Markets and Economy Will high tariffs push the US into recession?

As a trade war rages, a massive market sell-off in the US and around the world raises many questions for investors.

In the U.S., market perceptions of inflation have changed due to recent data points suggesting inflation is more persistent than expected.

But inflation isn’t the only area where perceptions are changing — recent data indicates that the U.S. economy is stronger than many expected.

Right now, it seems the inflation data matters more given how laser-focused the Fed is on tamping down inflation.

Vladimir Lenin once said, “There are decades where nothing happens; and there are weeks where decades happen.” That’s true of geopolitics, but I also think it can be applied to inflation. The last several weeks have been more like decades when it comes to inflation – both the perception and the reality.

In the U.S., market perceptions of inflation have changed due to recent data points suggesting inflation is more persistent than expected:

The most concerning part of the PCE report was core services ex-housing, which rose 0.58% month over month — one of its most substantial monthly increases.1 This component of inflation has become a major concern for the U.S. Federal Reserve (Fed) — in the February Federal Open Market Committee meeting minutes, participants articulated worries that inflation isn’t slowing enough in core services ex-housing, and that upward pressures on this component could continue because the labour market is very tight.

These data points changed market perceptions of inflation — and expectations for monetary policy tightening. Fed funds futures reflect this significant change: on Feb. 2, fed funds futures contracts indicated an expected terminal rate of 4.88% by August.2 But after receiving this trio of inflation indicators, fed funds futures indicated a terminal rate by August of 5.4% as of Feb. 24.2

But inflation isn’t the only area where perceptions are changing — recent data indicates that the U.S. economy is stronger than many expected.

It all started with that same January jobs report released on Feb. 3, showing far higher non-farm payrolls than expected. Other data points have corroborated the view that the U.S. economy is more resilient.

In remarks last week, St. Louis Fed President James Bullard explained, “It kind of seems like the U.S. economy might be more resilient than markets thought, let’s say, six to eight weeks ago.”5

What we’re seeing is a double-edged sword: The U.S. economy is in better shape than we expected, but inflation is in worse shape than we expected. So what matters more? Right now, it seems the inflation data matters more given how laser-focused the Fed is on tamping down inflation. That’s why as of Feb. 2, the S&P 500 Index had risen more than 8% year-to-date as rates fell, driven by tech stocks that are very sensitive to rates.6 Since then, the S&P 500 has given back a lot of those gains as markets have anticipated a more hawkish Fed.

This phenomenon is not isolated to the United States. We are also seeing the same situation in the eurozone; the economy is stronger than expected — but so is inflation.

So how do we make sense of this? I think this is likely a short-term phenomenon, with spending and prices heating up with unusually warm weather in colder parts of the U.S. and Europe. Downward pressure is likely to be exerted on both economic growth and prices, as the lagged effects of monetary policy tightening work their way through these economies. That doesn’t mean that growth and inflation will deteriorate quickly; I think it may be slower to moderate, but I expect it to ultimately move in the right direction.

The 10-year U.S. Treasury yield has risen back toward 4.00% rapidly over the last several weeks which, as I pointed out above, has exerted downward pressure on stocks.10 However, there may be a silver lining to be found in the higher 10-year yield.

As my colleague Paul Jackson pointed out, more than two-thirds of the gain has come from the “real” or inflation-adjusted component of the 10-year yield, which is represented by the Treasury Inflation-Protected Securities yield (the TIPS yield has moved from an early-February low of 1.15% to 1.58% last week).11 According to Paul, this suggests the rise in 10-year yields has more to do with optimism about the economic cycle, rather than concerns about inflation.

So markets are currently pricing in additional rate hikes and a further tightening of financial conditions, and this could, of course, lead to a continued near-term retracement of previous gains. However, I don’t expect actual tightening to be dramatically higher than what was expected back in January. Ultimately, I expect inflation to moderate and the Fed to end its tightening cycle, creating an improved backdrop for risk assets.

However, it might be a bumpy road over the next several months before we get there, with more defensive components of the market performing better. But keep in mind that as quickly as sentiment changed over the last several weeks, it can change again. That’s life in a data dependent world. Buckle up and stay diversified.

Source: U.S. Bureau of Economic Analysis, as of Feb. 24, 2023

Source: Bloomberg, L.P., as of Feb. 24, 2023

Source: S&P Global Markit, as of Feb. 21, 2023

Source: Federal Reserve Bank of Chicago, as of Feb. 23, 2023

Source: MarketWatch, “Fed’s Bullard: Markets have overpriced a recession,” Feb. 22, 2023

Source: Bloomberg L.P., Jan. 1, 2023, Feb. 2, 2023

Source: S&P Global Markit, as of Feb. 21, 2023

Source: Eurostat, as of Feb. 24, 2023

Source: Bloomberg News, “Euro-Area Core Inflation’s Refusal to Slow Set to Worry ECB,” Feb. 24, 2023

Source: Bloomberg, L.P.

Source: Refinitiv Datastream, as of Feb. 24, 2023

As a trade war rages, a massive market sell-off in the US and around the world raises many questions for investors.

With policy uncertainty rattling markets and consumer sentiment, it’s important to remember the market's long-term growth throughout its history.

There are signs of softening global growth prospects and rising economic policy uncertainty, plus a tectonic shift in fiscal stimulus around the globe.

