Sustainable investing in China fixed income: What are the key investment themes?

This is the third blog in a four-part series that seeks to demystify China’s sustainable investing landscape for fixed income. In our first blog we outlined the importance of China’s role in sustainable investing. The second piece in the series covered how China’s taxonomy is aligning with international standards. In this article we articulate the thematic investment opportunities that may exist in China from a fixed Income perspective. Visit our ESG Education page to keep abreast of this series.

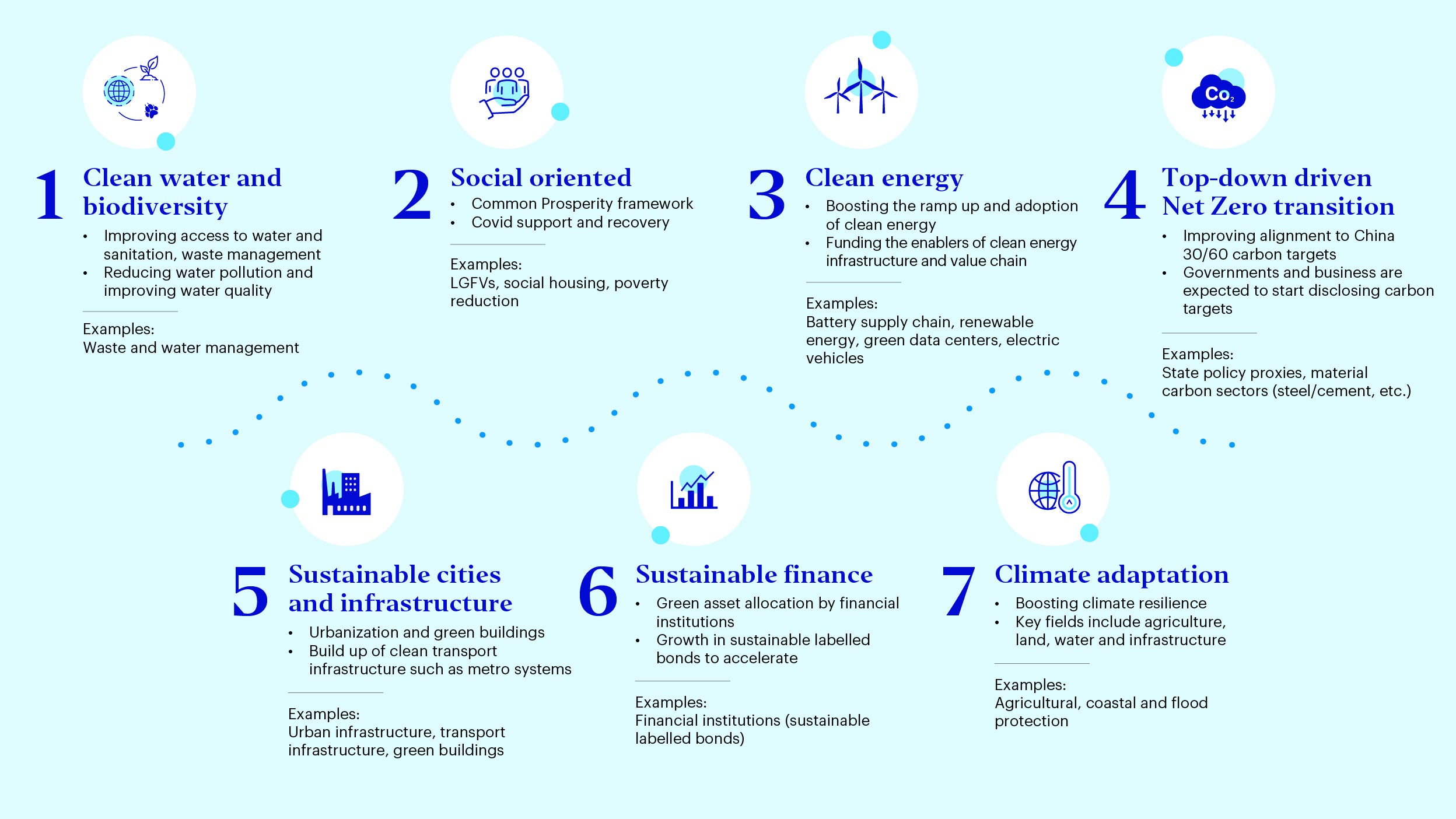

We believe there are seven key thematic opportunities that currently exist in China around sustainable investing in fixed income (Figure 1). These themes are multi-disciplinary by nature and very closely intertwine with China’s national policies. We believe these are long term ESG thematic plays that can be expressed in the investment universe, via sector tilts and single name selection.

