Tactical asset allocation views | Help on the way?

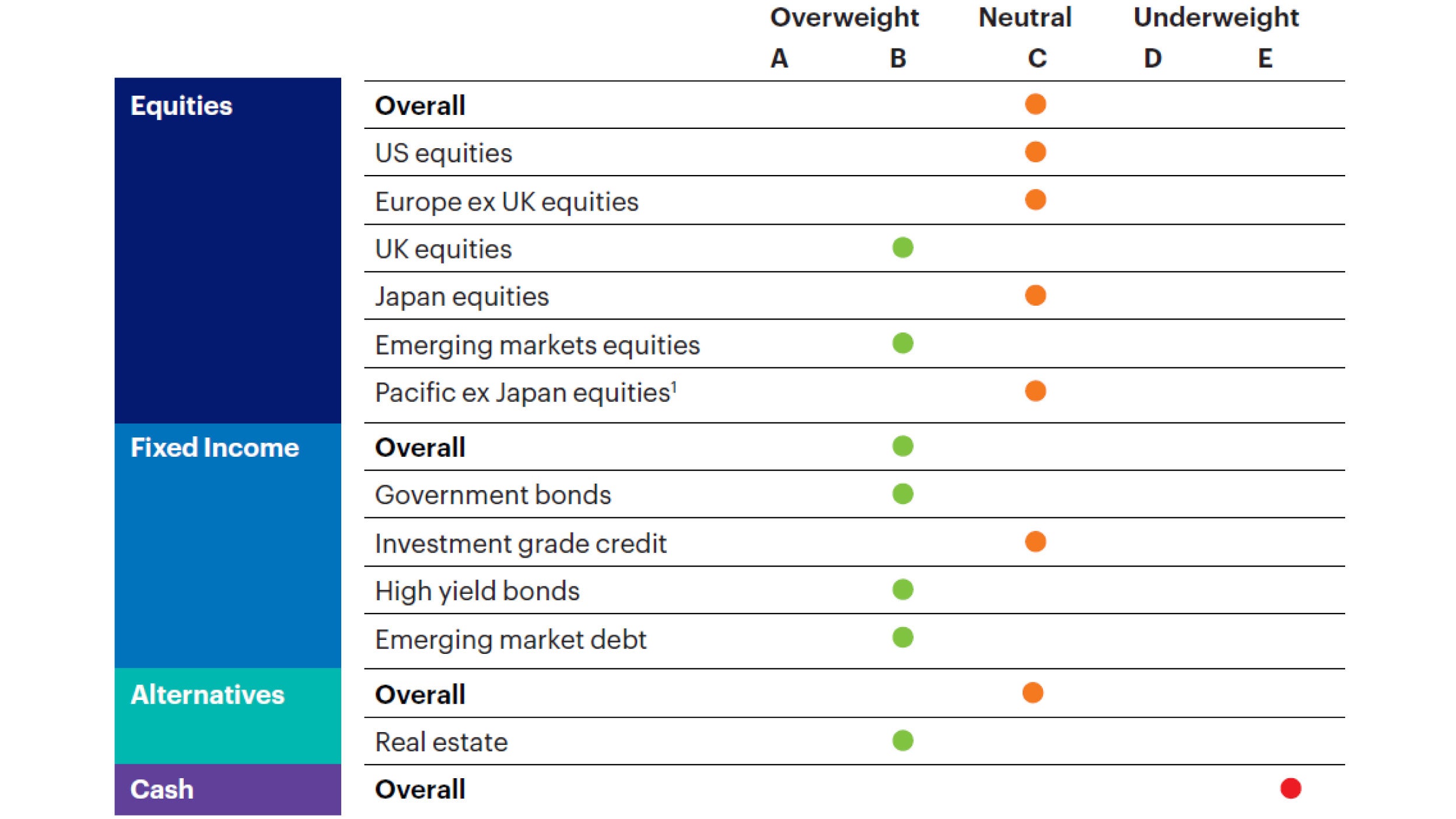

Each quarter, the Multi Asset Strategies UK team shares its tactical asset allocation views, providing an A-E rating for each asset class over a 1–3-year investment horizon. These views inform the management of the Summit Growth and Summit Responsible fund ranges.

Macro outlook

We believe that we are still in a constructive phase of the investment cycle, with evidence of policy relief and disinflation alleviating economic growth concerns.

