Sustainable investing in China fixed income: Focusing on the sustainable bond market

This is the last of a four-part blog series that seeks to demystify China’s sustainable investing landscape for fixed income. In our first blog we outlined the importance of China’s role in sustainable investing. The second article in the series looked at how China’s taxonomy is aligning with international standards. We articulated the thematic investment opportunities that may exist in China from a fixed Income perspective in the third blog. This fourth piece seeks to familiarize investors with China’s sustainable bond market. Visit our ESG Education page for more content like this.

As mentioned in our earlier piece, China has made tremendous efforts in recent years to facilitate the development of the sustainable labelled bond market. The latest version of the Green Bond Endorsed Project Catalogue (2021 Edition) unifies disparate green bond standards in the country and further aligns them with international standards. The November 2021 report, Common Ground Taxonomy – Climate Change Mitigation, adds clarity to the common ground on the definition of green between China and EU and has the potential to further spur cross-border investments of green capital.

China’s sustainable bond market has grown rapidly in the past few years. As of the first half of 2021, cumulative issuance of domestic-labelled green, social, and sustainable (GSS) debt was RMB 3.3 trillion.1 Like the global sustainable bond market, the largest source of all sustainable debt issuance in China is derived from green bonds, accounting for almost 50% of the total. Since its inception, China’s green bond market has become the world’s second largest by volume. Based on studies by the Climate Bonds Initiative (CBI), the total labelled green bond issuance in the domestic and overseas markets as at the end of 2021 reached US$ 109.4 billion (RMB705.5 billion) and US$ 327.0 billion (RMB 2.1 trillion) respectively, more than 60% of which were aligned with the CBI’s definition of green.2

Source: Bloomberg, data as of March 2022. Screening for USD-denominated bonds are those from China and HK with a minimum issuance amount of USD250mn. Green bond tagging is by Bloomberg.

Differences between the onshore and offshore green bond market

There were 1,643 onshore green bonds outstanding as at the end of 2021 valued at RMB 1.7 trillion (US$ 270 billion), with a three-year compound annual growth rate of 37.8%.3 While short-term bonds (with durations of less than three years) make up more than half of China’s overall bond market, medium-term bonds are more popular in the green bond segment. The largest tenor bracket for green bonds issued between 2016 and the first half of 2021 (excluding green asset-backed securities, ABS) was three to five years, with a combined issuance volume of more than 70% of the total.

China green bond also generally have high credit ratings. As of the end of June 2021, the proportion of publicly offered green bonds (excluding green ABS and policy bank bonds) with domestic ratings of Triple-A accounted for 66% of the total issuance. The trend is that the percentage of green issuance with higher credit rating continues to increase since 2017.

