Invesco Summit Responsible Range

Making responsible investing accessible

Attitudes are changing. Investors are increasingly looking to make a positive contribution to society and the environment through their personal finances, driving us towards a cleaner, healthier and more equitable future.

Responsible investments, which incorporate environmental, social and governance (ESG) considerations into the investment approach, aim to help investors do just that.

Key features

The Invesco Summit Responsible Range is a range of five risk targeted funds which are a low-maintenance, low-cost investment solution aiming to make responsible investing easily accessible for all investors.

The range

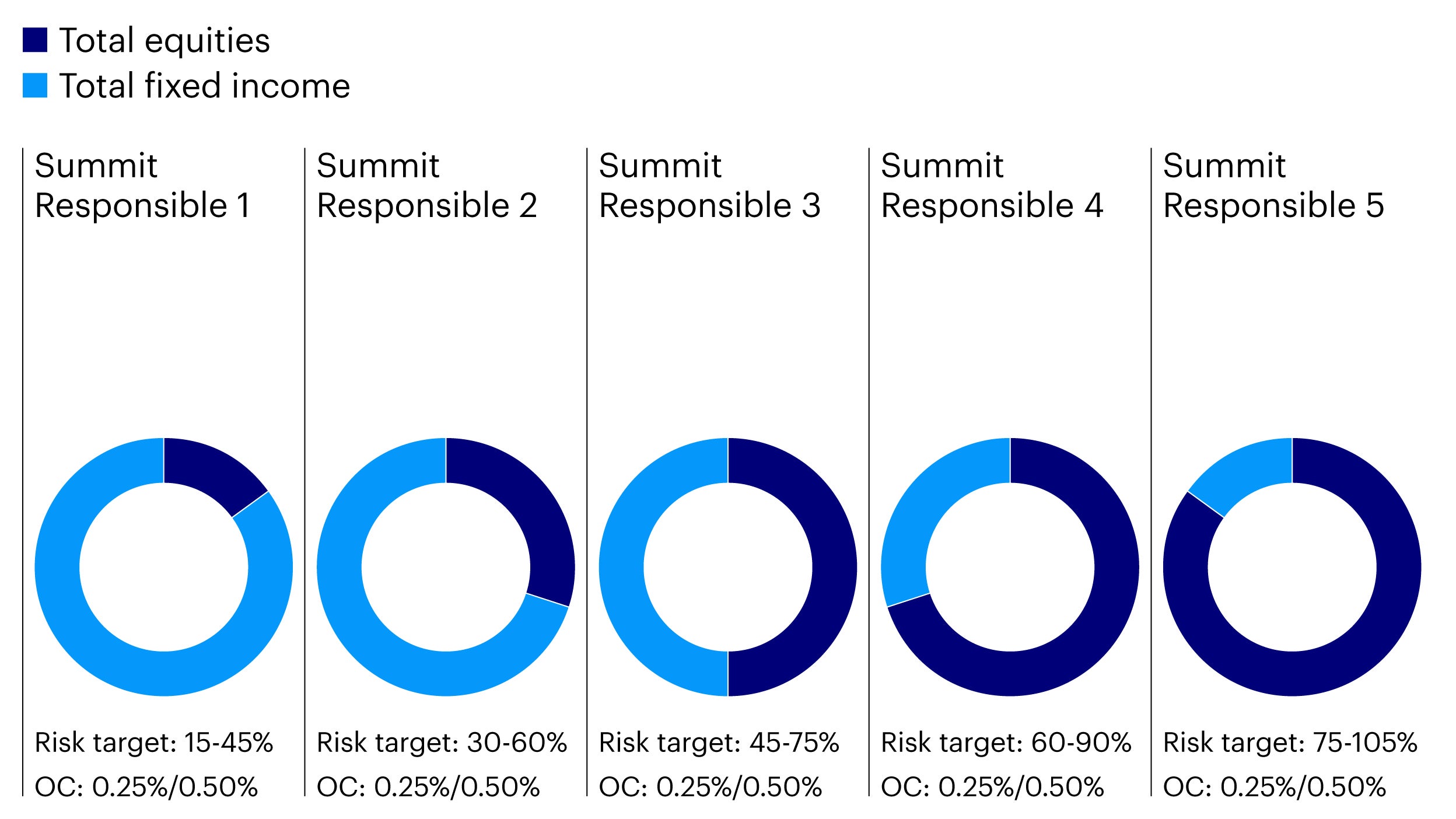

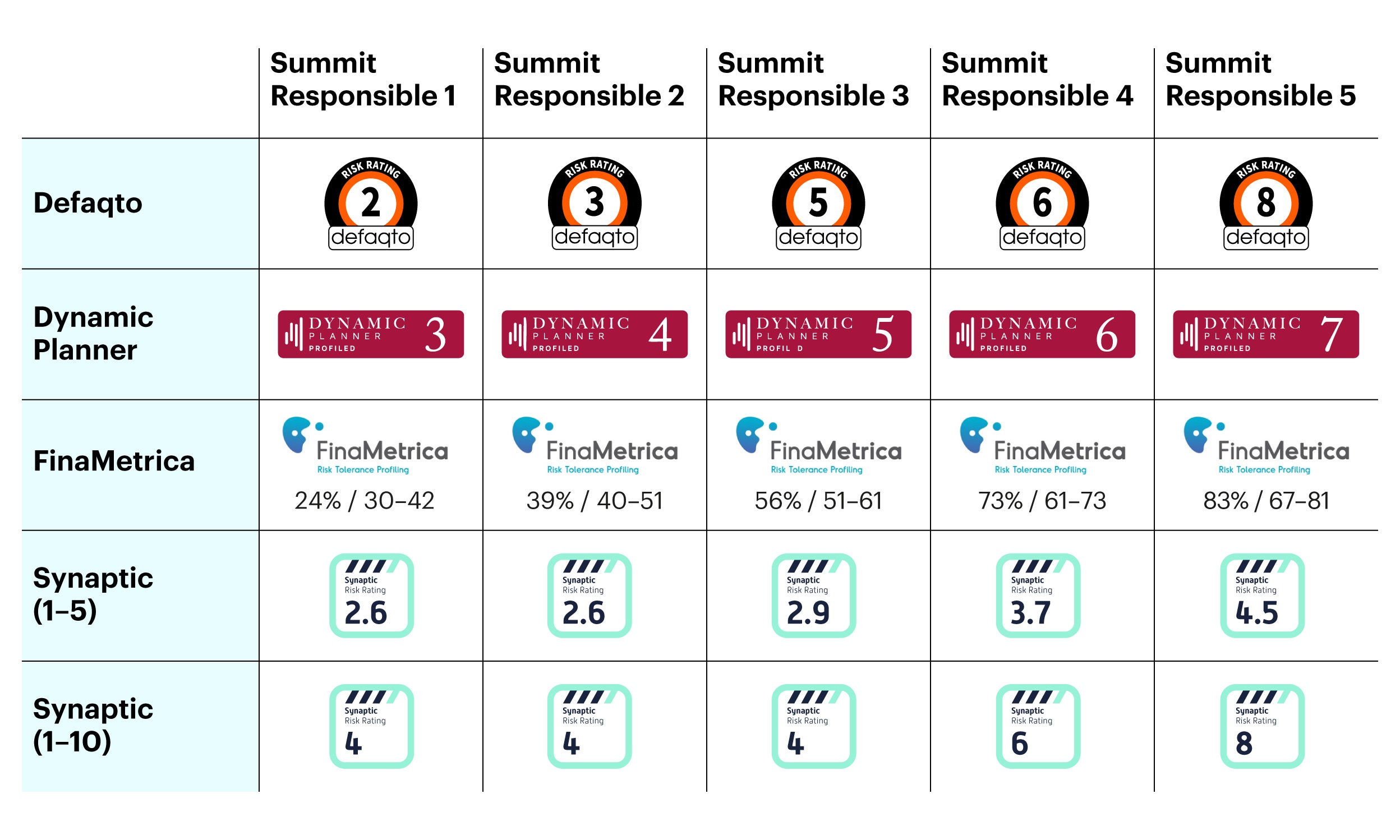

The Invesco Summit Responsible Range is made up of five risk-targeted multi asset funds that intend to invest 100% of their assets in investments meeting certain ESG criteria*, as well as aiming to grow the amount invested over the long term.

Each fund is managed to a different volatility target in order to help you find the one that’s right for your risk and return appetite.

As the funds are made up of exchange-traded funds (ETFs), offering simple and affordable exposure to financial markets, they are also affordable, with an Ongoing Charge* of 0.25% or 0.50% depending on the share class. See our Costs and Charges document for details of all fund charges.

For illustrative purposes only. Risk targets are relative to the MSCI AC World index. There is no guarantee that these risk targets will be met. OC = Ongong Charge. The Ongoing Charge is a fixed rate and covers the majority of the operating costs of the funds incurred over a year including, but not limited to, fees paid for investment management and administration, custodian fees, depositary fees and audit and legal fees. The Ongoing Charge excludes Indirect Ongoing Costs, Other Ancillary Costs and Portfolio Transaction Costs. For a full breakdown of charges that apply to each share class of our funds, please refer to our ICVC Costs & Charges document.

100% ESG objective*

15-105 % of global equity volatility

0.25% Ongoing Charge (Z share class, platform)¹

What is ESG?

ESG stands for environmental, social and governance, which are three key categories of considerations often used to help determine how responsible an individual investment is.

- Environmental criteria relate to how well a company or country contribute to the preservation of the natural world – includes issues like climate change, waste, pollution and consumption of natural resources.

- Social criteria measure a company or country’s relationship with customers, employees, suppliers and local communities – includes issues like human rights, data protection, customer satisfaction and diversity.

