Market Conversations: Is artificial intelligence coming for our jobs?

In this episode, we look at what artificial intelligence (AI) can and can’t do and discuss three types of companies that may benefit from this technology.

We aim to deliver unparalleled and pure access to some of the most exciting and innovative investment growth opportunities in the market today.

Our thematic ETFs focus on four key sectors across AI and energy transition with strategies and companies that are distinctive in the current market1.

Morningstar’s energy transition index and generative AI portfolios are currently outperforming traditional energy indexes and large cap stock benchmarks2.

Thematic investing focuses on forward-looking themes and go beyond traditional sector buckets, possibly providing greater precision by focusing on industries relating to an important trend or economic force. Invesco provides ETFs, along with timely insights, to help you gain exposure to themes that are top of mind. Discover our strategies that are tapping into the trends shaping our future.

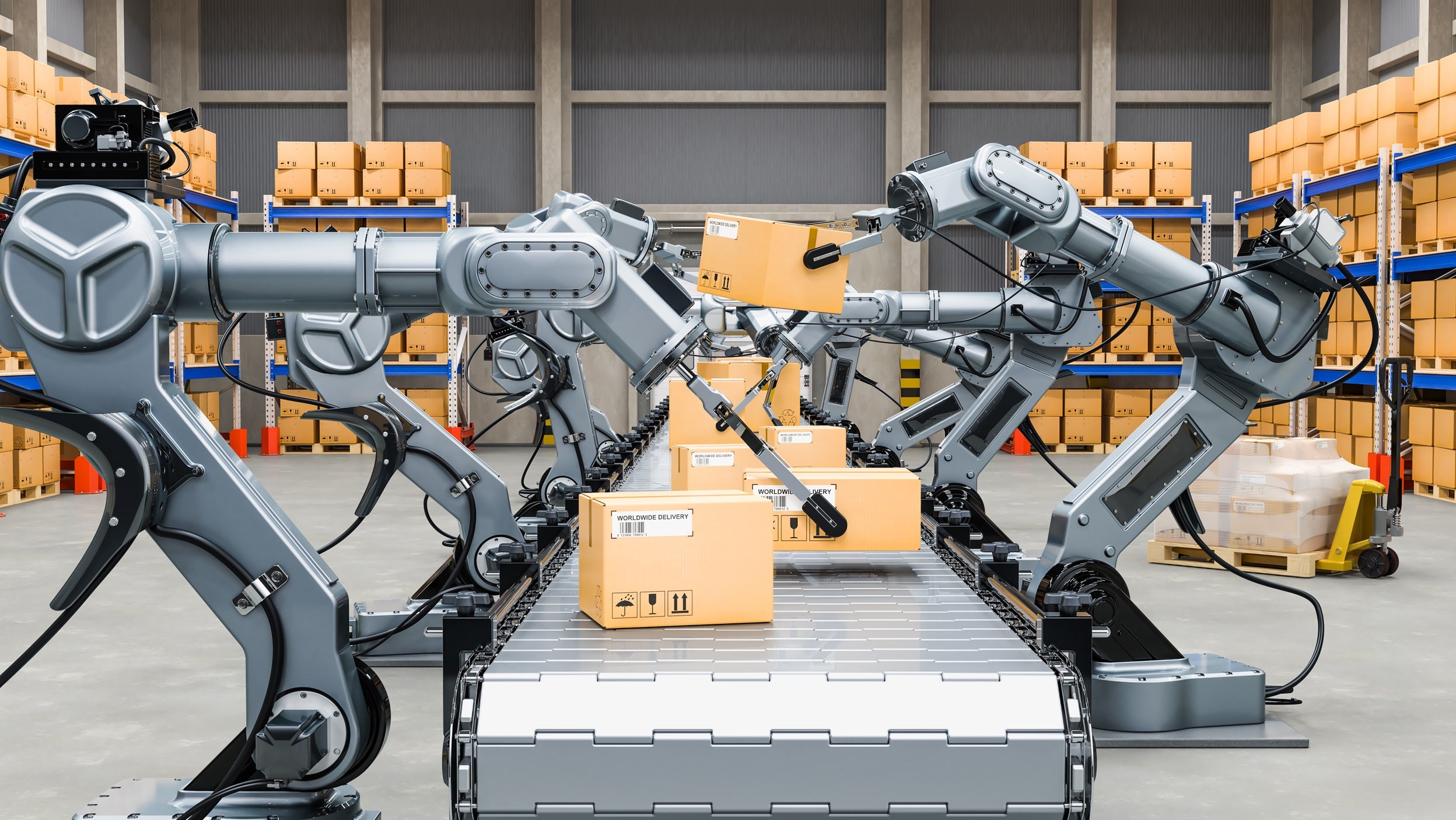

AI computing power, productivity, logic parameters and adoption continue to increase at staggering rates, and generative AI solutions – such as ChatGPT - have emerged as the next frontier in cognitive computing.