Source: Invesco Fixed Income. For illustrative purposes only.

- Clean water and biodiversity

Clean water is a key sustainable investment theme in China that has ample growth potential. The proportion of state-controlled water sections with good quality surface water (Grades I, II and III) increased from 66% in 2015 to 83% in 2020.1 Within the Chinese fixed income universe, a number of Local Government Financing Vehicles (LGFVs) play a key regional and local role in improving access to water and sanitation in cities alongside waste management. We favor issuers with clear policy objectives where there is stronger government support to ensure financial stability.

Reducing water pollution and improving water quality is a key pillar supporting biodiversity in China, alongside the country’s reforestation targets. China is also playing an international role to improve biodiversity in developing countries with the launch of the Kunming Biodiversity Fund announced at the COP15 biodiversity summit in Kunming last year.2 - Social oriented

Poverty reduction has been a key success story of China’s economic transformation. In April, the World Bank reported that China’s efforts in this area contributed to global extreme poverty dropping by over 75% in the last forty years (Figure 2).3 There are several LGFVs aligned with this theme that have an integral role to play in urban redevelopment and social housing.

Sources: Lugo et al. (2021), based on PovcalNet adapted from World Bank (2018a). Data as of 2018. Note: EAP refers to East Asia and Pacific region. Based on international poverty line of $1.90 per person per day, 2011 PPP.

China’s Common Prosperity policy also entails the equitable access of basic public services and is enabling the expansion of the country’s middle-income segment.4 This drive will benefit issuers that support local small and medium enterprises, consumption-related issuers and critically also issuers from less developed regions of China.

3. Clean energy

There are numerous potential investment opportunities that can be found within the global clean energy value chain. Given their scale, select Chinese issuers are seen as global enablers of clean energy such as large battery producers and electric vehicle (EV) manufacturers. In addition, issuers which adopt clean energy, particularly large electricity users, are also critical in accelerating the national shift towards clean energy.

For example, the Chinese tech sector has a key role to play in developing green and energy efficient data centers for the digital economy. Particularly as data centers are expected to account for around 4% of China’s total electricity consumption by 2030.5 Two Chinese tech majors have recently issued inaugural sustainability bonds for such use of proceeds.

4. Top-down driven Net Zero transition

As discussed in our earlier piece, alignment to China’s 30/60 carbon targets is expected to primarily be a top-down exercise. Over time, state owned enterprises (SOEs) are expected to align their business models with national net zero targets.

As such, we have already observed that SOE issuers from material carbon-emitting sectors such as energy, utilities, and aluminum, are setting targets to support China’s Net Zero goals. This trend is expected to drive higher climate disclosures and carbon target setting other SOEs as well as the private sector. The key investment implication of this is that over time the investment universe for Chinese fixed income is expected to become more strongly geared towards decarbonization objectives, achievable by thematic and single name selections.

5. Sustainable cities and infrastructure

Urbanization is a key mega trend in China, with the national urbanization ratio hitting 64.7% in 2021.6 The twin drivers of migration from rural to urban regions as well as urban renewal have propelled the development of China’s real estate market. In recent years there has been a particularly strong push towards the development of green buildings and last year the US Green Building Council found that China was the top country (outside of the US) in terms of the volume of LEED-certified7 green building projects, with over 14 million gross square meters of certified LEED space.8

Cities cannot be sustainable without infrastructure that supports sustainable transport nodes. China’s electric buses and metro systems play a key role in this front. China currently accounts for around a quarter of the world’s urban rail transit by length9 and we see potential investment opportunities in the metro issuers that are active in major Chinese cities.

