to support the implementation of these new legal requirements.

The above article is an excerpt from our recent whitepaper, which you can download in full here: Shifting Gears: Preparing for the new sustainable finance regulations in Europe.

Click on one of the below pieces or go back to the hub.

Keep up-to-date

Sign up to receive the latest insights from Invesco’s global team of experts and details about on demand and upcoming online events.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

-

Data as of 31 January 2021 unless stated otherwise.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.