NA2760664

Important information

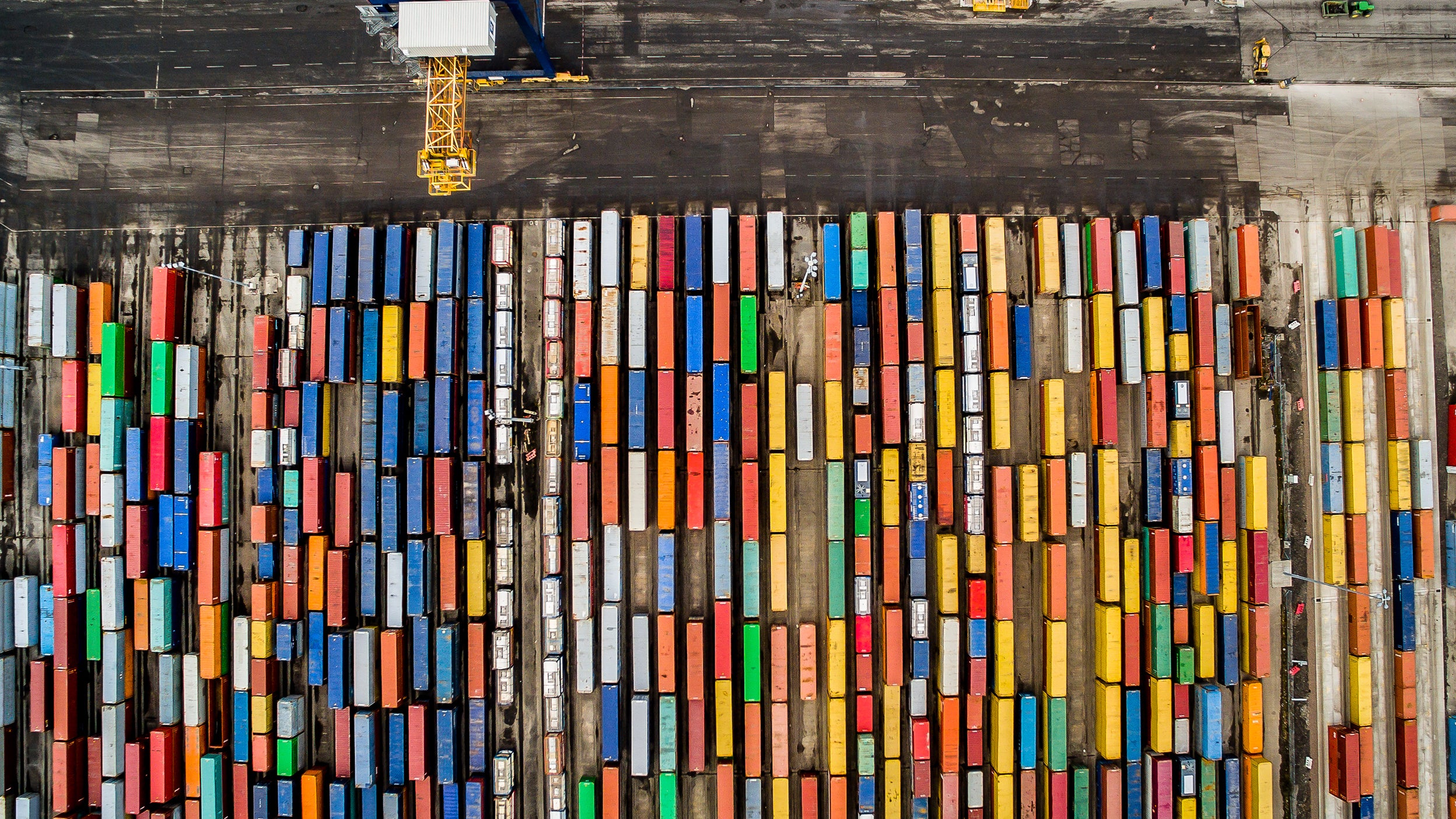

Header image: Andy Campbell

Some references are U.S. centric and may not apply to Canada.

Diversification does not guarantee a profit or eliminate the risk of loss.

Past performance is not a guarantee of future results.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions.

All investing involves risk, including the risk of loss.

An investment cannot be made directly into an index.

The Consumer Price Index (CPI) measures change in consumer prices as determined by the U.S. Bureau of Labor Statistics. Core CPI excludes food and energy prices while headline CPI includes them.

Personal consumption expenditures (PCE), or the PCE Index, measures price changes in consumer goods and services. Expenditures included in the index are actual U.S. household expenditures. Core PCE excludes food and energy prices while headline PCE includes them.

Purchasing Managers’ Indexes (PMI) are based on monthly surveys of companies worldwide, and gauge business conditions within the manufacturing and services sectors.

The flash PMI estimates are designed to provide an accurate advance indication of the final PMI data.

The U.S. Employment Situation Report is published monthly by the U.S. Bureau of Labor Statistics to track changes in employment and wages.

The Chicago Fed National Activity Index is a monthly index designed to gauge overall economic activity and related inflationary pressure.

The federal funds rate is the rate at which banks lend balances to each other overnight. Fed funds futures are financial contracts that represent the market’s opinion of where the federal funds rate will be at a specified point in the future.

The terminal rate is the anticipated level that the federal funds rate will reach before the U.S. Federal Reserve stops its tightening policy.

Tightening is a monetary policy used by central banks to normalize balance sheets.

The Federal Open Market Committee (FOMC) is a 12-member committee of the Federal Reserve Board that meets regularly to set monetary policy, including the interest rates that are charged to banks.

The Deutsche Bundesbank is the central bank of the Federal Republic of Germany.

Treasury Inflation-Protected Securities (TIPS) are U.S. Treasury securities that are indexed to inflation.

Fixed-income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating.

In general, stock values fluctuate, sometimes widely, in response to activities specific to the company as well as general market, economic and political conditions.

The opinions referenced above are those of the author as of Feb. 27, 2023. These comments should not be construed as recommendations, but as an illustration of broader themes. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

This link takes you to a site not affiliated with Invesco. The site is for informational purposes only. Invesco does not guarantee nor take any responsibility for any of the content.