While we acknowledge concerns around economic growth, recent evidence suggests that the global economy and corporate sector remains reasonably resilient. Furthermore, corporates and households are in reasonably good shape, particularly in the US, given they ‘termed-out’ debt at low interest rates during Covid.

Many US corporates are actually beneficiaries of higher interest rates due to the high levels of cash they have on their balance sheets, and the consumer still has some excess savings and has benefitted from a strong domestic equity market. The housing market is also much less sensitive to interest rates than it was 15 years ago.

With disinflation a feature across most major economies, many central banks are now expected to cut interest rates within our investment window of one-to-three years. This should be supportive for asset prices generally, barring a major recession – which is not our central case.

Against this backdrop, we share our tactical asset allocation views. Overall, these remain unchanged from last quarter, despite the strong performance seen in the last weeks of 2023.

David Aujla, Multi Asset Fund ManagerWith disinflation a feature across most major economies, many central banks are now expected to cut interest rates within our investment window of one-to-three years. This should be supportive for asset prices generally.

Asset class views: we currently favour fixed income, but are finding good opportunities in some equity markets

- Fixed income: Fixed income overall remains “overweight”, with good yields still on offer across bond markets despite the year-end rally.

- Equities: Our view of equities remains ‘neutral’ overall. However, we do see some good opportunities within parts of the asst class. For example, UK and emerging market equities appear to be offering good value, with both markets at multi decade lows in valuation terms relative to global equities.

- Cash: We remain negative on UK cash, despite the high yields on offer, as we believe rate cuts will start within our tactical time frame.

- Alternatives: We remain neutral on alternatives overall, as we believe traditional asset classes are offering better value at present. However, we have a positive outlook for real estate investment trusts, and believe they will benefit from policy loosening over our investment timeframe.

Source: Invesco, as at 31 December 2023. 1Developed Asia. *Indicates an upgrade or downgrade.

Download the PDF report to read our views in full. We discuss the macro backdrop and share insights on various regions and asset classes.

Globally diversified

In a world where diversification is hard to find, it's important we access a broad range of investments to deliver returns for our clients. Explore our fund ranges below.

FAQs

Active investors can analyse markets and economies and make forecasts on how they will behave. Based on these forecasts, they can adjust the balance of their portfolio to increase exposure to one region or asset class over another. This is called “tactical asset allocation”, as it involves making a tactical move in response to a particular market opportunity.

Different assets behave in different ways over the course of a full market cycle. For example, historically, bond prices have typically risen when equity prices have fallen (and vice versa).

If you are able to accurately forecast where markets are going, you can increase your exposure to those assets that are likely to perform best.

In a nutshell, “strategic” is long term whereas “tactical” is short term.

Before building a portfolio, you will set a strategy at the very outset. For example, “I want to achieve income and capital growth over a period of 10 years, and I believe that investing 60% of my portfolio in stocks and 40% of my portfolio in bonds will allow me to achieve this”.

Within these parameters, you might make tactical (or short-term) decisions based on market conditions. For example, “Within my 40% bond allocation, I’m going to shift the balance away from high yield credit towards government bonds, because I think we’re heading towards a recession and so I would like greater exposure to ‘safer’ assets”.

You’ve probably heard the saying: "don’t put all your eggs in one basket". This phrase neatly sums up one of the golden rules of investing – diversification.

Diversifying your investments across asset classes and geographies is the best way of controlling risk, as it helps smooth the ups and downs of financial markets. This way, one or two bad eggs shouldn’t have too much of a negative impact on your overall portfolio.

Related insights

Inside the markets | Multi-Asset review

Looking at market trends, political developments, the macroeconomic landscape and the impact it has on market volatility, stay ahead with expert commentary.

The big headlines | Quarter 1 2025

In this regular piece, we summarise the key headlines from the quarter that have impacted investment performance.

November 2024 MPS Market Review

Donald Trump completed an historic comeback in November as both he and his Republican Party swept the board in the US Presidential and Congressional elections.

Investment risks

-

The value of investments and any income will fluctuate. This may partly be the result of exchange rate fluctuations. Investors may not get back the full amount invested.

Important information

-

All data is provided as at 31 December 2023, sourced from Invesco unless otherwise stated.

This is marketing material and not financial advice. It is not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication.

Views and opinions are based on current market conditions and are subject to change.