Sustainable investing in China fixed income: Why China

This is the first of a four-part blog series that seeks to demystify China’s sustainable investing landscape for fixed income. In this first blog we outline the importance of China’s role in sustainable investing. In subsequent blogs we will cover how China’s taxonomy is aligning with international standards, which thematic investing opportunities may currently exist in China, and how the country's sustainability labelled bond market has evolved over time.

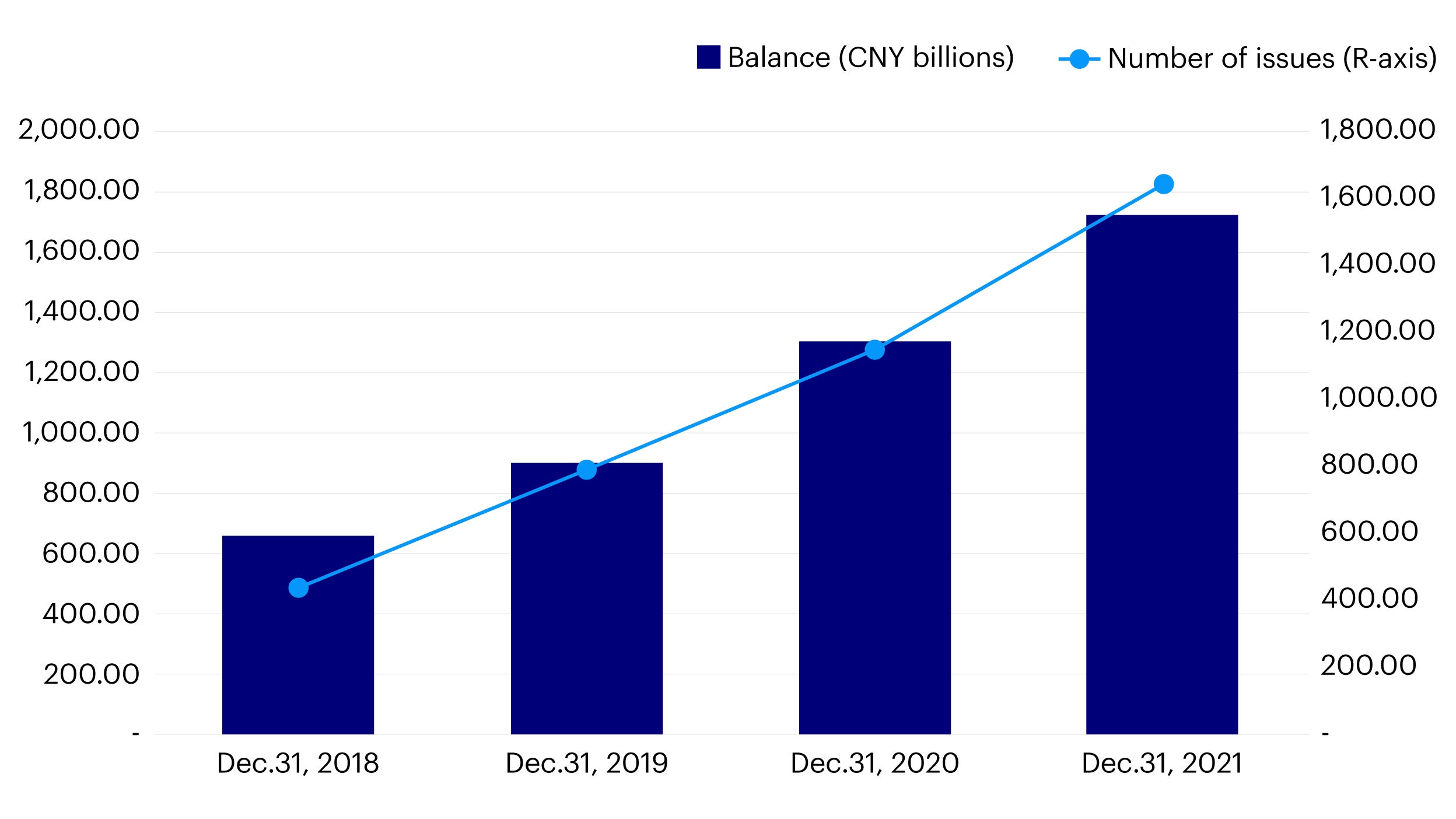

We believe that the time has come where ESG investing in China is increasingly a why not moment. China has been a strong advocate to promote sustainable finance and decarbonization efforts. The country’s ESG standards have been aligning with international ESG standards at a rapid pace. Concurrently, China is undertaking one of the largest energy grid transformations towards renewable energy globally. Home to the world’s second largest green bond market, there were over US$270 billion of green bonds outstanding as at the end of 2021.1 As such, we believe there are opportunities in ESG investing in China fixed income for investors that are searching for impact opportunities and financial return objectives.