- Governance criteria focuses on how well aligned a country or company is to the needs of their stakeholders – includes issues like whistle-blower schemes, corruption, lobbying, board composition and compensation

To learn more about responsible investing and for extra support, please explore our additional materials below:

Our ESG credentials

We understand that ESG will only continue to grow in importance, and so being able to clearly evaluate the measures that determine it is an essential part of assessing alignment and progress.

Compared to broad-based, non-ESG equity and fixed income indices2, as at 31 December 2023 the Summit Responsible Range provided a 6.3% higher ESG quality score: the average weighted value of all ESG criteria.

All data as at 13 March 2024.

How we invest

The Invesco Multi-Asset Strategies team uses a simple, three-step investment process when managing the Summit Responsible Range.

1. Responsible Asset Allocation

Selecting the underlying investments to ensure that they provide an overall improvement in the ESG quality score of the funds, as well as adequate exposure to global financial markets.

2. Strategic Asset Allocation

3. Tactical Asset Allocation

The team

The Invesco Summit Responsible Range is managed by David Aujla and Georgina Taylor, with the input from the global ESG team.

David and Georgina are part of the wider Multi-Asset Strategies (MAS) team, which is made up of over 170 investment professionals. Their skills combine to cover every aspect of multi asset investing, and they are responsible for managing just over £110bn in multi asset portfolios.

Georgina Taylor, Head of Multi Asset StrategiesResponsible investing is becoming more and more relevant to our clients. We have pioneered Responsible Asset Allocation as a separate step to a traditional Multi Asset investing process, bringing ESG to the front and centre of our focus. With this development, and by bringing the broad expertise of Invesco together, we are pleased to present a robust and responsible investment solution to meet those client needs.

Multi Asset insights

Multi Asset Tactical asset allocation views | Help on the way?

The Multi Asset Strategies UK team provides its tactical asset allocation views over a 12 to 36-month investment horizon. Find out why our view of fixed income is still constructive.

Multi Asset The big headlines: Quarter 4 2024

In this regular piece, we summarise the key headlines from the quarter that have impacted investment performance.

ESG insights

How to align ESG intentions with results: an introduction to new Invesco research

New white papers highlight the challenges that ESG investors and portfolio managers face in implementing ESG investment mandates.

Our research on client perceptions of ESG investing

Invesco recently surveyed 161 financial advisers and 201 advised investors to get their views on ESG and found a considerable and widespread appetite for these strategies.

Understanding ESG

Responsible investing has become an increasingly significant consideration for investors in recent years, but it’s still the cause of much confusion. Complete our training to support your understanding and earn structured CPD.

-

Footnotes

*Invesco Summit Responsible funds aim to invest 100% of their assets (excluding cash) in investments meeting certain ESG criteria. Further information can be found in the Prospectus and Key Information Document.

1 The Ongoing Charge is a fixed rate and covers the majority of the operating costs of the funds incurred over a year including, but not limited to, fees paid for investment management and administration, custodian fees, depositary fees and audit and legal fees. The Ongoing Charge excludes Indirect Ongoing Costs, Other Ancillary Costs and Portfolio Transaction Costs. For a full breakdown of charges that apply to each share class of our funds, please refer to our ICVC Costs & Charges document.

2 The indices used for comparison are the MSCI AC World Index GBP (Net Total Return) for equity, Bloomberg Barclays Global Aggregate Index GBP Hedged (Total Return) for broad fixed income and Bloomberg Barclays Global Aggregate Corporate Index GBP Hedged (Total Return) for credit.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

The Invesco Summit Responsible Range has the ability to use derivatives for investment purposes, which may result in the funds being leveraged and can result in large fluctuations in the value of the funds.

The funds' risk profiles may fall outside the ranges stated in the investment objectives and policies from time to time. There can be no guarantee that the funds will maintain the target level of risk, especially during periods of unusually high or low market volatility.

The funds may be exposed to counterparty risk should an entity with which the funds do business become insolvent resulting in financial loss.

The securities that the funds invest in may not always make interest and other payments nor is the solvency of the issuers guaranteed. Market conditions, such as a decrease in market liquidity for the securities in which the fund invests, may mean that the fund may not be able to sell those securities at their true value. These risks increase where the fund invests in high yield or lower credit quality bonds.

The funds invest in emerging and developing markets, where there is potential for a decrease in market liquidity, which may mean that it is not easy to buy or sell securities. There may also be difficulties in dealing and settlement, and custody problems could arise.

The use of ESG criteria may affect the product’s investment performance and therefore may perform differently compared to similar products that do not screen investment opportunities against ESG criteria.

Important information

All information as at 31 December 2023 and sourced by Invesco, unless otherwise stated.

Views and opinions are based on current market conditions and are subject to change.

For the most up to date information on our funds, please refer to the relevant fund and share class-specific Key Information Documents, the Supplementary Information Document, the financial reports and the Prospectus, which are available on our website.