What is the “principal adverse impact” in SFDR?

One of the more novel elements of the Sustainable Finance Disclosures Regulation (SFDR) is the introduction of the concept of “principal adverse impact”. While the concept is ill-defined in the regulation, it is generally interpreted as the negative impact that an investment has on climate change, the environment, social and employee matters, human rights and anti-bribery and anti-corruption.

Firms1 will be required to disclose their due diligence policies in relation to principal adverse impact or explain why they do not do so -- unless the firm has more than 500 employees, in which case they will be required to publish this information by 30 June 2021. The information will need to include:

- information about how the firm identifies and prioritises principal adverse impacts;

- a description of the principal adverse impacts identified and actions taken by the firms to mitigate these impacts;

- a summary of the firm’s engagement policy; and

- any responsible business codes of conducts or internationally recognised standards that the firm adheres to, including, where relevant the degree of alignment with the Paris Agreement.

Financial advisors will also be required to disclose to what extent they consider principal adverse impact in their advisory process and in their product selection process.

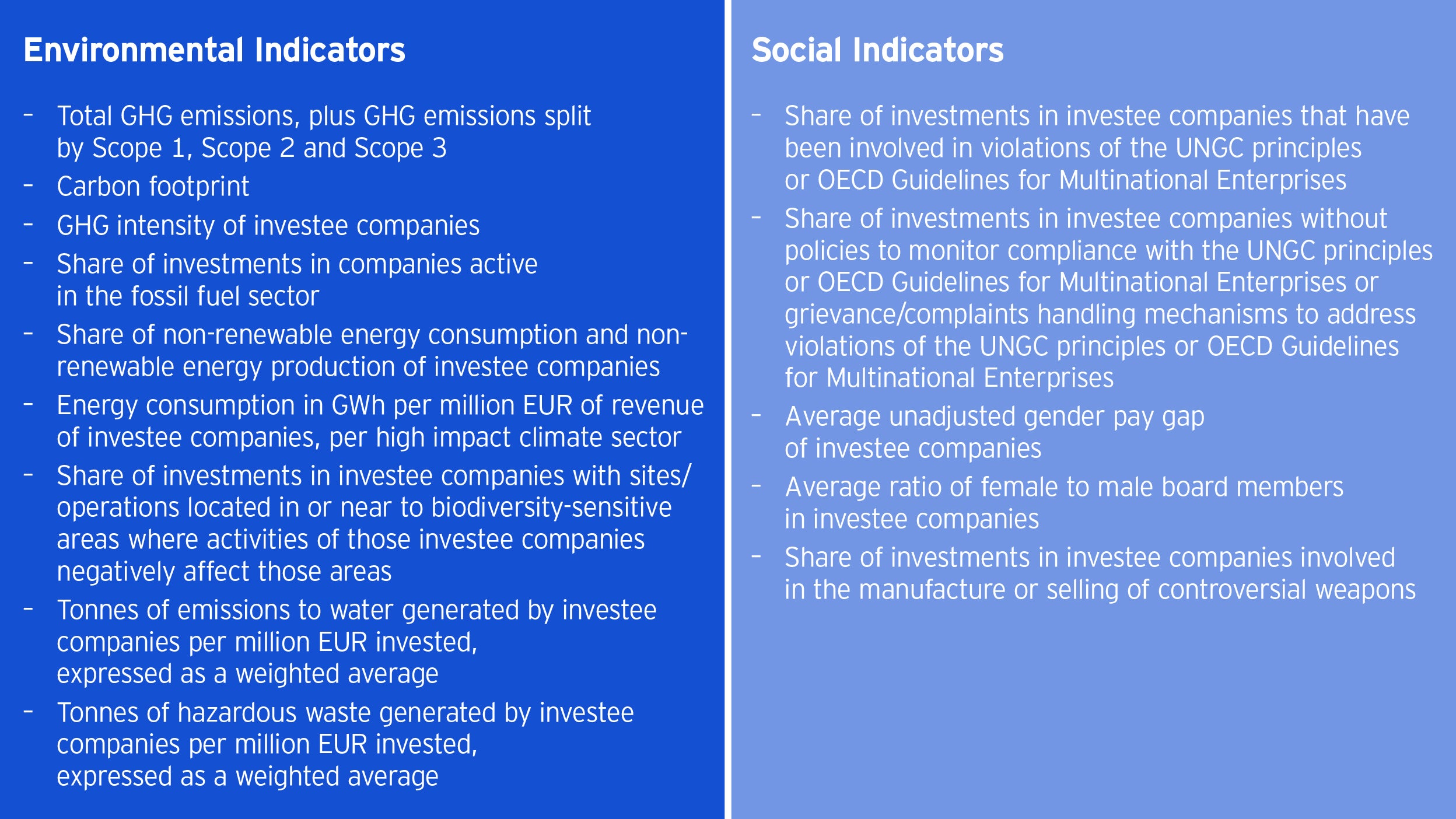

The European Supervisory Authorities have elaborated more detailed requirements that firms will need to comply with from 1 January 2022, including a list of mandatory indicators that firms will need to disclose on an aggregated basis for their assets.

Firms that comply with the above requirements at firm-level (either voluntarily or due to their size) will also be required to disclose at product-level in their pre-contractual disclosures whether and, if so, how their products consider principal adverse impact and provide information in periodic reporting by 30 December 2022. Firms that opt-out of these requirements at firm-level will need to include a disclaimer in their pre-contractual disclosures that they do not comply with these requirements.

Similar to the integration of sustainability risks, the European Commission has announced its intention to turn this disclosure obligation into a binding obligation as part of firms’ investment due diligence, requiring firms to go beyond merely reporting on the mandatory indicators to embedding such data into their investment processes. However, these rules are still awaiting finalisation and therefore implementation is not expected before mid-2022.

Compliance with these requirements is likely to require significant data gathering and aggregation across portfolios in order to comply with the disclosure requirements and, eventually, any due diligence requirements, as well as reviewing existing engagement and proxy voting policies where firms wish to rely on such activities to demonstrate that principal adverse impacts have been taken into account.

The above article is an excerpt from our recent whitepaper, which you can download in full here: Shifting Gears: Preparing for the new sustainable finance regulations in Europe.

ESG regulation: An A-Z guide

Footnotes

-

1 Asset managers, insurance companies, pensions funds and financial advisers.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

-

Data as of 31 January 2021 unless stated otherwise.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.