Source: Wind, data as of December 2021.

China’s alignment with international ESG standards

In recent years, China’s ESG standards have been aligning with international standards more rapidly than ever. This is expected to accelerate the pace of cross border flows into sustainable finance. The EU China Common Ground Taxonomy (CGT) released in November 2021 aims to create a harmonization of global taxonomies that can be used as a reference for other regions and countries which are developing taxonomies. Hong Kong, for instance, announced a plan to align with the CGT in December 2021.2 A key implication of the EU China CGT would be stimulating cross border financial flows in developing and labelling green financial products. For example, European issuers will be able to issue green bonds in China under the CGT and Chinese issuers can likewise issue green bonds in the European Union under the same taxonomy. We will explore this topic further in our second blog.

China is delivering the biggest shift to renewable energy in absolute terms globally

China is in the midst of a rapid scale up of renewable capacity that is unparalleled globally. Since 2015, China renewable energy capacity has surpassed that of Europe.3 China is now the world’s dominant supplier of solar modules, wind turbines, and lithium-ion batteries.4 The rate of change has been unprecedented, for example, total new offshore wind power brought online in China during 2021 was 1.6 times the total UK offshore wind capacity.5 Non-fossil fuel energy is expected to make up around 17.3%6 of total energy production in 2022 and is expected to increase to 80% by 2060.7 This will be integral for the development of green hydrogen infrastructure. As of late March, the National Development and Reform Commission (NDRC) put in place a plan to develop the country’s hydrogen supply chain over the next decade.8

China’s carbon neutrality targets represent a significant investment opportunity for fixed income investors

According to McKinsey, China needs to spend around 5.2% of its annual GDP from 2021 to 2050 to reduce emissions and develop low emissions energy sources in order to meet the Network for Greening the Financial System (NGFS) Net Zero 2050 scenario.9 In the same vein, the International Energy Agency (IEA) has forecast that China’s annual spending on the energy sector will reach US$640 billion by 2030 in order to achieve peak carbon emissions by this time, a 60% increase over recent years.10 This transition represents a significant investment opportunity for fixed income investors. We expect more green bond issuers to emerge across a wide range of sectors in both the private and sovereign space. In addition, we expect further innovation in sustainable bond formats such as China’s carbon neutrality bond format which is being viewed by some as a darker green bond given its stricter use of proceeds. We also expect more issuers to release net zero commitments and transition plans to align with the Chinese government’s targets of 2030 peak carbon and 2060 carbon neutrality. We will further explore the thematic ESG investment opportunities that exist in China in our third blog.

In conclusion, we believe that there is scope for China to become a core holding of any investor who is seeking to make an environmental impact. The alignment of China’s ESG standards with international standards also allows for international investors to take part in the internationalization of sustainable finance in China. The magnitude of the energy transition that needs to take place in the next five to ten years is unprecedented, and this entails significant investment needs. Fixed income investors have a key role to play to finance this transition, thereby achieving both impact and return seeking objectives.

Footnotes

-

1

China’s Green-Bond Market: Growing Issuance and Historical Outperformance, February 2022, China’s Green-Bond Market: Growing Issuance and Historical Outperformance - MSCI

-

2

Cross-Agency Steering Group announces progress and way forward to advance Hong Kong's green and sustainable finance development, December 2021, Hong Kong Monetary Authority - Cross-Agency Steering Group announces progress and way forward to advance Hong Kong's green and sustainable finance development (hkma.gov.hk)

-

3

Renewable energy statistics 2021, August 2021, Renewable energy statistics 2021 (irena.org)

-

4

China's renewables boom year poses major challenges to western markets, February 2022, China's renewables boom year poses major challenges to western markets | Wood Mackenzie

-

5

China continues strong renewables policy support after record PV, offshore wind power expansion in 2021, January 2022, China continues strong renewables policy support after record PV, offshore wind power expansion in 2021 | IHS Markit

-

6

China to promote renewable energy projects, raise share of non-fossil energy to 17.3% in 2022, March 2022, China to promote renewable energy projects, raise share of non-fossil energy to 17.3% in 2022 - Global Times

-

7

China commits to 80% of energy mix from non-fossil fuels by 2060, October 2021, China commits to 80% of energy mix from non-fossil fuels by 2060 | S&P Global Commodity Insights (spglobal.com)

-

8

China sets green hydrogen target for 2025, eyes widespread use, March 2022, China sets green hydrogen target for 2025, eyes widespread use | Reuters

-

9

The net-zero transition: What it would cost, what it could bring, 2022, The net-zero transition: Its cost and benefits | Sustainability | McKinsey & Company

-

10

An energy sector roadmap to carbon neutrality in China, September 2021, An energy sector roadmap to carbon neutrality in China – Analysis - IEA