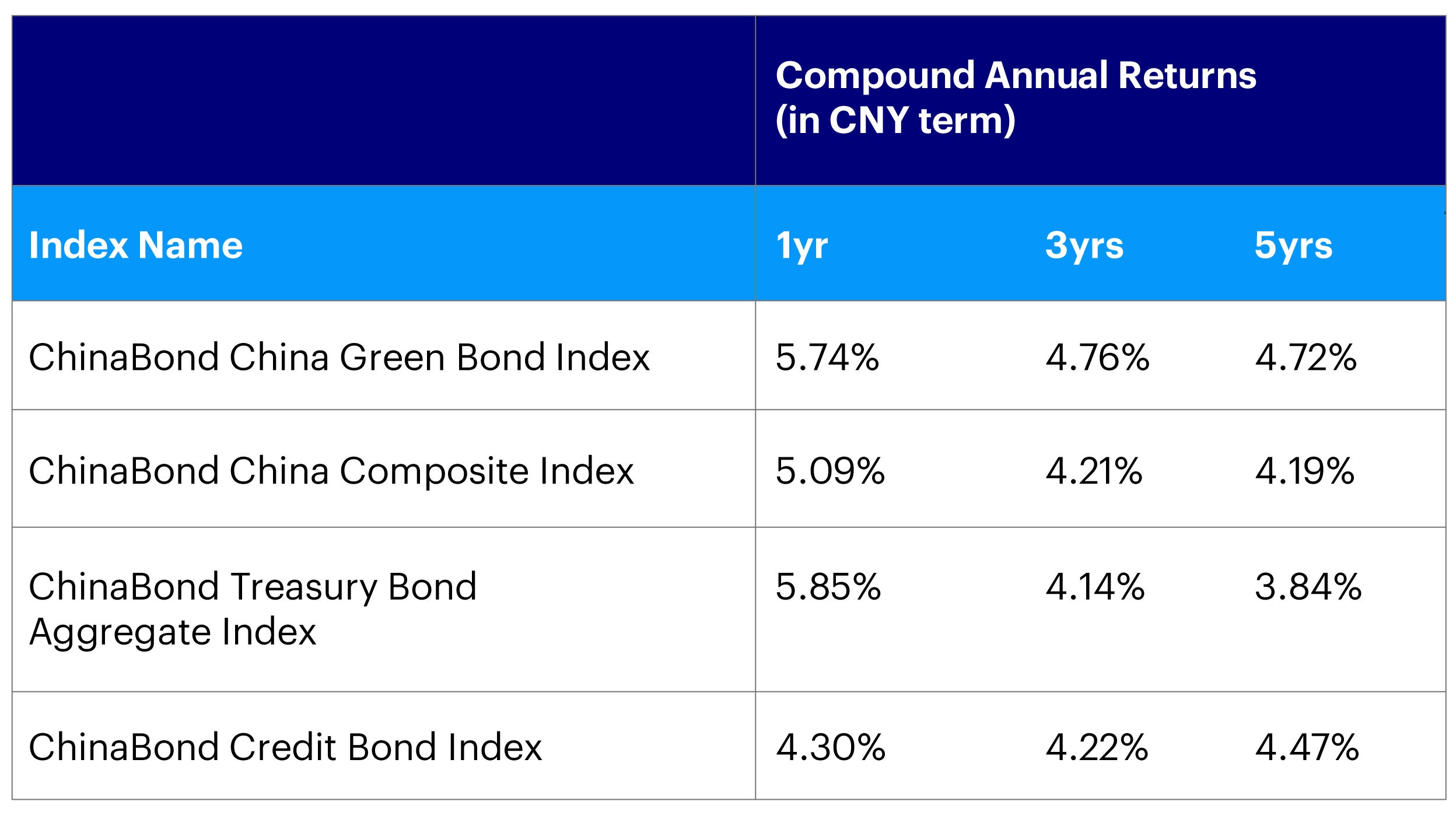

In line with what most investors would expect, China’s green bond indices have outperformed traditional onshore fixed income indices (Figure 2). The above-mentioned characteristics of tenor and rating helps to explain the recent outperformance as green bonds are less likely to be impacted during periods of market volatility. In addition, policy support provided by the Chinese government encourages flows into the sustainable bond market further contributing to the strong demand.

Source: ChinaBond Pricing Center, MSCI, data as of Dec. 31, 2021. Past performance is not a guide to future returns.

Between 2020 and the first half of 2021, total offshore green bond issuance reached US$ 9.3 billion, while offshore issuance of social and sustainability bonds reached US $1 billion and US$ 7.4 billion respectively. Offshore issuance of sustainability-linked bonds amounted to US$ 6.1 billion.

While green bonds remain the largest theme in the green, social and sustainability (GSS) bond market, we have seen significant growth in other types of labelled bonds. Offshore issuances have largely been denominated in USD and the majority have been issued by corporates in the real estate and renewable energy sectors.

Looking forward

To achieve its carbon neutrality goals, China’s sustainable bond market will have no doubt but to grow rapidly. The government is prioritizing the implementation of green finance policies to lead the way in climate transition. There has been both nationwide and local level policy support to incentivize issuance and investment in the market.

First, the People’s Bank of China (PBoC) has included green bonds in the scope of eligible collaterals for monetary policy operations and launched the carbon emission reduction facility (CERF) to provide lower cost funding to carbon reduction lending, thereby seeking to enhance the attractiveness of the green bond market. Second, green bond investment has been included in the China Banking and Insurance Regulatory Commission’s “Green Credit Statistics System” requiring banks to report and categorize green credit loans and to quantify the environmental benefits these loans produce. In addition, to support the sustainable development of the green finance industry, the Shanghai Clearing House has reduced fees for green bond transactions by 50%. At the same time, supportive policies have been launched across China among local governments, including incentives such as discounted interest rates, tax benefits, guarantees and subsidies for those investing in green bonds.

We believe China’s green finance infrastructure will continue to develop as the government looks to offer a market-oriented solution to achieving its carbon neutrality goals. By incentivizing financial institutions, investors, and companies to allocate financial resources into green investments, China can help to promote sustainable investments at home and abroad.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Footnotes

-

1

China’s Growing Sustainable Debt Market, January 2022, https://www.climatebonds.net/resources/reports/china%E2%80%99s-growing-sustainable-debt-market

-

2

China’s Green-Bond Market: Growing Issuance and Historical Outperformance, February 2022, https://www.msci.com/www/blog-posts/china-s-green-bond-market/03029315810

-

3

China’s Green-Bond Market: Growing Issuance and Historical Outperformance, February 2022, https://www.msci.com/www/blog-posts/china-s-green-bond-market/03029315810