The European Commission’s Sustainable Financial Action Plan – a summary

The Sustainable Finance Disclosures Regulation (SFDR), which went live on 10 March 2021, is by far the most immediate priority when it comes to the new EU sustainable finance regulations but it is just the tip of the iceberg when it comes to the EU’s ambitions in this space.

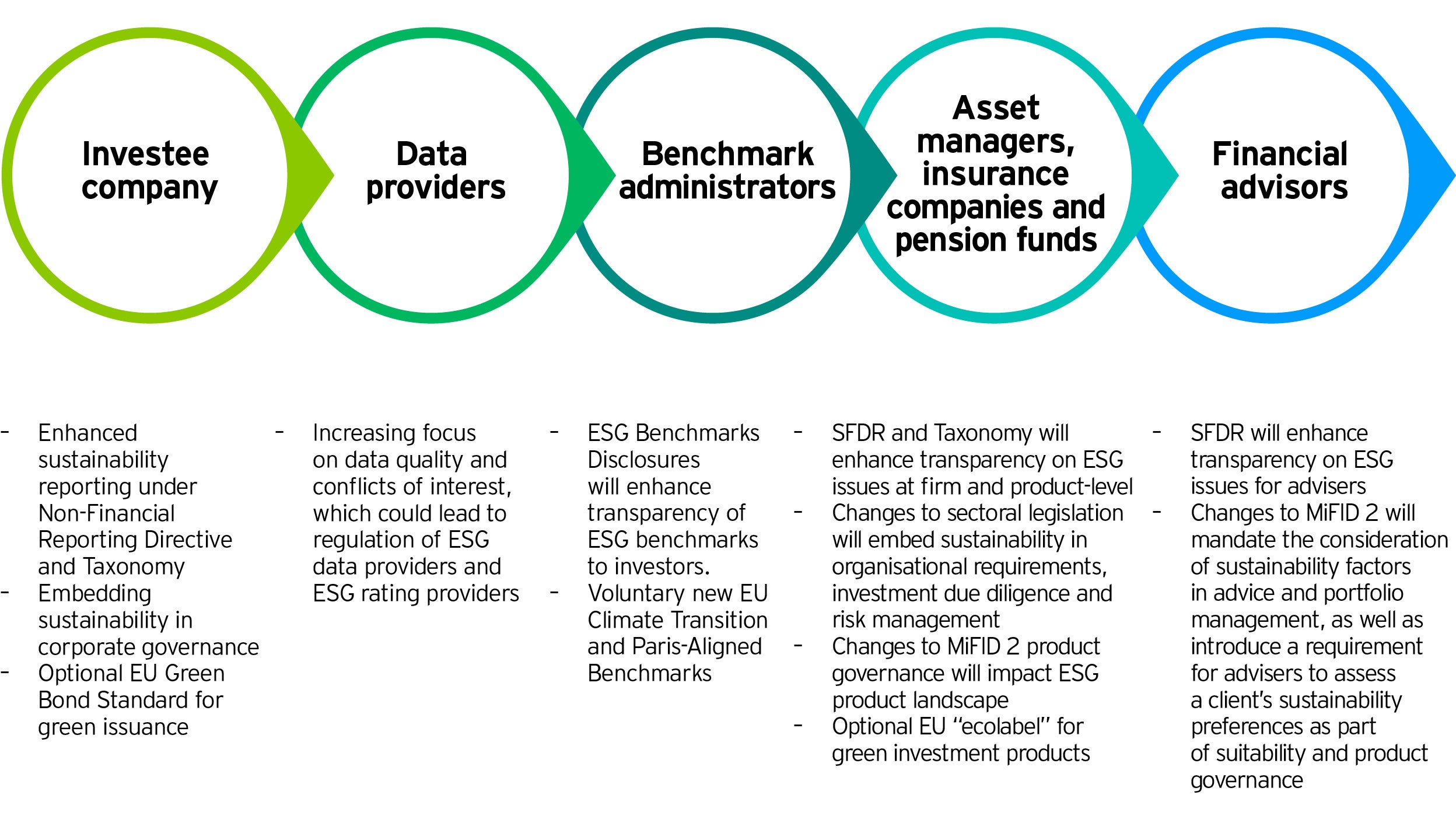

The European Commission’s Sustainable Financial Action Plan, launched in 2018, sets out 10 areas of action grouped under three themes that will lead to regulatory change across the financial services industry value chain:

- re-orient investments towards more sustainable technologies and businesses

- finance growth in a sustainable manner over the long-term

- contribute to the creation of a low-carbon, climate resilient and circular economy.

In our view, it is only by looking across the broad agenda and seeing how the different pieces of the jigsaw fit together that firms can take a strategic approach to the shift towards sustainability.

Timeline:

23 December 2020

Implementation of Climate Benchmarks and ESG Benchmark Disclosure Regulation

10 March 2021

Implementation of Sustainable Finance Disclosures Regulation (based on Level 1 Regulation; except principle adverse impact for firms with more than 500 employees which applies from 30 June 2021 (Article 4(3) &(4) and product-level principal adverse impact disclosures (Article 7) which applies from 30 December 2022)

21 April 2021

Commission to adopt final rules on integration sustainability in for funds, insurance firms and financial advisers and integration sustainability preferences into target market and product governance requirements for product manufacturers and distributors (UCITS, AIFMD, Solvency 2, IDD and MiFID 2) (expected). A proposal for a Corporate Sustainability Reporting Directive was published at the same time

Q2 2021

Adoption of Sustainable Finance Strategy and accompanying legislative proposals

June 2021

EBA report on integrating sustainability for banks and investments firms

December 2021

Implementation of Taxonomy disclosures for climate change

January 2022

Implementation of Sustainable Finance Disclosures Regulation Regulatory Technical Standards

December 2022

Implementation of Taxonomy disclosures for the remaining environmental objectives

To help navigate the increasingly complex regulatory landscape, moving beyond the alphabet soup of regulatory initiatives towards a thematic view across the following four pillars can help firms (such as asset managers, insurance companies, pensions funds and financial advisers) to take a consistent view across the board and understand the interconnectivity between the disclosures required under the SFDR and upcoming regulatory changes that will embed sustainability in the way firms operate:

Click on the above pieces to explore the topics in greater detail, or go back to the hub.

The above article is an excerpt from our recent whitepaper, which you can download in full here: Shifting Gears: Preparing for the new sustainable finance regulations in Europe.

Keep up-to-date

Sign up to receive the latest insights from Invesco’s global team of experts and details about on demand and upcoming online events.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

-

Data as of 31 January 2021 unless stated otherwise.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.