6. Sustainable finance

We believe that financial institutions in China have a significant role to play in extending sustainable finance lending options to the real economy in order to help reduce carbon emissions. Last November, the People’s Bank of China (PBoC) rolled out measures to support low-cost loans to financial institutions, including up to 60%of loan principal at a one-year lending rate of 1.75%.10 As of May 2022, the PBoC offered policy support to financial institutions to issue green and low carbon loans totaling RMB 230 billion, which equates to around 47.8 megatons of annual carbon dioxide reduction.11

7. Climate adaptation

Adapting to climate change is a key national priority and building climate resilience comes hand in hand with climate mitigation. Areas of focus include the protection of coastal belts, agricultural, land and water. Reforestation has been one of the most consistent targets in China’s Five-Year plans till date with a strong focus on building up the country’s carbon sink capacity of its ecosystems. Between 2010 to 2020, China converted 7.2mn hectares of marginal farmland into forest and grassland. As at the end of 2020, China’s forest area stood at 220 million hectares and its forest coverage reached 23%, with forest carbon storage approaching 9.19 billion tons.12

As China's efforts in sustainable development continue to bear fruit, we believe the themes listed above may evolve and new investment opportunities may also emerge. Invesco Fixed Income is devoted to being a part of this ESG journey for our investors and we will look to be positioned on these long term ESG investment themes.

Footnotes

-

1

Full Text: Biodiversity Conservation in China (scio.gov.cn), October 2021, http://www.scio.gov.cn/zfbps/32832/Document/1714277/1714277.htm

-

2

Xi Jinping announces biodiversity fund to help developing nations protect nature, October 2021, https://www.climatechangenews.com/2021/10/12/xi-jinping-announces-biodiversity-fund-help-developing-nations-protect-nature/

-

3

Lifting 800 Million People Out of Poverty – New Report Looks at Lessons from China’s Experience, https://www.worldbank.org/en/news/press-release/2022/04/01/lifting-800-million-people-out-of-poverty-new-report-looks-at-lessons-from-china-s-experience#:~:text=%E2%80%9CChina%20achieved%20its%20goal%20of,contributions%20to%20global%20poverty%20reduction

-

4

Making Solid Progress Toward Common Prosperity, January 2022, http://en.qstheory.cn/2022-01/18/c_699346.htm

-

5

Insiders highlight green data centers' role in achieving net zero goals - Chinadaily.com.cn, February 2022, https://global.chinadaily.com.cn/a/202202/22/WS62149f23a310cdd39bc883a6.html

-

6

China's urbanization rate hits 64.72% in 2021 - Chinadaily.com.cn, May 2022, https://global.chinadaily.com.cn/a/202205/07/WS62767f9da310fd2b29e5b43f.html#:~:text=China%27s%20urbanization%20rate%20of%20permanent,the%2014th%20Five%2DYear%20Plan.&text=Copyright%201995%20%2D%202022%20.,All%20rights%20reserved

-

7

Note: LEED stands for Leadership in Energy and Environmental Design

-

8

Mainland China Ranks Number One in the World for LEED Green Building in 2021, https://gbci.org/mainland-china-ranks-number-one-world-leed-green-building-2021

-

9

Pandemic behind it, China ramps up metro rail boom, March 2022, https://www.scmp.com/news/china/science/article/3168851/pandemic-behind-it-china-ramps-metro-rail-boom

-

10

China's central bank rolls out new lending tool for carbon reduction, November 2021, http://www.news.cn/english/2021-11/08/c_1310299029.htm#:~:text=China%27s%20central%20bank%20rolls%20out%20new%20lending%20tool%20for%20carbon%20reduction,-Source%3A%20Xinhua%7C%202021&text=BEIJING%2C%20Nov.,country%27s%20goal%20of%20carbon%20neutrality.

-

11

绿色金融助力碳达峰碳中和, March 2022, http://www.pbc.gov.cn/goutongjiaoliu/113456/113469/4500507/index.html

-

12

Full Text: Responding to Climate Change: China's Policies and Actions, October 2021,

http://www.scio.gov.cn/zfbps/32832/Document/1715506/1715506.htm