The Invesco Morningstar Global Next Gen AI Index ETF provides access to players in AI infrastructure management, data stewardship, semi-conductor & chip manufacturing, software services and more.

Energy transition refers to the shift from fossil-based systems to renewable methods. Renewable energy is expected to make up over 60% of U.S power generation by 20303, and has emerged as the cheapest source of electricity generation4.

As economies move towards these alternative sources, the Invesco Morningstar Global Energy Transition Index ETF exposes investors to organizations in the renewable energy, energy storage, hydrogen energy and carbon capture technology sectors.

Invesco and Morningstar’s partnership and mission is to provide investment offerings focusing exclusively on leading edge technology sectors. Combining Invesco’s strengths in ETFs with Morningstar’s experienced analysts and methodology, we seek to deliver exposure to innovative companies with long-term growth potential, in advance of mainstream market adoption.

Invesco Morningstar solutions invest in themes, while targeting the stocks of companies that are well positioned to benefit. The portfolio is however dynamic and with its’ forward-looking approach may expand into new themes based on Morningstar’s equity research teams insights.

Thorough, standardized scoring processes identify companies from across the supply chain that are well-positioned to benefit from the theme. Rules-based methodology brings transparency and discipline to the portfolio construction process, translating fundamental inputs into replicable indexes. Lastly, a forward-looking framework incorporates insights from experienced research analysists to assess how heavily the theme will impact a company’s future revenue and net profits.

Thematic ETFs can help diversify your market cap-weighted core equity strategies, and complement your individual stock portfolios.

Add these ETFs to your portfolio according to your own risk profile, goals and that of your clients.

Give us a call or connect with us below to learn more. You can also explore our ETF strategies, and full lineup of ETF products.

Investing on your own? You can find Invesco ETFs on your trading platform of choice, or consult your financial professional.

The markets are evolving and investing in thematic ETFs provide initial controlled exposure to game-changing industries and companies who are at the forefront of innovation

Generative AI and Energy ETFs offer access to companies who are reimagining the future and are positioned for long-term growth.

Thematic ETFs, often seen as providing more differentiated, less correlated sources of return, can capture the evolutions of every evolving leading-edge investment themes.

The products leverage forward-looking insights from Morningstar equity analysts in order to provide a high degree of thematic purity.

This differs from lower-touch thematic index construction approaches, such as relying on historical revenue figures or keyword searches across public filings. However, due to the index’s transparent, rules-based construction methodology, it also differs from strategies that employ more “active” approaches to stock selection.

In the US, 77% of assets under management in the large cap core space are passively managed. In the emerging markets, passively managed assets account for just 37% of the total5.

The index is reconstituted and rebalanced once per year, after the close of the market on the third Friday of December.

Market Conversations: Is artificial intelligence coming for our jobs?

In this episode, we look at what artificial intelligence (AI) can and can’t do and discuss three types of companies that may benefit from this technology.

What is going on with Chinese equities?

Absent any major reforms, China’s economic growth is expected to be slower — but also higher in quality with competitive discipline, improved capital allocation and growing consolidation.

Explore how our wide variety of ETFs can be cost-effective tools for building strong, tax-efficient portfolios that help you invest in new possibilities.

Trust Invesco to access the world’s largest economy and some of the most recognized and high-performing companies.

A rotational strategy that seeks to anticipate changes in the business cycle, incorporating factors expected to outperform in each market regime.

Want to learn more? Get in touch with our Invesco experts dedicated to supporting your investment goals and tailoring solutions to meet your needs.

NA3849110

Any statement that necessarily depend on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus. The views and opinions expressed are those of the authors at the time of publication, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals. There is no guarantee that these views will come to pass.